Melbourne woman loses $40k house deposit after ‘sophisticated’ scam call

The Melbourne woman had more than enough money in her account to put down a house deposit with her soon-to-be husband. Then a single phone call up-ended her life.

A woman who lost her $40,000 house deposit to scammers has warned that it could happen to anyone after sophisticated spoofing technology was used to fool her into thinking she was talking to her bank.

Janice*, 38, a Melbourne IT professional, was due to get married and had been saving to buy a house.

When she was walking her dog around the block, around 11am in July 2022, she received a call that would turn her life upside down.

“It can happen to anyone, that’s my whole takeaway. It’s about that given day, that given moment, what mindset you’re in,” she told news.com.au.

MORE: How to avoid real estate scams

The caller claimed to be from NAB’s risk department. Just a week earlier, Janice’s debit card had been compromised so the call wasn’t totally out of the blue.

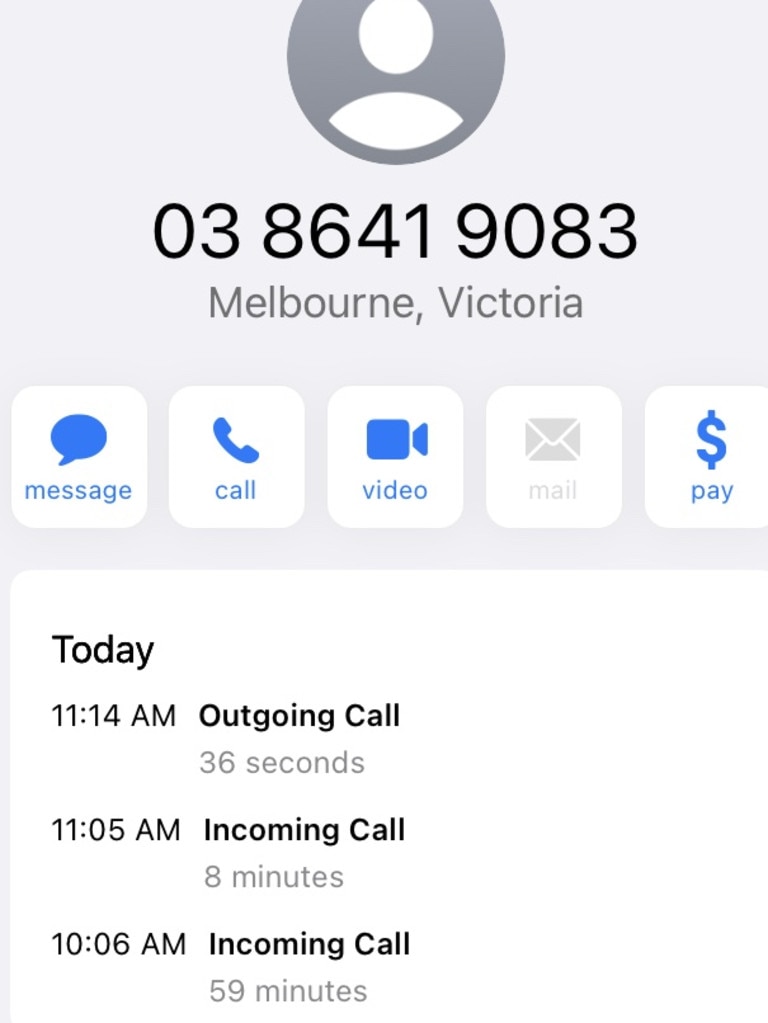

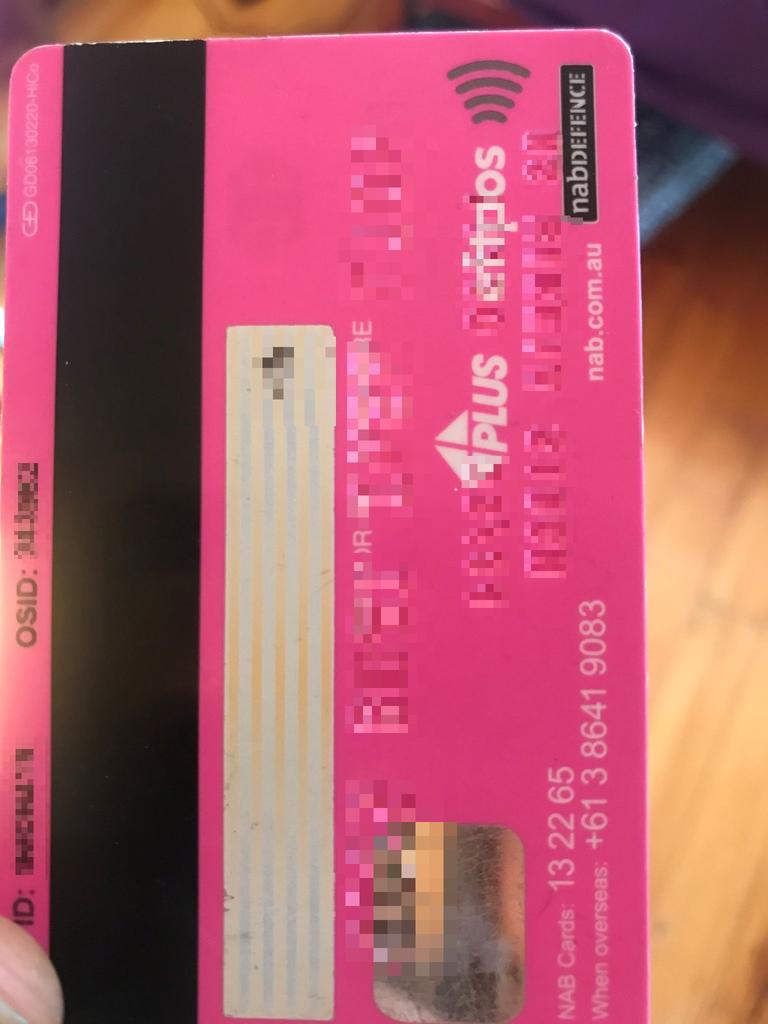

She checked the back of her NAB credit card and the phone number — 03 8641 9083 — was the same.

Little did she know she was actually speaking to a cyber criminal who was masking his real number and ‘spoofing’ his call so that it matched the bank’s real phone number.

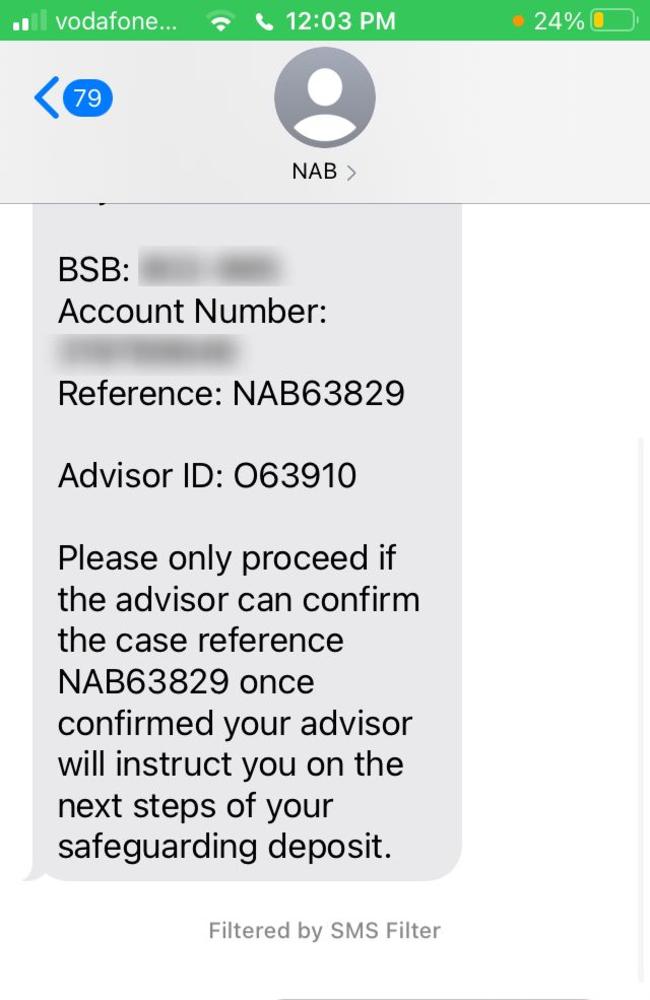

At the same time, she received a text message from what appeared to be NAB with fake reference numbers which also convinced her it was legitimate. Once again, this text message was spoofed.

Convinced, she followed the scammer’s instructions on what to do next.

Have you been the victim of a scam? Contact alex.turner-cohen@news.com.au

MORE: How to protect yourself from rental scams

The scammer, who had a “slight” accent, told Janice she needed to move her funds into a hidden account to keep her money safe.

Looking back, she knows she was coaxed into verifying a cryptocurrency account the scammers used to instantly transfer her money and spirit it away, never to be seen again.

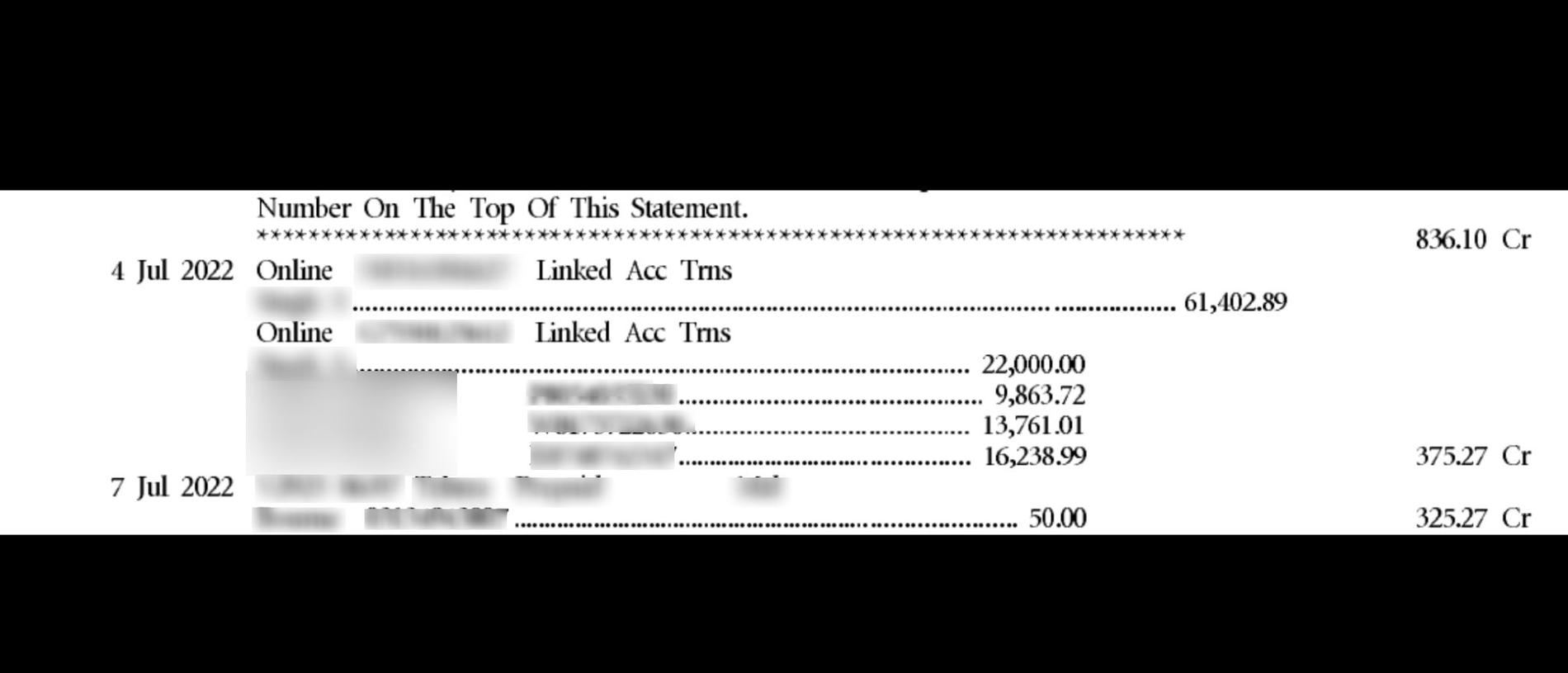

There was $65,000 sitting in her account ready for the down payment on a home.

The scammers convinced her to make three transfers totalling $39,000.

She thinks the only reason her account wasn’t wiped clean was because she had a $40,000 daily transfer limit imposed on her account.

They kept her on the phone for an entire hour. Once the call was over, Janice suddenly twigged that all was not right and urgently called the bank — this time the real NAB — to try to save her cash.

Janice waited on hold for an excruciating two hours as she tried to speak to someone at NAB.

When she finally did manage to warn her bank, it was too late — the money had already been transferred out via an instant OSKO payment.

“A brief holding period could have prevented the loss of my life savings,” Janice lamented.

“It took almost a month for me to be able to leave the house. I couldn’t talk to anyone without crying.”

NAB confirmed to her several weeks later that they were unable to recover a cent of the stolen money.

Her frustrations mounting, she took the case to the Australian Financial Complaints Authority (AFCA), which ordered the bank to pay back $1000 in compensation.

The compensation payout wasn’t because of NAB’s failure to stop the transfers, but simply because they had taken too long to update Janice on their investigation.

Even though it’s been two years since, Janice is still fielding scam calls.

And in a creepy twist, a few months ago, she received a call from a fraudster purporting to work for Telstra.

“I recognised the same voice,” she said, explaining it was the same scammer who had defrauded her of her life savings. “It gave me shivers.”

NAB would not comment specifically on Janice’s case but said they have been working with telco companies to stop phone spoofing and impersonation scams.

Australians lost $2.74 billion to scams last year, according to the Treasury Department.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au

Read related topics:Melbourne