Folly of setting emissions targets

The lockdown induced drop in greenhouse emissions due to COVID highlights the difficulties in setting binding targets

The lockdown induced drop in greenhouse emissions due to COVID highlights the difficulties in setting binding targets

Strength in Woolworths and BHP helped the market to hold on to gains at the close, as Fortescue shares rose to new heights.

The decision removes a cloud over executives and directors, including chair Catherine Livingstone and CEO Matt Comyn.

The Aston Martin DB5 left me shaken, not stirred.

Gains evaporated on Friday as banks and CSL fell, sending the ASX to a 0.2pc weekly loss, while early earnings have been resilient despite the pandemic pessimism.

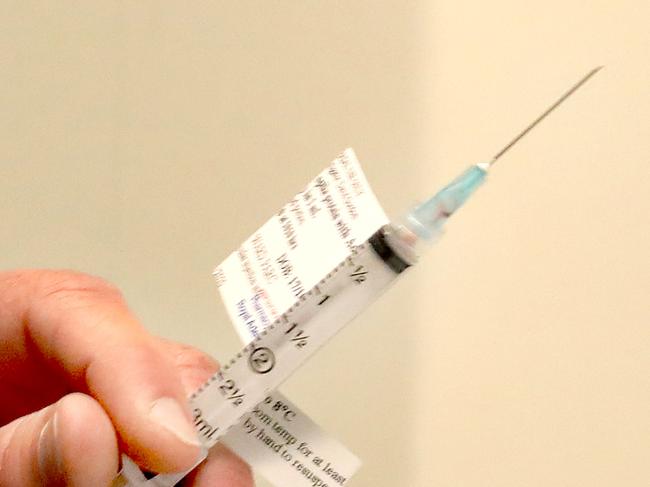

Investors are assuming a vaccine will fix the crisis, but not everyone, especially in the US, may be willing to co-operate.

Consumer stocks surged to records despite a 0.8pc slip in the ASX, while results from Qantas and Wesfarmers prompted little share reaction.

The ASX jumped 0.7pc to its best level since March, as CSL jumped 6.4pc and WiseTech added more than $2bn to its market value.

While optimistic, CSL says multiple vaccines will be needed to quash the coronavirus pandemic, as its lifted annual profit 9.6pc.

‘Emergency doses’ of a COVID-19 vaccine could be delivered by the middle of next year after CSL tightened its development timeline.

Healthcare sector giant CSL played a big role in lifting the Australian share market after booking higher full year profits and flagging a potential vaccine for coronavirus in mid-2021.

Australian biotechnology giant CSL has flagged manufacturing 100 million doses of a COVID-19 vaccine by mid next year and reported higher full-year earnings.

CSL and Cochlear did the heavy lifting as the ASX rose 0.8pc, while several household names surged to record highs at the close.

Is it time to split the shares in biotech giant CSL?

CSL confirms it is in talks with British pharmaceutical giant AstraZeneca about producing its vaccine in Melbourne.

Donald Trump has labelled as ‘tremendous’ a plasma therapy for COVID-19 to be jointly trialled by Australia’s CSL.

The $A weakened in late trade after all sectors bar real estate finished higher, led by a lift in CSL, as investors looked past a surge in virus cases in Melbourne.

Listen to the Money Cafe podcast on earnings season, CSL and the early super withdrawal that has beaten all forecasts.

Drug-maker CSL will produce millions of doses of Australia’s experimental COVID-19 vaccine as it is being tested to speed up an anticipated rollout.

People should not be alarmed about the supposed effects of carbon dioxide emissions.

Carbon dioxide emissions must be reduced.

There has been a strong take-up of the flu vaccine as people seek to bolster their immunity amid the coronavirus pandemic.

Specialty biotechnology company CSL has weighed into the global race to find a coronavirus vaccine.

Labor’s zero emissions goal jeopardises the economy.

As CSL’s share price soars, investors are hungry for more growth. A new wonder drug may just have the answer.

Coronavirus fallout threatens some of our stronghold industries, but the right leadership will see us survive and thrive again.

It is not possible to reach zero emissions.

Ideological opportunism rules the climate roost.

CSL is a star performer, but bad banks haven’t stopped the ASX 200 making big gains this calendar year.

Politicians will grasp any opportunity to avoid taking responsibility.

Original URL: https://www.theaustralian.com.au/topics/csl/page/9