‘Pain’: Devastating phone call tricks 23yo into losing thousands

A young man discovered he had been tricked in one “normal” phone call. But he was shocked by what the bank let happen next.

Juston Free thought his fast action had saved him from an elaborate scam, but despite his vigilance, he was shocked to see $7000 disappear from his bank account.

He had alerted his bank to a scam he had fallen for while the two transactions were still pending, yet days later the money was still transferred out of his account.

All up, the Queenslander lost close to $8500 in the scam. It was a lot of money for the 23-year-old.

It all started when he received a phone call from what he thought was from Heritage Bank’s fraud department warning his account had been compromised.

But later he would be devastated to uncover it was scammers. He believed the call was legitimate as they knew details such as how much money was in his bank account, his address and other security details, he said.

“It just seemed normal and when they were coming at you they had answers for any sort of questions,” he told news.com.au.

“They followed the normal rigmarole of the bank. But I lost over $8000.”

The scammers got him to share security details, told him to delete his online banking and not use his debit card.

What Mr Free didn’t realise was that during the phone call he had allowed the scammers access to his bank account.

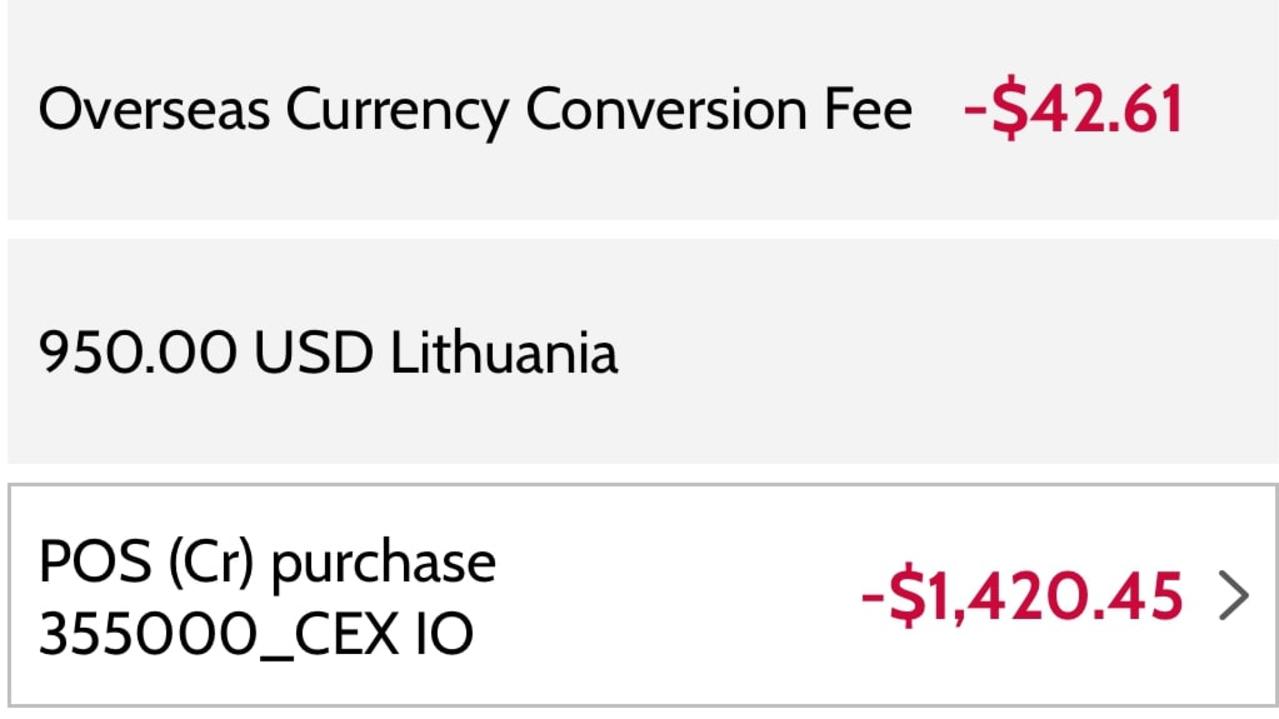

They immediately transferred out the Australian equivalent of $1420 to an account potentially in Lithuania, with Mr Free also slugged an overseas currency conversion fee of $42.61.

When he rang the bank later in the week to check up on his case, he discovered he had been scammed.

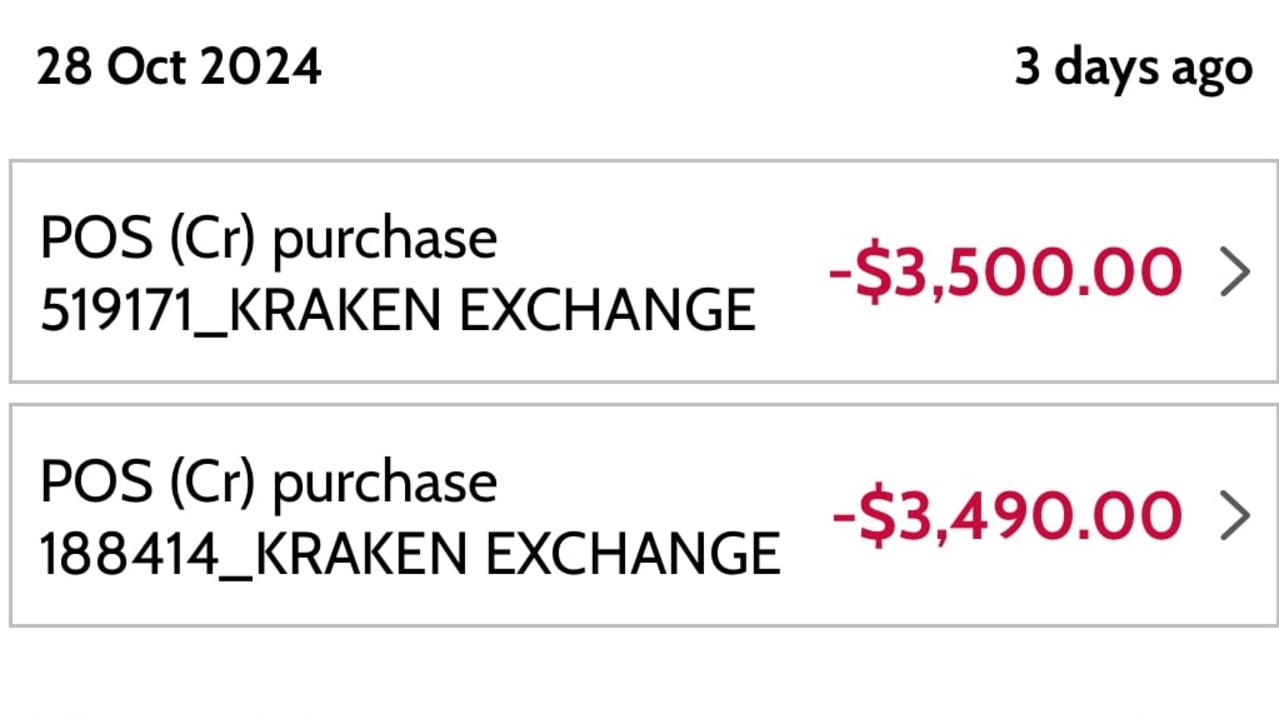

Yet two transactions had not yet cleared – one worth $3490 and another for $3500. Despite alerting the bank to the pending fraudulent transactions, they still cleared just three days later.

“I’m a bit angry at myself for not picking up on it,” he said.

“It’s disheartening you work hard for your money and to have something like that happen and just lose it like that and the bank not do much about it when they are supposed to be protecting your money – it’s frustrating.”

Have you been a victim of a scam? Contact sarah.sharples@news.com.au

The light vehicle mechanic said the level of detail the scammers knew about him was worrying and he was anxious it could happen again. He was also angry at himself that he was distracted while taking the phone call as he was busy working.

“My phone had to be wiped. I went and reset all my passwords for my emails and everything got logged out of to start again and that took me half a day to sort all that out again and it’s just a pain,” he said.

“My point of view is it’s the bank’s job to look after people’s money and you think they are doing everything they can to ensure people’s money is secure and safe. And it’s in their interests too because the more money and people they have banking with them the better off they are, to me it seems like there is no care left in it.”

He added there was a perception that only older people were caught up in scams but since opening up to friends and work colleagues, he discovered he wasn’t alone and wants more people to be honest about their experiences.

After lodging a fraud case with Heritage Bank, Mr Free was refunded the almost $7000.

“If they didn’t give it back I probably would have gotten pretty angry considering it was sitting there uncleared for four days and then they let it clear on the fourth day – it doesn’t really make sense,” he added.

However, he is still out of pocket almost $1500.

In a letter to Mr Free, Heritage Bank stated he had been the victim of an impersonation scam and the transaction could not be refunded as he had shared a unique security code with the scammers and potentially allowed remote access to his phone.

A Heritage Bank spokesman said they do not comment publicly on specific customer matters. “We take our responsibility to protect our customers’ savings and personal data extremely seriously,” he said.

“To support this commitment, we operate a 24/7 Scams Hotline and Security Operations Centre while continually investing in expert personnel, specialist software, and comprehensive fraud and scam management systems.”

There have been almost 200,000 scams reported to Scamwatch this year alone. In 2023, Australians reported a record number of scams, with losses totalling $2.7 billion.

sarah.sharples@news.com.au