‘We’re fed up’: Tax expert blasts Aussies ‘whingeing’ over ATO bills

Tax experts have had enough with “whingeing” Aussies complaining getting a tax bill, revealing it’s is their own fault, not the ATO’s.

If you are one of the many people who has been complaining about getting slugged with a bill this tax time then watch out, because an Aussie tax agent has had enough with the constant whingeing.

It has been more than a month since Aussies could start lodging their tax returns and in that time social media has been flooded with people raging at the ATO after getting a low return or being hit with a tax bill.

In response, tax experts across the country have been doing their best to explain how tax time actually works and why some people may actually owe money this year.

But, despite their best efforts, Aussies are continuing to make videos ranting and raging, accusing the ATO of “robbery” and “scamming” them of their hard earned money.

One of the tax agents that has been diligently responding to these videos and busting common tax myths is Natalie Lennon - and she is fed up.

The founder and director of Two Sides Accounting has had enough of the constant complaining and is now calling “bulls**t” on people’s online whinges.

Ms Lennon recently responded to a video of a 23-year-old worker who filmed an expletive ridden rant after receiving a $2000 tax bill.

“Right, how the f**k do I owe the ATO $2000 when I gave them $48,000. The government is f**king every c**t like aways,” Tyrone Northrop said.

Ms Lennon revealed that she had messaged Tyrone and asked him to send the details of his return to she could look over it for him and see if there were any issues.

“Because if you are going to whinge about your tax on here you better be sharing the details of your return and your income because I am calling BS on a lot of this sh*t and we’re fed up,” she added.

She explained her stance further in a follow up video, claiming she was calling people out because most of those that are “whingeing and whining on TikTok” haven’t bothered to listen to any of the great expert advice that is being given.

“Most of the errors that we are finding - people are sending me their tax returns and I am checking them - most of them are user errors from doing your own tax return,” Ms Lennon explained.

She added that it was “totally fine to do your own tax return” so long as you pay attention to the details and understand how returns work.

But for those that don’t, then they shouldn’t be doing their own tax because it leads to unnecessary mistakes.

“Yes we care, yes we want to help, but we can only respond to so many comments and can only do so many videos,” Ms Lennon said.

One big reason many Aussies may be unhappy with their tax return this year is due to the end of the low-and-middle income tax offset (LMITO), which is seeing a number of people getting less cash back than they have become accustomed to over the past couple of years.

Introduced as a temporary measure in the 2018/19 federal budget, the offset meant those earning between $37,000 and $126,000 were eligible for a tax cut of up $1500, but with the offset scrapped people are no longer getting that tax time boost.

Another person that has been battling tax return misinformation is Sydney tax lawyer, Harry Dell, who explained that not getting tax back isn’t actually a bad thing.

“I want to talk about the tax return mentality for Australians and tell you why you don’t want a tax return,” Mr Dell said in a recent video.

“And I know this year a lot of people are saying ‘I’m very disappointed I didn’t get a few thousand dollars in my tax return, I even had a bill’. That’s a much better outcome and I’ll show you why.”

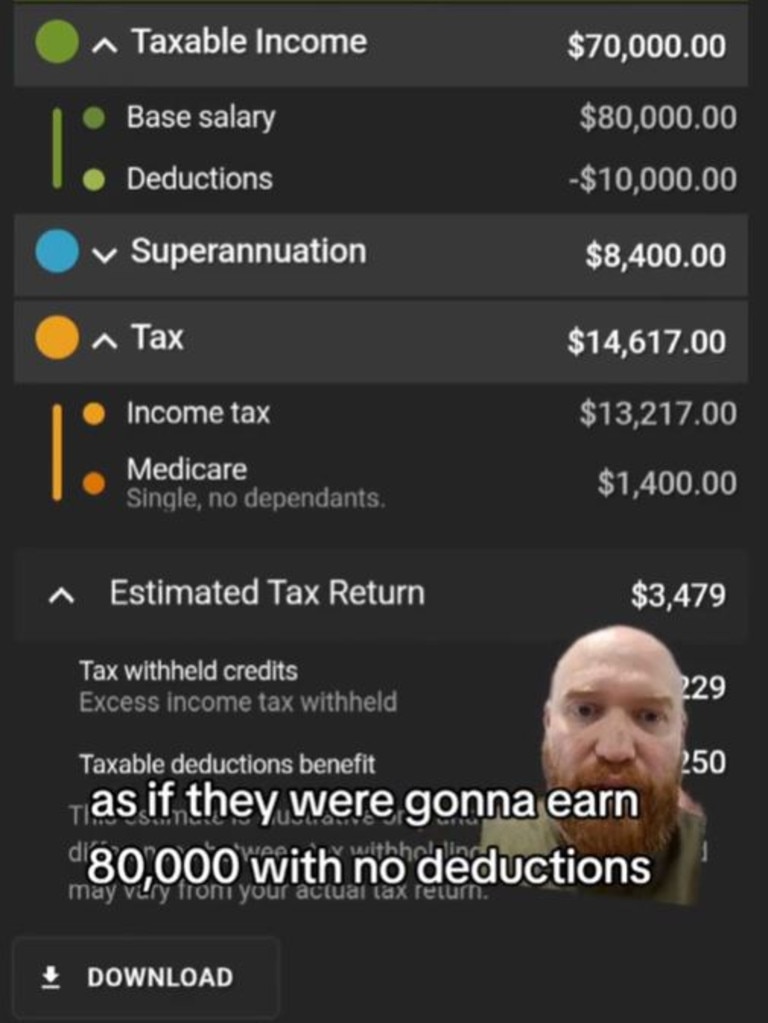

In Mr Dell’s example, he showed a calculation of someone earning $80,000 a year who had $10,000 in deductions when they lodged their tax return.

Their taxable was $70,000, meaning they should pay $14,617 in income tax and the Medicare levy.

However, Mr Dell explains this person was taxed as if they were going to earn $80,000 with no deductions, so a higher amount of $18,000 was withheld from their pay, meaning they got a $3500 return.

“Now sure, it is great to get $3500 but what you have done effectively is given the government an interest free loan for that income year,” the tax lawyer said.

“Because on your pay slip when you have pay as you go withholding it goes straight to the government every single week, fortnight or every month.

“So that $3500 tax return is just your money that they are returning back to you after having it in their bank accounts for quite a while.

“Tax return mentality serves the government. It gives them interest free amounts they can continue to spend on stuff and keep rolling it over because you are going to keep getting paid for your job and have pay as you go withholding and haven’t varied it.”

So, what if you have been hit with bill from the ATO? Well, according to Mr Dell this is actually “the best outcome”.

Aussies have until November 21 to pay their tax debt or even later if they are lodging through a tax agent.

“You’ve paid no extra interest on that money having that with you throughout the year, so you can invest in more stuff, you can have more money for a house deposit – all sorts of things,” he explained, adding you can also put in place a payment plan with the ATO to pay off the bill when you get it.

“But if after this, you’re still convinced that you want a tax return, you’re lost.”