‘Serious benefits’: Smart way to shave $10,00 per year off your tax bill forever

The key to making massive savings on your tax bill can come down to one seriously savvy strategy – and it will pay off “forever”.

Most people don’t really start thinking about their tax until the end of the financial year, but the reality is that at that point in time, it can be too late to make changes that will have a real impact.

The best time to plan in any financial year is July 1 for the year coming up, not for the year that’s just finished.

For most people, the biggest real opportunity to save tax is around your investments. What you invest into, how investments are structured and how they’re managed – all things that make a big difference to your tax position, and things that provide tax benefits that compound every year, forever.

And when it comes to investing, one of the biggest opportunities to save tax comes from share investing.

Franked dividends are your friend

In Australia, one of the most exciting elements of the tax system (at least for a money nerd like me) is franking credits.

This gets a little complicated and technical, but the short version is that when you buy shares, you’re entitled to a portion of the future profits of that company which are paid to you through dividends.

How dividends work in practice is as follows. You’re an investor in ABC company. ABC company conducts business and generates profits, then pays tax on those profits. Part of the after-tax profits are reinvested into the business, and part are paid out to shareholders of ABC company in the form of dividends.

The tax magic comes because these dividends are paid from profit after tax has been paid. The ATO are kind enough not to tax this money twice, so when you receive your dividend it comes with a tax credit attached.

This tax credit can reduce the amount of tax you pay on the dividend itself, but is also applied to your other income, so you can reduce the overall tax you pay on your total income.

Consider this example.

Over the year, you invest $500 per week into Australian shares that pay franked dividends.

By the end of the year, you’d have $26,000 in investments, which based on the long-term income (dividend) return on Australian big companies of 4.5 per cent, means an income earned of $1170. Assuming tax is paid at the company tax rate of 30 per cent, this dividend income would come with tax credits attached of $351.

This means the total amount of tax you’d pay in that financial year would be $351 lower if you invest into companies that pay franked dividends. And it’s worth calling out that this benefit is in addition to the core benefit of actually building your wealth and investment portfolio.

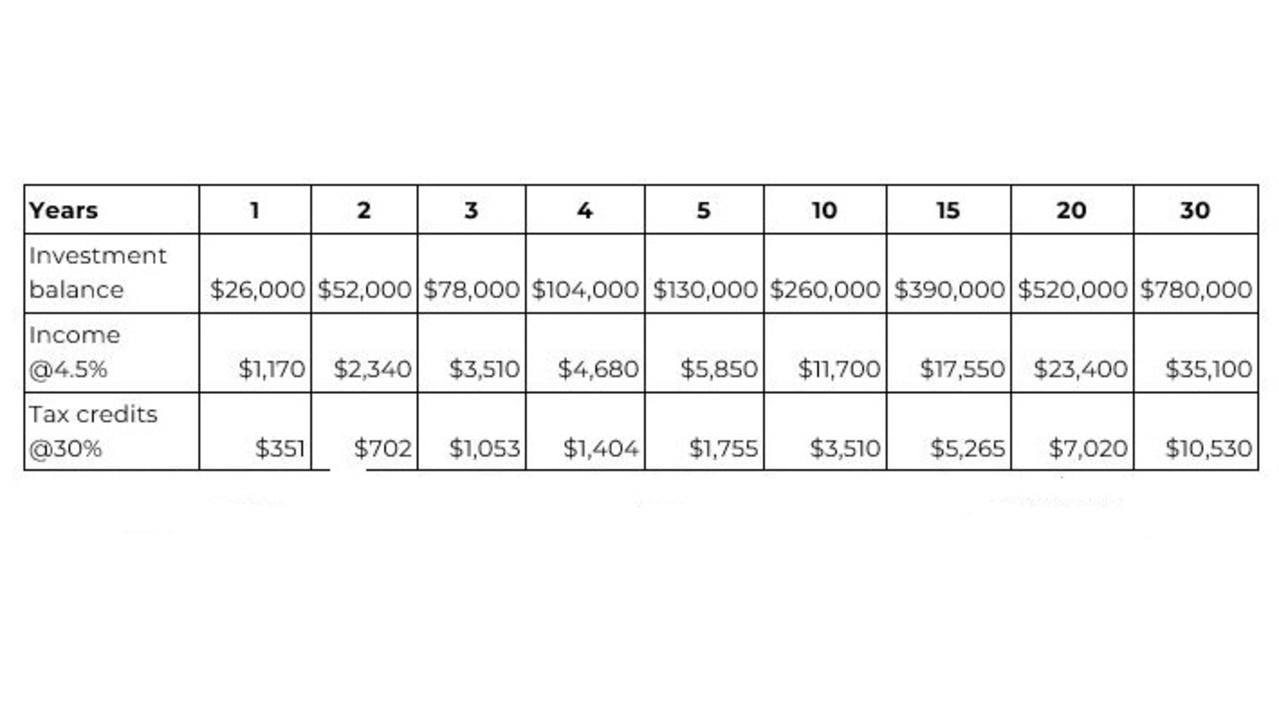

That benefit is pretty good, but here’s the thing – this benefit compounds every year you continue with the strategy. I’ve shown how this plays out over time in the table below.

Note that the tax benefits here are likely understated, because growth on investments are excluded and investment value is growing only by the new contributions to your investments.

You can see from the table above that the tax benefits early on are solid, but they increase every single year forever when you follow this strategy – to an annual tax benefit of $10,530 by the 30th year of the strategy.

How do you get franking credits?

The beauty of this strategy is that you don’t need to actually do anything, other than choosing to invest into companies that pay dividends with franking credits attached.

In Australia, this is basically any of the biggest companies, and you’d immediately access this when you invest through an index fund or ETF that invests into these big Australian companies.

It’s worth noting that franking credits are only available for companies listed on the Australian stock market that are operating in Australia. This is because franking credits are a reflection of Australian company tax paid to the ATO.

This means if you invest into US tech companies that pay their tax in the US and other countries, if they do pay dividends, they won’t have the same franking credits attached.

Is only investing in Australia an issue?

When you invest, spreading your risk through diversification is a key way to manage and reduce investment risk. You can diversify by investing in multiple companies, different sectors (i.e. tech and utilities) and different countries.

Essentially, the more diversified your investments are, the less exposed you are to the risk of any one company, sector, or country. If you’re invested in a wide range of investments, if one does poorly, you still have a heap of other investments that can do well, smoothing out your overall investment return.

This means that in a perfect world, you’d have a mix of Australian and international shares in your investment portfolio, so you benefit when the Australian and global markets are performing well.

That being said, if saving tax is important to you, you may want to consider weighting your investments more to Aussie shares that deliver franking credits.

The wrap

Tax is the silent killer, and most people don’t think too much about their tax position until after the financial year has finished when they start doing their tax return. But thinking ahead here can deliver some serious benefits.

Franking credits are a unique and powerful way to save tax that most people don’t think about as much as they should. But getting on the front foot here can help cut your tax bill this financial year and every financial year to come.

Investing the time to get your strategy right here will pay dividends.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.

Ben Nash is a finance expert commentator, financial adviser and founder of Pivot Wealth, the creator of the Smart Money Accelerator, author of Replace your Salary by Investing and host of the Mo Money podcast. He runs regular free online money education event which you can book here.