Scammers ask man question, it costs him $5000

Scammers asked the man a seemingly innocent question. But when he complied with their request, it cost him $5000.

A banker lost $5000 to scammers after the criminal asked him one simple request — and he complied.

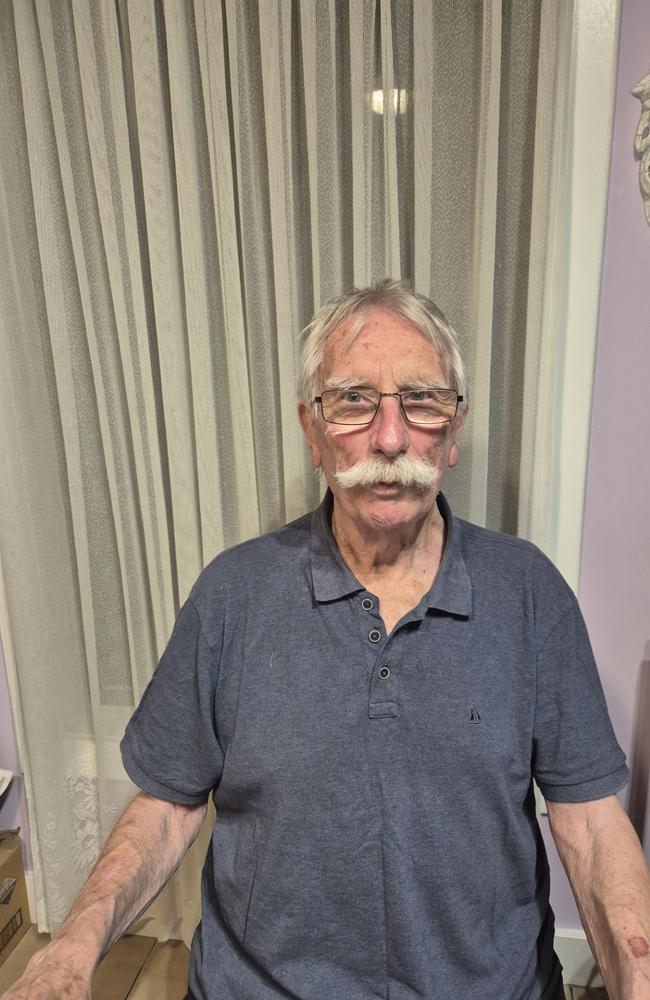

Peter Cook, who has worked in the banking industry for 28 years, is lamenting his loss after falling for an NBN scam that cost him a hefty chunk of his savings.

“We were left with a few dollars after the scam,” the retiree, 79, told news.com.au. He had to use his wife’s separate account to pay their bills.

In March this year, Mr Cook, based in Adelaide, said his internet was “really slow”.

His telco provider, Optus, rang him saying they would look into the issue.

Shortly after, he received a call from another woman, claiming to be from Optus, and he took the call. In actuality, this person was a scammer.

The fraudster then said they were passing the phone onto a technician, who Mr Cook described as having an Asian accent.

The alleged technician coaxed him into downloading an app called AnyDesk, under the pretext that this would solve his internet problems.

What it actually did was give scammers remote access to his phone.

“What struck me at the time, he asked me to ‘make sure your phone is facing down’,” Mr Cook recalled.

This simple request proved to be his undoing. With the phone screen not visible, the scammer was able to raid his bank account unimpeded — and he was none the wiser until afterwards.

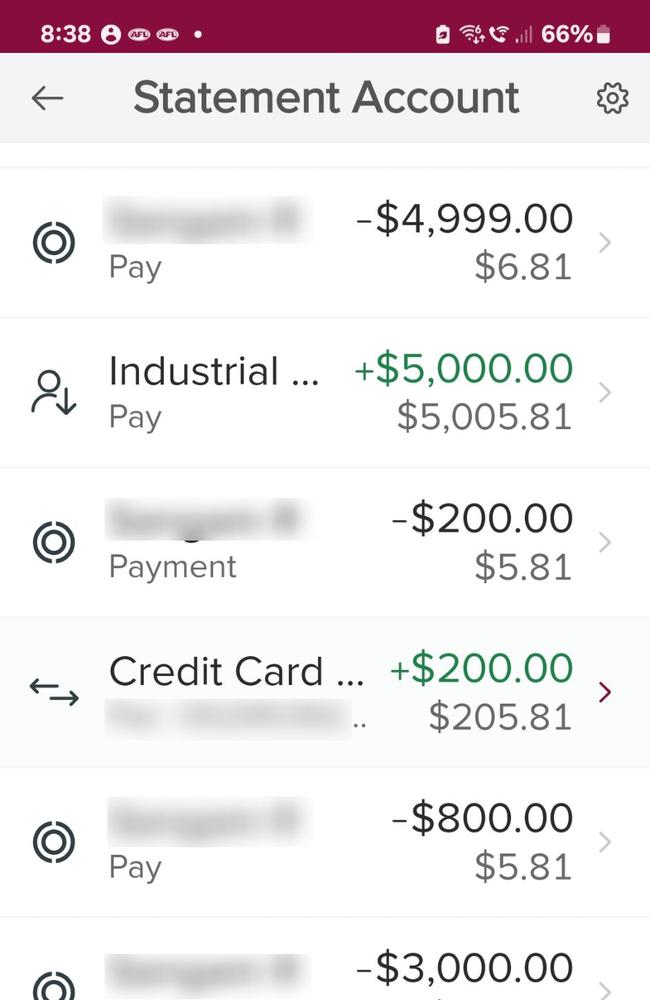

“I looked at my account and I’ve got no money left in it,” he said.

News.com.au knows of several others who have also been dudded out of tens of thousands of dollars by scammers purporting to be fixing their slow NBN connection.

Another victim said they were encouraged to switch their phone off to pull off a similar fraud.

Have you been scammed? Get in touch | alex.turner-cohen@news.com.au

Mr Cook quickly alerted his bank but the money had already disappeared and couldn’t be recovered.

He also made a report to police.

They were able to track the bank account to somewhere in Sydney, so the case was passed onto NSW police.

Mr Cook says police from the Bankstown department, in Western Sydney, told him they had captured an unknown man on camera withdrawing his cash from an ATM in Sydney. This person has not been arrested or charged.

NSW Police would not release the CCTV footage to news.com.au.

They said their investigations into the crime are continuing.

There were 863 reports to Scamwatch of Australians being caught out by NBN scams between January and July this year.

Chillingly, there were 5352 remote access scams from January to September this year reported to Scamwatch with Australians losing a whopping $5.8 million as a result.

NBN chief security officer Darren Kane said that there is “very limited” identifiable information that the organisation keeps on customers.

However, it does publish its upgrading programs across Australia which lists the suburbs it will be in.

He said employees and third party contractors are also required to undergo criminal background checks.

“Social engineering is certainly on the rise with the ability of these criminals to gather small pieces of identity that builds a picture of victim and that does and come from all sources available from the web and dark web,” he said.

“I very much believe they may target 100 to 150 different victims with details of those victims and ultimately one, two, three or four fall victim to the scams.”

Mr Kane added that the NBN will never ask to remote access the computer of a customer or advise them they have been hacked or disconnected.

The NBN will also never ask to seek payment for an appointment and there are no postage costs or hardware costs, he added.

A National Anti-Scam Centre spokesperson said remote access scams occur when criminals pretend they’re calling from a well-known bank, internet, phone, software or web security business and falsely claim there’s a problem with your account, phone, or computer.

“They tell you to download screen sharing software like Zoho, AnyDesk or TeamViewer or an app which will let them remotely control your computer or mobile phone,” they said.

“When you download the software or app they say they need to ‘fix the problem’, the scammer can now fully control your device. They don’t fix any problem, because there’s no problem to fix. They ask you to tell them your banking passwords or one-time security codes.”

alex.turner-cohen@news.com.au