Uncomfortable truth Aussies need to face about their tax returns

If you are feeling “ripped off” after completing your tax return this year, there is likely an uncomfortable truth you need to face.

While many Aussies are complaining about their minimal tax returns this year, there is a major part of tax time that a surprising number of people seem to be getting wrong.

It seems like anywhere you look online at the moment you can find someone taking issue with their tax return – but the truth is, the majority of Aussies shouldn’t automatically assume they will be getting a cash boost just because it is tax time.

Founder and director of Two Sides Accounting, Natalie Lennon, told news.com.au that there are many Aussies who don’t understand how tax returns actually work.

“If you are taxed correctly throughout the year on your salary or wage income and do not have any other income or deductions then generally you shouldn’t be needing to pay any tax or getting a refund,” she explained.

“You may get a small refund if you are a low income earner who earns under $45,000 due to the low income tax offset which can be up to $700.

“If you earn under the tax threshold of $18,200 then you would get all of your tax back.”

However, Ms Lennon said there are a number of factors that come into play that can affect this, including studying or training government support loans that need to be repaid once you hit the $48,361 income threshold or if you get bonuses or pay rises during the year that an impact your overall tax position.

If you are a single earning over $90,000 and do not have private health insurance you will also need to pay the medicare levy surcharge.

This ranges between one to 1.5 per cent of your income and is on top of the two per cent medicare levy that everyone must pay.

Money expert at Finder, Alison Banney, agreed that it was not actually a bad thing for people not to get any cash back at tax time.

“If you get no money back it just means that you’ve paid the correct amount of tax throughout the year,” she told news.com.au.

“Getting money back means that you’ve actually paid more tax than you needed to throughout the year. When you think about it, you’ve essentially lent your money to the ATO, and now they’re giving it back to you without paying any interest on the loan.

“Instead, that money could have been put to better use by, for example, keeping it in a high interest savings account and earning interest on it all year.”

Ms Banney said Aussies shouldn’t feel they’ve been “ripped off” if they don’t get a big tax return because “it means the system has worked for you as it should throughout the year”.

A lot of information is released in the lead up to tax time, which Ms Lennon believes adds to the confusion surrounding what Aussies should actually be getting back.

“In the lead up to June 30 every year all you hear on the radio and TV is to get your tax time purchases that are tax deductible. More often than not they are not 100 per cent tax deductible as everyone’s circumstances are different,” she said.

“We meet with our business clients before 30 June to estimate their profit for the year and discuss any tax deductible purchases they are thinking of making and then explain that, depending on their tax rate for every $1 they spend on tax deductible purchases, they may only get 30 cents back at tax time.

“They may also not get anything back at tax time this amount simply reduces any tax they might have to pay.”

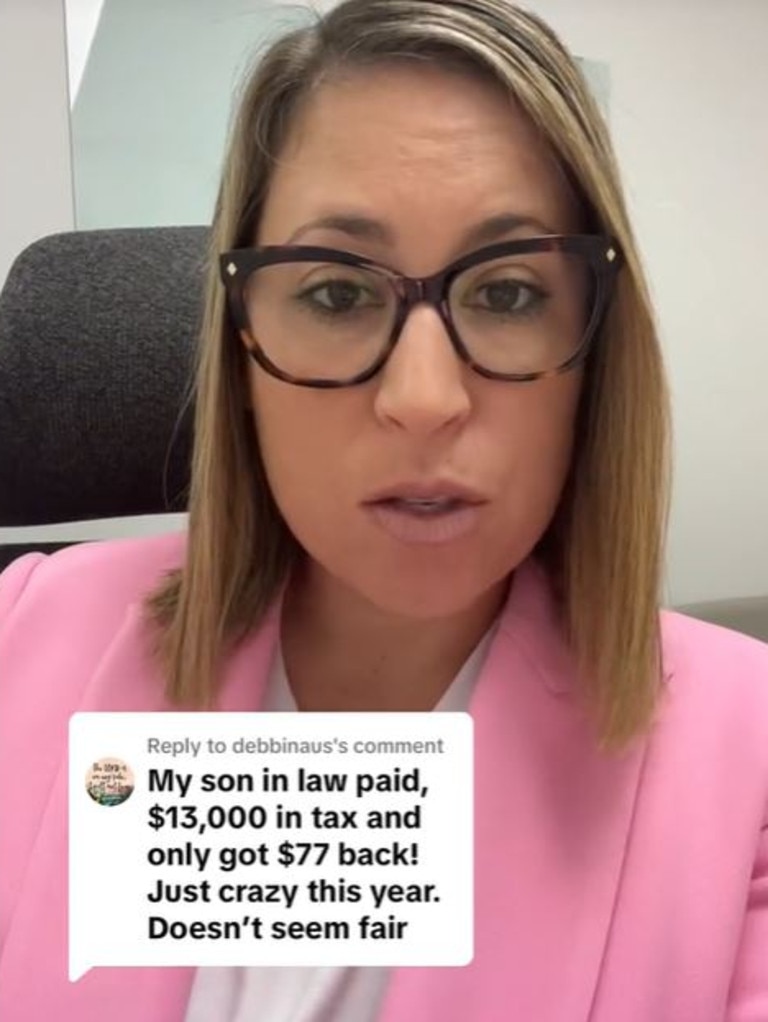

One of Ms Lennon’s recent TikToks on the subject revealed there are many that believe they should be getting a tax return every year no matter their circumstances.

“From the comments on my Tiktok which has now had almost 300K views and 700 comments it is clear that the average person feels that they are entitled to a tax refund,” she said.

“People also forget that additional income like interest or dividends or crypto gains are added to your salary and wages and taxed so there will be additional tax to pay on these amounts.”

So, why does it seem like so many more people are complaining about their low tax returns or getting hit with tax bills this year when compared to previous years?

Well, the end of the low-and-middle income tax offset (LMITO) is likely the biggest contributor to this.

The end of the offset means that those earning between $37,000 and $126,000 are no longer getting the tax cut of up to $1500 they have become accustomed to these past couple of years.

Ms Lennon also noted the hourly rate for the working from home fixed rate method went down to 67 cents from the higher Covid rate of 80 cents, a change which would have an impact on tax returns.

She also believes that a lot of people who are getting tax bills this year are likely people who have side hustles or have started their own businesses but aren’t aware of their tax requirements.

“We see this all the time when people start a business with no advice and then at tax time they think they will get a tax refund as that is what usually happens, only to find out that since they haven’t paid any tax on their earnings they are up for a large bill,” she said.

People completing their tax returns too early before all their prefill data, such as private health insurance, comes through is another reason why people may be getting bills.