Housing market is back for buyers as loans, investors have dipped

It’s been a savage year for Australian house prices but there’s been an abrupt change – and it’s good news for anyone keen to buy.

There’s been a lot of bad news in Australia recently. Ready for some good news? Our housing market is returning to something resembling normalcy in two big ways.

Over the last decade Australia’s housing market has been the plaything of investors. Property became something you amass in portfolios rather than a place you live. More people were engaged in negative gearing than backyard cricket.

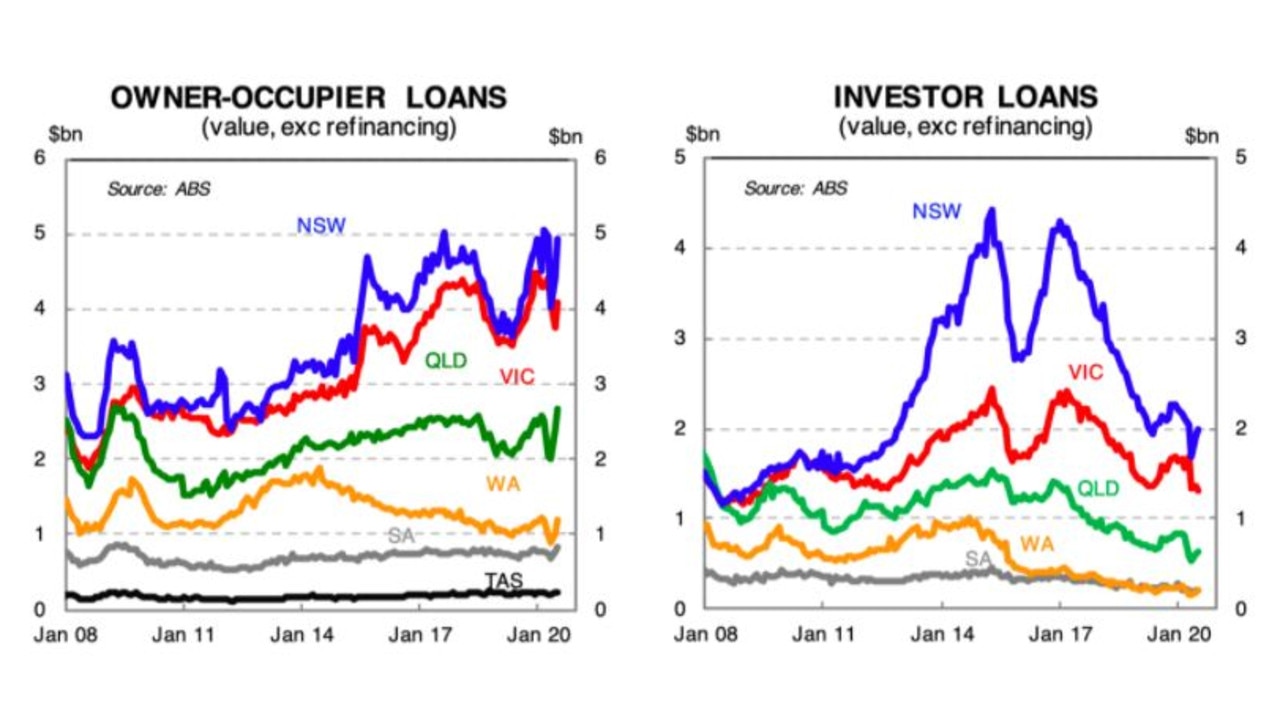

But that is changing, as the next two graphs show. They come from the Commonwealth Bank and they show loans for investor housing have been crunched. Not only during the pandemic, but earlier too. Owner occupiers are now by far the largest part of the market. This means more people buying a house without competing against investors.

RELATED: Australia’s ‘weird’ reaction to recession

The fall in investor loans was really sparked by regulatory changes. Remember the royal commission into banking? Around that time they made life harder for property investors, especially those using interest-only loans.

But recently another factor is cooling investors’ ardour: falling rents and rising vacancies. In the city centres of Melbourne and Sydney in particular, empty apartments are everywhere. Landlords are forced to cut rents to attract tenants and real estate agents are having to actually be nice to people. These are extraordinary times.

The other reason for investors getting cold feet is prices in the biggest and most expensive cities are falling. This is the second way in which our housing market is getting more normal. The enormous differences in price between Australian cities are eroding.

A GREAT EVENING-UP

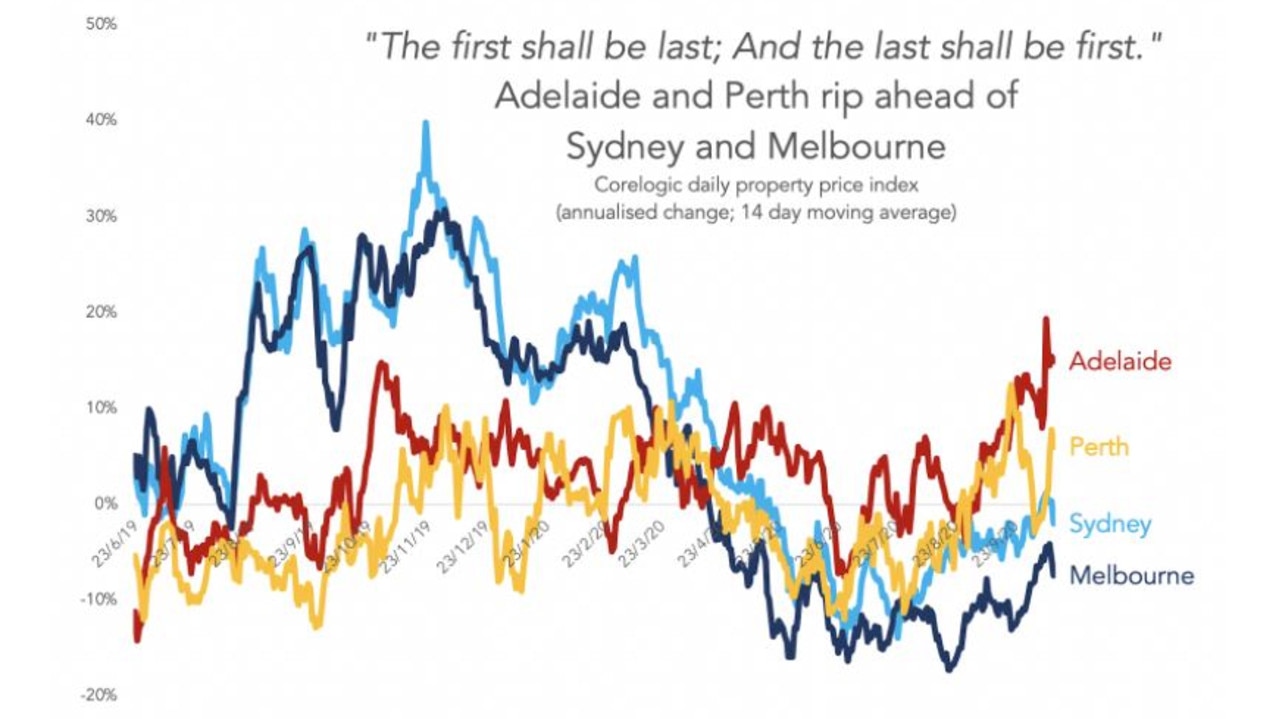

Since the start of the pandemic, prices in Melbourne and Sydney have been falling. That has dragged down the national average and it gets all the headlines. But behind the headlines, prices in Perth and Adelaide recovered swiftly and, as the next chart shows, they are now rising. In Perth in particular, that hasn’t happened for a long time.

RELATED: Disaster as Aussie jobs ‘evaporate’

RELATED: Why earning $180k doesn’t make you rich

The big reason for rising prices in those cities is low interest rates. Melbourne and Sydney would see rising prices too if the effect of low interest rates was not overwhelmed by falling populations (and, in Melbourne’s case, a viral outbreak plus massive lockdown).

When interest rates fall, the amount people can borrow to buy a house goes up. And interest rates have plummeted. You can now get a home loan with an interest rate under 2 per cent. That’s completely ridiculous. Inflation is supposed to be between 2 and 3 per cent a year. Home loan interest below inflation is barely comprehensible to me.

And this is the strange thing. The way we’ve got some normalcy back in our housing market by making the borrowing conditions very much abnormal.

So is this actually a good time to buy a house, as owner-occupiers seem to believe, or have the property investors actually got it right? Should we be nervous?

WE NEED TO TALK ABOUT INTEREST RATES

Australia’s long bull market in housing has coincided with a long decline in interest rates. Because houses are bought with borrowed money, the price of housing depends on the cost of borrowing money. Cheaper and cheaper loans translate to more and more expensive homes. Interest rates are now 0.25 per cent and the RBA might even cut them a tiny bit more in November, to 0.1 per cent.

The RBA has pledged never to take interest rates negative. So from here, ask yourself, where can interest rates go? And what happens if they do go up again?

A 30-year, $500,000 loan costs $2000 a month at 2.5% interest rates, but it costs $2500 a month if rates go up to 4.5 per cent. Rising interest rates would cap how much people can afford to borrow and cool housing markets. One argument you could make is that the low-point in interest rates (i.e. now) would be the high point in housing markets.

However, interest rates will only rise if there is inflation and wage inflation. And housing is sometimes considered to be a good asset to hold during inflation. (A bad asset to hold during inflation is cash. It loses its buying power by definition.)

If we, by some miracle, return to a world of inflation and wage inflation, normal interest rates, people who bought property in the pandemic might be pleased they did.

The other alternative is we turn into Japan, where interest rates stay extremely low for decades, wage inflation is tiny, and property prices don’t go up at all. If that happens, we will need to adjust to a very different kind of normal.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.