ASX rallies 0.7pc despite virus spread, weak data

The $A weakened in late trade after all sectors bar real estate finished higher, led by a lift in CSL, as investors looked past a surge in virus cases in Melbourne.

- Commonwealth Bank flags $300m provision

- 2021 off to a softer start: Macquarie

- Fortescue smashes production records

- Unibail Rodamco falls to €3.5bn loss

That’s all from the Trading Day blog for Thursday, July 30. Australian stocks gained 0.74pc with gains in all sectors bar real estate, despite a blow out in coronavirus cases in Victoria, taking a lead from strong gains on Wall Street overnight as the Fed reiterated its support for the US economy.

Locally, Commonwealth Bank warned of a new $300m hit from advice provisions, while Macquarie said its first quarter profit was softer than the same time last year.

Robyn Ironside 9.00pm: Pandemic panic ‘a threat to flights’

Airlines have been warned to prepare for more disruptive and unruly passengers as a result of the COVID-19 crisis, with the regulator advising that “onboard panic” could become a threat to flight safety.

In a recent cabin safety bulletin, the Civil Aviation Safety Authority recommended airlines provide more training for crew to deal with unruly passengers, including self-defence and the use of non-lethal protective devices.

The bulletin warned that, due to the pandemic, the potential risk of being exposed to infected individuals was likely to have “a negative impact on the mental wellbeing of some staff members and passengers”.

John Durie 8.14pm: EY: hope amid the uncertainty

Until the country gets on top of the COVID-19 pandemic, business uncertainty means companies will be reluctant to make major moves forward, according to Ernst & Young boss Tony Johnson.

The Melbourne-based executive is well aware of the difficulty created by the horrendous infection numbers in Victoria, saying “there is a real fatigue in the system in government and in business”.

He adds: “We need to switch off the daily scorecard and focus on the way forward.”

Johnson says it’s almost like you need one team focusing on the health issues and another ensuring the opportunities are not wasted.

He says the pandemic uncertainty is clearly worse than during the GFC because neither business nor government can safely work forward and there was a real risk of paralysis.

While expressing the wider concerns, the good news from EY’s perspective is this year’s revenue numbers have proved better than feared, so much so that the firm was able to pay staff a “COVID recognition bonus” which went to all staff by way of two days extra leave, and for the 25 per cent of staff who took a 20 per cent pay cut a bonus to cut the impact on their annual pay.

Ben Wilmot 7.44pm: Malls hit as Melbourne outbreak spikes

Shopping malls were sold down on Thursday as Melbourne’s coronavirus numbers soared and investors took stock of sobering results delivered by Unibail-Rodamco-Westfield, which owns the international Westfield empire.

Investors dumped mall owners exposed to Victoria, particularly Vicinity Centres, part-owner of the landmark Chadstone shopping centre, which was off by 4 per cent at $1.31, and the Scentre group, operator of the local Westfield empire, which was down 3.3 per cent at $2.02.

GPT, which also owns retail centres such as Melbourne’s Highpoint, fell 2.2 per cent with Stockland slipping 1.9 per cent.

The local sector is under pressure with the threat of further restrictions in Melbourne as consumers increasingly stay at home.

French company Unibail, meanwhile, posted a €3.5bn ($5.78bn) loss attributable to shareholders for the first half, compared to a €1.1bn profit for the same period last year. Investors drove down its locally listed shares by 5.3 per cent to $3.78.

The result was partly due to disruptions resulting from the COVID-19 crisis as the company’s shopping malls around the world shut for an average of 67 days.

Unibail chief executive Christophe Cuvillier acknowledged the pandemic-related decline in malls but argued top-quality properties would come through the crisis, particularly flagship malls focused on leisure activities.

Richard Gluyas 7.17pm: Market volatility ‘to hit’ IOOF results

IOOF expects to report a 33 per cent decline in full-year profit, mainly due to market volatility related to the COVID-19 pandemic.

The wealth manager, which will release its 2020 result on August 31, updated the market on Thursday, flagging an underlying net profit of $123m-$125m from continuing operations, down from $184.9m previously.

The decline was attributed to a 10.4 per cent fall in the All Ordinaries Index from June last year, which directly affected funds under management and administration (FUMA) and revenue.

Fund flows also took a hit from client concern and uncertainty about the macroeconomic environment, and there were “substantial” outflows due to the early access to super scheme, particularly in the pensions and investments (P&I) business.

IOOF expects a $25m contribution in underlying net profit from P&I for the five-month period of IOOF ownership. The contribution was adversely impacted by market volatility.

David Ross 6.45pm: ATO crackdown on legit early super access

The Australian Taxation Office has warned it is reviewing applications for the early super access scheme and those who don’t meet the criteria of hardship will be slapped with a higher rate of tax on their income or a fine.

Speaking on Thursday at the select committee on COVID-19 inquiry, members of the ATO said they had been writing to several people who had received money via the scheme.

ATO second commissioner, client engagement, Jeremy Hirschhorn said the agency had started a pilot program of contacting people if they did not meet the scheme’s early access requirements.

“We will not be forcing people to put money back in their super,” he said.

“If we withdraw our declaration and they will have to pay tax on their marginal rate, in the worst case we can impose penalties for misleading statements which is as much as $12,600.”

But Mr Hirschhorn said it was unlikely the ATO would impose “significant consequences” and said there would be some people who honestly believed they were eligible at the time of application but who later proved not to be.

Max Maddison 6.26pm: Virus transforms face of retail

Retailers are being battered by falling consumer confidence, but with shoppers migrating online en masse, many expect the pandemic to transform the face of retail.

The Australian Chamber of Commerce and Industry’s third survey of business conditions and confidence reveals a resurgence of infections in Melbourne and Sydney is playing havoc with business confidence.

ACCI chief economist Ross Lambie said insights from the upcoming survey demonstrated that concerns about the outbreak were flowing into investment and employment decisions.

Joyce Moullakis 6.03pm: MyState Bank focus on ‘real unemployment’

MyState Bank chief executive Melos Sulicich says lenders are keeping a close watch on real unemployment levels during the second wave of COVID-19, as bank customers brace for the worst.

Mr Sulicich has concerns about how Victoria will fare given the spike in COVID-19 infections in the state, and expects Australia’s first recession in almost three decades will be “moderate to deep”, with the economy only emerging slowly from the contraction.

“We’re all concerned about real unemployment and what real unemployment will be by the end of the year,” he said, noting unemployment had swelled to its highest level since the 90s.

Angelica Snowden 5.45pm: Woolies backs face coverings

Woolworths will “strongly encourage” shoppers in all NSW and ACT stores and in some Queensland stores to wear face masks from Monday amid “increasing numbers COVID-19 cases in NSW”.

The advice will be applied to stores in “hot spot” areas in Queensland, with customers being encouraged to wear masks from tomorrow.

The advice applies to Woolworths, Metro, BWS, Big W, ALH Hotels and Dan Murphy stores.

The new encouragement is in addition to the mandatory requirements for face coverings in all of Victoria, currently in place across Melbourne and the Mitchell shire, with the entire state expected to mask up from Monday.

“Even though wearing a face covering is not mandatory in NSW, ACT or Queensland, as the largest private sector employer with stores in almost every community, we feel it’s important we lead the way in helping reduce community transmission of COVID-19,” Woolworths Group CEO Brad Banducci said in a statement.

“Masks and face coverings are a highly visible symbol of the persistence of COVID-19,” he said.

“By encouraging and role modelling their use, it will further support the steps we need to collectively take to stop the spread of the virus and keep our team and customers safe.”

Face coverings are being provided to all Woolworths Group team members.

Nick Evans 5.06pm: Anglo American to reopen blast mine

Queensland coal major Anglo American says it plans to reopen its Grosvenor metallurgical coal mine in the Bowen Basin the second half of next year, after its closure following a blast that seriously injured five workers in May.

Anglo American delivered its half-year financial results in London on Thursday, and said it would look to reopen Grosvenor in the second half of 2021.

Coal boss Tyler Mitchelson said the company had decided to permanently seal the section of the mine where the explosion occurred, and the company would buy new mining equipment before it was opened again.

“The decision to permanently seal the longwall area continues our step by step approach to working through the Grosvenor incident. Safety comes first, and we’re taking the time to ensure mining does not restart until we know it’s safe to do so,” he said.

“We are in the process of developing the detailed technical road map to safely restart mining next year, including a detailed risk assessment process involving internal and external experts.

“New longwall equipment will be purchased, providing us with the opportunity to assess the best available technology to further expedite our automation and technology journey at Grosvenor.”

Anglo American booked first half profits of $Us471m, down from $US1.9bn in the first half of 2019, and underlying earnings before interest, tax, depreciation and amortisation of $US3.4bn, down 39 per cent from the previous corresponding period.

Read more: Anglo American chief lobbied minister on regulations before explosion

5.00pm: $A drops 40 bps

The Aussie dollar is pulling back in afternoon trade, giving up as much as 40 points since lunch.

After the close, AUDUSD is lower by 0.57pc to US71.46c, after hitting US71.41c.

That’s after a subdued reaction to weak building approvals data, and even the record jump in Victorian virus cases this morning.

The US dollar index is contributing somewhat, last up 0.14pc.

Eli Greenblat 4.53pm: Ex-Bunnings chief appointed Nufarm chair

The former long-serving chief executive of hardware chain Bunnings, John Gillam, has been appointed to the board of chemicals company Nufarm and named its new chairman.

Nufarm announced on Thursday afternoon the appointment of Mr Gillam to succeed Donald McGauchie AO as chairman.

Mr Gillam will join the board on July 31 and assume the role of chairman on September 24 following Mr McGauchie’s retirement as chairman and non-executive director, which was previously advised at the company’s 2019 annual general meeting.

Mr Gillam has had a 20-year career with Wesfarmers where he held a number of senior leadership roles including CEO of the Bunnings, boss of its chemicals arm CSBP and chairman of Officeworks. Mr Gillam’s experience as a non-executive director includes his role as chairman of buildings products company CSR.

Mr Gillam said Nufarm was a proud Australian company with strong customer standing and a growing market relevance in its chosen international markets.

“I am looking forward to leading the Board and working with the management team to further strengthen its market position and improve returns for shareholders.”

NUF finished Thursday’s session up 1.2pc to $4.13.

4.43pm: IOOF drags after earnings warning

Earnings warnings and Melbourne exposure were the key factors for the worst performers in Thursday’s trade, even as the broader market notched a 0.7pc gain.

IOOF led the move lower with a 7.8 per cent slip to $4.86 after providing disappointing guidance and tipping an increase in its remediation provisions.

Elsewhere, Chadstone shopping centre owner Vicinity fell 4pc as fears of further restrictions rattled the REIT sector and travel stocks.

On the plus side, ALS notched a second day of outperformance after delivering solid results yesterday.

Here’s the biggest movers at the close:

4.27pm: CUB sale helps AB InBev survive pandemic

The $16bn divestment of Carlton United Breweries to Asahi has gone some way in helping global beverage giant AB InBev to weather the coronavirus downturn, as the group today posted a collapse in half year profit.

The world’s largest brewer, and owner of Budweiser, Stella Artois and Corona, said its global brands revenue was down by 14.1pc globally, pulling earnings down 24.7pc for the half to $US7.36bn.

Normalised profit attributable to shareholders for the half was down to just $US76m in the first half, from $US4.714bn in the same prior period.

The group said it was taking a $US2.5bn impairment for its African business as a result of the COVID-19 uncertainty, but that it would be partially offset by the $US1.9bn gain on the disposal of the CUB arm.

Read more: Cheers! Ashahi’s CUB buy approved

4.11pm: Shares rally 0.7pc in optimistic trade

Nothing could get in the way of the local market’s rally on Thursday, the ASX adding 0.7pc despite downside drag from weak building approvals, rising virus cases and a warning of a challenging outlook from Macquarie.

Shares instead took direction from the US Fed, which pledged further support for the economy in the early hours of Thursday.

By the close, the ASX200 was up 45 points or 0.74 per cent to 6051.1, after touching highs of 6067.

CSL and the major miners were key in the move higher - CSL adding 1.5pc while Fortescue set new records of $17.59 after reporting record iron ore production for the June quarter.

David Ross 3.52pm: Insurers to test business interruption case

The Insurance Council of Australia and the Australian Financial Complaints Authority have launched a test case around Business Interruption Insurance.

In an announcement on Thursday the Council said the case would seek a decision from a superior court on whether references to a quarantinable disease under the Quarantine Act 1908 should be construed as the equivalent as a listed disease under the Biosecurity Act 2015.

Many business interruption insurance policies reference the 1908 act.

The possibility of a test case has been looming for several weeks as issues emerged surrounding wording of insurance policies but Thursday’s announcement locks in the case.

Details of which insurers or policy will feature in the test case are yet to be revealed.

The ICA will seek to have the matter heard on an expedited basis on behalf of all insurers and will fund costs. ICA CEO Rob Whelan said a decision from a superior court would assist insurers.

“Insurers believe the intention of pandemic and communicable human disease exclusions are clear. However, a judicial determination will provide insureds and AFCA with greater legal certainty on this issue,” Mr Whelan said.

AFCA lead ombudsman John Price said the regulator would proceed with the case following discussions with the insurance industry, ASIC, APRA, and Treasury.

“Resolution of this threshold issue is important to assist AFCA in its dispute resolution role,” he said.

David Swan 3.47pm: Appen falls victim to malicious hacking

Market darling Appen (ASX: APX) has revealed it was the victim of a malicious hacking attempt, describing it as a “random attack” and limited in nature.

Appen, which provides training data for tech giants thought to include Amazon and Apple, said hackers gained access to a third-party provider, and stole credentials enabling access to Appen’s systems.

“The third-party system was in use on a trial basis and is no longer being used by Appen,” CEO Mark Brayan said in a statement. “Appen’s investigation has determined that the unauthorised actors gained access to Appen’s user authentication database.

“Appen has no evidence that customer data was stolen. The company has not lost any customers as a result of this incident to date.”

It comes just a week after an expert panel chaired by Telstra boss Andy Penn handed down 60 recommendations to government ahead of a new four-year cyber security strategy, including that the government should work with industry to accelerate the adoption of cyber security standards in Australia.

Shares in Apen are up 1.18 per cent at 3.30pm to $36.09.

Bridget Carter 3.29pm: Ward gets promoted at MUFG

MUFG Bank has appointed Rob Ward as its Head of Project Finance and Head of ESG Finance for the Oceania region.

Mr Ward joined MUFG in 2012 and since 2016 has led the bank’s advisory business in Oceania.

As the new Head of Project Finance, MUFG said it would capitalise on Mr Ward’s energy and infrastructure market experience, while the newly-created position of Head of ESG Finance for Oceania is part of MUFG’s increasing focus on all aspects of ESG finance.

“As the Head of ESG Finance, Rob will bring together the significant investment the bank has made both regionally and globally to further help MUFG leverage its global network and meet the increasing demand for ESG financing and advice across our Institutional customer base,” said MUFG’s head of Global Corporate and Investment Banking, Oceania, Drew Riethmuller.

“As one of world’s leading Project Finance banks, we have seen demand for ESG-linked solutions and investments take a firm hold in Asia in recent years.

John Stensholt 3.17pm: Broncos payout in doubt as profits cut

The Brisbane Broncos rugby league club is forecasting its profit for the six months to the end of June to fall to only $22,000, with COVID-19 hitting its ability to sell tickets to fans and service sponsors with NRL matches held in mostly-closed stadiums.

That profit would be a big drop from the $1.3m net profit the Broncos, the only Australian sports team listed on the ASX, made in the first half of the 2019 calendar year, and could put in doubt its ability to pay a dividend to shareholders.

The Broncos also said revenue in the period would likely fall to about $17m, compared to $25.8 in the corresponding period last year, with factors such as falling sponsorship revenue to blame and the reallocating of 2020 memberships sold to fans to 2021.

“Sponsorship revenue is expected to materially decrease on the comparative period, reflecting the impact of COVID-19 restrictions on the Group’s ability to deliver some game day benefits,” the Broncos said in a statement to the ASX.

Merchandise sales are also down about 52pc from last year and merchandise royalty income from the NRL was likely to down 95pc as well.

The club, considered the biggest in the NRL and majority owned by News Corporation, said costs had also reduced markedly - to about $17m from $24.5m a year earlier - thanks to cost saving initiatives and a 20pc reduction in player salaries for the year.

Broncos shares were down 2c or 5pc to 39c on Thursday afternoon.

3.01pm: Approvals down 23pc from Feb: ANZ

A 4.9pc drop in building approvals data for June marks a fourth consecutive month of weakness, the longest decline since the GFC.

ANZ head of Australian economics David Plank writes that the decline now represents a 22.9 per cent collapse in approvals since February, including a 6.9pc decline in house approvals and 42.9pc slide in units.

Mr Plank points out the weakness will likely persist as the economy remains weak.

“Slow population growth, elevated unemployment and rising vacancy rates are all slowing the demand for new housing,” he says.

“The Homebuilder grant ($25,000 for constructing new residential properties, within value limits) and other government stimulus may somewhat offset the weakness implied by these factors. We expect more declines in approvals in the months ahead.”

Read more: Building approvals hit 8-year low

#Building approvals dropped for the 4th month in a row in June (−4.9% m/m), the first four-month decline since the GFC related downturn. Compared with Feb, monthly approvals are down 22.9%, including -6.9% for houses & -42.9% for units. @Adelaide__T @DavidPlank12 #aushousing pic.twitter.com/ebLoYgHrAW

— ANZ_Research (@ANZ_Research) July 30, 2020

2.42pm: Duxton backs water governance overhaul

Water services group Duxton says it will actively engage with the ACCC to improve the governance and regulation in the water market, after the regulator today handed down its interim report into the Southern Murray Darling Basin water market.

After almost a year reviewing it’s operation, the ACCC today slammed governance arrangements but rejected calls by some growers to bar independent traders.

Duxton, one such independent trader, told the ASX it would continue to work with the ACCC as they moved toward the final report in November.

“We note the report has identified opportunities to improve the governance, regulatory and operational frameworks that support the Australian water markets,” the company said in a statement.

“We believe that a focus in these areas will benefit all stakeholders and Duxton will actively engage in that process.”

D2O last traded down 0.7pc to $1.39.

Read more: Major change needed in Murray-Darling water trading

2.23pm: Electronics earnings upgrades to come

Expect further earnings upgrades for consumer electronics retailers such as JB Hi-Fi and Harvey Norman, according to Goldman Sachs.

Ahead of reporting season, the broker notes that both key retailers have seen an uplift in sales from the government stimulus and shift in spending from travel to home improvement.

But, given the macro data trends and feedback, Goldmans anticipates a further lift in consensus earnings upgrades through reporting season, especially for Harvey Norman.

The broker tips Australian comparable store sales to be up 10.5pc for FY20, implying a 22pc lift for the second half, with segment margins up 100 basis points for the full year.

“Based on the latest ABS data, high frequency data and industry feedback we now believe the strong sales trends will persist for JBH and HVN well into 1Q21 and to a lesser degree into the all important profit period of 2Q21,” Andrew McLennan writes.

“As a result we take this opportunity to review our earnings forecasts for both companies, with JBH earnings per share up +2.2pc and +14.3pc in FY21 and FY22 and +11.3pc.”

JBH last up 3.1pc to $45.84, HVN higher by 0.9pc to $3.58.

Perry Williams 2.09pm: Qatar LNG a worry for Woodside

Woodside Petroleum’s $US20.5bn Browse LNG project may be among developments facing long delays if rival producer Qatar proceeds with a major gas expansion, Bernstein has warned.

The Middle East producer could add an extra 60 per cent or 49m tonnes of LNG by 2025 to its current 77m tonne capacity, toppling Australia as the biggest global exporter and piling pressure on higher cost projects that have yet to be sanctioned.

Browse is “a more complex project which will require higher cost and longer front end engineering and design period. Given the challenges of this development, we remain cautious that the project will move ahead on the company’s timeline of 2023 final investment decision,” Bernstein analyst Neil Beveridge said.

Marginal projects including Browse, US developments Driftwood and Rio Grande and Indonesia’s Abadi “may face significant delays or ultimately be cancelled given these projects will continue to face significant constraints in the years to come”.

Woodside’s 2023 timeline for sanctioning Browse has prompted analysts to question whether the energy producer risks the high emissions project potentially becoming marginal or even stranded should it start producing later in the decade.

Two of Woodside’s partners in Browse, BP and Shell, are also shifting their focus away from high emissions gas developments amid a fast-moving transition away from fossil fuels due to climate change.

The Perth-based gas operator doubled the carbon price assumption it uses to model oil and gas projects to $US80 a tonne from $US40 a tonne in anticipation a greater focus on meeting Paris climate targets could see a more onerous carbon regime put in place in Australia and other countries where it operates.

WPL last traded up 0.4pc to $20.33.

Read more: Woodside’s Browse return in focus

Lilly Vitorovich 1.51pm: Seven reworks debt for transformation

Seven West Media, the media company controlled by billionaire Kerry Stokes, has renegotiated the terms of its $750m debt with its bankers, easing liquidity pressure as chief executive James Warburton works to turnaround its embattled television and newspaper operations.

Most importantly, the changes give Seven access to $250m during the coronavirus crisis, which Mr Warburton said provides “funding certainty” during its transformation plan over the next 18 months.

Mr Warburton, who took the helm last August, said the group is “working tirelessly to transform both our television and newspaper businesses”.

“While we are focused on achieving the lowest possible cost-base, our energy has been directed to driving audience and winning the content battle in both television and newspapers to deliver ratings, revenue and cash flow,” Mr Warburton said in a statement.

“Our content led growth strategy has come to life with the success of Big Brother, combined with the strength of the AFL and our programming spine throughout the day.”

Seven has identified $170m in cost cuts across the group including AFL, with the majority of benefits to be delivered in the 2020 and 2021 financial year.

SWM last up 4.4pc to 9.6c.

1.43pm: Significant dividend yield for Fortescue

Fortescue shares are rallying to new record highs on Thursday, after handing down fourth quarter production ahead of estimates and primed to deliver “significant dividend yield” according to RBC.

Shipments from the iron ore miner exceeded the top end of its guidance range at 178.2 megatonnes, as it kept a cap on costs too.

“Given its iron ore price leverage, we think FMG remains an attractive vehicle for investors seeking exposure,” RBC says.

“We expect the stock to remain supported given spot prices around $US110/t — and FMG’s realisation levels improved — which underpins significant cashflow generation.

“Given performance through FY20, we estimate a significant dividend yield (~9pc), which is likely to be a focus for investors heading into the FY results in August.”

FMG last up 4pc to $17.52, giving it a market cap of $51.9bn – on par with ANZ.

Read more: Fortescue hits new Pilbara iron ore records

1.39pm: China boosts exporter support

China’s State Council has pledged to roll out more measures to boost exports and attract more foreign investment to put the world’s second-largest economy on a more healthier footing.

This comes after China posted increases in exports and foreign direct investments in June from a year earlier, defying a global slump triggered by the coronavirus pandemic. But economists and officials have warned of downside risks in the coming months as rising numbers of new infections could weaken demand.

In a meeting Wednesday chaired by Chinese Premier Li Keqiang, the cabinet said the government will introduce “effective measures” for exporters that have faced a sharp decline in overseas orders.

The State Council also said China’s less-developed central, western and northwestern regions should encourage the growth of labour-intensive industries and develop their export sectors.

The government also pledged to provide more support for foreign investors in the country, including extending government-subsidised loans to hi-tech foreign companies.

Dow Jones Newswires

1.19pm: Building approvals tipped to fall further

Building approvals have further to fall, even after its biggest drop in eight years, says CBA.

Senior economist Belinda Allen notes today’s 4.9pc fall in building approvals for June was after a 15.8pc fall in May.

The bank tips housing construction to fall by 25pc in 2020 – with approvals a key indicator of future activity.

Offering some upside in the data, alterations and additions to homes jumped by 11.4pc to be just 2pc lower than last year – likely supported by the $680m HomeBuilder support package, Ms Allen says.

Read more: Building approvals sink to 8-year low

1.01pm: Mall owners drag, Fortescue hits record

Heavyweight Commonwealth Bank and iron ore miners are supporting the index at half time, cheering US Fed support despite a blow out in virus cases in Victoria.

Still, travel exposed stocks such as Qantas and Flight Centre, and those with heavy Victorian exposure such as Chadstone owner Vicinity are feeling the pain.

At 1pm, the benchmark is just shy of daily highs, up 50 points or 0.84pc to 6056.8.

Fortescue is outperforming, up 3.5pc to a new record high of $17.49 after setting new production records in the past quarter.

Elsewhere, Commonwealth Bank is up 0.6pc while the rest of the majors pull back by around 0.4pc.

Here’s the biggest movers at 1pm:

John Stensholt 12.35pm: Tabcorp secures lucrative QLD racing deal

Tabcorp has staved off competition from Racing.com, the joint venture between Seven West Media and Victorian racing authorities, to clinch a new broadcasting deal for all Queensland racing.

The new 10-year deal will see Tabcorp’s Sky Racing service carry the three Queensland codes – thoroughbred racing, greyhounds and harness racing – on an exclusive basis.

Racing.com, which has its own free-to-air network, had also tendered for Queensland telecasts in the hope of adding to its suite of Victorian and South Australian thoroughbred rights. Seven telecasts major Saturday meets from Brisbane under a separate deal.

But Tabcorp managed to win the tender for all rights, though is understood to only be paying in the low millions of dollars per year.

The new deal comes despite Racing Queensland, the body which oversees all three codes in the state, taking legal action against the now Tabcorp-owned UBET last year over the state’s new point of consumption taxon wagering.

Racing Queensland had wanted Tabcorp to bear the full cost of the increased tax take, lodging a claim for $11m in underpayment for one quarter last year rather than pass it on to the racing industry in the form of reduced fees and other financial commitments paid to Racing Queensland.

Meanwhile, Citi analyst Bryan Raymond upgraded his 12-month price target for Tabcorp to $3.70 given an encouraging outlook for the wagering division given the entire industry experienced a strong June quarter and strong lottery ticket sales.

Tabcorp shares were down 3c to $3.53 during trading on Thursday.

12.29pm: IOOF dragging on disappointing guidance

IOOF is one of the worst performers in lunch trade, shedding 5.9 per cent after its profit guidance fell short of analysts expectation.

The financial services group said it expected profit from continuing operations of between $123m and $125m, as financial market volatility and COVID-19 uncertainty hit flows.

In addition, IOOF said a review of its advice remediation provisions indicated an additional $80m hit.

IFL shares last down 5.9pc to $4.96.

Patrick Commins 12.07pm: ¾ Vic firms to stay on JobKeeper 2.0

Treasury Secretary Steven Kennedy says he now expects three quarters of Victorian firms will remain on JobKeeper beyond September and that the government should be “open to responding” to the deteriorating situation in that state when determining how the eligibility tests were to be applied for firms applying for the wage subsidy beyond the initial six-month term.

Dr Kennedy told the Senate COVID committee that “had the Victorian circumstance not emerged we would have expected far fewer firms in Victoria to flow through to the second JobKeeper because of the reapplication of the eligibility test”.

“In our latest estimates we now think at least 75 per cent of Victorian firms will stay on JobKeeper because of the circumstances they find themselves in compared to other states.”

He said he advised government “to be open to responding to those circumstances as they emerge”.

“The rules are yet to be made for the full application of JobKeeper, and as the government makes those rules it has to keep that (the deteriorating situation in Victoria) in mind.”

Follow the latest in coronavirus updates at our live blog

Bridget Carter 12.04pm: Maas Group revives IPO plans

DataRoom | NSW-based construction materials, equipment and services company Maas Group is reviving plans for its initial public offering.

The company was slated for a listing through Morgans and Moelis last year, but the plans were placed on hold as the company bedded down acquisitions.

Now the group is back in front of investors for a series of one-on-one presentations this week to institutional investors and private wealth networks.

More to come

Nick Evans 11.47am: Pilbara Minerals refinancing hopeful for lithium

WA lithium producer Pilbara Minerals says it has managed to refinance a $US100m bond taken out in 2017 to fund construction of its Pilgangoora lithium mine in 2017, in a sign the gloom surrounding the lithium sector may be beginning to lift.

The company said on Thursday it had received commitments for a new $US110m debt facility, backed by BNP Paribas and the Clean Energy Finance Corporation. The new senior secured facility carries a rate of about 5 per cent interest, Pilbara Minerals said, well below the 12 per cent rates carried by the previous debt facility, and is repayable in 5 years.

Importantly, Pilbara Minerals will only make interest repayments for the first two years, lightening the company’s burden as it waits for a recovery in its core markets.

The company released its quarterly production report on Thursday, saying it had shipped 29,312t of lithium concentrate in the quarter, and finished June with $86.3m at bank.

“Market signalling indicates lithium pricing may be approaching the bottom, with several investment banks and industry analysts forecasting a demand surge and price turnaround in 2021,” the company said.

Pilbara Minerals shares last up 2c to 36.5c.

11.33am: Building approvals dive to 8-year low

Building approvals for June have dropped much sharper than expected, down 4.9pc to the lowest level in eight years.

In the latest data from the ABS, June approvals sank almost 5pc, from expectation of a 2.8pc decline, led by a 14.8pc slide in NSW approvals.

Nationally, private home approvals were the worst hit, down 5.7pc, while private sector dwellings excluding houses were down 5.3pc.

Behind NSW, approvals in WA fell 11.7pc, by 10.9pc in Queensland, 10.8pc in Tasmania and a more moderate 4.6pc in South Australia and almost flat 0.2pc in Victoria.

Shares are holding gains of 0.63pc, and the Aussie dollar little changed on the news.

Lachlan Moffet Gray 11.22am: HSF profit trimmed despite revenue lift

Law firm Herbert Smith Freehills has managed to buck the coronavirus trend, recording a slight increase in revenue for the 2020 financial year, despite the pandemic contributing to an almost 10 per cent decrease in per-partner profit.

The big six firm recorded total revenues of £989.9m ($1.79bn), an increase of 2.5 per cent on the previous year.

Total profit decreased 7.7 per cent on the previous financial year to £283.2m ($512m), resulting in a per-equity partner profit of £857,000 ($1.55m), a decrease of 9.7 per cent on last financial year.

CEO Justin D‘Agostino, who took over the role at the height of the pandemic in May, said that despite coronavirus contributing to the profit decrease, the firm still achieved its second-highest annual profit on record.

“It is encouraging that we achieved another year of revenue growth, underlying the core strength of our business,” Mr D‘Agostino said.

“Overall, we saw a slower start to the last financial year, with a stronger performance in the second half of the year, notwithstanding the significant challenges of COVID-19, in particular the short term impact we saw on transactional workflows, many of which were put on hold.”

11.20am: Domino’s sales boost priced in: UBS

UBS analyst Aryan Norozi has downgraded Domino’s Pizza to Sell from Neutral, while raising his price target 26pc to $64.

Mr Norozi boosts his 4Q sales forecast about 10 per cent in line with global peers after a strong delivery update caused by COVID effects, but he says “this is more than priced in”.

He notes that Domino’s share price is up 109pc year to date as COVID-19 boosted online sales, while also giving scope for consolidation via potential restaurant closures.

But despite a long global growth run-way, strong return on capital and balance sheet, Domino’s forward PE multiple of 38 times is 37pc above its pre-COVID average and the highest since 2006, while short interest is the lowest since 2015.

He sees a lack of earnings upside at the FY20 result driving a “de-rate”.

DMP last down 1.1pc at $73.98.

11.11am: Splitit quarterly shows $US27m cash burn

While there is a lot of white hot excitement in the buy now pay later sector, its important to follow the cash.

ASX-listed Splitit’s latest quarterly shows the group had a cash burn of $US27.2m during the June quarter, including merchant funding. Cash burn for the year to date was $US32.6m.

Splitit has cash buffer in a combination of capital raising and borrowings of more than $US58m.

Merchant sales volumes in the second quarter increased 176 per cent to $US65.4m, while gross revenue increased 246 per cent to $US2.4m.

Total customer numbers increased 309,000 increased 26 per cent.

Investors are clearly looking through the cash burn, with shares jumping 4.8 per cent to be trading at $1.44.

Eli Greenblat 10.49am: DJs to open 20 new BP food outlets

Up-market department store David Jones will expand its food stores located at BP petrol stations by 21, to be opened by the end of 2020 across both Melbourne and Sydney – taking the total to 31 dual-branded sites in Australia.

David Jones said the new stores have all been carefully designed to cater to the expectations of busy, urban customers, offering the store’s food-for-now and food-for-later options, pre-prepared meals and groceries.

All partner sites will also have a select range of the David Jones Food offering available to order on Uber Eats, reflecting significant customer demand for the service.

“David Jones has embarked on a very exciting journey with our partner BP with the aim of transforming fresh convenience food in the Australian market,” DJs Food managing director Pieter de Wet said.

“We have been delighted with the performance of our 10 trial stores in Victoria and New South Wales, and the feedback and response from our customers has been very positive.”

David Jones struck the unlikely partnership with petrol station operator BP last year.

Read more: David Jones, BP in marriage of convenience

10.35am: Samsung profit climbs 7.3pc

Samsung Electronics reported Thursday its net profit grew 7.3 per cent year-on-year in the second quarter, with strong demand for memory chips overcoming the impact of the coronavirus pandemic on smartphone sales.

The world’s biggest smartphone and memory chip maker said profits in the April-to-June period were 5.56 trillion won ($US4.66 billion).

Operating profit rose 23.48 per cent to 8.15 trillion won, even as sales dropped 5.6 per cent to 52.97 trillion won.

The firm is the flagship subsidiary of the giant Samsung Group, by far the biggest of the family-controlled conglomerates that dominate business in the world’s 12th largest economy, and it is crucial to South Korea’s economic health.

AFP

10.11am: Virus count no worry for shares

Shares have shrugged off the surge in Victorian virus cases, instead following the strong Wall Street lead to add 0.7pc in early trade.

At the open, the benchmark ASX200 is up 41 points or 0.68 per cent to 6047.1, with all sectors firmly in the green. Still, its less than the 1.4pc lift projected by overnight futures.

Financials are leading the boost, after the US Fed reiterated its support for the US economy battered by the coronavirus pandemic. Even CBA is higher, despite warning of a further $300m in provisions for their advice business.

Macquarie is unfazed by a warning on its first quarter performance too, its shares are up by 1.6pc to $127.02.

But Vicinity Centres fell 1.4pc, Scentre fell 0.7pc, Tabcorp fell 1.1pc and Qantas lost 2pc, while SKYCITY Entertainment and Star Entertainment fell 0.4pc.

9.52am: What’s on the broker radar?

- Coles target price raised 11pc to $19.50 – JP Morgan

- Domino’s Pizza cut to Sell, target price cut 26pc to $64 – UBS

- Downer raised to Buy – Goldmans

- IGO cut to Hold – Shaw and Partners

- IGO cut to Neutral – JP Morgan

- St Barbara cut to Neutral – JP Morgan

9.41am: ASX upside capped by virus concern

Australia’s share market may be capped by news of a record 723 new VIC coronavirus cases, exceeding the previous peak by almost 200 cases.

The index was set to rise strongly based on offshore leads, with overnight futures relative to fair value suggesting the ASX200 would open up 1.4pc at 6113 points.

That followed a 0.2pc slip to a 6-day low of 6029 yesterday after QLD closed its border to Greater Sydney due to COVID-19.

Any upside may now be capped by the risk of an extension of the current 6-week lockdown in VIC, which would worsen the economic downturn.

Economically-sensitive stocks exposed to VIC should underperform, particularly banks, REITS, travel and entertainment stocks.

Still, the prospect of further US sharemarket strength may see buying on dips below 6000 points.

Overnight, the S&P 500 rose 1.2pc to a 5-day high close of 3248. It has now spent 6 of the past 11-days above the June high at 3233.

More importantly, the VIX index has spent 8 of the past 9 days below its 200-day moving average at 26.9pc.

This allows risk-parity investors to buy more risk assets including shares.

CBA’s provision of an additional $300m for advice remediation may add to underperformance from banks. Macquarie may also underperform after warning that 1Q earnings fell “slightly” and market conditions “remain challenging”.

9.38am: Vic virus surge jolts AUD

A mammoth 723 new coronavirus cases in Victoria has prompted a slip in the Aussie dollar ahead of the open.

It's a new record for Victoria, just a week after masks became mandatory across the state.

AUDUSD had been trading at US71.89c at 8.30am AEST, but is dropping sharply now, down 12 points to US71.77c.

Read more: Victoria hits new record with 723 new cases

9.36am: Genworth cuts interim dividend

Genworth Mortgage Insurance Australia Ltd. will not pay an interim dividend in a bid to preserve capital, as its first-half result was impacted by the economic impacts of COVID-19.

The company on Thursday recorded a net loss of $90m for the half year ending June 30, down from a net profit of $88.1m a year earlier. That came against the backdrop of an 8.1pc lift in new insurance written to $13.5bn and a 30pc increase in gross written premium to $239.3m.

Genworth Australia, which provides insurance to lenders against the risk of borrowers defaulting, said it would not pay an interim dividend due to the ongoing uncertain economic outlook, and recent guidance from the Australian prudential regulator.

“The company believes it is prudent to preserve capital to sustain its strong capital position,” said Genworth Australia. “Any future dividend will be subject to economic conditions, retaining a strong capital buffer and may require Australian Prudential Regulation Authority approval.”

Dow Jones Newswires

Nick Evans 9.32am: Fortescue smashes production records

Fortescue Metals group has smashed through its own production records, shipping 178.2 million tonnes of Pilbara iron ore last financial year and saying it realised a bumper average price for its products.

Fortescue released its June quarter production report on Thursday, saying it had easily beaten the 177 million tonne top end of its annual production guidance for the financial year, and shipped a record 47.3m tonnes in the June quarter.

The iron ore major said the pandemic crisis had lifted its production costs by US22c a tonne for the June period, as it lengthened shift rosters and took measures to protect its workforce, with cash production costs of $US13.02 a tonne for the June period and $US12.94.

Read more: Fortescue ships record tonnes while iron ore surges

Samantha Bailey 9.13am: Unibail Rodamco falls to €3.5bn loss

Unibail-Rodamco-Westfield, the company that owns offshore Westfield assets, has posted a €3.5bn loss ($5.78bn) attributable to shareholders for the first half, compared to a €1.1bn profit for the same period last year.

That result was partly due to disruptions resulting from the COVID-19 crisis, as the company’s shopping malls around the world shut for an average of 67 days.

Since reopening, Unibail-Rodamco-Westfield said a recovery in sales had been better than anticipated, and further increases in activity are expected as life returns to normal.

The company, which reports its annual results on a calendar year cycle, stopped short of providing any outlook or new guidance for the full year for 2020, saying the duration and impact of the COVID-19 pandemic on its operations and financial results remains material.

Bridget Carter 9.05am: Strategic Education strikes deal for Laureate

DataRoom | US-based Strategic Education has reached a deal to buy Laureate Education, outlaying $US642.7m for the Torrens University owner.

The deal was announced in the United States over night.

It comes after the strategic buyer started closing in on the business before the outbreak of COVID-19 earlier in the year, ousting local private equity firms Pacific Equity Partners and BGH Capital in the competition.

Negotiations paused following the COVID-19 outbreak and Strategic Education negotiated a slightly lower price.

The transaction comes at a time many others in the making earlier have stalled because deals are seen as difficult to price in the current environment.

Working for Strategic Education was Bank of America, while the Australasian operations of Laureate have been for sale through Goldman Sachs.

Chris Jenkins 9.02am: CBA flags fresh $300m advice provision

Commonwealth Bank has announced a new $300m provision being made to pay remediation to customers for problematic financial advice highlighted by the Hayne royal commission.

The provisions cover financial advice provided through CBA’s “aligned” businesses,

including Count Financial, Financial Wisdom and CFP-Pathways.

The bank announced it would book the charge in the second half of its 2020 financial year. The bank had already recorded provisions worth $534m during the first half of the 2020 financial year. it is due to report its full-year financial results on 12 August.

“The total to-date aligned advice remediation provision recognised is $834 million, which includes $698 million in customer refunds (including $280 million of interest) and $136 million in program costs,” a statement issued by the bank to the ASX said.

“The provision assumes an average refund rate of 37 per cent (excluding interest) of the ongoing service fees collected between FY09 and FY19 (61 per cent including interest).”

The banks said it believed it had “adequately provided” for the issues but would continue to monitor the need for more remediation.

The bank also announced a number of accounting changes that would be reflected in its full year results.

8.51am: IOOF sets out profit guidance

IOOF has tipped profit of $125m for the 2020 financial year, citing uncertainty caused by COVID-19, even as it reports funds under administration more than $200bn.

In a fourth quarter update this morning, IOOF said funds under management, advice and administration grew $6.7bn or 3.4pc for the quarter to June 30, to $202.3bn.

Still, the uncertainty of the past six months has rocked the group’s results, with profit from continuing operations expected between $123m and $125m.

“The recent recovery in equity markets has been the major contributor to the $6.7 billion uplift in FUMA and pleasingly, we have continued to attract strong flows into our platforms. That said, the impacts of the COVID-19 pandemic are continuing,” chief Renato Mota said.

“Our advisers are seeing first-hand client concern and uncertainty around macro-economic conditions. This client sentiment is particularly apparent through withdrawals associated with the Early Release of Superannuation scheme and subdued flows in Financial Advice.”

8.40am: Macquarie flags weaker Q1

Macquarie has flagged continuing uncertainty into the year ahead, as it said operating net profit for the first quarter was already lower than last year.

In a trading update issued ahead of its AGM today, the bank said it could not provide earnings guidance for the year ahead due to the “significant and unprecedented uncertainty” caused by COVID-19.

Macquarie chief Shemara Wikramanayake noted that the group’s annuity-style businesses were up on the same time last year, along with Macquarie Asset Management, due to the sale of its rail operating lease business.

Still, those gains were offset by lower income in Banking and Financial Services, which included higher provisions, and “significantly lower” investment related income in MacCap.

“Macquarie remains well positioned to deliver superior performance in the medium term due to its deep expertise in major markets; strength in business and geographic diversity and ability to adapt its portfolio mix to changing market conditions; ongoing programs to identify cost saving initiatives and efficiency; strong and conservative balance sheet; and proven risk management framework and culture,” Ms Wikramanayke said.

8.30am: Sandfire forecasts output drop

Sandfire Resources forecast a drop in annual copper and gold output after churning up record volumes of the commodities in fiscal 2020 despite challenges posed by the coronavirus pandemic.

Sandfire said it expected to produce between 67,000 tonnes and 70,000 tonnes of copper in the 12 months through June, 2021, and 36,000-40,000 troy ounces of gold. That compares to output of 72,238 tonnes of copper and 42,263 ounces of gold in the previous year.

Management also forecast higher costs, with closely watched C1 costs tipped to rise to $US0.90-$US0.95/lb in fiscal 2021 from an average of $US0.72/lb in the year before.

Dow Jones Newswires

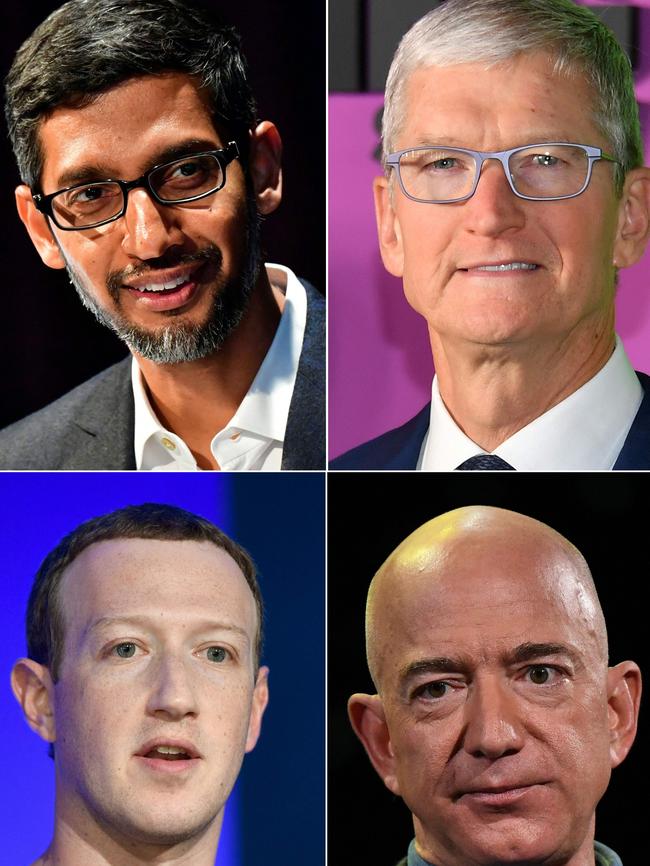

7.33am: Tech bosses face Congressional grilling

The chief executives of Amazon.com, Facebook, Apple and Alphabet’s Google faced relentless criticism at a congressional hearing, with Democrats and Republicans alike challenging their business practices.

The session, conducted via videoconference because of the coronavirus pandemic, laid bare deep-rooted frustration with some of the country’s most successful companies, at a moment when Americans rely on them more than ever.

It also highlighted the threat the companies face from ongoing investigations by antitrust authorities, with politicians citing internal company emails and witness interviews as evidence that the platforms improperly abuse their dominant position.

The tone of the questions, directed at Amazon’s Jeff Bezos, Facebook’s Mark Zuckerberg, Apple’s Tim Cook and Google’s Sundar Pichai, was almost universally hostile.

Democrat David Cicilline, chairman of the House Antitrust Subcommittee, kicked off the hearing by declaring: “Our founders would not bow before a king. Nor should we bow before the emperors of the online economy.”

The executives defended their companies’ practices and said that they face stiff competition that forces them to serve customers and innovate.

Mr Zuckerberg faced a series of questions about Facebook’s acquisition strategy. Mr. Pichai defended Google from a litany of accusations, ranging from taking advantage of its dominant online search engine to its work in China.

Lawmakers in both parties accused Mr. Bezos of presiding over bullying of independent sellers on the Amazon marketplace, citing reports in The Wall Street Journal that employees had used seller data to launch competing products.

Apple got fewer questions than the other firms, with Mr. Cook defending its policies on its App Store.

Dow Jones

6.15am: ASX poised for positive open

Australian stocks are tipped to make a firmly positive start, after Wall Street posted solid gains following the Federal Reserve meeting.

At about 6am (AEST) the SPI futures index was up 48 points, or 0.8 per cent.

Yesterday, Australian stocks slipped 0.2pc, reversing intraday gains as Queensland imposed a new border ban on Sydneysiders, and as inflation fell at the fastest rate on record.

The Australian dollar was higher at US71.86c, from US71.40c.

Spot iron ore was up 2.6 per cent to $US110.90.

6.05am: US stocks edge higher

US stocks climbed as Federal Reserve officials reiterated their support for an economy battered by the coronavirus pandemic.

The S&P 500 ticked up 1.3 per cent, with all 11 sectors in the index higher as of the 4pm close of trading in New York. The Dow Jones Industrial Average rose about 163 points, or 0.6 per cent. The tech-heavy Nasdaq Composite rose 1.4 per cent.

The Fed, as expected, left rates near-zero at the end of its policy meeting. The central bank also said it would continue increasing holdings of Treasurys and other securities.

“It’s very hard to fight the central bankers and the amount of fiscal stimulus that’s been introduced into the system,” said Chris Dillon, a capital markets investment specialist at T. Rowe Price Group Inc. “And more is expected to come.”

The Fed moved rapidly in the midst of the market rout in March to pump money into the economy, buoying credit markets and US. stocks. The S&P 500 was on course overnight to return to positive territory for the year, up 0.8 per cent.

“The current economic downturn is the most severe in our lifetimes,” Mr. Powell said during a press conference. He pledged the Fed would use its full range of tools to support the economy and reiterated that the course of the recovery would ultimately depend on the trajectory of the virus.

The central bank had said it would extend emergency lending programs that had been set to run through September by an additional three months to keep propping up activity during the pandemic.

The Fed’s aggressive actions have created new conundrums for how investors should calculate the risks of the assets they hold even as the pandemic has left millions unemployed, and up-ended how people live and work.

Gold prices settled at another all-time high. Gold for July delivery, the front month futures contract, gained 0.5 per cent to $US1953.50, rising for nine consecutive days.

The US dollar slipped, with the WSJ Dollar Index, which tracks the US currency against those of major trading partners, falling 0.2 per cent.

Earnings at major U.S. companies have so far beaten the gloomy expectations of analysts. Just over a third of companies in the S&P 500 had reported through Tuesday, posting a 38 per cent decline in earnings from a year earlier, according to FactSet. Still, 78 per cent of firms topped forecasts.

Tech stocks held strong as the chief executives of Amazon.com, Apple, Facebook and Google appeared before Congress. The House Antitrust Subcommittee is investigating the market dominance of online platforms. The four stocks make up roughly a fifth of the S&P 500, according to FactSet.

Shares of Apple, Amazon, Facebook and Google parent Alphabet rose more than 1 per cent.

Overseas, the Stoxx Europe 600 index slipped less than 0.1 per cent. China’s Shanghai Composite Index advanced 2.1 per cent, and Japan’s Nikkei 225 fell 1.2 per cent.

Dow Jones Newswires

5.50am: Recovery depends on relief: Powell

The resurgence in coronavirus cases in recent weeks is weighing on US economic activity, and recovery will depend on policies to provide support, Federal Reserve Chair Jerome Powell said.

American consumers will not return to spending until they feel it is safe to do so, and in the meanwhile Powell said some additional support will be needed to make it through the worst crisis in recent memory.

“The path forward will also depend on policy actions taken at all levels of government to provide relief and to support the recovery for as long as needed,” Powell told reporters.

AFP

5.45am: Fed: US recovery depends on virus

The US Federal Reserve stressed that the course of the coronavirus pandemic will be critical to the economic recovery.

With the US case count on the rise and recent indicators showing the tentative rebound may be stalling, the policy-setting Federal Open Market Committee (FOMC) held the benchmark lending rate at zero as expected.

“The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world,” the committee said in its statement.

“The path of the economy will depend significantly on the course of the virus,” which “poses considerable risks to the economic outlook.”

The FOMC repeated its intention to hold rates near zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

But it refrained from making a more explicit commitment to allowing inflation to rise beyond the Fed’s longstanding 2.0 per cent target before tapping the brakes on the stimulus it is providing to the economy.

Many economists are expecting a change in this “forward guidance” but few thought it might happen before September given the growing uncertainty around the economic outlook, especially as Congress has not yet agreed on a new emergency spending package.

The Fed also extended a facility to provide US dollars to nine foreign central banks through March 2021 to “ease strains in global dollar funding markets” caused by COVID-19.

AFP

5.40am: Markets tread water before Fed

Global equities moved mostly sideways as investors kept a nervous eye on Washington, hoping the Federal Reserve would extend its dovish monetary policy while politicians struggle to hammer out a new stimulus package.

On Wall Street the Dow was just shy of a 100 point gain by the late New York morning, while European stocks were mostly directionless at the close.

“Stock markets are mixed today as traders look ahead to the Federal Reserve’s announcement later today,” said CMC Markets analyst David Madden.

“There has been a lot of chatter the Fed will reiterate the point that rates will stay ultra-low for years to come,” he said.

Gold held steady after hitting record highs for two straight days, though observers say uncertainty over the spread of the coronavirus, a weaker dollar and geopolitical worries could soon push the metal to fresh peaks above $US2000 per ounce.

On European markets, London closed flat, Frankfurt lost 0.1 per cent and Paris gained 0.6 per cent.

AFP

5.35am: Virus-hit Singapore Airlines suffers loss

Singapore Airlines (SIA) reported a first-quarter net loss of more than $US800 million, the latest carrier to take a massive hit as a result of the coronavirus pandemic.

Passenger traffic was reduced to almost zero in the three months to June, SIA said, leading to the Asian carrier’s biggest-ever quarterly net loss of SG$1.12 billion ($US816.58 million).

The numbers extended the flag-carrier’s financial bloodletting after losing Sg$732 million in the 2019 fourth quarter ended March 31, leading to its first-ever annual loss.

“Demand for air travel evaporated as travel restrictions and border controls were imposed around the world to contain the spread of the virus,” SIA said.

AFP

5.32am: GM posts $US758m loss

General Motors reported a smaller-than-expected loss as strong pricing for some newer auto models partially mitigated the hit from much lower sales in the wake of the coronavirus pandemic.

The big US automaker reported a loss of $US758 million in the second quarter, compared with a $US2.4 billion profit in the year-ago period. Shares rose following the results.

AFP

5.29am: Boeing reports big loss

Boeing reported a bigger-than-expected loss and said it would further trim its plane production because of weak demand in the wake of the coronavirus.

The aerospace giant suffered a $US2.4 billion second-quarter loss, reflecting the hit from much lower commercial plane deliveries as airlines suspend purchases due to falling consumer demand.

Chief Executive Dave Calhoun said the company would further trim its plane production schedule and warned the company “will have to further assess the size of our workforce” in a message to employees. The comment suggests deeper job cuts after Boeing said it would eliminate 10 per cent of its staff earlier this year.

AFP

5.25am: Spotify posts strong user growth

Music streaming giant Spotify reported it reached nearly 300 million monthly users in the second quarter of 2020, avoiding much of the economic fallout sparked by COVID-19.

Spotify reported a total of 299 million monthly active users, representing and increase of 29 per cent compared to a year earlier.

Paying subscribers in turn grew by 27 per cent to 138 million, and the company said the business “continues to operate at a high level despite the continuing uncertainty surrounding the COVID-19 pandemic.” At the same time the streaming service reported a widened net loss of 356 million euros ($US418 million).

Spotify attributed the higher than expected loss to the “impact of social charges related to the increase in our share price,” but maintained that had it not been for this impact “all of our key metrics would have finished at or ahead of our expectations.”

AFP

5.22am: General Electric reports loss

General Electric reported a bigger-than-expected loss, due in part to sagging sales from its aviation business in the wake of the coronavirus outbreak.

The company’s loss was $US2.2 billion in the second quarter, compared with a loss of $US61 million in the year-ago period. Revenues tumbled 24 per cent to $US17.8 billion.

As with so many other companies, the coronavirus and shutdowns to contain the virus was the driving factor behind 2020 results.

GE suffered a 44 per cent fall in revenues in its aviation business, where orders for plane engines have been derailed due to the downturn in commercial aviation that threatens major carriers.

The company also took a one-time accounting charge of $US608 million in light of weakened expectations for aviation and customer credit risk. Aviation had been one of GE’s stronger division prior to the coronavirus outbreak.

AFP

5.20am: Santander books massive charge

Spain’s Santander bank said it had booked a 12.6-billion-euro ($US14.8-billion) writedown due to the degraded economic outlook over the coronavirus pandemic.

The charge pushed the bank — the eurozone’s second largest by market capitalisation — to a 11.1-billion-euro net loss in the second quarter.

The bank said the loss did not affect its liquidity and pointed out that it still earned an underlying profit of 1.9 billion euros.

That was still 48 per cent lower than the same period last year, however, as the bank increased by 46 per cent to 3.1 billion the amount of money it put aside to cover the risk on loan losses.

“The past six months have been among the most challenging in our history,” Santander’s executive chairwoman Ana Botin said in a earnings statement.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout