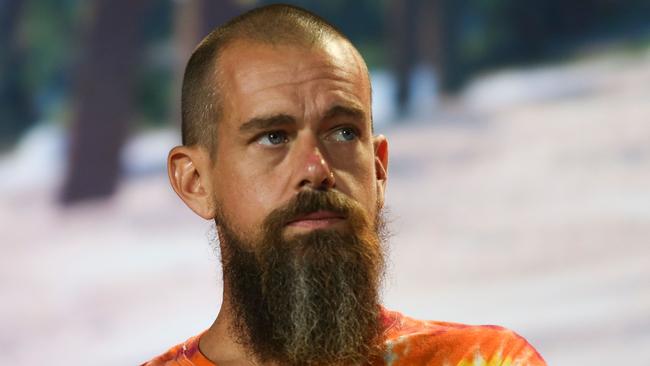

Jack Dorsey-led Block smashed after quarterly result

The fintech saw as much as $1.7bn wiped off its market value in Friday trading after customers tightened the purse-strings.

A big slide in quarterly profits has blasted as much $1.7bn off Afterpay owner Block’s market value as people tighten their belts amid a slowing global economy.

Block (ASX:XYZ) shares plummeted as much as 32 per cent in early trading.

Profits for the three months to March 31 totalled $US189.9m, or 31c per share, down around 59 per cent from the prior period’s $US472m, or 74c per share.

Adjusted earnings were US56c per share. Analysts had expected US97c per share, according to FactSet.

Revenue fell from $US5.96bn to $US5.77bn, a miss on analyst expectations of $US6.19bn.

After-hours trading on Wall Street set the tone early for Aussie investors, where Block traded 19 per cent lower.

Block chairman Jack Dorsey said: “Our growth in the first half of this year does not meet our bar.

“We understand the drivers behind our recent deceleration in growth and have incorporated updated views on the macro environment into our revised guidance for the year.”

The company downgraded expectations for gross profit margins year-on-year from 15 per cent to 12 per cent and expects 9.5 per cent growth in gross profit to $US2.45bn in the second quarter.

Block’s quarterly showed net income for the quarter dropped from $US470m to $US188m with a remeasurement loss of $US93m on its bitcoin investments, down from a $US233m gain the prior corresponding period.

In an investor call after the results were handed down, Block chief operating officer and chief financial officer Amrita Ahuja said the company expected more people to spend when their tax returns kicked in.

“Tax refunds are an important seasonal driver of Cash App inflows,” said Ms Ahuja. “This year we saw a pronounced shift in consumer behaviour during the time period that we typically see the largest disbursement, late February and into March. This coincided with inflows coming in below our expectations.

“During the quarter, non-discretionary Cash App Card spend in areas like, grocery and gas was more resilient, while we saw a more pronounced impact to discretionary spending in areas like travel and media. We believe this consumer softness was a key driver of our forecast miss.”

Block’s ASX shares were trading at $6.50, down 26.7 per cent. The company’s previous close of $92.13 was already 39 per cent down on the height of a $155.33 share price hit late last year.