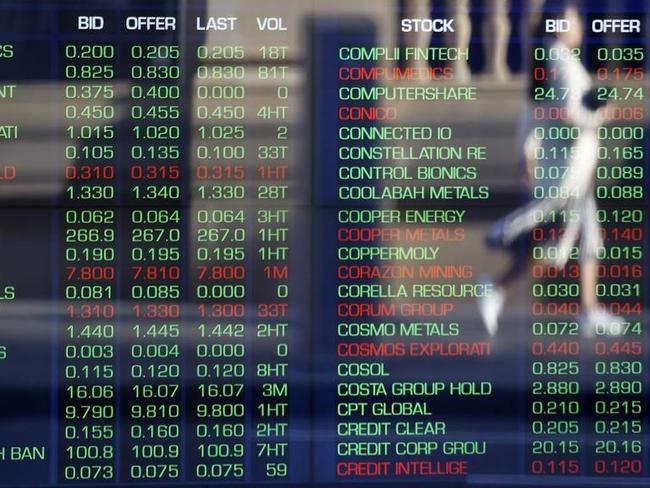

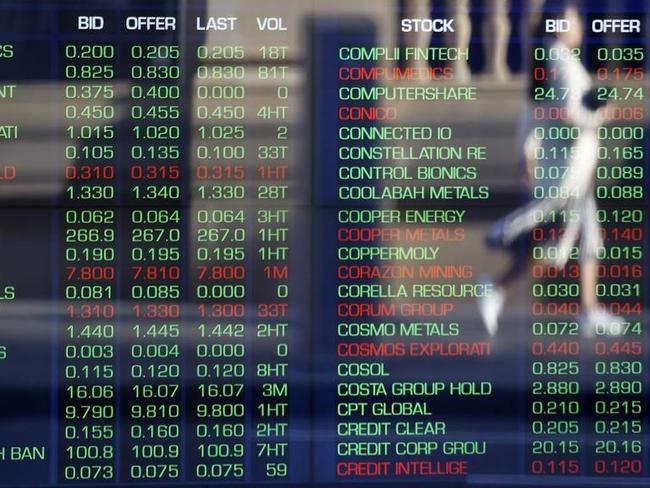

ASX 200 edges higher; Star’s hotel sale ramps up

Salter Bros understood to be leading race for Star’s Sydney hotel, as casino group reviews Bally’s last-minute offer. Stocks lift from six-month lows. Energy sector leads gains. Johns Lyng dives.

Salter Bros understood to be leading race for Star’s Sydney hotel, as casino group reviews Bally’s last-minute offer. Stocks lift from six-month lows. Energy sector leads gains. Johns Lyng dives.

ASX briefly erased its year-to-date gain as tariff fears and risk aversion hit global markets. Star shares drop 15 per cent as it looks at liquidity proposals. Endeavour down as profit falls. Australia Post profit jumps.

Macquarie shares dive to a seven-week low after its interim profit falls short of analysts’ expectations. Zenith cuts Paradice midcap fund. Deloitte cutting more jobs. Amcor declines after maintains guidance. Global markets await US jobs data.

Hezbollah’s south Beirut stronghold was hit by more than 30 Israeli strikes overnight, Lebanon’s official National News Agency reported, as a huge fireball lit up the sky ahead of Monday’s anniversary of the Hamas attack that sparked the war.

Consumer stocks down as big names Coles, Woolworths and Wesfarmers trade ex-dividend. More pain for iron ore prices weighs on mining heavyweights. Public demand tipped to drive second quarter GDP growth.

Bank and energy gains offset declines by iron ore and gold miners. REA falls on news it is considering a bid for Rightmove. The Star suspended from trading.

ANZ CEO Shayne Elliott tells parliament a ban on staff drinking alcohol during work hours is ‘entirely reasonable’, after its conduct scandal. Star halts as NSW casino regulator looks at licence. Ramsay and Harvey Norman fall.

The S&P/ASX200 closes up 0.44 per cent to 7,749.70. RBA’s wait and watch continues with May unemployment rate at 4 per cent. Horror day for winemaker Australian Vintage. Sigma-Chemist union hits ACCC hurdle. ASX Ltd tanks on costs blowouts.

ASX 200 down for a second day before US inflation data and the Fed’s interest rate decision. Upgrade boosts Woodside. Nickel Industries dives. SkyCity Adelaide licence probe resumes. China inflation data mixed.

Guzman y Gomez to list with $2.2bn value. Telix jumps on cancer drug ‘signal’. Household savings hit fresh record. Rival offer may revive BHP’s Anglo bid: Morningstar. CSL to help US stockpile avian flu vax.

Original URL: https://www.theaustralian.com.au/author/megan-neil