Australia’s inflation rate could skyrocket as US CPI rises

News from the US could act as a crystal ball for what’s going to happen in the Aussie economy and it doesn’t look good for homeowners.

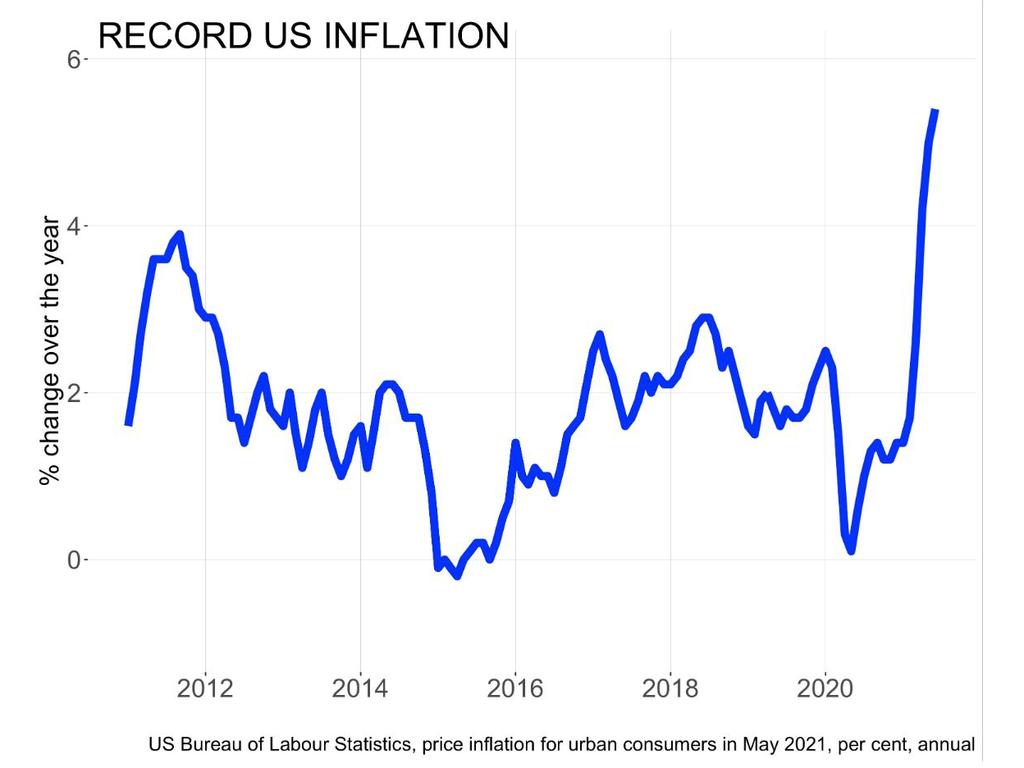

Big news from the United States. Inflation has hit 5.4 per cent. An astonishing level. As the next graph shows, American consumer prices are rising at the fastest rate in over a decade. Used cars and energy are a major cause of the lift.

RELATED: Terrifying prediction for mortgage payers

Some of this is temporary, due to the fact this time last year prices were low. But economists believe some of it could be here to stay.

America is often just ahead of Australia, and we could soon be facing higher inflation too. The low interest rates that have helped lift Australia’s economy out of the pandemic recession are like dry tinder for inflation. And the record government spending just pours fuel on the fire.

Inflation is caused by too much money chasing too few goods – when people can borrow freely the amount of money chasing those goods goes up and companies can raise prices.

The house price connection

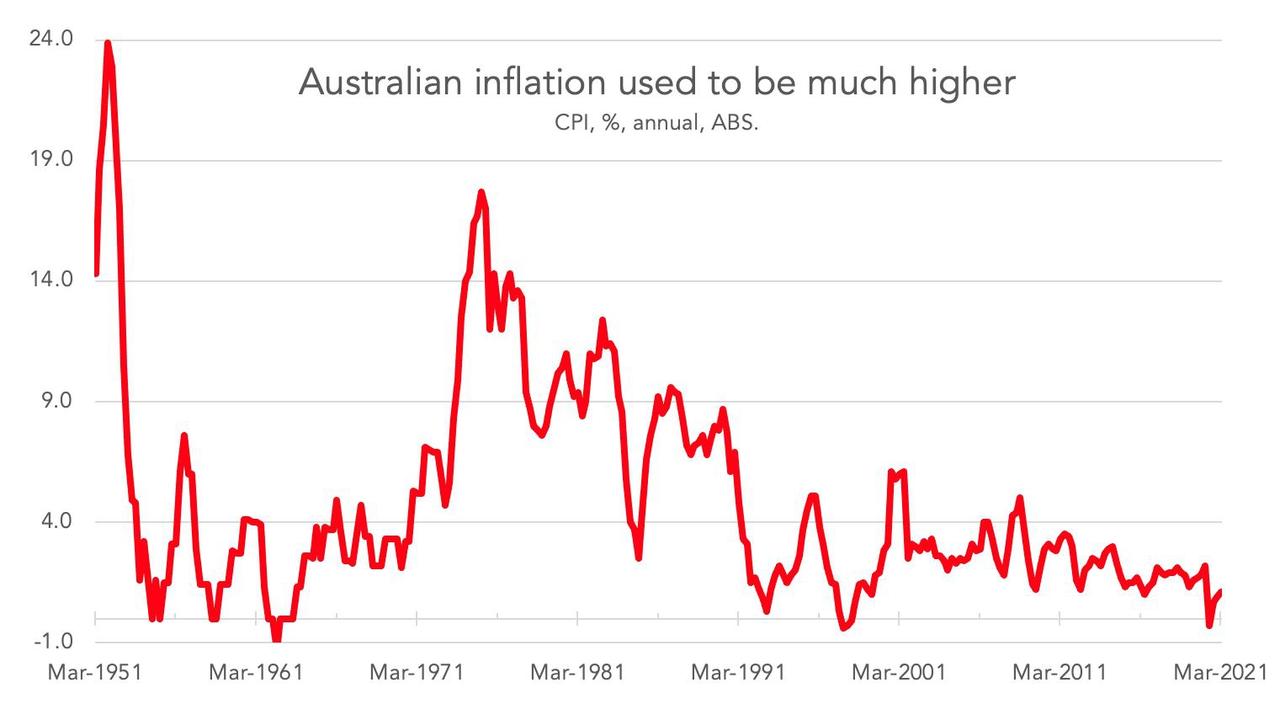

When we talk about inflation, we always have to talk about interest rates. The two go together. The RBA watches inflation and tries to control it by changing interest rates. When they raise rates, that means they are trying to push inflation down by making it more expensive to borrow money.

When they cut rates, they are trying to lift inflation a bit by making it cheaper to borrow.

They try to keep inflation in a narrow band between 2 per cent and 3 per cent a year (recently mostly successfully, as the next chart shows).

RELATED: ‘No idea’: Sign Aussie economy is doomed

RELATED: Why interest rates may have to rise sooner

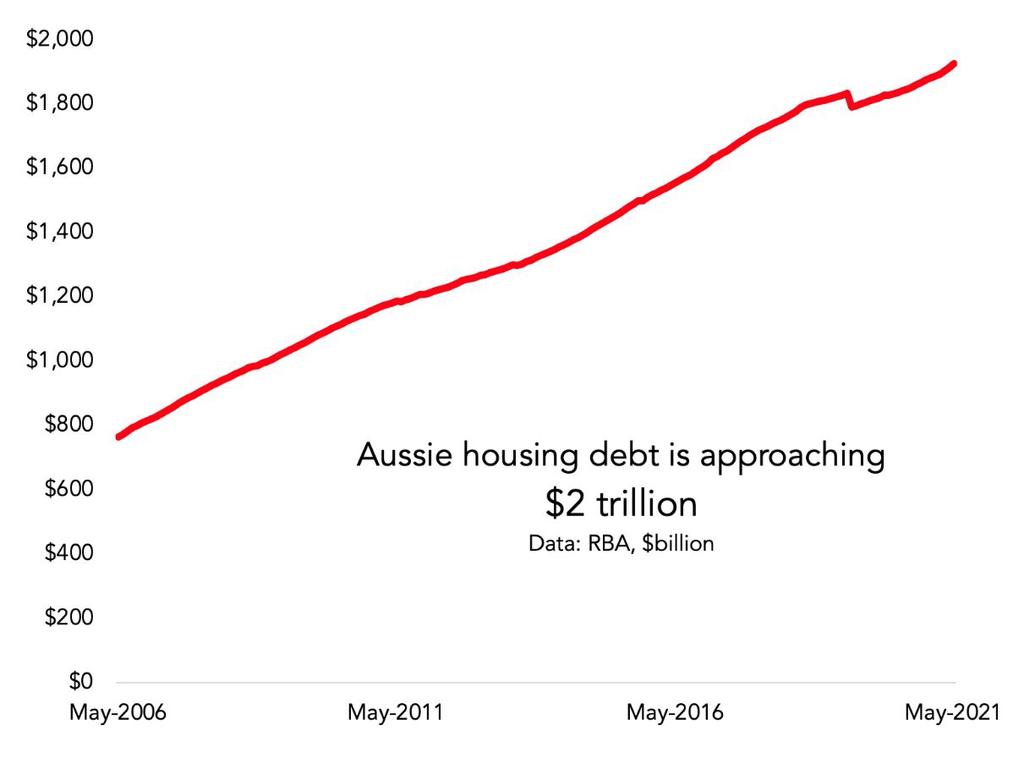

And when we talk about interest rates, we have to talk about house prices. Aussie house prices have recently gone into the stratosphere. That’s because you can borrow a million dollars or two at 2 per cent interest. But what happens to the record 1.9 trillion in housing debt if rates start to rise?

Australia’s interest rate policy works in several ways. When rates are low it unleashes four main effects.

1. Mortgage repayments fall, leaving people with more disposable income.

2. The Australian dollar falls, making life easier for our exporters and making imports more expensive.

3. It is cheaper to borrow, encouraging people and companies to go into debt to spend money.

4. It lifts house prices, which makes Aussies feel wealthier.

All of these effects encourage spending, which is why we use interest rate policies to try to make the economy stronger. Lower interest rates give us more economic growth and lower unemployment. We need all the help we can get right now as much of the country is deep in lockdown.

But all the spending caused by low interest rates can also lead to inflation. And interest rate rises tend to follow hot on the heels of inflation

The RBA has said interest rates won’t rise until 2023 or 2024. But New Zealand is getting ready to raise interest rates this year, following a huge lift in house prices in that country.

If inflation in Australia rises, the RBA will come under pressure to do the same. It will be a wobbly time for asset prices – after all, the current record highs in the stock market also owe their existence to loose interest rates.

And trust me, we won’t like it if prices are rising at 5.4 per cent a year. Aussies like to complain about inflation when one product goes up by 5 per cent (e.g. electricity), even if other things are falling in price at the same time (clothes, computers and TVs are good examples).

If average inflation is 5 per cent, it will mean some things are rising at 1 per cent and other things are going up at 9 per cent. That will feel really bad.

The American experience is a warning for us. We are enjoying the economic upside of our spending spree now, but we must be wary of what follows.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.