‘I’d find more money on the ground’: Aussies weigh in on HECS indexation refunds and credits

Aussies have taken to social media to share their thoughts, feelings, and big concerns about the refund they’ve just received from the government.

Thousands of Aussies are confused, annoyed, and straight-up offended over the amount of money they’ve received back on their higher education loans.

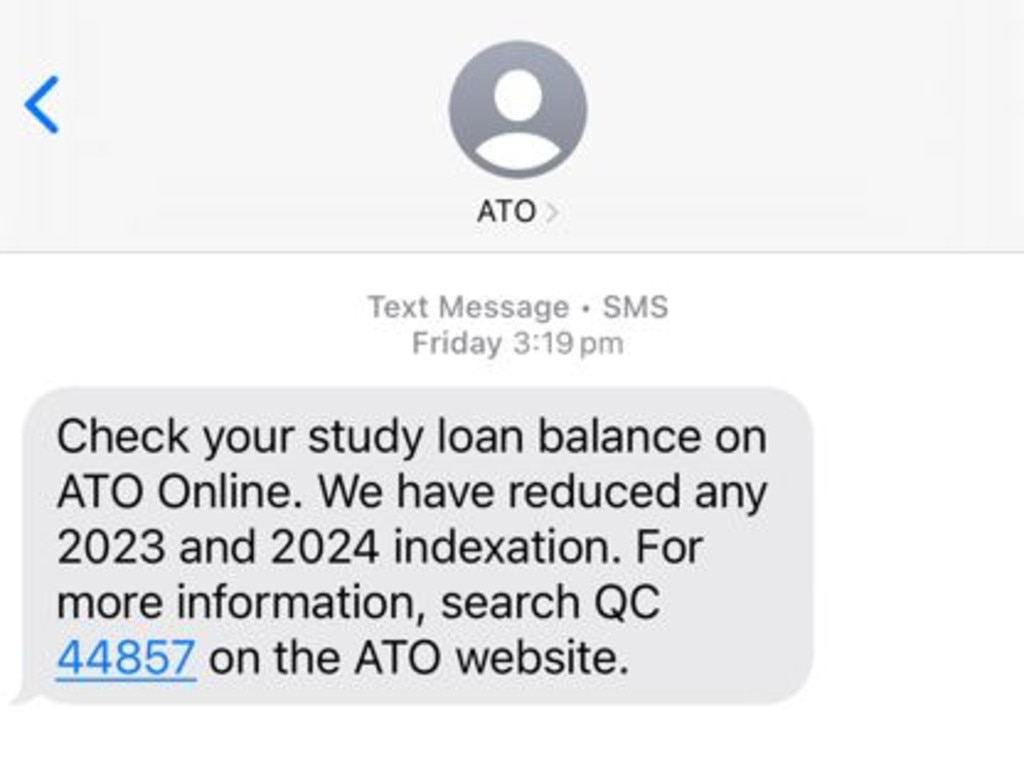

Aussies with HECS-HELP debt received a text last week letting them know that indexation accrued between 2024 and 2024 would be partially wiped.

The Australian Taxation Office (ATO) sent out a text that read, “Our study loan balance has changed. We have reduced any 2023 and 2024 indexation.”

Higher education loans in Australia don’t charge interest, but they are subject to indexation based on inflation.

In 2023, millions of Aussies saw their loans increase by a whopping 7.1 per cent - the biggest jump seen in 30 years. In June 2024, the indexation rate was 4.7 per cent.

There have been many conversations online since young people were shocked by their ballooning HECS debts in 2023 and 2024, and the Labor government has now offered some relief.

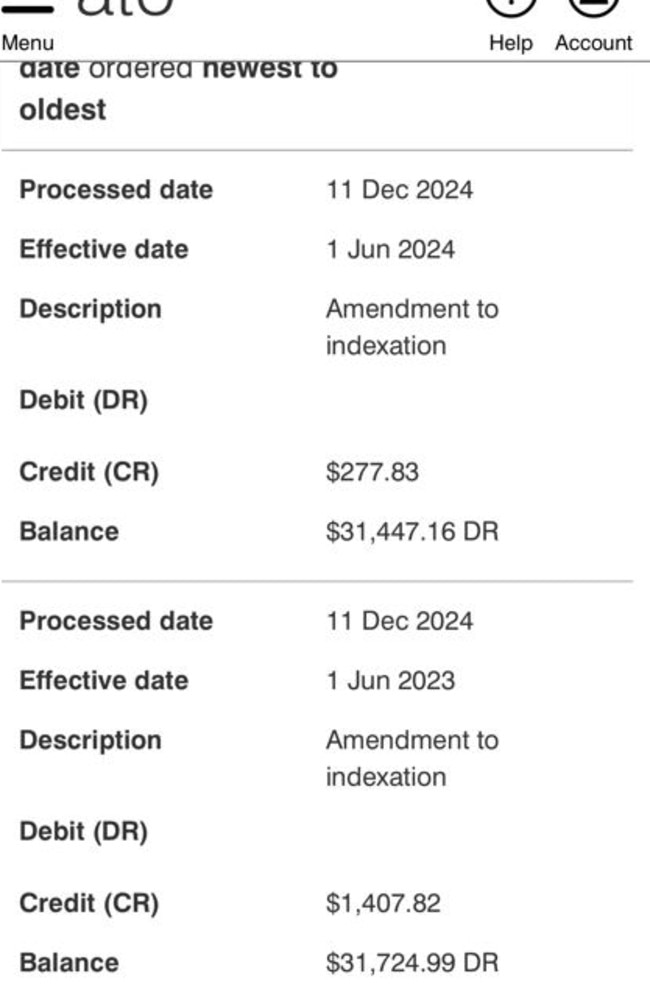

Around $3 billion has been wiped from more than three million student debts, after the government announced the 2023 and 2024 indexation rates would be reduced to 3.2 per cent and 4 per cent respectively.

People who paid off their loans after the June 1, 2023 hike will receive a refund to their nominated bank account, providing they don’t have any other existing tax debts.

It comes after the government announced that, from June 1 next year, HECS loans will be indexed in line with either the Consumer Price Index (CPI) or the Wage Price Index (WPI), depending on which figure is smaller, as a way to ensure the rates are not outpaced by wage growth.

The fact Aussies are now getting money taken off their HECS debts has become an enormous conversation online, but not everyone is happy.

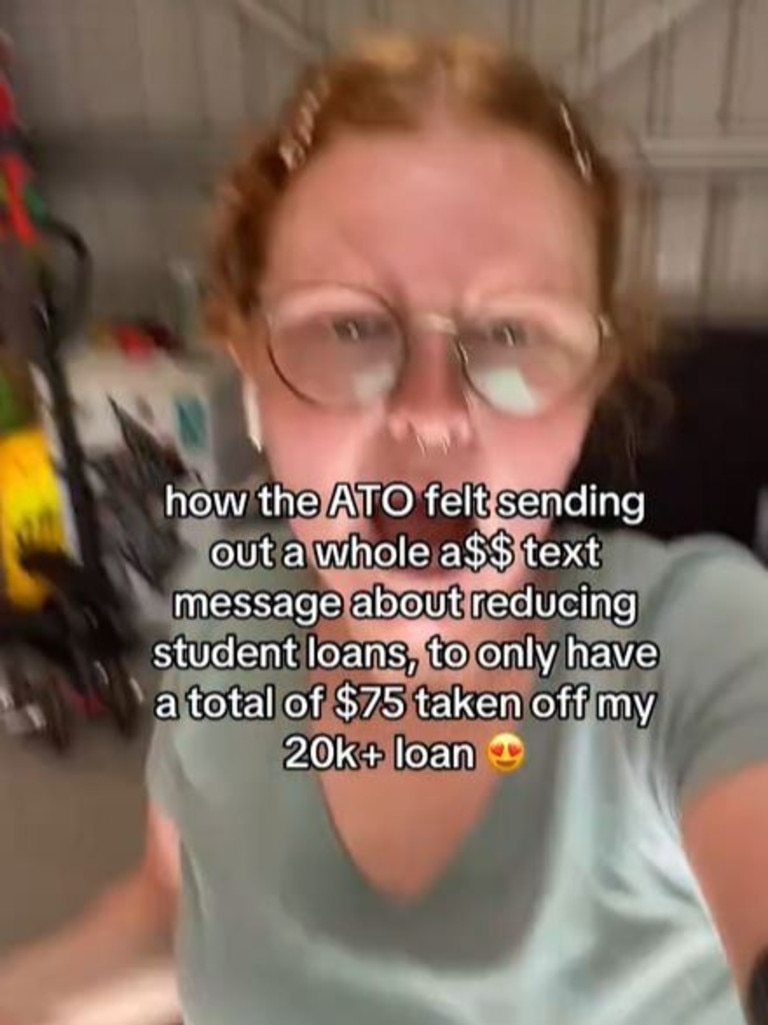

Libby Barret took to social media to express dismay at having only $75 taken off her $20,000 student debt.

Online she admitted she thought it was going to be a “Christmas miracle”, but the amount was less than she anticipated.

That admission amassed over 200,000 views and other Aussies were quick to share how much they got taken off their loans, which created even more confusion over how the kickback was calculated.

When someone shared that they’d had $1100 taken off their debt of $23,000, Ms Barret replied, “I do not understand the logic behind it”.

“I got $30 off,” another shared.

One Aussie said that she had a debt of over $63,000 and only got refunded $179.

“Like, at that point, just don’t tell me,” she said.

Another shared that they got over $1000 taken off their loan and added, “Hell yeah!”

Someone else shared that they had over $16,000 in debt and gotten over $1000 removed.

“I’m not complaining, but how does this work?” she asked.

Meanwhile a woman shared her husband got $12,000 taken off his student loan debt, but she only scored $2000 reduction.

“I’m not even looking, I know I’ll be disappointed,” someone wrote.

“$26! I’d find more money on the ground,” one vented.

“I have a $25k debt and they wiped just over a thousand off. Weird that it doesn’t work out the same percentage for everyone,” one wrote.

Another young Aussie, who runs the climate action account Project Planet on TikTok, said she was excited when she first read that HECS refunds were being rolled out, but was left disappointed after checking her MyGov account.

“It is not as exciting reading that my debt has fallen from $107,000 to $103,000. It still feels like I am never going to be able to pay that off,” she said.

The ATO confirmed to news.com.au that the “indexation rate for study and training loans is now based on the Consumer Price Index or Wage Price Index whichever is lower”.

The ATO also explained that the credits are based on individual’s circumstances, as well, as indexation.

“We’re processing differential credits for 2023 and 2024 indexation rate changes and our calculations will accommodate any compounding effect of the indexation across both income years. The credit will also depend on the individual’s specific facts and circumstances.”

Further afield online, the confusion has continued.

One Aussie on X called the refund a “joke” and not enough.

“The couple of hundred dollars that come off a person’s HECS debt will be less than the next index increase, so this move is literally air. It has no substance,” the person wrote.

While another said that we need to “stop” indexation altogether to create real change for Aussies with loans.

“All the government ever needed to do about HECS was to not index it annually. That’s the greatest rort and theft. Plus, it discriminates against women who work less, leave the workforce for a long period of time and end up paying double what men do for their degree,” someone else declared.

Director of tax communications at H & R Block Australia Mark Chapman warned that “most people won’t get a refund” and that for those who do, it won’t be a huge amount.

“This reduction is made in the form of a HECS credit, which reduces the balance of your loan if you still have an ongoing HECS debt, that credit will be taken off the amount you still owe,” he told news.com.au.

“Only if you’ve already paid off your debt will the credit be converted into a refund which will be paid to you by the ATO when you lodge next year’s tax return.”

Mr Chapman added that for the majority of taxpayers, there will be “no refund”, but for those who do receive one, the amount will depend on indexation.

“A person with an average HELP debt of $26,500 in 2023 will receive a credit of up to $1, 190,” he said.

“This is the difference between the 2023 consumer price index rate (CPI) of 7.1 per cent and the wage price index rate (WPI) of 3.2 per cent, and the 2024 CPI rate of 4.7 per cent and the WPI rate of 4.0 per cent.”

Mr Chapman stressed that “you don’t need to do anything” and the ATO will automatically calculate your indexation credit and apply it to your loan debt.

“If you completely repaid your HELP debt after 2023 or 2024 indexation was applied, the credit would be via a refund to your bank account assuming there are no outstanding tax debts,” he said

Mr Chapman added that Aussies should do their best to make “voluntary repayments” on their HECS debts.

“Making voluntary repayments means that you will have less indexation and a lower student loan balance than you otherwise would have had,” he advised.