Richest 250 - Canva’s Melanie Perkins and Cliff Obrecht on early rejection

The Canva founders were rejected by more than 100 investors before they got their first ‘yes’.

The List is the biggest annual study of Australia’s 250 wealthiest individuals, with final figures calculated in late February 2022. See the full list here.

It’s a company that has created three billionaires, is used by 60 million people every month and is now the fastest growing enterprise in Australian history.

Canva is being called “the new Google”, and so big is its reputation that an early backer compares star co-founders Melanie Perkins and Cliff Obrecht, 34 and 36 respectively, to Google’s legendary Larry Page and Sergey Brin. In a global technology sector full of big names, this is quite the company to be keeping. Canva is now valued at more than $55 billion, yet Perkins and Obrecht insist they are only getting started, given that they have only been in business for nine years.

But what is less well known is that the now husband-and-wife team were rejected by more than 100 investors before they received their first “yes”.

Today’s runaway success is a far cry from Canva’s earliest days, in which Perkins and Obrecht spent three months in 2012 living on the floor of a San Francisco apartment belonging to Perkins’ brother, travelling to Silicon Valley every day to pitch the idea they were sure would transform the world of design software, and getting knocked back again and again. She even used the free wi-fi in the local shopping mall during the day to set up the meetings in which she’d inevitably be rejected.

“We pitched to almost every VC [venture capitalist] in the world,” Obrecht says. “There were some really dark moments. Raising investment is essentially a sales pipeline, and your investors are your prospects. You have a spreadsheet with 100 investors, and then you cross them off 10 or 20 at a time, because they’ve all rejected you, and then you have to build the pipeline again. And you get rejected again.”

See The List: Australia’s Richest 250

The technology boom around the world in the past decade has been marked by big investments and big valuations. Barely a week seems to go by without a new privately owned startup being anointed with the once-rare “unicorn” status of achieving a $1 billion valuation.

It means big headlines, and inevitably large estimates of the wealth the startup has accumulated as a result of the funding deals. While many tech leaders have altruistic intentions, and indeed Canva’s founders want to give away much of their wealth, the very foundation of the startup scene is often based around the chase for large funding rounds and the subsequent achievement of pulling off the deal and then announcing a big valuation number.

Australia's Richest 250

Rinehart tops Richest 250, Canva’s Perkins the big mover

The top 10 on The List are wealthier than ever before, led by two of the country’s most successful businesswomen who have changed the face of corporate Australia.

Can restaurant king Justin Hemmes take on Melbourne?

The Sydney bar tsar reveals what his plans are for expanding his empire beyond his home turf.

How dark moments gave birth to vast Canva fortune

The Canva founders were rejected by more than 100 investors before they got their first ‘yes’.

Newcomers: The 29 wealthy debutants making their mark

Meet the little-known powerhouses, including one worth $1bn, who made The Richest 250 for the first time.

‘One service station was never going to be enough’

For Nick Andrianakos, a ‘journey of discovery to the lucky country’ has led to an estimated $894m petroleum fortune built over a lifetime.

Retail lobs into the ‘Meccaverse’

For Mecca founder Jo Horgan, there’s nothing so ‘viscerally delightful’ as going into a store and playing with products.

Tech guru Richard White’s plan to give back

WiseTech’s Richard White wants to beef up Australia’s STEM capacity. He’s setting up a new technology education foundation to get the ball rolling.

How ‘snowmobile approach’ made Bonett a billionaire

Online gift card billionaire and commercial property magnate Shaun Bonett says there are very few people who invent things. The real art is in putting things together in a better way.

Bevan Slattery kicks off his last hurrah

If Bevan Slattery’s has big plans: to pull off what will be the largest private digital infrastructure project in Australia’s history.

‘I just love anything that’s difficult’

If it sounds too good and big to be true, unstoppable property developer Lang Walker knows it’s the project for him as he loves nothing more than proving the doubters wrong.

The fortune four million parcels built

Meet the little-known powerhouse behind Australia’s burgeoning e-commerce industry.

How our billionaires relax

It’s not all work for the big players on The List: The Richest 250. They wind down in various ways, from the sporty to the leisurely – or just collecting ritzy houses.

Simple lessons in David Dicker’s 25-year overnight success

It took until the fast car enthusiast was 50 to realise what he needed to change to be a success in business – pay staff well, hire more women and stay out of the way. The results have been startling.

How Culture Kings founders made millions

Australian retail phenomenon Culture Kings is about to launch its biggest play, with its 30-something founders taking on the US market.

Gina Rinehart tops The List as NFT revolution takes off

This year’s edition of The List - Australia’s Richest 250 will show how mining and technology are now the country’s two most successful sectors.

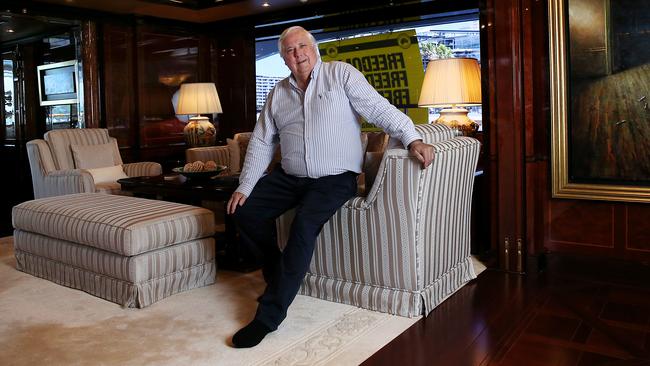

Cars and politics fuel Clive Palmer’s passion play

Clive Palmer makes more income than almost every other Australian billionaire. But how he chooses to spend it is unique.

High flyers: Private jets the new toy of choice

Forget fast cars, super yachts or luxury houses. The hottest trophy asset for Australia’s rich elite right now is a $100m jet. So who has bought one?

Yet behind the headlines and celebrations, little is known about how the big deals get done. In the case of Canva, now the fastest-growing startup in world history in valuation terms, nothing seemed to come easy.

A decade ago, after months of being rebuffed, the Canva duo’s spreadsheet was filled with red cells, representing investors who had variously told them that the market for online design software wasn’t big enough; that their company was located too far away from Silicon Valley; that the fact Obrecht and Perkins were romantically involved was an issue; and that Canva ultimately didn’t have the right team in place to be able to successfully scale up the company.

It didn’t help that their first pitch decks were convoluted – one slide, for example, speaks of “tentacles, search engines and virality” – and the couple were putting potential investors offside by asking them to sign non-disclosure agreements because they were concerned someone would steal their idea.

Their idea, however, was a good one. Take the power of Adobe’s design products and marry it with the simplicity and collaboration – as well as zero dollar cost – of Google Docs. But investors weren’t seeing it.

“By that stage you feel like you’ve burned every bridge, because you’ve exhausted all of your good contacts and they all talk to each other. You’ve been running around town for the past six months trying to raise money, and no one’s given you the money, so it’s like, what does that say? What does it mean?” Obrecht says.

“There was starting to be a bad smell around the business and it starts becoming a self-fulfilling prophecy. No one wants to even take calls from you.”

The pair spent a week crying in their soup, as Obrecht puts it, and discussing whether they should give up.

“We had a sort of misery walk and just pulled ourselves up off the floor and went again,” he says. “And fortunately that was the time it worked.

“We always felt like we were on the right path, but people just weren’t seeing it. And rather than blame the people we blamed ourselves, and thought, we’re not presenting it well enough, and we’re not making it clear.

“We were being asked to demonstrate that there’s a problem that needs solving, and that we have a solution that solves that problem, and we can deliver on that if we get funding and grow a really significant business... We really always put it on ourselves and blamed ourselves; we have a strong internal locus of control rather than external locus of control. We just thought it was on us.”

So desperate to land funding was Perkins that she learned kitesurfing in order to impress high-profile venture capital investor Bill Tai, at his famed MaiTai start-up summit at Richard Branson’s private islands in the Caribbean.

Tai was won over by Perkins and Obrecht’s gumption – they ambushed him at a dinner he was hosting in Perth – and he introduced them to investors who would end up becoming Canva’s first backers. In 2013 Canva’s co-founders finally signed on the dotted line of their first venture capital raise, a $US3 million round from Tai along with Blackbird Ventures, Matrix Partners, InterWest Partners, Australian venture capital firm Square Peg, 500 Startups, and angel investors including Google Maps co-founder Lars Rasmussen.

Obrecht says the repeated rejections, and creeping self-doubt about what they were trying to build, led to a heavy scepticism even once they’d finally landed the deal.

“We had got it close to the finish line many times. We had a mentor continually tell us that the round is not closed until the money’s in the bank. You can sign term sheets, and there are a lot of non-binding steps in the process, but you can’t rest on your laurels even if you’ve signed anything until the money’s there.

“It was back in the day where reputations weren’t as important, because VC is so much more competitive now. And if a VC pulled a term sheet now it would be bad. But we just made sure we could get through that process to the finish line as quickly as we could... And we got the money.”

That seed round was then followed in October 2015 by a Series A round, a major $US15 million tranche of funding led by Wesley Chan, a US-based former top Google executive who remains on Canva’s board to this day. Hollywood stars Owen Wilson and Woody Harrelson also poured money into the company.

Chan was told about Canva by Didier Elzinga, the chief executive of one of Australia’s other most successful and valuable start-ups, Culture Amp. A general partner at Felicis Ventures, Chan arranged a 30-minute coffee at Canva’s offices that turned into a three-hour meeting, causing him to miss his flight back to the US. He says he was struck by the stories of rejection that the co-founder couple told so openly.

We had got it close to the finish line many times. We had a mentor continually tell us that the round is not closed until the money’s in the bank

“Every investor has told us they’re passing, they said ‘we can’t ride a bike to your company’,” Perkins told Chan, as he recalls. “And a lot of people are confused by what we’re building; we have lots of users but we’re not making much money. And we don’t have a pedigree. Silicon Valley investors are looking for people who went to Stanford and worked at Google or Facebook. And by the way, the price on this company is very expensive. We only want people who believe in the same vision we do. So you have every reason to say no.”

Chan says it was this very Australian humility, which he sees in almost every start-up founder from Down Under, that endeared Perkins and Obrecht to him instantly and told him they were different.

On the flight home to San Francisco he drew up a spreadsheet of reasons he should invest in Canva and reasons why he should not, and the “not” list outnumbered the other by about 15 to one.

“I wrote down on the column of why I should do it that ‘she loves what she’s building’. And that was it. That was the one thing. I helped write the ad system at Google, I served as chief of staff at Google, it was only a couple hundred people when I joined. And the thing about [Google co-founders] Larry and Sergey was that they loved it. And they truly believed they wanted to build a company that lasts for 100 years.

“Melanie and Cliff remind me so much of Larry and Sergey at Google. And this deal has been my career maker. I took that leap of faith, and it could have worked out the complete opposite way and so many things could have gone wrong. But I thought the worst that could happen is that I get fired and go build more things for Google, or the upside is that Canva becomes the next Google. And look what happened.”

It would be much easier starting up Canva now, Obrecht says, given the sheer number of venture capitalists out there and the amount of capital sloshing around the market.

He also says that the co-founding team still lead their investment rounds, including a most recent $US200 million capital injection that valued Canva at $US40 billion ($55 billion) last September. The company has been doubling in size every year, growth that accelerated during the pandemic.

“It’s still us, we just have a lot more support now. So when the investors have financial questions I might be on that email thread, but it’s Damien [Singh, Canva’s chief financial officer] probably answering it and we’ve got a legal team handling stuff too. It’s a lot smoother for us now, and that’s because of our experience as well. We’ve done God knows how many fundraisers cumulatively, so we’ve got quite experienced at this.”

The last two years have been the biggest yet for Perkins and Obrecht, who tied the knot on Rottnest Island last year and announced plans to give away the vast majority of their stake in Canva, which is about 30 per cent of the company. That should amount to billions of dollars flowing through to charity, and the Canva Foundation is on track to become Australia’s largest charitable foundation.

Questions remain over what’s next for Canva – when and where will it list on a stock exchange, how sustainable is its meteoric growth, can it continue to hire and retain top-tier engineering talent – but for now its co-founders are still enjoying the ride.

“That wild dream we had many years ago of becoming the future of publishing and design is fortunately coming to fruition,” Perkins says. “Our mission to ‘empower the world to design’ is five very simple words. They’ve taken the past 10 years of my life and we’ll be working on it for many many more years to come.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout