Son storms into parents' house as $36k stolen in chilling scam targeting Aussies

Sinister criminals are targeting Australians, draining their bank accounts, but also threatening and abusing them along the way.

Scammers kept an Australian woman on the phone for six hours before telling her to step away from her computer for an hour as they drained her account of $8400.

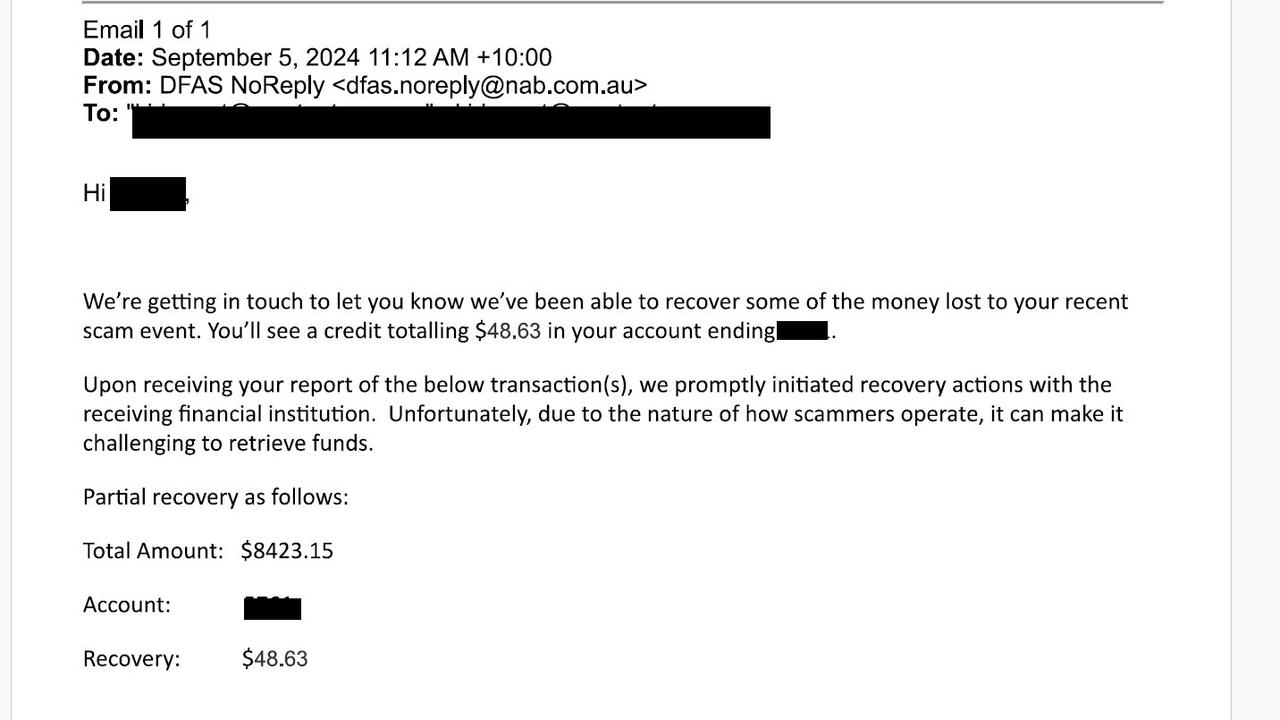

It’s left her stepdaughter battling to help her stepmum after National Australia Bank recovered just $48 of the stolen funds.

Felicity* said her stepmother received a call from someone claiming to be from the NBN in August this year advising that they were upgrading services in the area – something that didn’t cause alarm as she had previously been notified about upgrades.

“They asked her to remain by her computer to monitor any disruptions. Over the next six hours, they asked numerous questions, provided her with several numbers to write down, commented on the specific length of her longstanding relationship with her internet provider Westnet, and even verified the last four digits of her credit card. Luckily, she did not give the rest of the digits,” she told news.com.au.

“They claimed she was eligible for a rebate due to slow internet speeds, specifying an exact amount of $2470 she could receive. Finally, they instructed her to step away from her computer, citing potential radiation emissions, and, once the procedure was complete, to leave it off for an hour.”

It was only when her stepmother checked her emails later and discovered that her daily transaction limit had been increased that she started to fear something had gone wrong.

The 75-year-old then discovered the missing $8400 from her bank account.

$5.8 million lost already this year

Chillingly, there were 5352 remote access scams from January to September this year reported to Scamwatch with Australians losing a whopping $5.8 million as a result.

The NBN scam seems to one of the most common with some revealing to news.com.au how they have been caught out or narrowly escaped being sucked in, with 863 reports to Scamwatch between January and July.

It comes as news.com.au reported on Sylvie Leber who lost $10,000 in March to a remote NBN access scam leaving her daughter furious as her mum was blamed for “extreme carelessness” rather than being treated as a fraud victim.

Have you been a victim of a scam? Contact sarah.sharples@news.com.au

For Felicity, she said her parents had an almost lucky escape as a substantial house settlement was due to drop into the account just two weeks later.

But she feels NAB closed the case quickly – just a month after it was initiated – and with very little of the stolen funds returned complaining there was no transparency over their investigation.

She was told by the bank that a “NAB Fraud analyst had performed a liability assessment and deemed that your parents are liable for the losses” and the assessment is only available internally.

“My parents are extremely shaken and they are now too frightened to do anything on the computer and I get as it also rattles me as to how easily it seems to have happened,” Felicity added.

“We expect everyone to internet bank but don’t give tools or knowledge on how to do it safely.”

‘Lack the scepticism’

She said her stepmother had no idea about switching things on like two factor authentication.

“I am deeply frustrated on behalf of my parents and concerned for others who, despite having technological access for their daily activities, lack the scepticism or most current knowledge to identify and avoid scams,” she added.

NAB executive of group investigations and fraud Chris Sheehan said while he can’t comment on individual cases for privacy reasons, the bank has seen a significant increase in scams in recent years and are working hard to stop these criminals.

“The results of scams can be devastating on the people they impact, both emotionally and financially,” he said.

“These criminals are continuously evolving the way they target Australians and that’s why it’s important to stop the crime before it happens.

“It’s important all Australians pause and be alert to scam red flags before clicking a suspicious link or providing anyone with remote access to your computer or other devices. Remote access scams occur when victims are contacted via phone, text or email by a scammer falsely claiming to be from a familiar company, such as a telco or IT company.”

‘The scammers piggybacked’

Felicity added that her parents are worried as they had a text from the NBN in the lead up to the scam saying the group would be working in the area and claimed “the scammers piggybacked on that”. It’s an issue being raised by other victims.

Scarily, Robyn’s mum was “abused” by scammers pretending to be from the NBN a few years ago who told her they knew where she lived” and “threatened” her.

The scammers also accessed her computer remotely and took the pensioner’s lifesavings of $8000.

The 85-year-old wasn’t concerned by the phone call as she had reached out the previous day about internet issues.

“She was kept on the phone for three hours and when she tried to end the call, because she was expecting a doctors tele appointment, she was abused and called back,” Robyn, who did not want her surname used, added.

“During those three hours, her Suncorp account was drained even though she did not give out any account number or passcodes. I am sure they also searched every aspect of her computer.”

However, in a surprising twist Robyn’s mum got lucky with an AFP and Suncorp investigation recovering her money, although she was left feeling “stupid” and “humiliated”.

90-year-old rebuffs scammers

Just this week 90-year-old Dan got a phone call from NBN scammers. He resisted their attempts to access his computer and asked them to send him an email. The male scammer ended up rude and aggressive.

Even though he hadn’t given out details, Dan still felt at risk and cancelled his account as a safety precaution, he said.

“Easy to fall prey, because my NBN was listed to be done, and installed last Thursday. How do they get access to such info?” he added.

But NBN chief security officer Darren Kane said that there is “very limited” identifiable information that the organisation keeps on NBN customers. However, it does publish its upgrading programs across Australia which lists the suburbs it will be in.

He said employees and third party contractors are also required to undergo criminal background checks.

“Social engineering is certainly on the rise with the ability of these criminals to gather small pieces of identity that builds a picture of victim and that does and come from all sources available from the web and dark web,” he said.

“I very much believe they may target 100 to 150 different victims with details of those victims and ultimately one, two, three or four fall victim to the scams.”

Ripped NBN cord out of the wall

Then there’s David O’Donnell, who had to burst through his family door as NBN scammers had his dad “twisted” with one on the mobile phone and the other on the landline two years as he dad bounced between the two calls.

They had convinced his dad, who is in his early 80s, to install a program called Anydesk on his computer but Mr O’Donnell knew it was a scam and he “walked up to NBN box and ripped the cord out of the wall”.

He was on the phone to Commonwealth Bank’s fraud department at the same time who said a transfer of $36,000 had already been made.

“The were funds transferred to a Westpac bank account in Strathfield in Sydney … and it was coded as a transaction for the sale of Ford Falcon sedan,” he told news.com.au.

“The next day to their credit the CBA reversed the transaction and refunded mum and dad’s money.”

But Mr O’Donnell is convinced there wouldn’t have been a refund if he hadn’t essentially caught the scammers in the act, adding his dad was “livid” and “pretty shocked” by the experience.

“I can’t understand why the government authorities can’t do anything and at end of day they should know where these bastards are. But they don’t have the political willpower to do anything about it and go after the scammers?” he added.

How to spot a scam

NAB expert Mr Sheehan added that people should never feel under pressure to provide personal details to anyone and should check the details of any suspicious text message or email before providing account information.

“If you’re in any doubt, delete the message and contact your bank,” he added.

“We will always do whatever we can to try and prevent scams and recover stolen money. However, in a lot of instances this can be extremely difficult, with funds often quickly sent overseas or moved to cryptocurrency platforms which are largely unregulated. If NAB is at fault, we will always reimburse a customer.”

Mr Kane added that the NBN will never ask to remote access the computer of a customer or advise them they have been hacked or disconnected.

The NBN will also never ask to seek payment for an appointment and there are no postage costs or hardware costs, he added.

News.com.au approached Westnet, which is owned by iinet for comment, but did not hear back. Felicity was told there were no known issues of a data breach affecting the internet provider’s systems.

A National Anti-Scam Centre spokesperson said remote access scams occur when criminals pretend they’re calling from a well-known bank, internet, phone, software or web security business and falsely claim there’s a problem with your account, phone, or computer.

“They tell you to download screen sharing software like Zoho, AnyDesk or TeamViewer or an app which will let them remotely control your computer or mobile phone,” they said.

“When you download the software or app they say they need to ‘fix the problem’, the scammer can now fully control your device. They don’t fix any problem, because there’s no problem to fix. They ask you to tell them your banking passwords or one-time security codes.”

Sharing these lets the scammer access your bank accounts, personal information and steal your money, they added.

“You might not realise they have stolen your money and emptied your bank accounts until the next time you log in,” they said.

Overall, more than 10,000 scams were reported in Australia in 2023/24, an 81 per cent increase from the year before, according to the Australian Financial Complaints Authority’s annual review.

*Name changed

sarah.sharples@news.com.au