Why the RBA is cracking down on mega mortgage loans

Excessive mortgages have been handed out to people who may not be able to pay them back. This is why that’s bad news for Australia.

No more mega loans, OK? The Reserve Bank of Australia is seeing more and more normal people take on truly heroic mountains of debt, and it is getting very nervous.

The 22-year-old teacher with the million-dollar mortgage? The couple with a house they haven’t paid a cent off who are now getting more finance for a beach house ? The guy with the leased BMW and the highly leveraged property portfolio? All these people are in the firing line.

“There is a risk of excessive borrowing due to low interest rates and rising house prices,” said the RBA in a new report published on Friday that hinted at more property crackdowns to come.

The Reserve Bank keeps an eye on the housing market because it wants to avoid a housing meltdown. Australia hasn’t had a recent event like Ireland or America has, where house prices crash and it makes a weak economy even weaker. They want to keep it that way, and the best way to make sure that doesn’t happen is to prevent the issue getting too far out of hand in the first place.

LVR

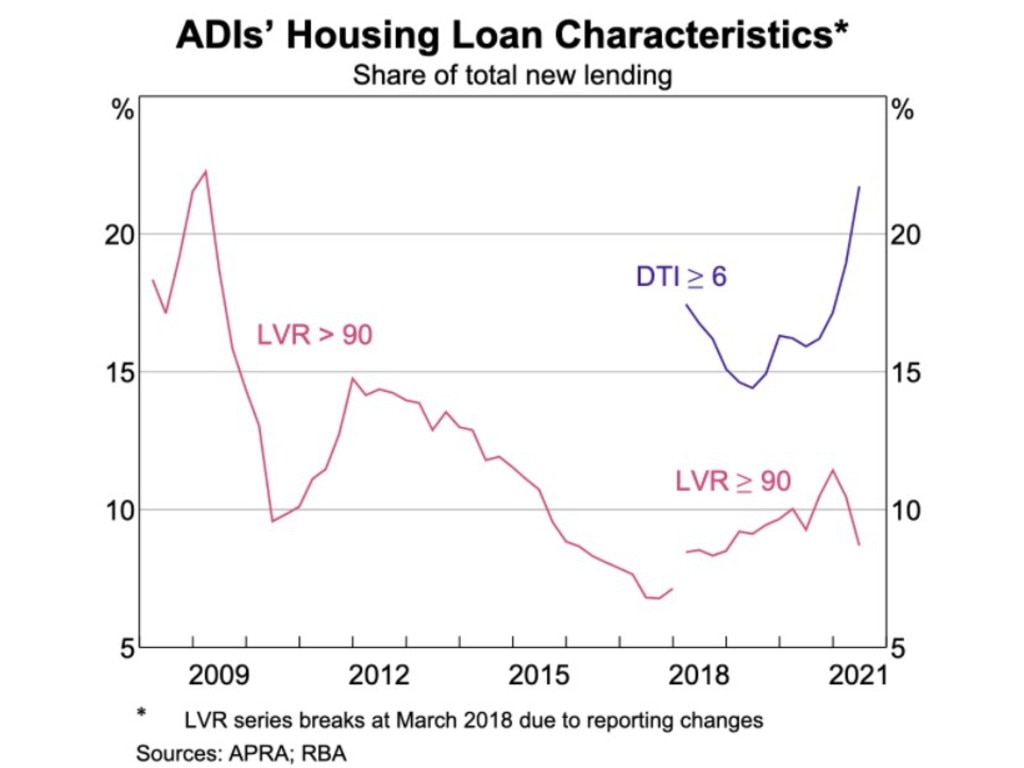

People are suddenly borrowing over six times their income, the RBA has found. Despite fewer people borrowing more than 90 per cent of the value of their house (LVR>90), debt-to-income ratios (DTI) greater than six are rising fast as the next graph shows. That means more and more people borrowing over $600,000 on a $100,000 income.

(LVR stands for Loan-to-Value ratio. Borrowing $900k on a million dollar home is an LVR of 90. ADI stands for authorised deposit-taking Institution and it refers to banks DTI is Debt-to-income.)

In this time of pathetic income growth and ultra-low mortgage rates does it make sense for mortgages to be rising so fast? Or does that just put us at risk in the eventual scenario where rates do go up?

Sure, your million-dollar mortgage may be just manageable with rates at 2 per cent. You need to find $3,700 a month, assuming a 30-year loan on principal and interest. But if rates go to 3 per cent the repayment is suddenly $4,200. For some households that will push them over the edge.

And some people have mortgages even bigger than that. In NSW 40,000 households had monthly mortgage payments over $5,000 back in 2016. It would be even higher now. Terrifying.

The reason the RBA cares about people with loads of debt relative to their income is those people are the most likely group to end up in mortgage stress. If there is a recession, people who owe a lot of money are likely to stop spending on day-to-day items and make any recession even more severe.

Interest rates

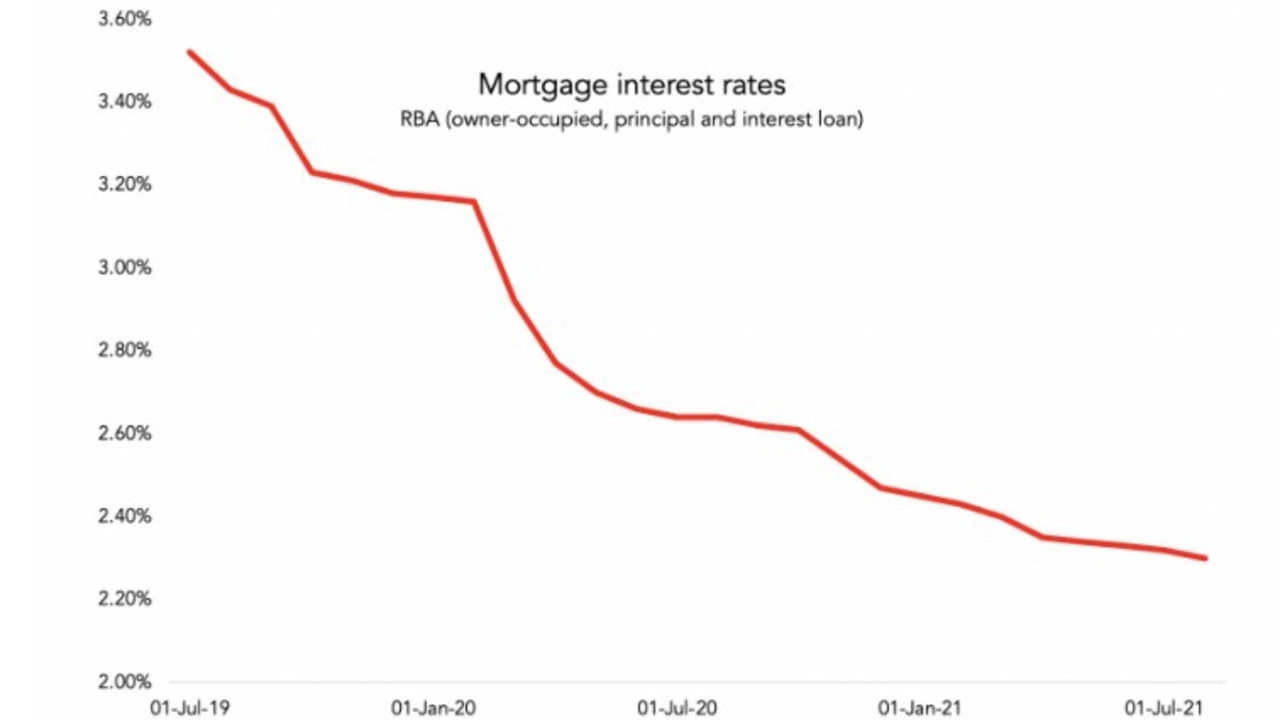

Obviously Aussies are borrowing a lot more these days, and the biggest reason why is the level of mortgage interest rates. Rates are cheap as the next graph shows! You can borrow to buy a house at rates as low as 2 per cent interest a year. That means borrowing huge sums is much more affordable.

The RBA set official interest rates very low to make the economy grow faster and prevent recession, and one effect of low rates is to spur the housing market. Shouldn’t they just put interest rates up if they don’t want higher house prices? The answer is … maybe not.

Why not just raise interest rates?

The low interest rates also make our dollar lower which makes things easier for our exporters. And they make it cheaper for companies to borrow money to expand their businesses. That’s helpful, because businesses that are expanding hire more workers and reduce the unemployment rate. So raising interest rates is simple and would reduce risk in the housing market, but it would come with unwanted side effects.

Enter Macroprudential Policy.

Macroprudential policy is what you do when you want the housing market to be cooler but you can’t risk raising interest rates.

The government has already brought in one new macroprudential rule to try to cool the housing market. As of last week, banks need to assess your ability to repay if rates went up 3 per cent, not just if rates went up 2.5 per cent.

That change means people can borrow about 5 per cent less. It could in theory cool the market, but in reality very few people are borrowing right up to their limit (the people who are are mostly first home buyers – they will get hit hardest by this rule change.)

What’s most likely to happen is that the unstoppable momentum of the Australian property market continues, blowing through the rule change like a Mack truck through a pile of boxes.

The RBA says the recent rule change will take a few months to affect the housing market, but admits after that “settings may need to be adjusted.”

More Coverage

So this is not the end. The new RBA report includes a menu of other ways to crack down on the housing market, looking at macroprudential rules used in Canada, Norway, New Zealand, Ireland, and more. Their menu of options includes limits on loan-to-value ratios, for example, so you can’t borrow more than 90 per cent of the value of a new house. It also includes limits on borrowing by investors.

If the housing market keeps tearing along - and it probably will - get ready for more clampdown just before Christmas.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.