Melbourne lockdown and Westfield offshore centres drive mall rout

The shopping centre industry’s woes are playing out as the pandemic rages in Victoria and overseas.

Shopping malls were sold down on Thursday as Melbourne’s coronavirus numbers soared and investors took stock of sobering results delivered by Unibail-Rodamco-Westfield, which owns the international Westfield empire.

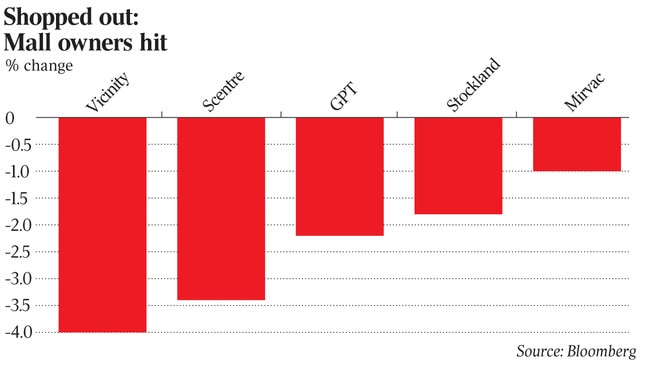

Investors dumped mall owners exposed to Victoria, particularly Vicinity Centres, part-owner of the landmark Chadstone shopping centre, which was off by 4 per cent at $1.31, and the Scentre group, operator of the local Westfield empire, which was down 3.3 per cent at $2.02.

GPT, which also owns retail centres such as Melbourne’s Highpoint, fell 2.2 per cent with Stockland slipping 1.9 per cent.

The local sector is under pressure with the threat of further restrictions in Melbourne as consumers increasingly stay at home.

French company Unibail, meanwhile, posted a €3.5bn ($5.78bn) loss attributable to shareholders for the first half, compared to a €1.1bn profit for the same period last year. Investors drove down its locally listed shares by 5.3 per cent to $3.78.

The result was partly due to disruptions resulting from the COVID-19 crisis as the company’s shopping malls around the world shut for an average of 67 days.

Unibail chief executive Christophe Cuvillier acknowledged the pandemic-related decline in malls but argued top-quality properties would come through the crisis, particularly flagship malls focused on leisure activities.

The company, which bought the international Westfield empire in a $32bn deal struck with Sir Frank Lowy in 2018, has been severely affected by the pandemic’s impact on the US and Europe, where it owns malls.

Unibail, which also owns other commercial properties, said its recurring net result slumped by 27.2 per cent to €667m, as malls in some countries closed and others were hit by stay-at-home orders.

The company, which has a secondary listing on the ASX as part of the Westfield takeover, has dumped some large schemes, scaling back its development pipeline to €6.2bn, a €2.1bn drop.

Mr Cuvillier said the first half of 2020 was unprecedented as the mall owner was forced to substantially close most of its shopping centres from March.

But he pointed to signs of recovery even as property values slumped, as the company had an overall like-for-like portfolio revaluation of 5.1 per cent.

“After the reopening, sales have been recovering better than anticipated. This shows our centres continue to be attractive destinations for people to visit and will see further increases in activity as life returns to normal,” he said.

Unibail has €12.7bn of cash and undrawn credit facilities available and also sold a 54.2 per cent stake in a portfolio of five French centres.

The mall owner is in advanced discussions on another €1bn of disposals and has a total of €4bn left to sell, with the aim of offloading these over the next couple of years.

Its net reinstatement value — a measure of shareholders’ equity — declined 14 per cent and shopping centre valuations fell by 5.2 per cent, with the company’s gearing hitting 41.5 per cent.

The company said it was too early to provide new guidance on the outlook for 2020, citing the continued risk of government measures to combat COVID-19, as has happened in California, and the potential for further portfolio writedowns.

Unibail said of the €2.8bn of revaluation in the first half, about €2.3bn was related to COVID-19 impacts. Cash collection from tenants, bankruptcies and how the crisis evolved would affect how it fared in this half.

Adjusted recurring earnings per stapled share fell 28 per cent on the same period last year to €4.65 a share, with about 81 per cent of the impact coming from COVID-19.

The company has pushed back billions of euros worth of development projects that are now skewed towards mixed-use projects that include offices, hotels and even housing.

Mr Cuvillier told investors that 2020 had started positively, but once shopping centres were shut this had significantly impacted operations.

Some malls in France had to reopen later as larger centres in Paris and Lyon faced more restrictions while Sweden and The Netherlands were hit by stay-at-home rules. In the US, the Westfield World Trade Centre is still not allowed to open.

Unibail deferred April and May rents for stores that were closed and indicated there would be no penalties for late payment. No decision on rent relief had been made, with talks starting in May.

But in a positive sign, malls operating for 11-12 weeks now have footfall at 80-90 per cent of normal. However, there are tighter rules in Spain and France, while malls in business districts such as London’s Westfield Stratford and Westfield Les Quatre Temps are being hit as people work from home.

Shoppers were making quicker trips to malls to buy fewer items. Actual tenant sales in June were down 19.7 per cent, which Unibail saw as encouraging as restrictions eased, but it warned that rent collection “needs a lot of work” after slumping to 38 per cent as the pandemic peaked.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout