Federal Budget 2020: The problem with Federal Government’s big tax cuts

We’re all excited about the upcoming tax cuts from the Federal Budget. And there is one sure thing we’ll spend it on.

Tax cuts are coming in the Budget. I’m somewhat pleased. You’re somewhat pleased. We’re all gently chuffed. A bit more money in our pockets. We’ll take it.

But here’s the thing about tax cuts. They reveal the government lacks ideas. They have no vision. I mean this in the nicest possible way. They just can’t think of anything they want to spend the money on so they give the money to us.

In 2021-22, i.e. next year, there’s much more in tax cuts than spending. $29 billion in new tax cuts vs $17 billion in new spending.

RELATED: Federal Budget 2020: Winners and losers revealed

RELATED: Detail that should ‘concern’ all Australians

RELATED: How to get your backdated tax cut

The Coalition is in power and this is the spirit of what it means to be economically right-wing, to be Liberal. The very heart of it is the idea governments are not great and you should, given the chance, give decision-making power to people or businesses, not government.

It’s a nice idea. It can’t hurt. (Except for the budget bottom line, obviously, that gets hurt to the tune of tens of billions of dollars.)

As well as directing huge tax cuts at individuals, the Treasurer is giving them to business. Usually they give an instant asset write-off to small businesses in the budget. This year it goes to a lot of big companies too. Oh, and it is unlimited. Which makes it an expensive tax cut next year.

Every company with revenue under $5 billion can get the write-off (which means basically that if they buy something, instead of claiming a tax deduction for it in chunks over, say, five years, they can claim it all at once). This won’t help corporate giants like BHP, Rio Tinto, Coles, Woolies, but it will help the next rung down. They can buy new machines, cars, buildings etc.

Again, the government is not fussy about what the assets are. They can be anything, It doesn’t have the vision for how the money should be spent, it wants businesses to have the vision. The money helps that vision happen.

There’s also a hiring credit, which will give some money to any industry to hire people aged 16-35. Again, basically any industry and any job. Even if you would have hired them anyway.

Is that good enough? Instead of leading, the government is talking about the recovery being “business-led.”

The Prime Minister is not talking about a Green New Deal full of rotating solar panels, or a technology road map where Australia tries to get good at making software. He’s not focused on education or on exporting medical services either. There’s a small increase to the five-year infrastructure program, some funds for research and, yes, a bit of money for manufacturing, but not nearly as much as you might think given how much they talk about it.

The absence of vision for what we should do as a nation means even if we recover from the recession, we’re not going to see much change.

Pre-pandemic, our economy was trundling along without all that much exciting new productive activity happening. We shut down car-making. As far as new industries opening, um, maybe we could count Uber Eats?

In 2018-19, the most recent year for which we have data, 350,000 business opened up and 290,000 businesses closed down, leaving net new business of 60,000. We have 25 million people. That means just one in every 400 people moved into business into 2018-19. Of them, a lot were sole-trading delivery drivers and the like. Point is, it’s not exactly a melting pot of new ideas around here. It doesn’t feel like Silicon Valley.

Here’s the sad truth about our economy. When Aussies have a little money and a dream to make their life better, they don’t start a business. They buy property. It’s the tried and true way to make money in this country. Start your investment property portfolio.

The risk is the government puts all this money in our pockets and we just use it the way we’ve always used it – to buy houses. Unlike starting a business, an investment property never blows up into a major employer that creates a lot of value for everyone else.

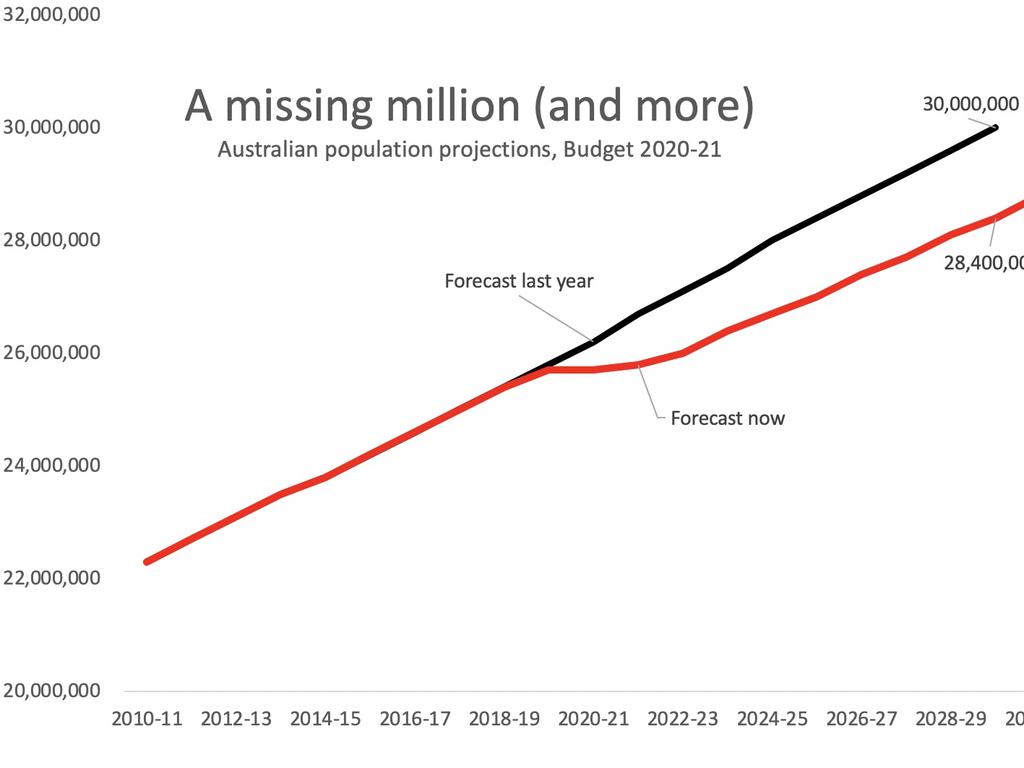

What’s more, it might not be a great time to buy houses. Population growth in this country is expected to slow to a crawl as migration stops and the birthrate tanks. It is forecast to be the slowest population growth in over a century. Not all states will grow. In fact, by June 30 next year, the population of NSW is expected to fall. That certainly hasn’t happened any time recently. The expected population of Australia will be 1.6 million people less in 2030 than expected.

Usually, I’m for letting business take the lead. But this year, there’s definitely room for a bit of vision too.

Without leadership we might get stuck doing the same things we’ve always done. And they haven’t always been that helpful.