RBA’s claims recession is over slammed as ‘garbage’

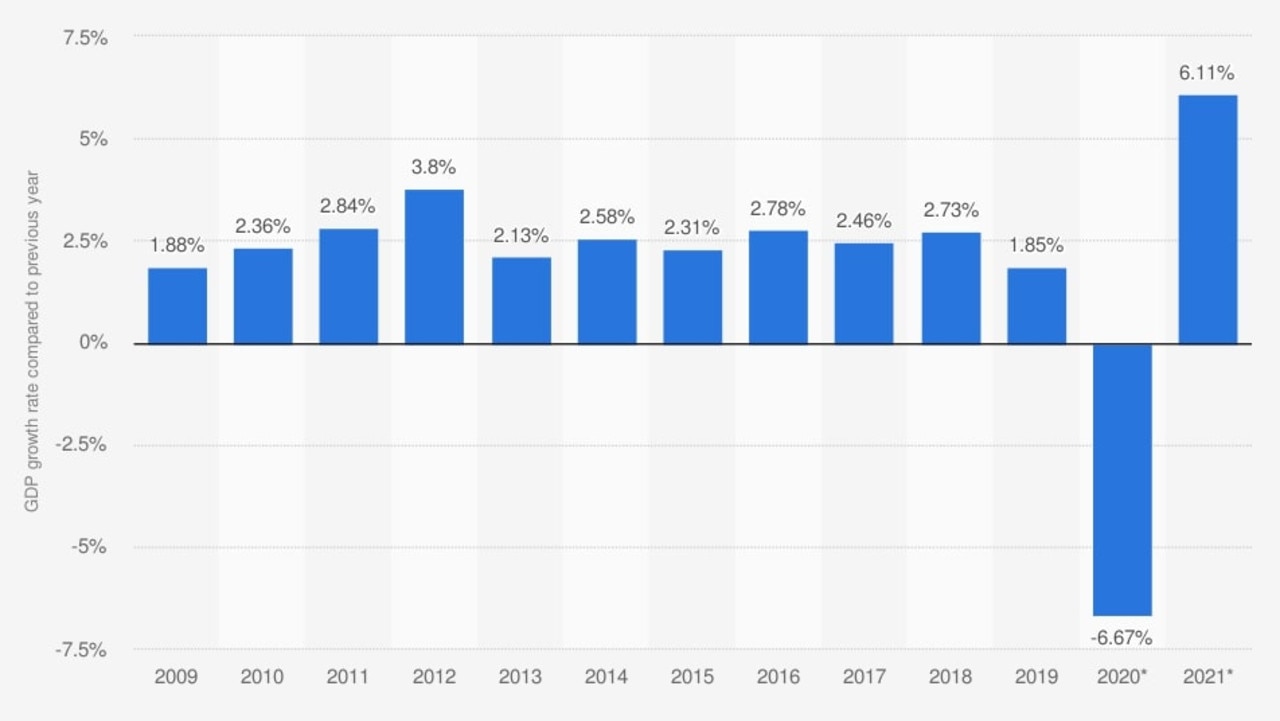

The RBA has declared our first recession in 30 years is over already – but there’s a big problem with that exciting claim.

It sounds almost too good to be true.

When Reserve Bank deputy governor Guy Debelle declared Australia had “probably recorded positive growth” in the September quarter, the headlines quickly followed.

After all, a quarter with positive growth means Australia is most likely – technically – out of recession.

So why did many respected economists, including former BT financial chief economist Dr Chris Caton declare this spin “garbage”?

“Channel 7 News repeating the garbage that the RBA has called the end of the recession. No it hasn’t!,” he declared on social media.

So, what’s the truth?

What Mr Debelle told Senate estimates on Wednesday was not an official declaration the recession was over but it was clearly designed to boost consumer confidence.

RELATED: Families earning $189k too ‘rich’ for help

A bit premature to be talking about the end of the recession. Dangerous even if policymakers believe it. It will linger with us for years.

— Callam Pickering (@CallamPickering) October 27, 2020

Technical recession is may indeed be over but it’s effects will linger for an extended period of time, it won’t actually be over until every person that lost a job has got one again, policy support is needed until then #ausbiz https://t.co/TZeM6L3BYB

— Alex Joiner (@IFM_Economist) October 27, 2020

“At the moment it looks like the September quarter for the country probably recorded positive growth rather than slightly negative,” Dr Debelle said.

“The growth elsewhere in the country was more than the drag from Victoria and the drag from Victoria was possibly a little less than what we guessed back in August.”

So why would the Reserve Bank make such a call? Technically, a quarter of growth does mean Australia is no longer in recession.

The big reason is pretty simple: to boost consumer confidence and encourage Australians to spend money in the lead up to Christmas.

The RBA’s decision to front-run the expectation that Australia is technically out of recession was intriguing for two reasons.

The first reason is that the official figures don’t get released until December. Why would the RBA spruik the possibility the pain is over before it’s confirmed?

RELATED: 1.7 million lost Aussies due to COVID

The second is that it’s a big call to declare the economy is out of the woods, given the JobKeeper scheme still hasn’t been wound down, a move that could still spike unemployment.

“Technically he is correct. The data for September will almost certainly be positive,” Indeed’s chief economist Callam Pickering told news.com.au.

“But the impact of what we’ve gone through will linger. The unemployment rate does tend to continue to increase. We saw that with the 1980s and the early 1990s recession.”

Mr Pickering agrees the comments are designed to boost confidence.

“The Reserve Bank tries to shape expectations for the economy. They try to boost confidence,” he said.

“They want households out there spending money, particularly over the Christmas period. So, if they come out and say the worst is behind us, we are in the recovery phase, that helps shape expectations.”

It’s only when the wage subsidy JobKeeper is withdrawn that the economic reality will become clearer.

“We are going to get a feel for what the permanent damage as a result of COVID has been.”

As former BT financial chief economist Dr Chris Caton noted, “a small positive growth rate after a 7 per cent fall is hardly surprising and not a sign of recovery, or even a “turnaround”.

“The RBA and Guy Debelle know this and never said otherwise.”

RELATED: Disaster as Aussie jobs ‘evaporate’

So, does the Treasurer Josh Frydenberg believe Australia is out of recession? News.com.au asked and the answer wasn’t clear. He wasn’t prepared to use the word “recession” or “over”.

“We have seen the economy fighting back from the economic effects from COVID-19 with 446,000 jobs coming back over the last four months,’’ Mr Frydenberg said.

“Of the 1.3 million people who lost their job or were stood down around 60 per cent are now back at work. With Victoria now easing its restrictions the Australian economy is well placed to recover further.

“However, the road ahead will be challenging with a global economic environment very challenging.”

In other words, Australia’s economy is bouncing back better than many expected, but it’s too early to say the worst is over.

The Reserve Bank will release it’s formal forecasts on Friday in it’s Statement on Monetary Policy.

But even the RBA concedes that making predictions as economists is more fraught than ever before.

“The range of uncertainty around the numbers at the moment is as large as it has been in my career,” Mr Debelle said.

“We are having a lot of trouble trying to understand where we are let alone where we are going.”