Major change to Aussie cash revealed

A major change to Aussie cash could be on the cards – which would essentially keep cash in the Australian system despite the dominance of card payments.

A major change to Aussie cash could be on the cards – which would essentially keep cash in the Australian system despite the dominance of card payments.

An estranged Aussie mum hadn’t spoken to her son in years when she embraced him back into her life — but one question she asked revealed a chilling problem.

A few small lifestyle changes could save Aussies hundreds of dollars on their power bills this festive season, a leading electrical expert has revealed.

Millions of Aussies are rushing to make appointments so they can claim extras from their health insurance before the December 31 cut off.

Aussie drivers have been warned that fuel prices are expected to rise ahead of the Christmas period. Here’s how much you’re likely to pay in your state.

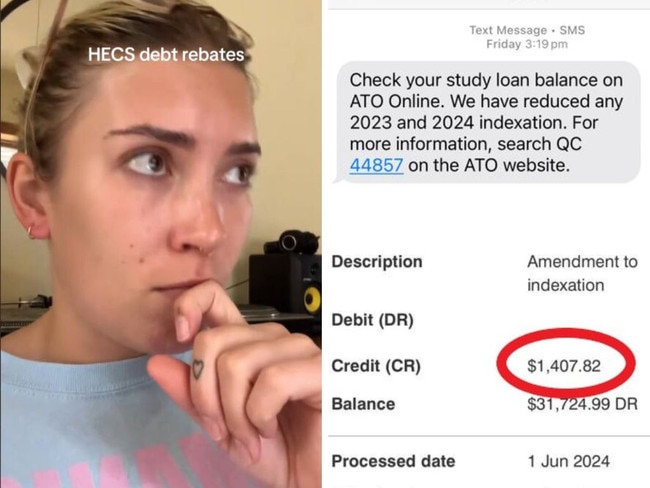

Aussies have taken to social media to share their thoughts, feelings, and big concerns about the refund they’ve just received from the government.

A father of three who recently relocated his family has admitted he got a little emotional after checking the receipt of his last Aldi shop.

It was something many Aussies used to not even think twice about doing, now new research has revealed the impact the past decade has had on one specific habit.

A young Aussie has caused divide online by revealing the staggering amount she’s saved while on Centrelink benefits.

Christmas is one of the happiest times of the year, but as the cost-of-living crisis worsens, millions of Australians are giving up essentials to put presents under the tree.

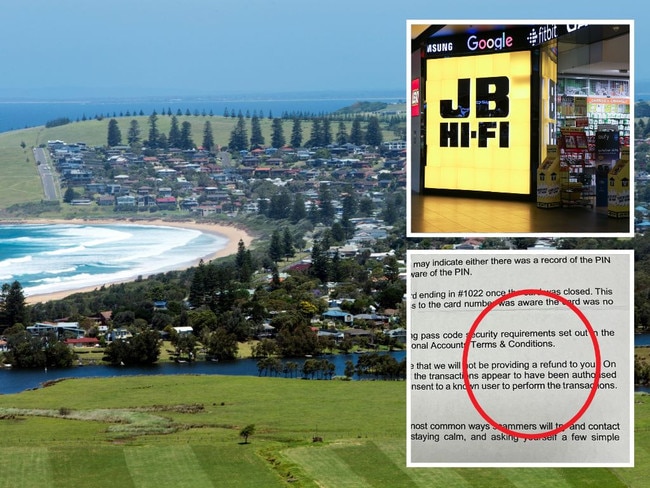

An Australian retailer’s hack has leaked concerning data and one customer has been left “infuriated” by the impact and lack of remorse.

Falling prices at the checkout mean Aussie families are tipped to pay slightly less for Christmas BBQ favourites this holiday season, according to new research.

Donald Trump has taken to X to share his latest plan and it has completely divided, even people who voted for him.

The RBA’s slow response to the post-Covid economic boom is to blame for Australians paying more on their mortgage today, a consulting firm has found.

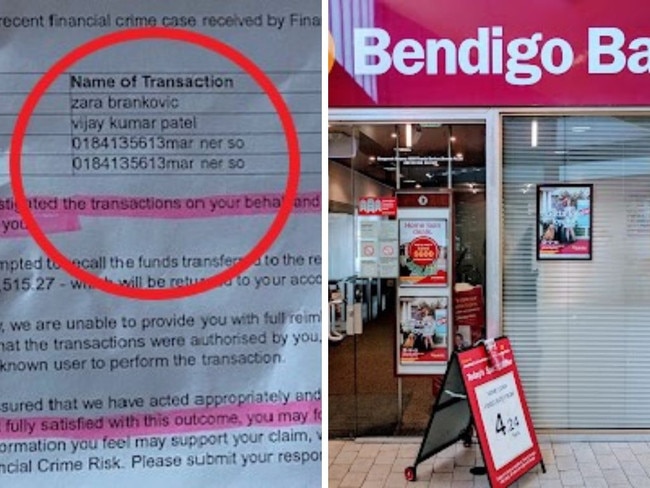

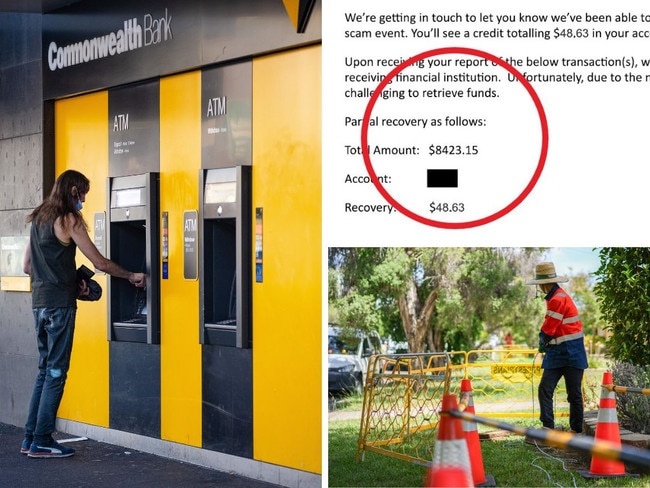

After a Melbourne man was scammed out of $11,000 and confronted his bank, he didn’t expect to hear this.

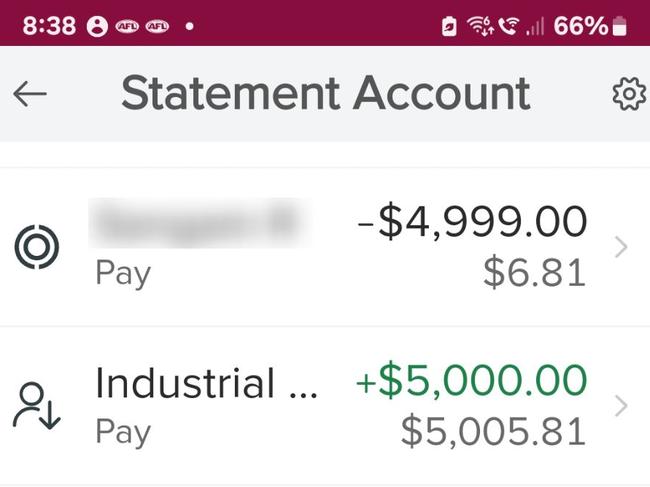

Scammers asked the man a seemingly innocent question. But when he complied with their request, it cost him $5000.

There’s a popular new trend taking off online, but there’s a very grim reason no one should be laughing.

It is the most festive time of the year, but it can also be the most “stressful”, especially for a family of three living off one salary.

Buy-now pay-later giant Afterpay has revealed some surprising Aussie fashion trends in its latest Afterpaid report, with one colour dominating 2024.

Some people from one cohort are reporting having to steal essential items more frequently to survive the cost-of-living crunch.

If you can actually remember your MyGov login, you should probably take a squiz at how much HECS you owe after tonight.

It’s a picturesque coastal town where a terrifying incident has been hidden and police are yet to catch the person involved.

A video of Aussies going about their shopping has exposed a concerning Christmas trend, with people making some major admissions.

A young Aussie has revealed the wild reason she’s planning to sell her home and why she needs to “lessen her expenses” as she prepares for a big life change.

The RBA board will meet on Tuesday and announce the final cash rate decision for 2024 later in the day.

Online behemoth Amazon has just announced the cut-off date for its Christmas Day delivery service.

Three lucky Aussies have become instant millionaires over the weekend, after scoring the lucky numbers which led to them taking home more than $1m each in Lotto prizes.

A Melbourne couple who lost a staggering $1.9 million to scammers eerily came face-to-face with one of the criminals while they were holidaying in China.

It’s one of the most legendary Aussie items of all time – but it’s getting harder and harder to afford as prices explode and wages plummet.

Households in one state are getting a cash kicker to knock the top off power bills before Christmas.

More than one million Australians will receive a boost to their social security payments in the new year due to annual indexation.

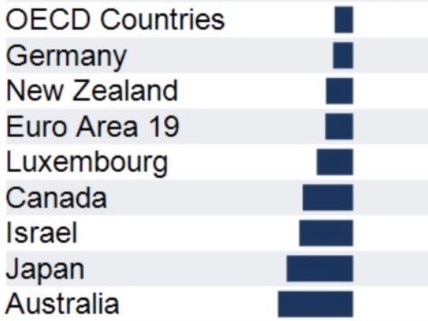

Australians are getting poorer and a leading economist has produced a simple chart that shows why.

A recession gripping Australia’s struggling retail sector is tipped to end – as household confidence grows and consumers look to spend their tax cuts.

A surprise jump in spending in major two areas has given early indications Aussies are starting to spend again, in spite of a high cost of living.

At least five different products from Woolworths, Aldi and Lindt have become the latest casualties in the ‘shrinkflation epidemic’ plaguing Aussie shoppers.

The Prime Minister treated world leaders to a $40,000 performance at dinner adorned with $18,000 worth of flowers, new documents reveal.

Despite using privacy-invading facial recognition cameras, a major retailer has held its spot as the No.1 most trusted Australian brand.

Thousands of shoppers will be in the running to win up to $100 off their next shop as part of an instant win giveaway in the lead-up to the festive season.

The Albanese government has slammed a bank’s decision to charge customers a fee to withdraw money from their own accounts, claiming it “doesn’t seem fair”.

As the federal election looms, Peter Dutton has used a three-year anniversary to attack Anthony Albanese over a broken promise.

A Melbourne man saw his money disappear from his account but was shocked when the bank blamed him. What he did next changed everything.

Aussies looking to cut back this Christmas are walking away from this holiday tradition, but it might not be saving them as much as they think.

Cigarettes are right near the top of the list of the fastest-rising prices in Australia – and it’s hurting all of us, even nonsmokers.

Aussies may be entitled to a share in billions of dollars’ worth of “unclaimed money” accumulated over the years. Here’s how you can find out if you’re eligible.

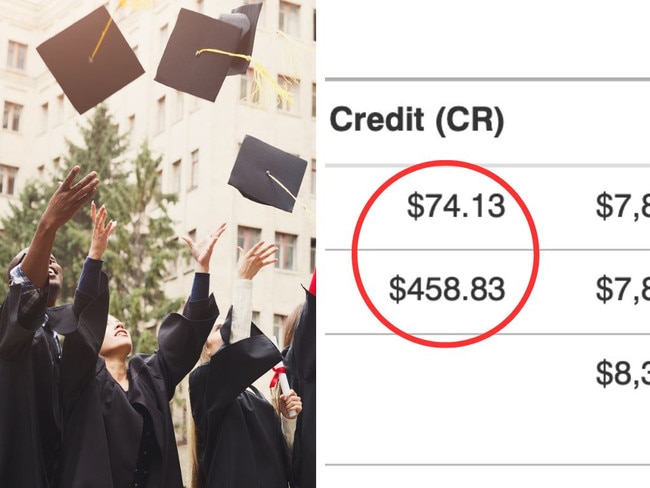

Three million Aussies will get hundreds of dollars wiped off their HECS debts, with the new laws set to change how pesky annual indexation charges are applied.

The Greens have been accused of selling out in agreeing to back Labor’s Help To Buy bill, with the Liberal Party vowing to repeal the law if they win the election.

The Australian Council of Social Services has urged the government to lift the Jobseeker rate in line with the aged pension.

A state government is making big changes to clamp down on the “harmful” industry’s grip on addicted gamers.

Australia Post says consumers need to be on guard for scams as Black Friday sales ramp up and criminals target unsuspecting victims.

Hundreds of thousands of Aussies are due to share in $280m worth of cost-of-living relief, including hundreds of dollars being allocated for each schoolchild.

One of the USA’s most prestigious universities is making a radical change and others are following in its footsteps.

One of Australia’s two supermarket giants has denied it is sitting on unused land in one capital city to stop any competitors opening up.

With less and less Aussies sending letters by mail, Australia Post is hoping to increase stamp prices in an effort to curb its financial losses.

A new report has revealed the insane amount of money Australians need to earn in two major cities to live comfortably and start a family.

One Aussie state has made a huge move to crack down on unregistered tradies ripping off homeowners – urging people to “dob” them into an anonymous tip off line.

Major Aussie banks are teaming up to try to stop scammers before transactions have even left a victim’s account.

A young man discovered he had been tricked in one “normal” phone call. But he was shocked by what the bank let happen next.

The housing and homelessness crisis is so bad in one major state that a peak body has called on political parties to commit to a bold election platform.

Australians have the legal right to put their work phone on ‘do not disturb’ during out of office hours, but bosses are ignoring these new laws.

More than 200,000 homeowners are eligible for cost of living concessions, are you one of them?

Aussies are doing what the Reserve Bank of Australia is asking and cutting back on spending, but they might need to wait nine months for a reduction on their mortgage.

More than a quarter of people living in disadvantaged areas are forgoing important trips to the dentist as costs continue to cripple everyday Australians.

Cost-of-living threatens to blow out the cost of Christmas lunch for lots of Aussies, but one retailer reckons there’s an easy way to space out spending for the big day.

The 94-year-old man has lost nearly $10,000 in a cruel scam, with police releasing photos of a man they believe can assist with inquiries.

Legal papers have officially been filed against Coles and Woolworths on behalf of consumers in relation to alleged dodgy sale prices.

If you ever needed proof our blessed politicians are out of touch, cast your eyes to this unbelievable interview with the NSW Housing Minister.

A 36-year-old woman has revealed the awful state of her home and why it was always filthy. The reason is heartbreaking.

Another major Australian corporation is ordering staff back into the office, in another sign the pandemic-era work from home norm is changing.

Coles chairman James Graham has raised eyebrows after accusing Aussies of using the cost of living crisis to turn on supermarkets.

Aussie consumers and businesses are seeing through the high cost of living as sentiment and spending improve, new reports show.

A Melbourne woman has revealed the “disaster” she found herself in as scammers drained her life savings, including while she was in her bank branch.

An anonymous Coles worker has accused the supermarket giant of “gaslighting” its customers after a shopper slammed the price of a popular sweet snack.

Aussie farmers are up in arms about supermarket behemoths Coles and Woolies, but an ACCC hearing has heard they have nowhere else to go.

An Australian billionaire, who became famous for buying multimillion dollar homes on The Block, says he had a “fantastic time” at his “awesome job” in Adelaide.

Australians may be closer to knowing when they are heading to the polls next year, after the Prime Minister appeared to drop a clue in a key policy call.

Sinister criminals are targeting Australians, draining their bank accounts, but also threatening and abusing them along the way.

The big four banks are profiting a huge $200k off the average Aussie mortgage by charging higher than neccesary interest rates, new research has found.

Australians lamenting burdensome student loans could get major relief under an overhaul being proposed by the Albanese government.

As the cost of living crisis continues to cripple everyday Aussies, residents of one city may see their monthly water bills increase by a staggering 50 per cent.

Woolworths Group has railed against allegations it deceived customers with false discounts on specially-marked products.

Original URL: https://www.news.com.au/finance/money/costs/page/8