Afterpay-owner Block smashed after quarterly earnings fizzle

The fintech saw as much as $1.7bn wiped off its market value in Friday trading after customers tightened the purse-strings.

The fintech saw as much as $1.7bn wiped off its market value in Friday trading after customers tightened the purse-strings.

Simon Molnar has raised $5.9m to expand his retail start-up into the US after nabbing major retailers including R.M. Williams as a customer.

China’s DeepSeek is less than two years old – demonstrating that under the right infrastructure and investment, innovation is fast to follow. Australian needs to take notice.

Afterpay, the buy-now-pay-later giant, has launched a major brand campaign which aims to position its services as the savvy smart alternative to using credit cards.

While names like Atlassian, Canva and Afterpay are well-appreciated tech stars, the dramatic transformation of this local company has been relatively overlooked.

Banks weigh after a bearish note from Citi. Miners supported after China’s GDP surprise. Rio Tinto, Glencore reportedly in merger talks. Insignia soars after CC Capital outbids Bain. Lovisa gains on broker upgrade.

Buy-now pay-later giant Afterpay has revealed some surprising Aussie fashion trends in its latest Afterpaid report, with one colour dominating 2024.

Ikea is teaming up with Afterpay to leverage the BNPL company’s significant Gen Z and Millennial customer base and help shoppers manage spending this festive sales season.

Anthony Eisen became one of the country’s wealthiest men after co-founding tech giant Afterpay more than a decade ago – now he has left his executive role to focus on philanthropy.

Barefoot Investor tells a bride-to-be who discovered her fiancé’s $9000 Afterpay and Uber Eats debt to ‘give love a chance’ before kicking him to the kerb.

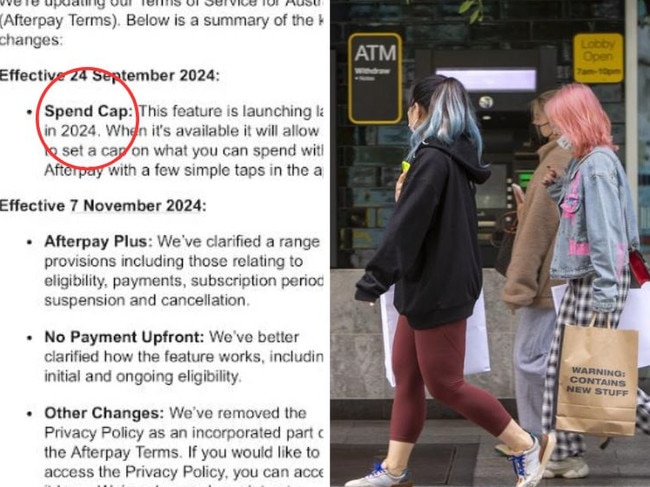

One of the world’s largest buy now, pay later services says it will introduce a self-regulated spending limit for customers to help prevent them over extending on impulse purchases.

Afterpay customers received an email from the company announcing the change that will be brought in later this year.

A brand marketing campaign by Afterpay, which aimed to prove the power of the discipline, has exceeded return-on-investment and customer acquisition targets to drive effectiveness and growth for the business.

Salesforce is cutting down on collaboration spaces and hot desks in its new tower, moving away from a trend adopted by Afterpay and Canva, which the software company says just doesn’t work.

Australia’s largest buy now, pay later operator and a payment terminal giant plan to woo customers after relocating to the most unlikeliest of locations – a reimagined brewery.

Psychologists say patients are unable to access their help because of rising costs, with shortening waitlists triggering concern that people are simply unable to afford the psychological care they need.

‘People were making good money for good effort. But it wasn’t egregious’: Luke Sayers. Mercer to cough up $11.3m for greenwashing. ASX has worst day in almost two years. JB Hi-Fi falls on downgrades. Afterpay owner among top gainers on strong guidance.

US fintech Block is banking on the founder of Afterpay to help reinvent sales at its payment terminal company Square after slowing growth.

CBA hits new record high. NIB’s long-time CEO Mark Fitzgibbon flags retirement amid battle with St Vincent’s Health. Rex halts trade as Deloitte experts fly in. Viva interim earnings rise amid ‘soft’ conditions.

Word is that demand for Guzman y Gomez’s Thursday IPO is so hot investors won’t be able to satisfy their appetite for shares. But Morningstar has advised caution.

The central bank may compel buy now, pay later operators such as Afterpay to ditch the no-surcharge rules currently forced on retailers.

Afterpay has called for Treasury to ‘take all necessary steps’ to align its BNPL regulatory framework with that of New Zealand’s, as the industry braces for tighter lending obligations.

Developers will be able to secure pre-sales with buyers initially stumping up just $10,000, in a new play by Commonwealth Bank and Coposit to help get more projects built.

Jim Chalmers’ third budget deserves the moniker ‘audacious’ for all the wrong reasons. What sets this budget apart and marks it out as inferior to the efforts of Keating and Costello is that it unashamedly increases the footprint of government in the economy and in Australians’ lives.

Desperate Australians have turned to platforms such as Afterpay to cover mental health care, amid calls to increase Medicare rebates for psychiatry services.

Afterpay owner Block’s profit guidance has exceeded analysts’ expectations by $US200m but that’s come at the expense of 1000 jobs and an aggressive switch to AI.

Court imposes $30m fine in waste management cartel case. Afterpay owner Block soars on profit swing. ABB rejigs leadership, ups guidance. Brambles, Austal fall. Woodside sells Scarborough stake to JERA.

New backers of the fintech platform Pay.com.au, chaired by Damien Waller, include barrister Allan Myers and Perth’s Rubino family.

In this list of 50 world-changing inventions across health, technology, sustainability, fashion and the arts you’ll find creativity, imagination, and a talent for invention – it’s a tribute to the Australian spirit.

BHP pulls materials lower. St Barbara rejects Silver Lake bid. BrainChip dives amid first strike. Qantas warns of moderating airfares. Technology One ups dividend.

Original URL: https://www.theaustralian.com.au/topics/afterpay