Real reason Aussies are furious with ATO

Furious Aussies are turning on the government and ATO as an increasing number of workers are slapped with unexpected tax bills.

Tax time is approaching. Find out what you can and cannot claim for deductions this financial year and who is on the ATO's tax hit list.

Furious Aussies are turning on the government and ATO as an increasing number of workers are slapped with unexpected tax bills.

Fall into this common cash trap and you’ll be costing yourself money this year – and every year into the future as well.

Millions of Australians may get stung this tax season, discovering they owe thousands of dollars in debt to the tax man.

Many Aussies are getting their tax return back and finding it a lot lighter than previous years but there’s a very simple explanation for it.

If you want your tax bill to be hundreds or even thousands of dollars less, then financial adviser Ben Nash reveals some easy ways to pay less.

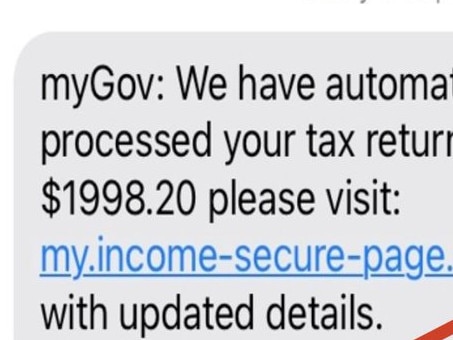

Aussies are being warned to be on their toes as tax time nears as authorities investigate a series of scams pretending to be from the ATO.

Yes, tax time is confusing. But there are plenty of smart, simple ways to cut your tax bill today – and hang onto more of your hard-earned cash.

Australians with a side hustle can make the most out of their upcoming tax returns by following these simple tips.

About a fifth of Aussie workers use AI tools in their jobs, and the ATO says these are fair deductions at tax time – as long as they can tick three boxes.

The millions of Australians with crypto in their digital wallets have been warned about a tax-time crackdown.

The key to making massive savings on your tax bill can come down to one seriously savvy strategy – and it will pay off “forever”.

The ATO is warning that one simple thing could lead to delays in getting this year’s tax refund or even having to redo paperwork to get your return.

It’s almost tax time but there’s some bad news for Australians hoping to get a big return this July.

The Australian Taxation Office is warning Aussies not to rush to lodge their tax return in early July as it could cause you problems.

One major bank has urged Australians to remain vigilant ahead of tax time, with the bank tracking double the monthly average of ATO scams in one month alone.

With tax season just around the corner, many Aussies will be eager to get some extra cash in their pocket this year. Here’s how to speed things up.

From breast implants to sleep apnoea machines, each tax time brings with it bold attempts to get money back on weird and wacky items.

New data has revealed where the ten highest-earning suburbs in the country are and the results may surprise you.

More than two million Aussies are being given an urgent warning ahead of tax time, as the ATO cracks down on this common $8.4 billion act.

Australians are demanding to know how 66 people who earned an average of $14.5 million each got away with paying no income tax.

Historically this tax saver “sucked” and was expensive. But that has all changed and now it’s an opportunity to get one up on your tax return.

Tax accountants have revealed their three biggest hacks while putting in a tax return, with new rules brought in for those working from home.

The Australian Tax Office has issued a warning to social media influencers and those with a side hustle ahead of tax time.

Taxpayers could be in for a shock this tax time, as the Australian Taxation Office taxes aim at dodgy claims in three key areas.

A Queensland worker who has been smashed by the rising cost of living is wondering how she will pay her tax bill and is scared she could end up in big trouble.

The biggest losers of the inflation crisis will be turning to one source of funds in the next few months with scary implications for individual finances.

Labor has been criticised for its plans to bring forward a key tax for a major industry in this week’s federal budget.

Major changes to taxation for one industry will bolster the government’s coffers as it seeks to help Australians doing it toughest.

If you’re worried your single bachelor’s degree is taking longer than expected to pay off, take a look at these poor buggers.

More than 10 million Australians will get less back from the tax man this year, but the Treasurer has denied he used Easter as cover for the bad news.

Original URL: https://www.news.com.au/topics/tax-time/page/3