‘Very sophisticated’: High alert for tax time scams

As if tax time isn’t stressful enough, an Aussie banking association has issued a warning over end-of-financial-year cons.

People need to be wary of scammers ripping them off under the guise of tax time cons, Australia’s Customer Owned Banking Association warns.

In June 2023, Australians lost $38 million to scams, government figures show.

End of financial year business makes an attractive disguise for scammers, Customer Owned Banking Association financial crimes chief Leanne Vale said.

Too good to be true sales, tax return fakes and deductible donation offers can all be trojan horses.

“Scammers are very sophisticated in the way they target people. If you suspect you have been scammed, it’s important to contact your bank or card provider immediately, as they may be able to stop the transaction and freeze your account,” Ms Vale said.

“Criminals will align their scams with what is happening in people’s lives, so during this specific time of year many people are preparing for tax time, making tax deductible charity donations or getting a bargain during the EOFY sales,” Ms Vale said.

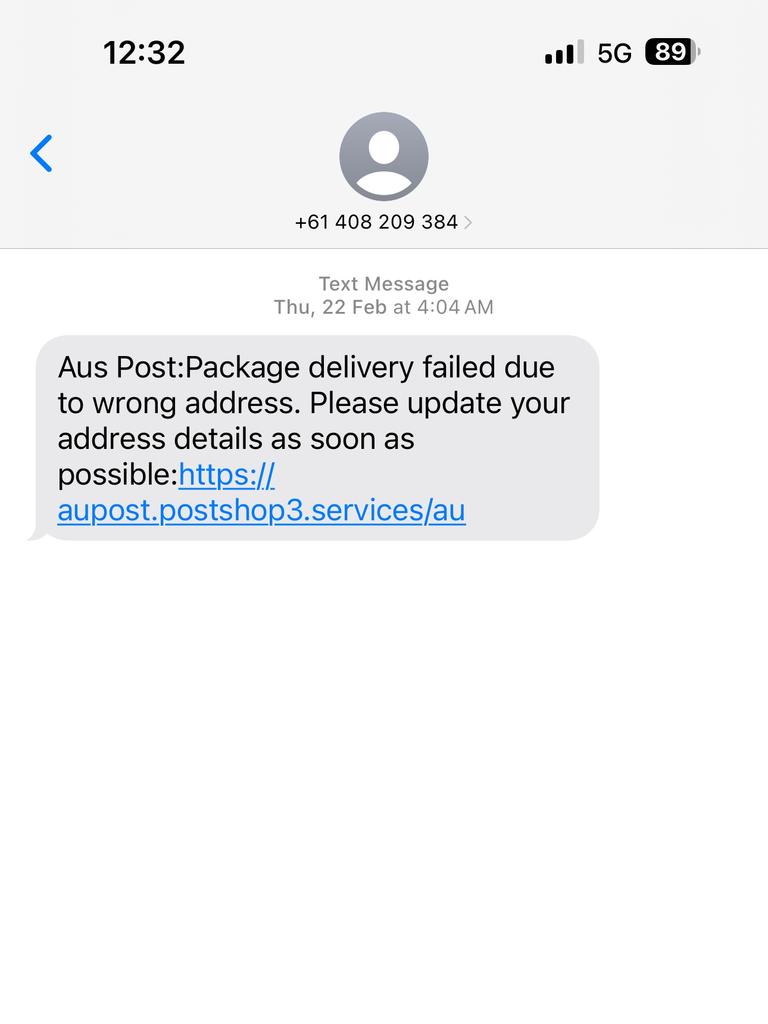

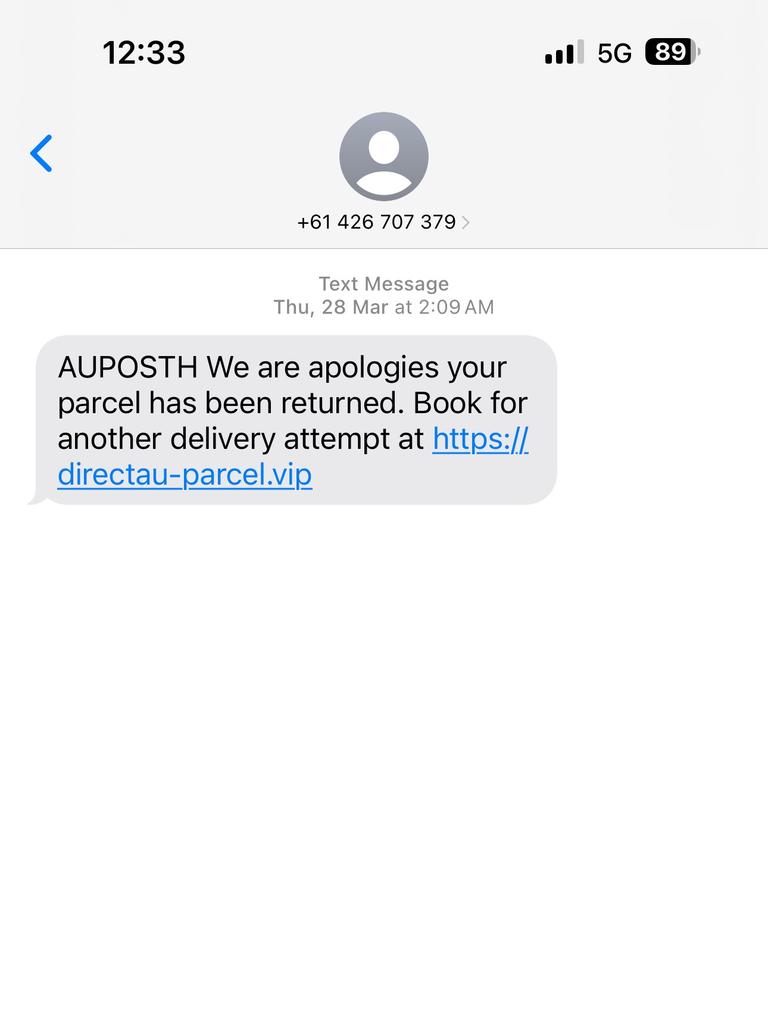

When shopping, consumers should check the website names which mimic big retailers, and that a site has privacy terms, contact details and terms and conditions.

If the store is an Australian website, the URL will have a .com.au, and you can check the domain name against the Australian Domain Authority’s website register.

Consumers should also be wary of emails offering bargains; do not click any links, instead go directly to the retailer’s official website.

“Scammers set up fake websites which can sit under actual retailers’ sites, so these can be hard to spot. They can also use logos and ABNs to make a fake website look real,” Ms Vale said.

“It’s good practice to always verify that the website you are planning to buy from is legitimate, but alarm bells should be ringing if a deal seems too good to be true.”

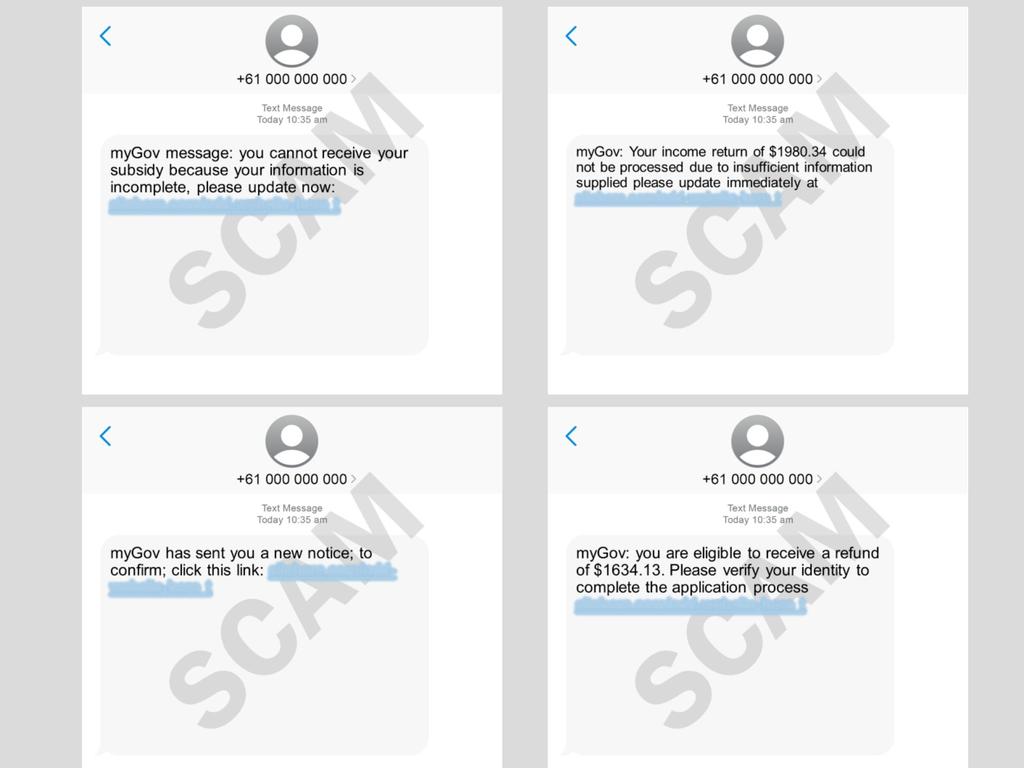

Fake myGov emails and text messages should be on people’s radars as well.

Fake myGov emails pushing urgency, account suspensions or threat of penalty are a particular red flag.

On the other side of the tax coin, fake tax deductible donations are a regular end of financial year scam.

“Sadly, scammers take advantage of people’s generosity, so June is rife with charity scams.

It’s important to be vigilant before you open your heart and wallet,” Ms Vale said.

Donations should only be made to registered charities, don’t click on links in emails and social media posts, and if you get an unsolicited phone call, hang up and phone the charity on their listed number.

Donating to a charity is tax deductible, as long as your donation is $2 or more and you make it to a deductible gift recipient charity.