Consumer confidence skyrockets amid coronavirus, recession

We’re in a massive recession – in the middle of a devastating global pandemic – and yet Australia is not behaving in a way that’s expected.

Yet more evidence that we are having the world’s weirdest year. First we found out average incomes had gone up in a recession.

Then we found out total mortality had fallen in a pandemic. Now we discover consumer confidence has bounced so high it is higher than it was before any of us had heard of the coronavirus.

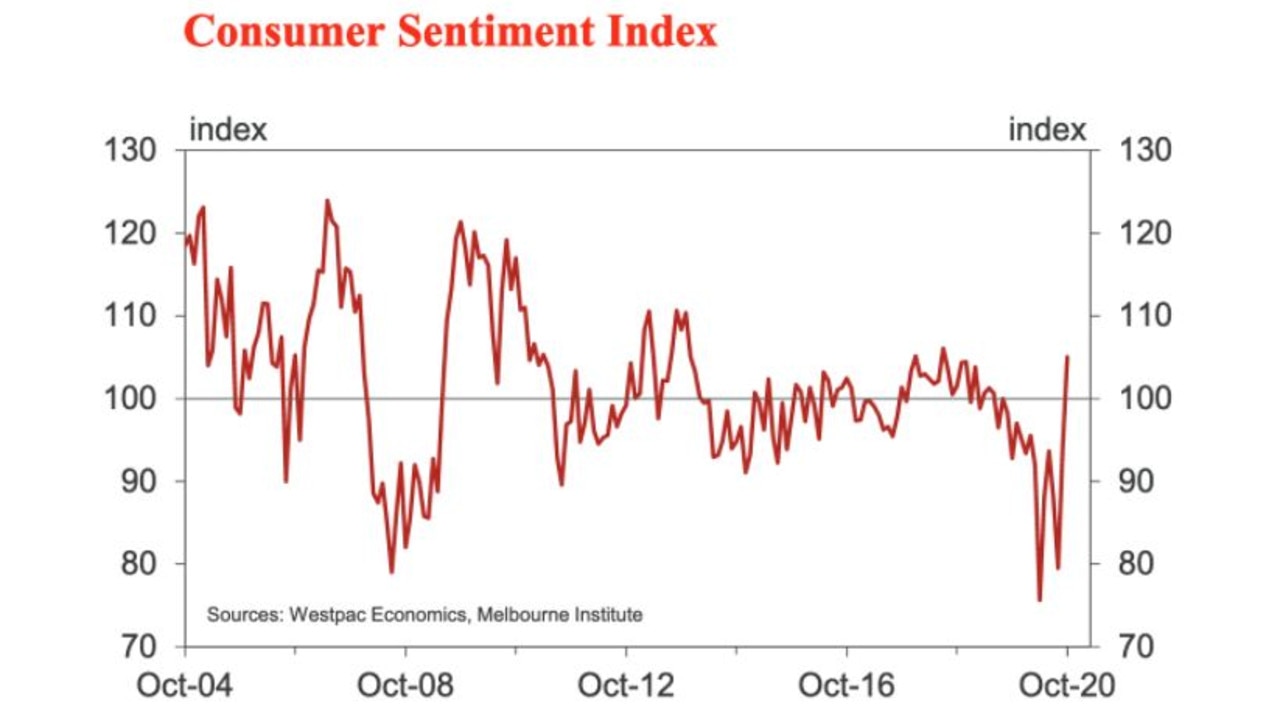

Westpac and the Melbourne Institute measure consumer confidence every month. This month the results came back and they were astonishing. The big collapse in confidence that began back in March is now gone. But it’s more than that. As the next graph shows, confidence was higher in October 2020 than it was in October 2019 and even October 2018 too.

RELATED: The mistake we’ll make with tax cuts

RELATED: Australia would be better off without WA

“This is an extraordinary result,” said Westpac chief economist Bill Evans.

Now, consumer confidence numbers come from a survey. Sometimes surveys can be wrong. Random error and polling error can bias the results.

It’s worth remembering that Roy Morgan put out their consumer confidence numbers recently too, and while they showed some recovery, they were nothing like as good as Westpac’s results.

The difference between the two surveys is that Roy Morgan surveyed Australians before the Budget, while Westpac’s survey covered the period after the Budget. Tax cuts were fresh on people’s minds.

Evans said he’s been assessing the perceived impact of the Budget on people’s finances since 2010 and he has never seen people so positive.

“(Since 2010) the net balance of respondents who assessed that the Budget would ‘improve their finances’ was – 29 per cent, a clear majority expecting measures to adversely affect their finances. We have never seen a Budget response that showed a net positive balance – until now.”

This year more people expected the Budget to make them better off instead of worse off. You’d certainly hope so, seeing the billions and billions the government spent.

RELATED: One question test to tell if you’re broke

Of course, not everyone is equally happy, Those making over $100,000 a year have the most to grin about from the Budget – they reported very positive assessments of it. Meanwhile, those arguments that women got a raw deal out of the Budget? True. More women see the Budget as worsening their finances.

“Within the overall result there is a positive balance of 21.9 per cent from males compared to a slight negative of -3.7 per cent for females,” said Evans.

HOUSING

Shifts in the housing market can come fast, and if this survey is right, there could be sudden pressure on in the housing market.

“The ‘time to buy a dwelling’ index increased 10.6 per cent to its highest level since September 2019,” said Evans.

People have been saving money during the pandemic, and interest rates have been slashed, making it easy to borrow big amounts. While investors are still on the sidelines, owner occupiers are starting to buy up big.

A combination of big deposits and big loans could push Aussie housing up in the last months of 2020. People across Australia see it as the best time to buy a dwelling since September 2019, and if you recall, back then house prices were going crazy.

HOWEVER …

Of course, the sugar hit of a tax cut has to compete against the cold reality of the end of JobKeeper and JobSeeker. Australians have mostly sailed through the pandemic easily, and it’s easy to overlook how important those spending programs were. We have been complacent about them but we might miss them when they are gone.

Don’t forget that the official unemployment rate is expected to continue to rise until December this year. On Thursday we will get new official unemployment number, and while last time unemployment was lower than expected at 6.8 per cent, this time it could go the other way. Will Aussies still feel uber-confident if unemployment slips to 7.5 per cent? Or even 8 per cent?

We still live in very volatile times. There’s no doubt going to be plenty of news to help us forget the Budget in the next few months. Winter is coming in the northern hemisphere, and with it will doubtless come new viral outbreaks.

Plus the US election and all it may bring. Fingers crossed we maintain our confidence through to Christmas.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.