Why ATO whistleblower will face trial

A court has revealed why a whistleblower who revealed intimidation tactics by the tax office will face a criminal trial for speaking out.

Tax time is approaching. Find out what you can and cannot claim for deductions this financial year and who is on the ATO's tax hit list.

A court has revealed why a whistleblower who revealed intimidation tactics by the tax office will face a criminal trial for speaking out.

The man who blew the whistle on intimidation practices within the Australian Taxation Office has lost a bid to have a criminal trial thrown out.

Former Treasury boss Ken Henry says the controversial stage three tax cuts can stay because they aren’t the problem with the tax system.

The daughter of a former Australian Taxation Office deputy commissioner has been found guilty in one of the country’s biggest ever tax frauds.

A staggering $16 billion is waiting to be claimed, and people don’t even need to buy a lottery ticket to get their hands on it.

Many Australians are taking advantage of this common tax deduction but be warned, the tax office has ways to detect over claiming.

A Sydney man has learned his fate after scamming vulnerable Aussies out of nearly $30k by pretending to be from the ATO.

A major crackdown is under way against Australians who fail to meet an important business obligation, the tax office warns.

A potential 300,000 Australians could be about to get a shock when they realise they have to pay out on their huge profits.

The ATO says the clock is ticking for a million Australians who face a hefty fine, with a key deadline due for the end of the month.

A financial report by liquidators has revealed the crippling financial woes of a major builder, which owes millions of dollars to hundreds of creditors.

A proposed change to the way Aussies do their taxes could see some people who work from home could lose out on $1400 a year.

As Aussie businesses have been hit by a spate of recent hackings, the ATO, which holds data for 14 million people, is dealing with a huge number of attempted attacks.

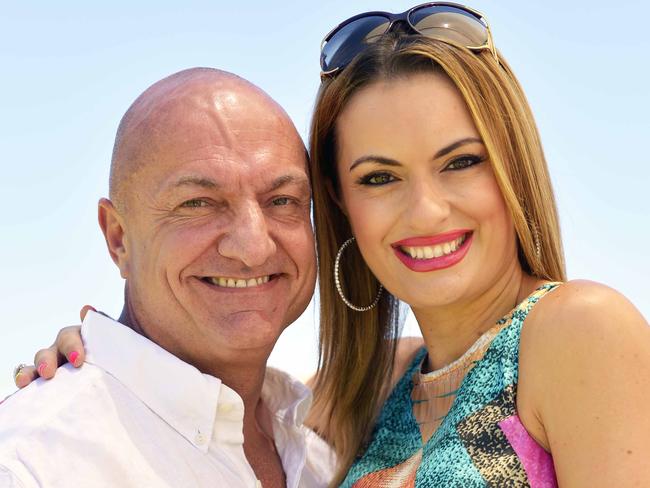

A socialite and lifestyle blogger has had a major victory in court against the Australian Taxation Office over her $4.5m mansion.

Aussies are coughing up millions in fines for submitting shady tax returns, including one tax agent who has been blasted for serious misconduct.

New data has revealed the richest and poorest postcodes across Australia, with one area making a shocking jump in just 12 months.

The ATO has revealed it has received a whopping 43,000 tip-offs from the public for “cash in hand” tax cheats and other “shadow economy” activities.

There’s an easy way to beat the share market downturn and pay less tax – you just need to do this one thing.

Aussies often get creative with their tax returns, but some take it to a new extreme with the ludicrous expenses they claim.

The new financial year is here, meaning there are some big changes afoot. Here’s what you need to know about what’s happening.

With a new financial year upon us, Aussies will be thinking about their tax returns – but the ATO has warned against filing yours straight away.

If you have avoided lodging your tax return, you could face severe financial penalties or even jail. But you could also be missing out on a tidy sum of cash.

From tech to home appliances and fashion and beauty, here are the best end of financial year deals.

Millions of Aussies are expected to get some sweet relief in the form of money back on their tax, but you’ll be surprised about where it will be spent.

Accountants have revealed the more obscure claims that have worked and the ones that have been rejected at tax time.

Tax time is just around the corner, and many Aussies will be even more eager than usual to get some extra cash in their pocket this year.

The Australian Taxation Office has warned one group of Australians will be targeted as tax time approaches.

There are huge tax cuts coming and one group of Australians will be biggest winners. Here’s everything you need to know.

Australians will likely be in for a nasty surprise at the end of this financial year when they take a look at their super balances.

The ATO has executed a number of raids across the country in what it describes as a “warning” to fraudsters.

Original URL: https://www.news.com.au/topics/tax-time/page/4