Tabcorp vows to fight $1bn Racing Queensland fee claim

Tabcorp says it will vigorously defend a $1bn claim by Racing Queensland against UBET over the state’s new wagering tax.

Tabcorp says it will vigorously defend a $1 billion claim brought by Racing Queensland against UBET over the state’s new point-of-consumption tax on wagering.

Racing Queensland wants UBET to bear the full cost of the increased tax take, rather than pass it on to the racing industry in the form of reduced fees and other financial commitments paid to Racing Queensland.

It lodged a claim for $11 million in underpayment of fees from October to November, the first quarter of the new tax.

But because the agreement that is in dispute extends for 25 years out to 2044, it could be worth $40m a year or a cumulative $1bn to Racing Queensland or Tabcorp. Analysts at Goldman Sachs said that if Racing Queensland’s claim was successful it would result in a “substantial increase in wagering taxation paid by Tabcorp out to 2044”.

The December quarter has historically accounted for 27-28 per cent of Tabcorp’s wagering revenue in Queensland due to the profile of Spring racing, meaning a successful claim would cost it about $40m.

Cash-strapped state governments have raced to introduce point-of-consumption taxes on the wagering industry to capture the online-only bookmakers such as Ladbrokes, CrownBet, SportsBet and Bet365 that are based in the Northern Territory and do not pay wagering taxes.

South Australia introduced a 15 per cent point-of-consumption tax in 2017 and was followed a year later by Western Australia and Queensland — both 15 per cent, NSW (10 per cent) and Victoria (8 per cent).

The Queensland government had budgeted $70m in revenue from the first year of the tax, but promised to ensure the racing industry was left no worse off by effectively rebating the tax to Racing Queensland.

But in a statement yesterday Tabcorp appeared to accuse the peak racing body of double-dipping because it wanted to stop the wagering giant from reducing its payments by the amount of the tax collected, while keeping the compensation from the Queensland government.

It said the claim by Racing Queensland argued that UBET should not receive a reduction or offset in the fees paid to reflect the increase in tax on sports wagering revenue

“As UBET believes that it is entitled to be ‘made whole’ in respect of the impact of the POCT (tax) for the duration of the QPP (Queensland product and program deed) it does not consider that there has been an underpayment,” Tabcorp said.

The claim in the Supreme Court of Queensland comes amid pressure to renegotiate the deal between Tabcorp and Queensland Racing that effectively funds the industry.

Tabcorp operates UBET — the formerly state-owned tote operator — under licence from the racing industry that extends to 2044.

It is different to the deals in the other two eastern seaboard states, including a joint venture with Victoria Racing, that has allowed more generous funding of race fields in those states. Goldman Sachs said the consumption tax issue was likely to be “Queensland specific" because of the relative health with the Victorian and NSW racing industries.

Even so it said that if Tabcorp lost the case it would amount to a 3.7 per cent hit to earnings before interest, tax, depreciation and amortisation in 2020 and a 6.2 per cent hit to net profit after tax.

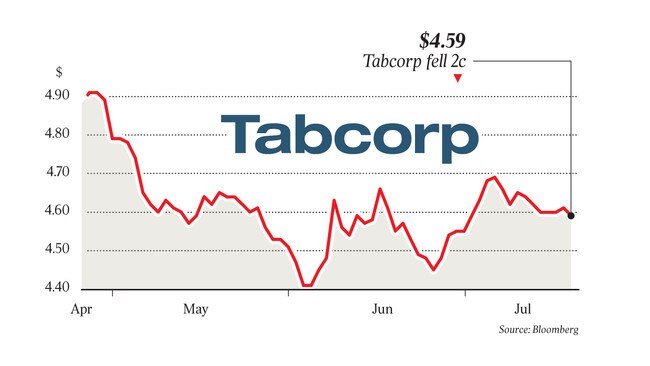

The firm already had a sell recommendation on the stock and said a court loss would cut its $4.45 a share valuation by 17c or 3.9 per cent. Tabcorp shares fell 2c to $4.59.

While the point-of-consumption taxes have been seen as a negative for bookmakers, Macquarie analysts have argued that it could improve the competitive position of Tabcorp against online bookmakers because an estimated $300m annual costs would hit their marketing budgets and pricing.

“The corporate bookmakers had a much bigger operating cost advantage than today given lower race-field fees and that there was no point-of-consumption tax (progressively introduced from 2017 to 2019),” Macquarie said.