Data reveals costs of staples continue to ‘march ever higher’ as inflation soars and wages fall

It’s one of the most legendary Aussie items of all time - but it’s getting harder and harder to afford as prices explode and wages plummet.

ANALYSIS

In Australia, the list of issues that prompt a major backlash from the electorate is a relatively short one.

But one of the issues capable of uniting a sizeable majority of people in collective frustration is outsized rises in the cost of living.

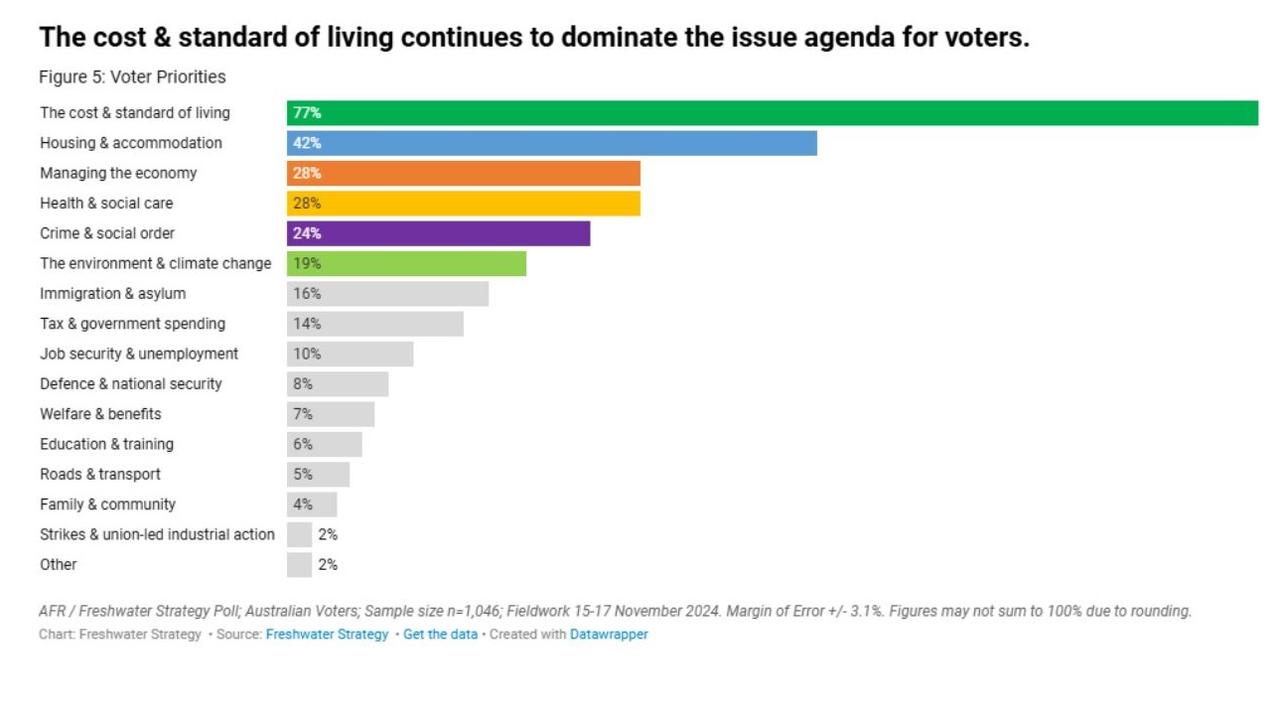

After more than two years of the highest sustained inflation in three decades, the cost of living is frequently revealed as the number one issue for voters in opinion polls.

But how much has the cost of various household goods and services actually risen over time, both compared with the relative performance of different items and the broader headline rate of inflation?

In order to provide some perspective on cost of living pressures over time, we’ll be looking at cumulative price growth from two points in time, December 2019, due to it being the last snapshot of consumer prices not impacted by the pandemic, and September 2009, since a nice round 15 years has passed since.

Cost of living since the pandemic

When looking at a chart of the various goods and services we’re focusing on today compared with wages growth since just prior to the pandemic, it’s immediately clear why so many households are feeling the pinch from the cost of living.

Of the 14 items we are looking at today, 11 have seen cumulative price growth in excess of wages growth, with one – the cost of gas bills – rising by 164.1 per cent more than wages.

Of the other three, two (childcare and electricity) have been lowered using government subsidies and have not organically grown at a rate slower than wages. If not for the impact of the electricity subsidies provided by the Albanese government and several state governments, cumulative electricity price inflation in the consumer price index (CPI) since 2019 would be 27.0 per cent instead of -7.4 per cent.

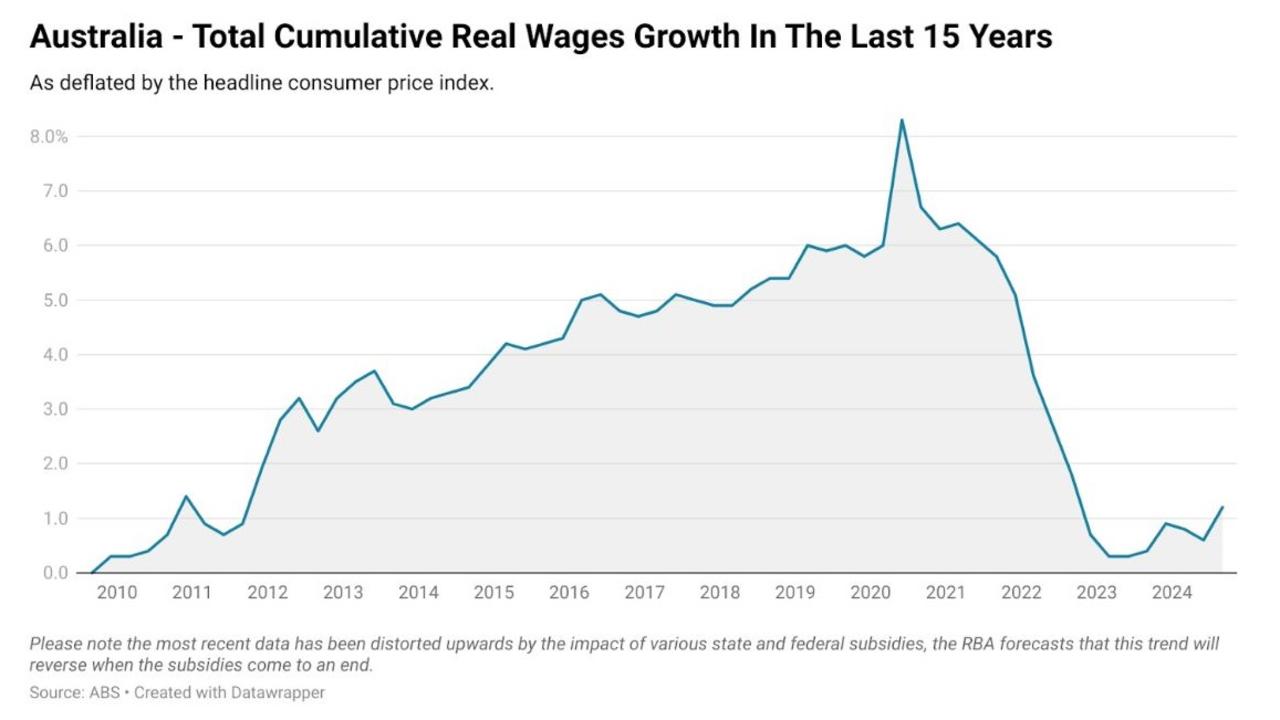

If we cast our gaze back further, the last 15 years have delivered wages growth of just 1.2 per cent after accounting for the impact of headline inflation. It’s also worth noting that this figure takes into account the impact of various government subsidies artificially suppressing the rate of headline inflation.

The Reserve Bank of Australia forecasts that real wages will once again fall in the second half of 2025, as the impact of the subsidies draws to a close.

The longer view

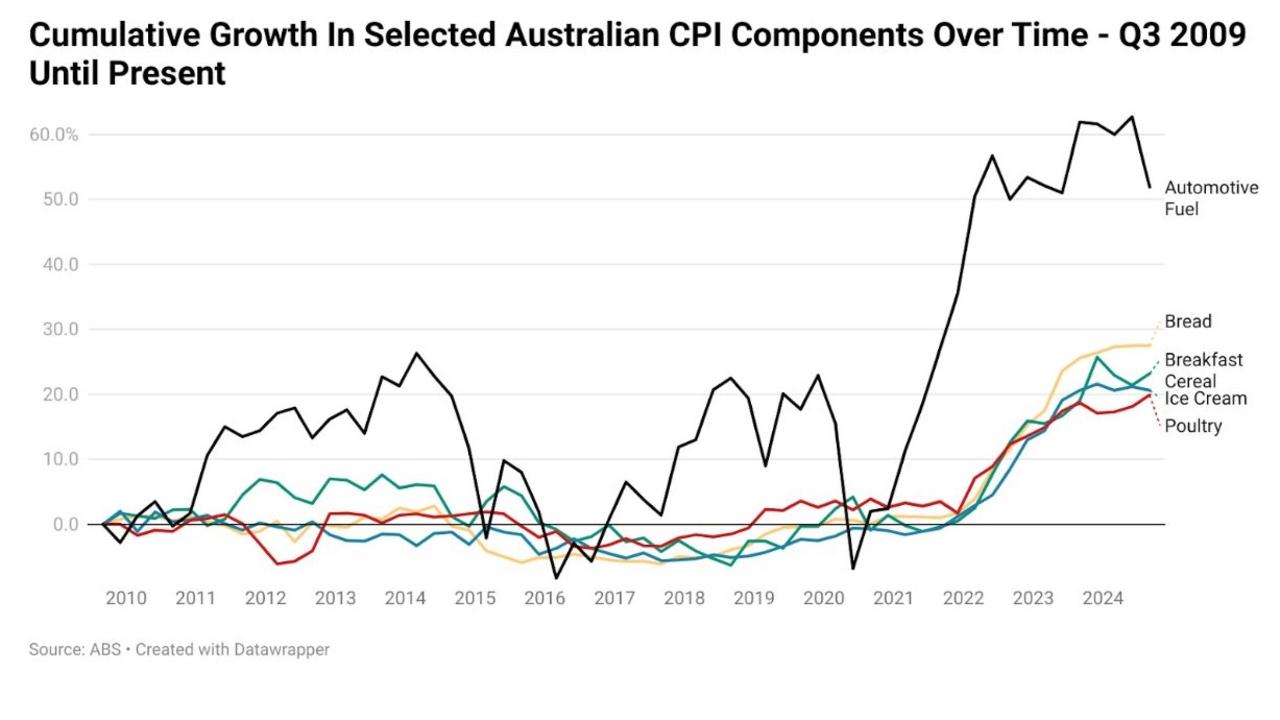

If we take the starting point for our snapshot of cumulative inflation back 15 years to shortly after the Global Financial Crisis, things look quite a bit different. The ebbs and flows in the prices of CPI components such as automotive fuel, bread, breakfast cereals and even the common supermarket chook begins to emerge.

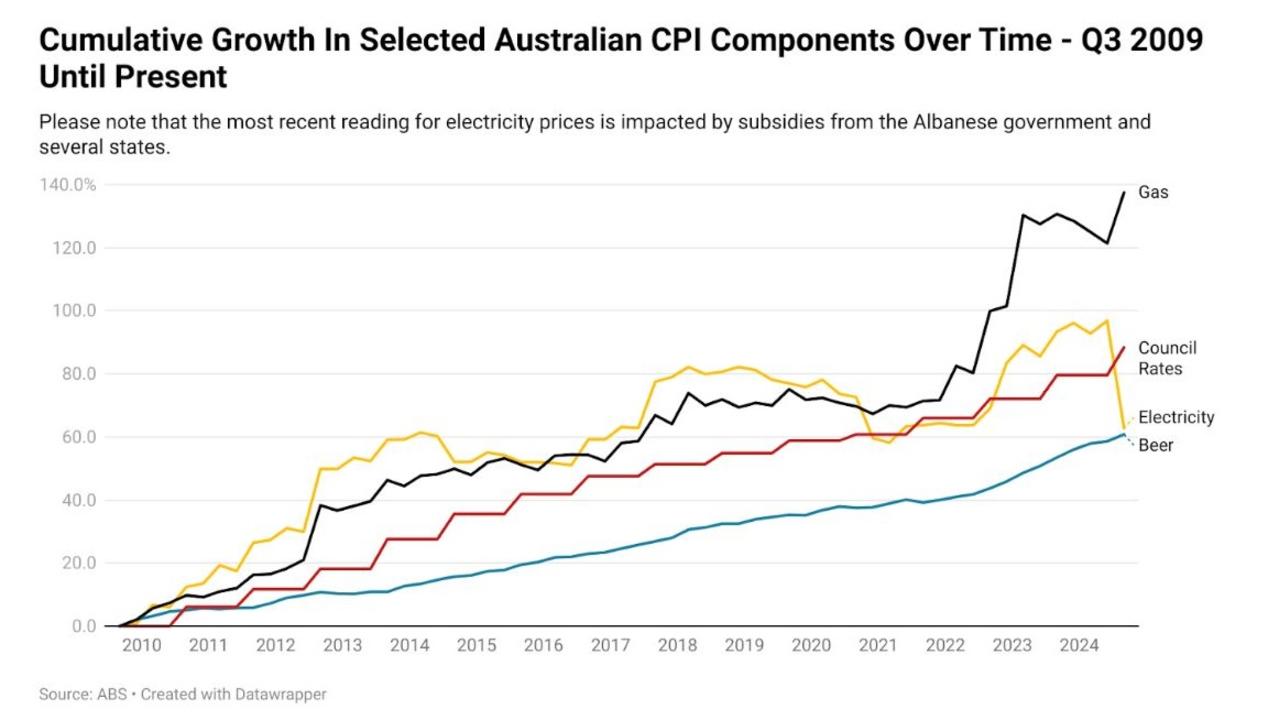

Meanwhile, other components of the CPI assessed today such as gas, council rates, electricity and beer have tended to much more consistently march ever higher with the passage of time.

This serves to illustrate how low growth in other CPI elements can mask much higher rates of inflation in some of life’s more essential items. This is a key element in why inflation can be perceived quite differently by various people.

For example, for a low-income household in outer metropolitan Victoria reliant on gas for heating and who needs to drive far more than the average household, the rise in their cost of living would be significantly different over the various different time horizons to the average household.

The elephant in the room

While Australians vent their frustration at their electricity bill or the cost of petrol up in lights along our nation’s roads when it rises above what we collectively believe is acceptable, when it comes to the cost of the single biggest expense in the lives of the majority of Australians, skyrocketing costs don’t rate that sort of broadbased response.

The elephant in the room of the nation’s cost of living is housing prices.

Before we get into the comparisons of the last 15 years, it’s worth noting that housing prices start from a much higher base than other CPI components. For example, between the third quarter (Q3) of 1997 and Q3 2009, wages grew by 52.9 per cent, headline inflation rose by 40.8 per cent and housing prices rose by 177.6 per cent.

The September quarter of 1997 was chosen as the starting point due to this being the beginning of the current Australian Bureau of Statistics Wage Price Index.

In terms of the last 15 years, wages have cumulatively risen by 50.0 per cent, headline inflation has risen 48.3 per cent and housing prices have risen 110.0 per cent.

Of all the different price pressures faced by households, the cost of purchasing a home has experienced by far the most significant relative increase.

Different perspective

As the Albanese government touts its inflation-fighting credentials in the run up to next year’s federal election, many Australians are left wondering how their lived experience is so different to the news headlines.

This is due to how inflation is measured by different people.

For the government, financial markets and the RBA, inflation is the annual rate of change in the consumer price index. But for the average person on the street, inflation is seen as the total increase in the cost of a product over a more protracted period of time.

Ultimately, how inflation is measured outside of the more academic approach taken by policymakers is very much a matter of personal perspective, defined by one’s own purchases and timeline under consideration for price growth.

This difference in perspective with policymakers has been a major issue at the ballot box throughout much of the developed world in recent years and there is little sign Australia will buck the trend at next year’s federal election.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator