Richest 250: Australia’s richest on Bombardier, Gulfstream buying spree

Forget fast cars, super yachts or luxury houses. The hottest trophy asset for Australia’s rich elite right now is a $100m jet. So who has bought one?

At the southern end of Melbourne’s Tullamarine airport, among the hangars where the ghosts of Ansett Airlines still roam, billionaire entrepreneur Paul Little smiles broadly as he steps onto the stairs of his pride and joy.

The former Toll Holdings boss has owned his Gulfstream G650 for more than five years but it still looks as good as the day he took delivery of the $85 million private jet, which back then was the gold standard of executive planes.

Little was a trendsetter in buying the first business jet able to fly non-stop to Sydney and Melbourne from Los Angeles, joining the likes of Multiplex heir Tim Roberts, media magnates Rupert and Lachlan Murdoch, and Westfield’s retired co-founder, Sir Frank Lowy.

More recently, other members of The List, such as Melbourne billionaire plumbing supplier Jonathan Munz (who never flies at night), Westfield heir David Lowy (who flies the plane himself) and Spotlight billionaire Zac Fried have also become buyers of the prized plane.

Australia's Richest 250

Rinehart tops Richest 250, Canva’s Perkins the big mover

The top 10 on The List are wealthier than ever before, led by two of the country’s most successful businesswomen who have changed the face of corporate Australia.

Can restaurant king Justin Hemmes take on Melbourne?

The Sydney bar tsar reveals what his plans are for expanding his empire beyond his home turf.

How dark moments gave birth to vast Canva fortune

The Canva founders were rejected by more than 100 investors before they got their first ‘yes’.

Newcomers: The 29 wealthy debutants making their mark

Meet the little-known powerhouses, including one worth $1bn, who made The Richest 250 for the first time.

‘One service station was never going to be enough’

For Nick Andrianakos, a ‘journey of discovery to the lucky country’ has led to an estimated $894m petroleum fortune built over a lifetime.

Retail lobs into the ‘Meccaverse’

For Mecca founder Jo Horgan, there’s nothing so ‘viscerally delightful’ as going into a store and playing with products.

Tech guru Richard White’s plan to give back

WiseTech’s Richard White wants to beef up Australia’s STEM capacity. He’s setting up a new technology education foundation to get the ball rolling.

How ‘snowmobile approach’ made Bonett a billionaire

Online gift card billionaire and commercial property magnate Shaun Bonett says there are very few people who invent things. The real art is in putting things together in a better way.

Bevan Slattery kicks off his last hurrah

If Bevan Slattery’s has big plans: to pull off what will be the largest private digital infrastructure project in Australia’s history.

‘I just love anything that’s difficult’

If it sounds too good and big to be true, unstoppable property developer Lang Walker knows it’s the project for him as he loves nothing more than proving the doubters wrong.

The fortune four million parcels built

Meet the little-known powerhouse behind Australia’s burgeoning e-commerce industry.

How our billionaires relax

It’s not all work for the big players on The List: The Richest 250. They wind down in various ways, from the sporty to the leisurely – or just collecting ritzy houses.

Simple lessons in David Dicker’s 25-year overnight success

It took until the fast car enthusiast was 50 to realise what he needed to change to be a success in business – pay staff well, hire more women and stay out of the way. The results have been startling.

How Culture Kings founders made millions

Australian retail phenomenon Culture Kings is about to launch its biggest play, with its 30-something founders taking on the US market.

Gina Rinehart tops The List as NFT revolution takes off

This year’s edition of The List - Australia’s Richest 250 will show how mining and technology are now the country’s two most successful sectors.

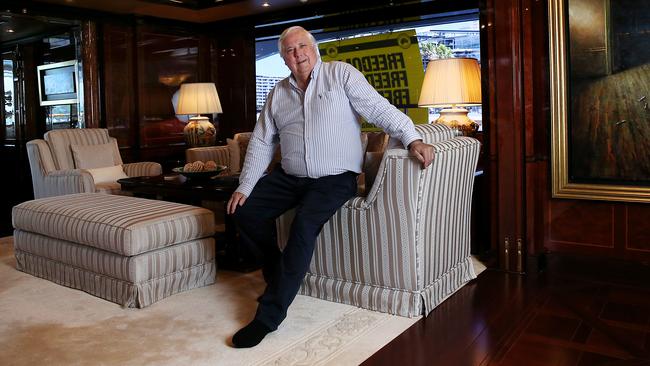

Cars and politics fuel Clive Palmer’s passion play

Clive Palmer makes more income than almost every other Australian billionaire. But how he chooses to spend it is unique.

High flyers: Private jets the new toy of choice

Forget fast cars, super yachts or luxury houses. The hottest trophy asset for Australia’s rich elite right now is a $100m jet. So who has bought one?

Media and mining magnates Kerry Stokes and Gina Rinehart have preferred the smaller but equally luxurious Gulfstream G600.

Now the world’s leading private jet manufacturers are setting new standards for space and power in the air, releasing the Gulfstream G700 and the Bombardier Global Express 7500, the world’s largest business jet.

Property developer John Gandel is the only Australian owner of the latter new age, $100 million aircraft, but Andrew Forrest, Kerry Stokes and Perth-based gaming founder Laurence Escalante each have one on order.

Trucking magnate Lindsay Fox and his family are taking delivery of a new Global Express 6500 in the second quarter of this year that is $20 million cheaper than the 7500.

The plane will be predominantly used by Lindsay and his wife Paula Fox, who has had a home in Hawaii for 45 years. But Lindsay’s son Andrew Fox says that it will also be used for Linfox board meetings in Asia, India and New Zealand.

“Our price has been locked in,” he says. “Bombardier will also let us use our current Global 6000 plane until we get delivery of the next one.”

The Fox family are lucky. An explosion in private jet travel globally in the past year following the onset of the Covid pandemic has seen aircraft deliveries in most categories pushing out to the second quarter of 2023 and beyond. The industry also has the lowest level of pre-owned jets available for purchase in 40 years.

There are more first-time buyers entering the market than at any time in recent history

“This is unprecedented,” says one key player in the local jet market. “I’ve never seen anything like it in 30 years of owning jets. Over 12 months, not only have you seen an increase in pre-owned and new aircraft values, the availability is non-existent. I would typically get brokers asking ‘have you got an aircraft for sale?’ a couple of times a month. We are now getting 10-plus a day.”

There are more first-time buyers entering the market than at any time in recent history, due to a lack of reliable commercial airline schedules around the globe, passenger fears of contracting Covid on regular services and the inability of companies to visit business sites.

There were also 4 million private jet charter flights taken around the world in 2021, as more wealthy individuals and even public companies chartered single flights, leased planes, or embraced a fractional ownership model that gives them a certain number of flight hours per year in return for owning a stake in a jet.

“The American market is so petrified of Covid that people don’t want to be in airports – international or domestic – and the value of corporates using a private jet where they can have five to six executives on a single plane and stay safe is huge,” Andrew Fox says. The Fox family and property magnate Max Beck own the Essendon Fields industrial property development in Melbourne’s north, which houses the city’s second-biggest airport.

“If you compare what is going on with business jets compared with total aircraft movements, the airport has grown 11 per cent but corporate jet movements have grown 26 per cent between 2020 and 2021,” says Essendon Fields CEO Brendan Pihan. “Six per cent of our movements are business jets but they represent 30 per cent of our revenues.”

Motorcycle racing five-time world champion Mick Doohan, the president of global player Jetcraft International for Australia and New Zealand, says the wealthy now have a reason to justify private jet ownership like never before.

“The airlines will take time to recover, many sectors/city pair flights will cease,” he says. “The owners wish to avoid crowded places like airports and the processes involved – queues for check-in, immigration border security, even a coffee. These dynamics favour getting an aircraft they can fly non-stop. Certainly the elderly, who never thought about purchasing or chartering a jet, for pure health reasons are deciding to at least charter one.”

Doohan adds that with the wealth created from the bull run in global sharemarkets over the past decade – especially in recent years – there is a younger generation aged between 30 and 50 buying or chartering planes.

“We are seeing young families that have never chartered a jet before. Especially over the past 12 months, that has increased. It’s hard to quantify but new entrants have represented about a third of our buyers in the past year.”

First-time buyers in Australia include Colin DeLutis, the former Carlton Football Club vice president, executive chairman and founder of DeGroup, and founder of Westco jeans. He has purchased an Embraer Praetor 500 – about half the size of a Global Express with about six hours of flying range – which is scheduled for delivery in March 2023. Another is Rich Lister David Dicker, CEO of Dicker Data. “I think it’s still a ridiculous extravagance but I’m going to do it anyway,” he says.

“I’ve got 11 or 12 board meetings a year in Australia. I’ve got various computer industry functions and so I have the best part of 15 business trips and I’m between Australia, Dubai and New Zealand. I need a long-range plane because I’ve got to get to Dubai. I’ll be paying for the running costs of it; they are expensive to run. They burn a lot of fuel and you can’t do anything about it.”

Private jet pilot Mike Bartlett, who worked for the Pratt family’s Pratt Aviation arm for 22 years and still flies for the family, has more recently set up his own private jet buyer’s advocate group called Jet Assist. He describes the current market conditions as “extraordinary”.

“You almost cannot get your hands on a used aeroplane,” he says. “People are buying aircraft sight unseen, no due diligence. It is really incredible. Used aircraft are asking 20 per cent higher prices compared to before Covid.”

Bartlett says a traditional rule of thumb in the industry is 10 per cent on average of the used private jet fleet globally is on the market at any one time. If it is more than 10 per cent it is a buyer’s market, while less than 10 favours sellers. In January 2022 the market was running at 3 per cent.

“Covid has changed a lot of people’s thinking with regard to their wealth,” he says. “People are saying ‘What the hell, I am going to buy a jet. I can afford it’.”

Bartlett agrees with Mick Doohan that the buyers are now younger. In addition to sharemarket wealth, he says, some new buyers have made their money in property.

“It was the older families who originally had these planes, but you are seeing a difference now in generational wealth. The second and third generations are embracing aircraft.”

The buyers are also being attracted by what this new generation of planes can do in the air.

“The technology you would usually get in the high-end jets is migrating into the smaller planes,” Bartlett says.

“Garmin has done some incredible things with touchscreens. It has come up with an emergency auto-land system. It will find an airport and land the plane if the pilot is incapacitated.

“You are seeing smaller planes being retrofitted with these cockpits. People are spending the money on doing up the cockpits to make them completely digital.”

Gulfstream recently previewed its G800 business jet, on sale from next year, which can fly almost 15,000km non-stop. The instrumentation includes a record 10 touch screen displays and there is a pandemic-friendly plasma-ionising cabin ventilation system. The cabin can also be split into four zones.

Perhaps the biggest illustration of the current heat in the market is the way the jets are being paid for. Bartlett reckons that in 60 per cent of sales, people are paying cash. “And big dollars. You are talking north of $20 million. Jets go in and out of favour with the financiers, including the big four banks. Unless you are a long-term, strong customer of the banks, banks are not really interested.’’

Government tax incentives and programs are also encouraging investment in the sector.

Last year’s federal budget allowed businesses with up to $5 billion in annual turnover to claim an immediate deduction of the full value of all new, eligible, depreciable assets of any value used or installed before June 30, 2022.

“It has driven the last three transactions I have been involved with,” Bartlett says.

Andrew Fox says the tax changes have been embraced by private jet owners looking to upgrade, including his own family. “One of the biggest drivers in the way the Australian market looks at aircraft is that up until now you only got 10 per cent depreciation, compared to America, where they got 100 per cent. With Treasurer Josh Frydenberg’s changes going forward, the move to introduce a 100 per cent write-off is an incentive to upgrade and plenty of people are doing that.”

Australia now has a dozen major private-jet terminals, including two that Mick Doohan’s company runs, called Platinum Business Aviation Centres – one at Essendon and another on the Gold Coast.

The biggest by far is Paul Little’s $100 million Melbourne Jet Base, built and owned by his Little Group, a massive VIP facility at Melbourne Airport that Little believes sets the standard – as his jet once did – for private jet facilities anywhere in the world.

The Jet Base has capacity for 200 aircraft turns a month, full kitchen and function facilities, a fully accessible hotel-level suite available for guests, and a suite for pilots and space for a flight crew.

“The object of the facility is to get people to house their planes there, because by doing that there are a range of other services that we can provide for them,” Little says. “So we certainly accommodate people who just want to fly in and fly out, but the other category of people is those looking for a home to hanger their aircraft.”

“To help that process, all the crews have their own office facilities overlooking a lot of the aircraft. That has elevated the importance we place on the crews, not just the owners of the aircraft or passengers on the aircraft. The crews are also very important.”

Little believes that the current booming demand in the private jet market will take the Jet Base, which turns over $15 million per annum, to another level.

“Our long-range aircraft can go to Los Angeles in 12-13 hours nonstop,” he says. “That’s pretty compelling. And one stop to London.

“Being joined at the hip with Melbourne Airport, we also get to take advantage of the curfew environment, the cost of fuel, and the safety aspects of flying in and out of Melbourne Airport, which is much better than some of our competitors. So I think the facility is obviously world class, but we are also attached to a world-class airport that really values what we can do to help them and assist them.”

Before the onset of Covid, the Jet Base was also starting to offer wealthy customers on commercial airlines a quick airport arrival and exit, away from the public eye.

“If someone wants to fly in a chopper, go directly to the plane, bypass the terminal check-in and security and meet an existing commercial flight, we can do that for them,” Little says. “We just love the concept and our customers love it.

“We had a couple of the very high-profile tennis players using it pre Covid and they loved it. They brought their families through. If you want total confidentiality, there is a big car park underneath the Jet Base building; you can come in a private car or a chopper and be gone. No one would even know you were there.”

Income for the Jet Base – which forms part of the 19.5ha airport site Little Group leases from the federal government – will also be underwritten by the decision of Qantas to expand its line maintenance engineering in Victoria.

“We’ve got a lot of spare development area at Melbourne Jet Base for future growth if we wish to do that,” says Little. “But what this long-term contract brings, not just to our business but also the Victorian Government and the Victorian economy, is significant aviation employment coming back to Melbourne for the maintenance of aircraft. That is really important to our state and it is important to us.”

Closer to Melbourne, Essendon Fields is developing a service centre to cater for a growing market of private jets, after striking a deal with the global manufacturer Bombardier to set up a new maintenance, repair and overhaul (MRO) facility.

The new $25 million building features a 4700sq m hangar, lounge and meeting room space and can house Bombardier’s Global 7500 jet, which has a maximum range of 7700 nautical miles (14,260km). The new facility will employ more than 45 workers.

Half of the 100 Australia-based Bombardier private jets are already housed at Essendon Fields, including the Fox family’s Global 6000.

“It is a huge uplift for Bombardier and huge upside for us,” Andrew Fox says of the new facility. “One of the better reasons it is located at Essendon is the majority of the private aircraft in Melbourne are at Essendon. These owners don’t have to travel a further 10km to Tullamarine and they have total privacy.”

Essendon Fields CEO Brendan Pihan says the development cements the joint venture partner’s commitment to general aviation at Essendon, which encompasses business jets.

“From a skilled workforce perspective, Bombardier is the type of organisation that will continue to invest in staff and qualified mechanics to ensure people can work on a range of different aircraft types,” he says. “It will enable aircraft from different jurisdictions to be serviced here. Absolutely we are seeing this as a growth part of the market.”

Mick Doohan, who started operating a hangar at Essendon Fields in 2018, says he sees no end in sight to the current market dynamics for private jets.

“I would think we will have another 18 months of these conditions,” he says. “The Global Financial Crisis was the biggest correction there has ever been with aircraft values. I don’t think we will see a correction like that again because the demand will still be there.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout