How to get a bigger tax refund this year

Tax time is around the corner, so here are the most important things you can do to slash your tax bill and get a larger refund.

Tax time is approaching. Find out what you can and cannot claim for deductions this financial year and who is on the ATO's tax hit list.

Tax time is around the corner, so here are the most important things you can do to slash your tax bill and get a larger refund.

Australia’s leading professional accounting body has provided its top tips in the lead up to tax time, including the “crucial” details that Aussies need to know.

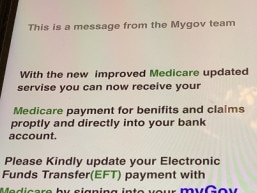

As if tax time isn’t stressful enough, an Aussie banking association has issued a warning over end-of-financial-year cons.

Labor’s Industry Minister is advocating for a cut in corporate taxes to help companies have the capital to invest in the future.

With the ATO watching closely this tax time, sole traders can rest easy and claim these business expenses this year.

Two major groups of Aussies are being warned to be vigilant with their tax returns as the Australian Tax Office is set to crack down on common errors.

The drawbacks of stamp duty are well documented, but the latest taxation data highlights why the effects of this yoyo tax extend beyond the property market, writes Cameron Kusher.

It’s a common tax return mistake that too many Australians make – and it could be costing them thousands.

Aussies are being warned they could face a fine if they aren’t mindful of two key dates on the Australian Taxation Office’s calendar.

The fitness industry is calling for a major tax change to give health conscious Aussies a helping hand.

The tax office’s approach to collecting $15 billion in tax debts has been slammed in a new report.

After three years of “lenient payment terms”, the ATO is back to collecting an estimated $50 billion of outstanding tax debts.

The jury trial of a construction boss accused of defrauding the Australian Taxation Office out of more than $13m has heard a warning about a ‘notorious’ case.

The days of governments filling the coffers via bracket creep should be a thing of the past, writes taxation specialist Robert Carling.

The Prime Minister has confirmed a significant shake-up to Australia’s taxation system, set to get high-income earners off-side.

Home builder Simsai Construction has gone into liquidation after a dispute with the Australian Taxation Office over debts nearing $4.5 million.

Nearly one third of the largest companies in Australia paid no income tax in 2021-22, according to the ATO.

More than 330 jobs will go at PwC following the consulting giant’s involvement in a taxation scandal earlier this year.

Aussies are being urged to lodge their tax return in the next few hours otherwise they risk getting hit with a $1500 fine.

A special Australian Taxation Office task force has bagged a mammoth amount of cash in its fight against tax avoidance.

The company claims it isn’t going under, despite the tax office issuing a wind up order to claw back creditor funds.

A small business owner from Sydney’s east has emphasised that everything is ‘business as usual’ despite owing almost $900k in debt.

A receptionist from one of Sydney’s leading brothels has revealed business is booming because of cashed-up tax return recipients.

The tax office has lashed some for wrongly claiming deductions — and it says the move is hurting Australians who need it most.

The ATO has issued a warning to a group of tax-dodging Aussies, saying it’s not a matter of “if” they’re caught but “when”.

The “greedy” son of the former deputy commissioner of the Australian Taxation Office has learnt his fate for directing a $105m tax fraud.

The son of the former deputy commissioner of the ATO was motivated by greed when he defrauded taxpayers out of $105m in an “immoral” tax scam.

Scott Brunton’s reign at the top of the Tasmanian training ranks could be over after the Federal Court ordered his business be wound up in the wake of a crushing debt to the Australian Taxation Office.

Tax experts have had enough with “whingeing” Aussies complaining getting a tax bill, revealing it’s is their own fault, not the ATO’s.

If you are feeling “ripped off” after completing your tax return this year, there is likely an uncomfortable truth you need to face.

Original URL: https://www.news.com.au/topics/tax-time/page/2