Inflation fears for Australia as US hits 5.4 per cent

Aussies emerging from lockdown have another hurdle approaching as a worrying 10-year high grips the US and abroad.

The pandemic might be almost over but shortages and price rises are coming this way. Consumer prices in America are rising the fastest they have in ten years and Aussies may have to get used to something similar.

As petrol shortages hit Britain and blackouts hit China, the price of oil has nearly tripled to over $80 a barrel. Gas prices have hit record highs in Asia and coal is soaring, causing consumer prices to rise at a level that makes economic policy experts very uncomfortable.

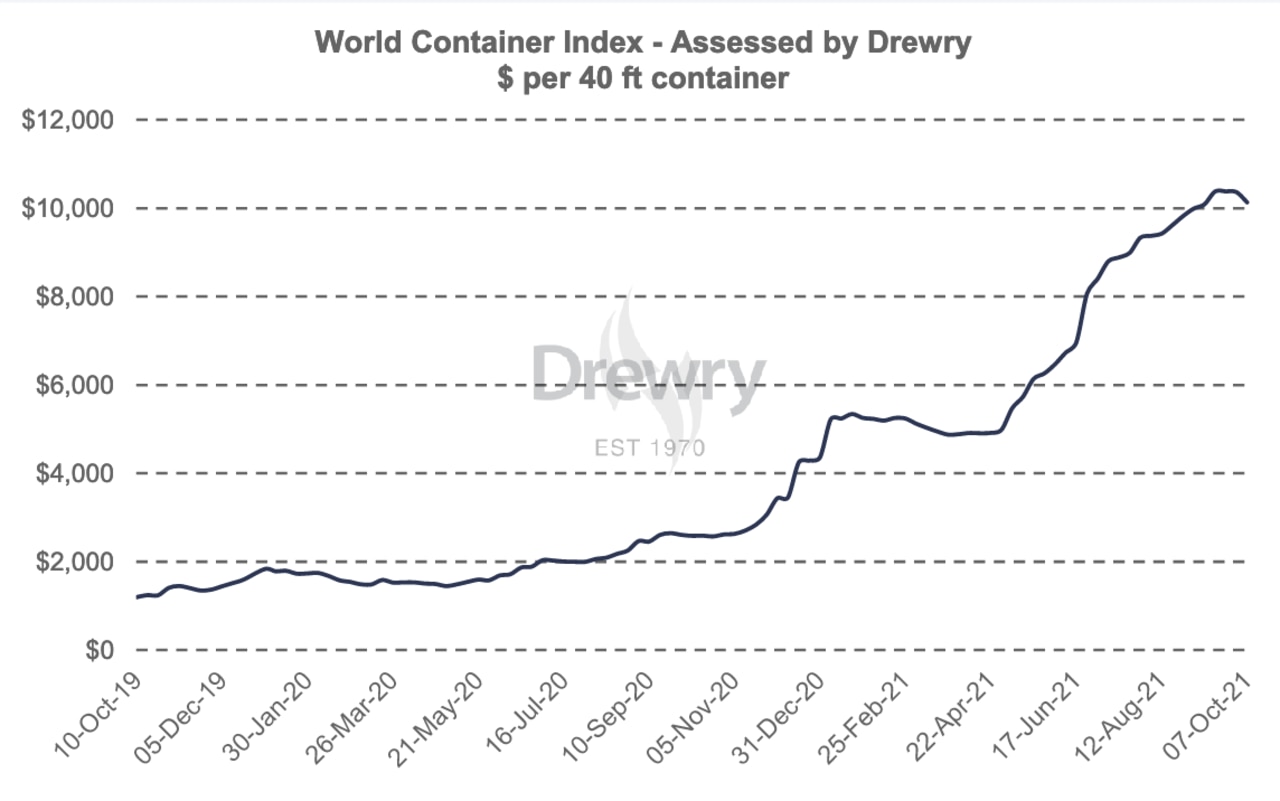

Energy is an input to almost everything we buy, so rising energy prices make life more expensive at the petrol station and beyond. Add that to ridiculous price hikes in the cost of shipping, as shown in the next graph, and you can start to see why price rises are a near-certainty. The cost of sending a container around the world used to be a bit over $1000, now it’s over $10,000.

When will these price rises hit, and how long will they last? To find out what will happen in Australia, it is often useful to look at America. The latest US inflation data came out this week and it is concerning. The latest number is 5.4 per cent, meaning prices are 5.4 per cent more than they were a year ago.

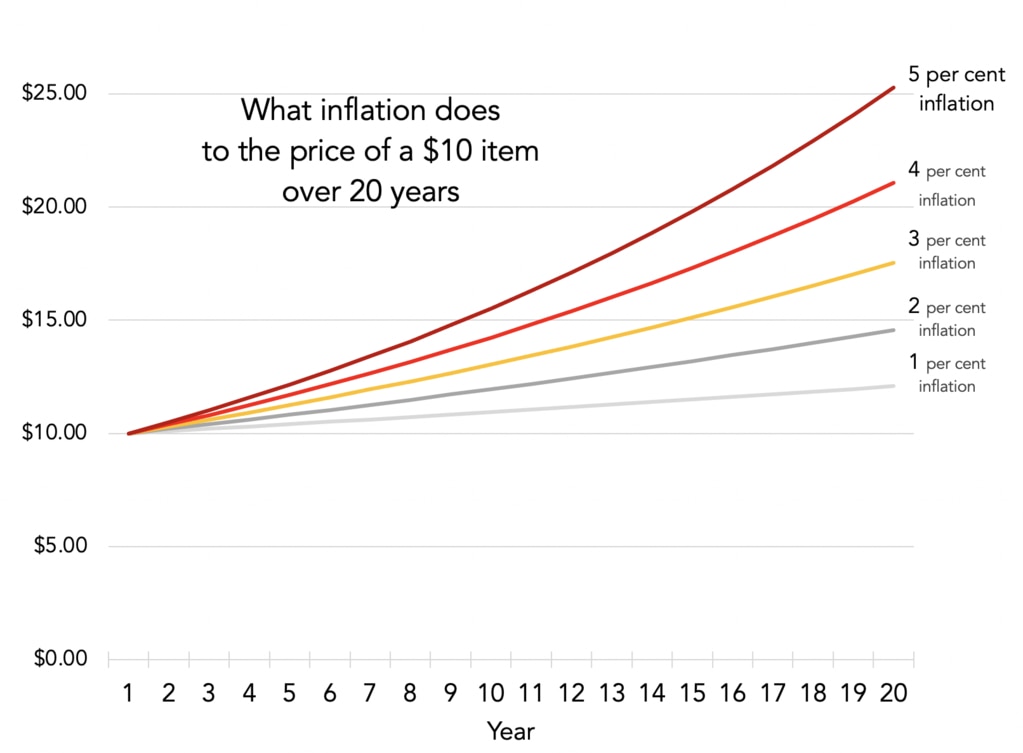

Does 5.4 per cent sound small? The following chart shows why we should be concerned.

Inflation is sneaky. What might look like a small number builds up over time. If you have 5 per cent inflation this year, next year’s 5 per cent inflation applies to the new higher price. It compounds.

If we had 5 per cent inflation for 15 years, something that cost $10 this year would cost around $20 in 15 years time. Whereas if inflation is only 2 per cent that item costs $13.20 in 15 years time. Small-seeming differences in the annual inflation rate can have huge differences on how quickly things rise in price, as the next chart shows.

This compounding effect is really bad news for people with money in the bank – inflation shrinks the buying power of your savings, unless you’re able to get an interest rate that is higher than the inflation rate.

The Food Connection

Demand for energy is causing people to substitute mineral fuels for biofuels. That means soybeans get turned into oil and then into diesel. It is no surprise the price of soybeans has risen.

In America bakers are terrified they can’t get the oil they need to make bread and have asked the government to earmark some oil for food and prevent the biodiesel sector from turning it all into fuel for cars.

Meanwhile the shortage of soybean oil has also driven up the price of palm oil and canola oil. Palm oil is in almost all manufactured food. Its price hit an all-time high in September.

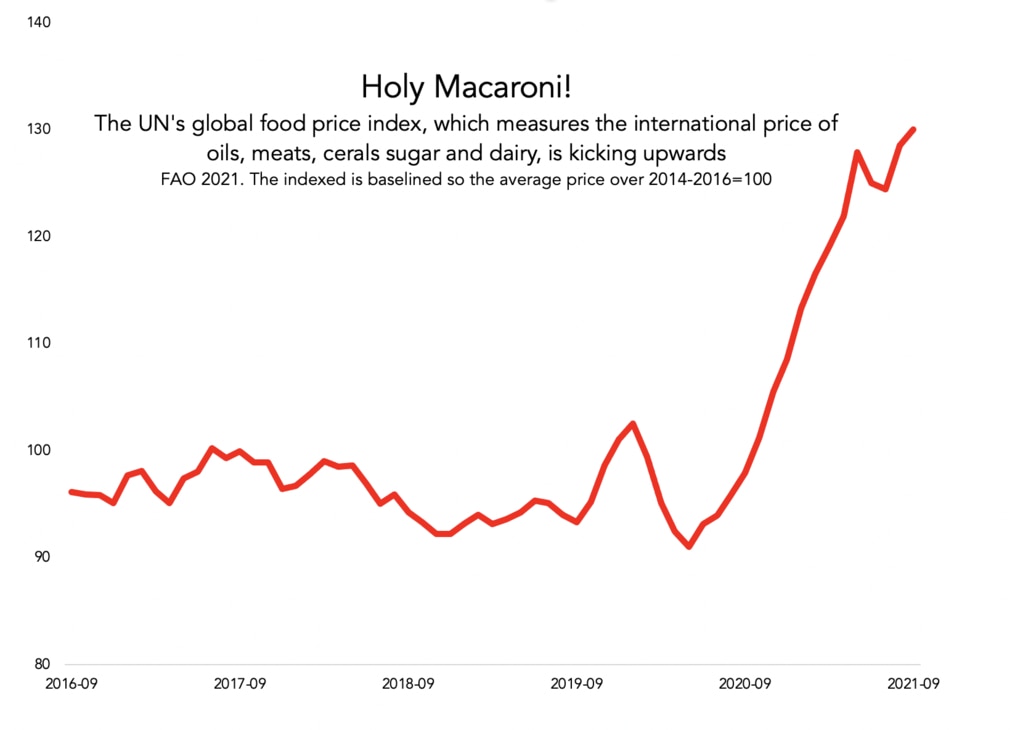

The price of food has been ramped up by supply shortages and shipping issues that have crimped supply, and that has caused a significant kick in prices, as the next chart shows.

If this keeps up we could be looking at significantly higher grocery bills next year, as well as higher energy costs.

So what will the RBA do? Would it raise interest rates to try to keep a lid on inflation? The bank has promised it won’t raise interest rates until inflation is back in the 2 to 3 per cent range sustainably, and it says it doesn’t expect that to happen until 2024.

But they’ve been wrong before, and if inflation shoots up because of supply constraints it will put the RBA into a tough spot. After all, raising rates is helpful for quelling domestic inflation, when the economy is running fast and hot. It’s not so helpful for putting a lid on imported inflation.

The start of 2022 could look very different. And with an election in the offing, politics could suddenly swing back from the unfamiliar topic of pandemic preparedness to the extremely familiar terrain of cost of living pressures. If petrol and groceries are both going up in price at once, it’s hard to imagine the election being fought on any other topic.

Jason Murphy is an economist @jasemurphy. He is the author of the book Incentivology.