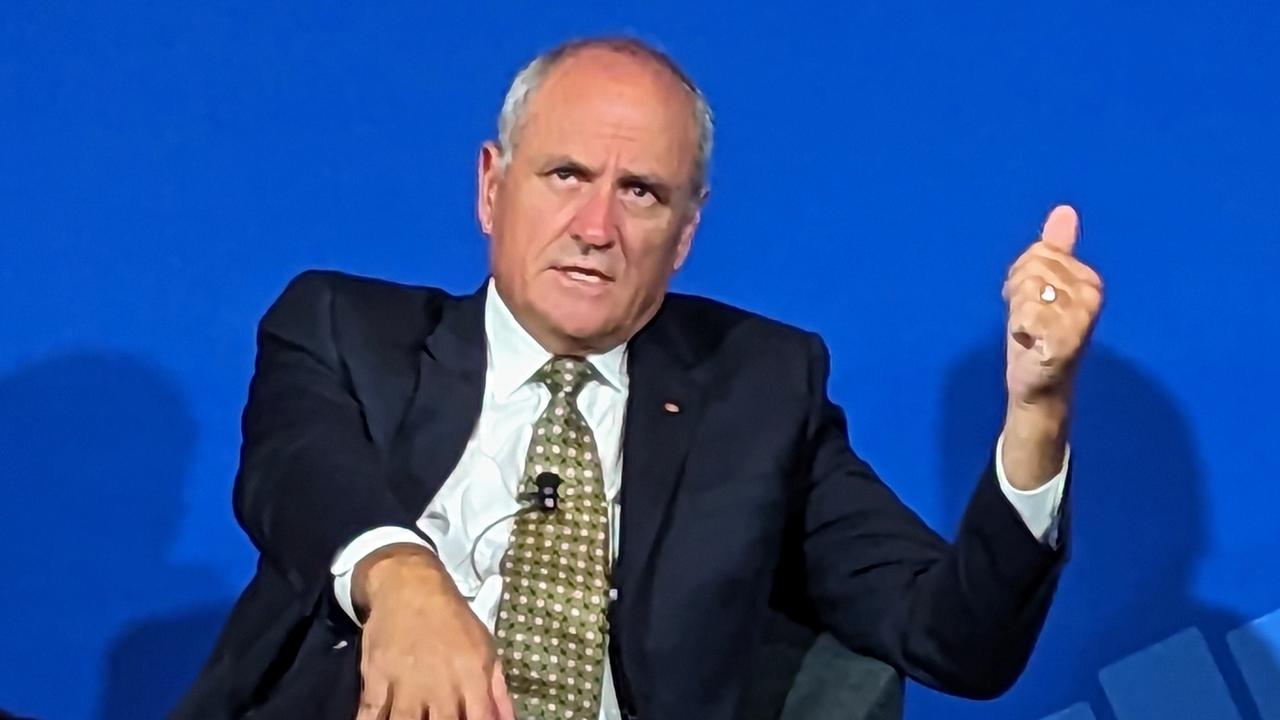

Former Treasury boss Ken Henry says tax changes are needed, but not where expected

Former Treasury boss Ken Henry says the controversial stage three tax cuts can stay because they aren’t the problem with the tax system.

A former Treasury boss who led the last major review of Australia’s taxation system says the controversial stage three tax cuts that will benefit the highest earners should stay.

Ken Henry says he understands why politically it would be a good call to axe the cuts due to come into effect in July next year, he said Australia’s revenue base should not rely on the personal income tax system.

“As far as I’m concerned, I’d leave them as they are. They’ve already been legislated. They are consistent in their framing with what we recommended in our tax review, published 12 years ago,” Dr Henry told ABC TV’s 7.30 program on Wednesday.

“It’s not in the personal income tax system where the effort has to be made. It’s in the other components of the tax system where the effort has to be made to raise more revenue.”

The stage three tax cuts, due to come into effect in July 2024, largely affect medium to high-income earners and are set to cost $254bn over 10 years.

Stage three involves abolishing the 37 per cent marginal tax bracket for those earning $120,000 to $180,000 and creating a flat rate of 30 per cent for those earning between $45,001 and $200,000.

Dr Henry said the tax review published 12 years ago stated that Australia needed to place less reliance on personal income tax as a source of revenue, and more reliance on other revenue.

“The particular problem that we confront right now in my view in placing too much reliance on the personal income tax system is the intergenerational inequity that it sets up,” he said.

“We have to learn to be able to live with a tax system that generates more revenue from more reliable bases that are more equitable, particularly for younger people, and which do less damage to the economy‘s growth prospects.”

Dr Henry told 7.30 spending has been out of control for at least the past 10 years.

“At the same time, the growth rate of the economy, at least in GDP per capita terms and productivity, has been as bad as at any time in our history, apart from the recession of the early 1980s and the early 1990s,” he said.

Dr Henry said the Albanese government’s recent announcement about a tweak to the superannuation didn’t go far enough to address the issue.

The government has announced Australians with more than $3 million in their superannuation accounts would have their concessional tax rate doubled from 15 per cent to 30 per cent from 2025.

“Those that are being proposed raise something of the order of $2 billion. Clearly that is a drop in the bucket compared to the $50 billion at least that needs to be raised in additional revenue,’ Dr Henry said.

“We’re going to need many measures of that sort if this is how we’re going to address the problem by incremental change here and incremental change there and so on.

“ We’re going to need 20 or 30 such measures in order to address the fiscal challenge that we confront.”

Dr Henry, who ran the Treasury department from 2001 to 2011, led the Henry Tax Review in 2009 which was virtually ignored after the Resource Super Profits Tax initiative was shouted down,