Australia’s Richest 250: Behind property magnate Shaun Bonett’s ‘snowmobile approach’ to investing

Online gift card billionaire and commercial property magnate Shaun Bonett says there are very few people who invent things. The real art is in putting things together in a better way.

The List is the biggest annual study of Australia’s 250 wealthiest individuals, with final figures calculated in late February 2022. See the full list here.

Shaun Bonett calls it the “snowmobile approach” to investing. The billionaire commercial property magnate is discussing how he decides to put his money outside bricks and mortar, a strategy that has led to what has to be his best deal yet.

Bonett is the 85 per cent owner of online gift card business Prezzee, a fast-growing digital company that claimed last year to have reached the coveted “unicorn” status as a startup that has achieved a $1 billion valuation.

Prezzee has surged during the online shopping boom, as more consumers buy the digital gift cards the company provides for retailers such as Macy’s and Ubereats in the US, and buy now pay later businesses including Afterpay, Zip and Klarna in Australia and elsewhere.

Bonett’s firm claims to have been the first to conceive of the concept of combining BNPL with gift cards. Prezzee also supplies “white label” gift cards for corporate customers such as QBE, Coca-Cola, Allianz, Atlassian and Samsung.

Australia's Richest 250

Rinehart tops Richest 250, Canva’s Perkins the big mover

The top 10 on The List are wealthier than ever before, led by two of the country’s most successful businesswomen who have changed the face of corporate Australia.

Can restaurant king Justin Hemmes take on Melbourne?

The Sydney bar tsar reveals what his plans are for expanding his empire beyond his home turf.

How dark moments gave birth to vast Canva fortune

The Canva founders were rejected by more than 100 investors before they got their first ‘yes’.

Newcomers: The 29 wealthy debutants making their mark

Meet the little-known powerhouses, including one worth $1bn, who made The Richest 250 for the first time.

‘One service station was never going to be enough’

For Nick Andrianakos, a ‘journey of discovery to the lucky country’ has led to an estimated $894m petroleum fortune built over a lifetime.

Retail lobs into the ‘Meccaverse’

For Mecca founder Jo Horgan, there’s nothing so ‘viscerally delightful’ as going into a store and playing with products.

Tech guru Richard White’s plan to give back

WiseTech’s Richard White wants to beef up Australia’s STEM capacity. He’s setting up a new technology education foundation to get the ball rolling.

How ‘snowmobile approach’ made Bonett a billionaire

Online gift card billionaire and commercial property magnate Shaun Bonett says there are very few people who invent things. The real art is in putting things together in a better way.

Bevan Slattery kicks off his last hurrah

If Bevan Slattery’s has big plans: to pull off what will be the largest private digital infrastructure project in Australia’s history.

‘I just love anything that’s difficult’

If it sounds too good and big to be true, unstoppable property developer Lang Walker knows it’s the project for him as he loves nothing more than proving the doubters wrong.

The fortune four million parcels built

Meet the little-known powerhouse behind Australia’s burgeoning e-commerce industry.

How our billionaires relax

It’s not all work for the big players on The List: The Richest 250. They wind down in various ways, from the sporty to the leisurely – or just collecting ritzy houses.

Simple lessons in David Dicker’s 25-year overnight success

It took until the fast car enthusiast was 50 to realise what he needed to change to be a success in business – pay staff well, hire more women and stay out of the way. The results have been startling.

How Culture Kings founders made millions

Australian retail phenomenon Culture Kings is about to launch its biggest play, with its 30-something founders taking on the US market.

Gina Rinehart tops The List as NFT revolution takes off

This year’s edition of The List - Australia’s Richest 250 will show how mining and technology are now the country’s two most successful sectors.

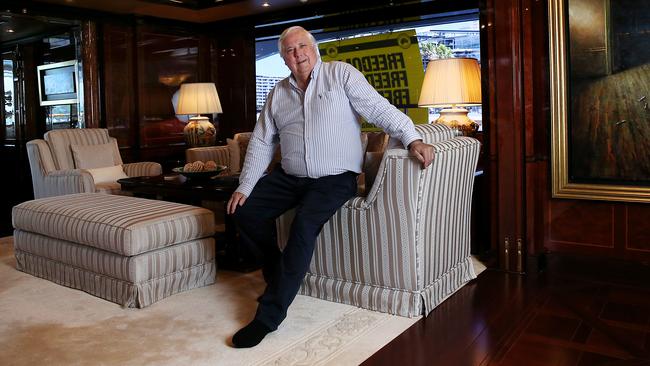

Cars and politics fuel Clive Palmer’s passion play

Clive Palmer makes more income than almost every other Australian billionaire. But how he chooses to spend it is unique.

High flyers: Private jets the new toy of choice

Forget fast cars, super yachts or luxury houses. The hottest trophy asset for Australia’s rich elite right now is a $100m jet. So who has bought one?

It is growing rapidly, and to give an indication of how technology fortunes can be made faster than in any other sectors, Prezzee’s achievement of that billion-dollar valuation status since 2015 compares with Bonett taking more than two decades to get to the same level with the collection of shopping centres, office buildings and pubs controlled by his Precision Group.

Prezzee’s revenue increased by 400 per cent in 2021, finding success in that BNPL sector and expanding into North America and Europe. It has also signed a global master services agreement for the supply of digital gift cards to global giant Mastercard’s loyalty solutions business, and is on track to hit $1 billion in transactions in the 2022 financial year.

These are heady days for the business, which also encapsulates Bonett’s investment strategy outside of the property industry that underpins his wealth. Which is where that “snowmobile” analogy comes in.

“A snowmobile is a piece of equipment where everything existed before the person who invented it put it all together. But he thought about how to put everything together in a different way to create this snowmobile,” Bonett tells The List. “So if you want to do private equity, and you want to adopt risk mitigation but to have that very high potential opportunity, you look for snowmobiles.”

What Bonett means is that he likes to invest in companies that take existing products or equipment – like a snowmobile, which first combined skis, a seat and engine – that are tweaked to make a new popular product or technology.

Gift vouchers, and more lately plastic gift cards, were already ubiquitous, but a digital version that was easy to use with technology that could be adapted across different retailers and payment sectors, and across borders and now languages, wasn’t necessarily widespread.

In other words, it can often be something that looks simple and sounds obvious in hindsight that are the best investments, as Bonett explains.

“There are people out there who have a vision to do something in a better way, a more efficient and productive way. There are very few people who invent things. But there is an art form to putting things together in a better way.

“Everything I’ve always been attracted to [invest in], I usually adopt that lens. And it’s probably the most effective risk lens. Nothing becomes a total disaster. And then the next level of due diligence becomes more about execution risk. Can they make it work?”

See The List: Australia’s Richest 250

Prezzee is now the company in Bonett’s portfolio with the biggest potential, and valuation, but he has long been investing in technology startups and other fields outside property. He was an early investor in online job advertisement firm Seek, and also invested in and later joined the board of iSelect, the insurance, utilities, personal finance products and energy online comparison business, in 2003. He also has stakes in, and is now chairman of, Litigation Lending Services, one of Australia’s earliest legal funders; private equity finance company Lenders Direct; and Skyfii, which provides customer insights to shopping centre owners, governments and other public facility owners using analytics and data.

Bonett’s overall portfolio has helped Precision weather Covid, which for two years has meant its shopping malls and offices in particular have had to cope with various government lockdown orders.

He says the idea of spreading his investments across different sectors harks back to his early days in business. While now based in Sydney, he started in business in 1994 in Adelaide, where he had studied law after his parents – his father was a doctor – moved to Australia in the mid-1970s from Europe. Bonett was working as a commercial lawyer, but a recession hit South Australia and, in his words, “Adelaide was going broke.”

“We went from doing all the interesting commercial work to suddenly focusing on receivership and liquidation. It was a bit like going from the feeling of being in summer to being in a terrible storm. And seeing what comes from that, because when people are working in insolvency they are unfortunately dealing with people who are being crushed. It might be because of mismanagement or bad decisions, but quite often they are innocent people. So it taught me to have three Plan As.”

Bonett remembers dealing with John Spalvins, of Adsteam fame, who rode high in the 1980s with his Adelaide Steamship Group before high interest rates and too much debt wiped him out early the following decade.

The State Bank of South Australia also collapsed in 1991, and Bonett remembers construction at the giant Myer Centre in Adelaide’s CBD grinding to a halt at one stage. “From that point in time I said to myself, this is not for me. I did not want to be an undertaker.”

Bonett had noted that several of his law peers had left to go into the finance industry.

Structured debt financing, the combination of several finance products from various entities or syndicates, was becoming more popular, and Bonett would find there was a yield differential between the price he could buy an asset at and the money he could borrow.

He raised $6 million to buy his first small neighbourhood shopping centre, with a supermarket and about 20 shops attached, and set about refurbishing and improving the asset. The increase in its value would allow him to buy another centre a year later, and Bonett was away in the property game.

It was around then that he met his long-time mentor, Geoff Tauber, who would back him in his early ventures after his family had sold toy wholesaler Playcorp to Coles and continue to do so for more than two decades. Tauber is still a director of Precision today.

Bonett remembers some advice from Tauber. “He said, listen Shaun, one of the mistakes that people often make is that they give themselves to one asset class. They become so committed and engaged in that asset class. They become really subject to its rising and falling.” Opportunities in the likes of Seek, iSelect and others followed.

“People have different names for it – angel investment, seed investment, early-stage investment, pre-IPO investment. I think the idea is if you invest early enough you get reasonably good at it. Yeah. Even if you get nine out of 10 wrong, you do well when you get one right.”

During times of disruption you are looking to minimise damage. You wait for a storm to come and then assess what actually needs to be done.

Prezzee is certainly a case in point so far, of getting that one investment right. Bonett met co-founders Matt Hoggett and Claire Morris in 2015 when the duo were trying to raise capital.

He says that they had been frustrated with the time they would have to wait for funding from publicly listed companies and found a private investor like him more receptive. He would invest initially for a 55 per cent stake, and more recently has bought another 30 per cent shareholding.

He remembers trying to convince some of his friends who ran companies to use the Prezzee digital cards as rewards for their staff, and their pleasant surprise when they actually did so.

“They were trying it because they thought they were doing me a good turn. But then they’d come to me later and say, wow, it’s an amazing communication tool with staff. To get a message from your boss and $100 or $200, $300 and a thank you for their commitment, the staff didn’t forget that.”

Then the pandemic hit, and Bonett says the silver lining was that it probably accelerated Prezzee’s growth by two or three years as customers in lockdown or unable to travel sent the digital cards as gifts to family and friends, and corporations used them as incentives and staff rewards.

Covid lockdowns have also been a big learning experience for Bonett regarding the property assets in his empire. He says he was glad to not lay off staff, as others in his industry did. “During times of disruption you are looking to minimise damage. You wait for a storm to come and then assess what actually needs to be done. And that’s probably from being brought up by a doctor. It’s like if someone comes to you with a wound, you don’t just chop their leg off. You try to stabilise and make an assessment.”

See The List: Australia’s Richest 250

What has Bonett assessed about the changes to consumer habits after two years of Covid, and how will that affect landlords and retailers?

“It has never been so hard to engage with consumers. They literally have a shield up around them. Unless you are able to properly engage with them – and it is not just about price, you have to have a genuine product or opportunity that resonates – it is going to be tough going.”

Take shopping centres, Bonett says. Malls with supermarkets and must-visit shops are doing well, others that rely heavily on discretionary spending are struggling.

“Most landlords over the years just filled in the mall with whatever tenant they could find. It turned out a lot of them were discretionary and you ended up with a lot of fair weather tenants.

So what landlords in retail and also in commercial are discovering is that the strategic approach is the only one to adopt. So you’ll see a much greater level of food and beverage and lifestyle products. And the brands that embrace the omni-channel approach [of mixing bricks and mortar with digital] are the ones that are going to do well, and are actually making more money than ever.”

Valuations of property assets have held up reasonably well so far though, and Bonett notes banks haven’t been “panic merchants” just yet. But he says a day of reckoning is probably coming at some stage.

“You don’t need to be a rocket scientist to realise that any shopping centre which has an over-reliance on discretionary spend is going to suffer. And whether that’s in three months or six months, or 12 or 18 months, it’s got to come.”

Which is where Prezzee returns in the conversation. With consumers becoming harder to reach, loyalty schemes will help and Bonett believes Prezzee can have a big part to play in that. It is, given it involves gift-giving or rewarding someone, a much more positive sector to be in than most.

“It is about making things better. I always like to say, the only friction that there is in the business is when we negotiate with the retailer, the commission,” says Bonett. “Other than that point, it is positive; it’s not adversarial. And then once you align yourself with the retailer, it’s as much about driving their sales.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout