How to claim Covid expenses on tax

The Australian Taxation Office has revealed what you can and can’t claim as a Covid expense when you lodge your return.

Tax time is approaching. Find out what you can and cannot claim for deductions this financial year and who is on the ATO's tax hit list.

The Australian Taxation Office has revealed what you can and can’t claim as a Covid expense when you lodge your return.

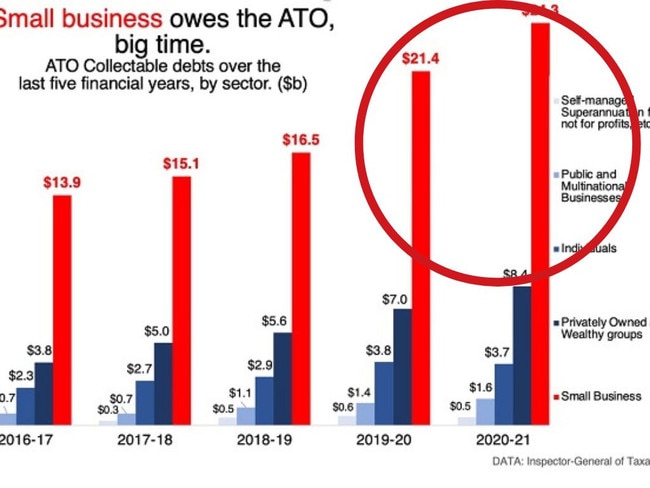

The level of debt small business owes to the tax office has got out of hand – and there’s one group they’re coming down on hard.

The average Aussie needs a whopping $2.7 million to retire, but there’s a simple way to add $558,000 to your stash without doing any extra work.

With tax time fast approaching, the ATO has revealed why Aussies may get less than they were expecting on their return this year.

With tax time just around the corner, let’s take a look at some of the weird expenses Australians have attempted to claim on their tax return.

Experts have revealed key tips on how you can get the most out of your tax return at the end of the financial year.

The ATO will be chasing those with outstanding debts much harder in the coming months, with 20,000 Aussies already paying back $4 billion.

The viral song based on a children’s nursery rhyme and blasted across the Liberal Party’s campaign ads has been given a major revamp.

The ATO has outlined the major areas it will be targeting, shooting a specific warning to people who are claiming work from home benefits.

Crypto assets will be a key focus of the ATO at tax time as the organisation looks to crackdown on the mistakes Aussies are making.

Tens of thousands of Aussies are set to be targeted by the ATO over a tax return loophole that’s costing $850 million.

The trial of five people who are alleged to have ripped off $105m from the Australian Taxation Office through unpaid taxes and GST has begun.

Cryptocurrency traders are being warned the ATO will apply extra scrutiny in the upcoming tax season. Here’s what you need to know.

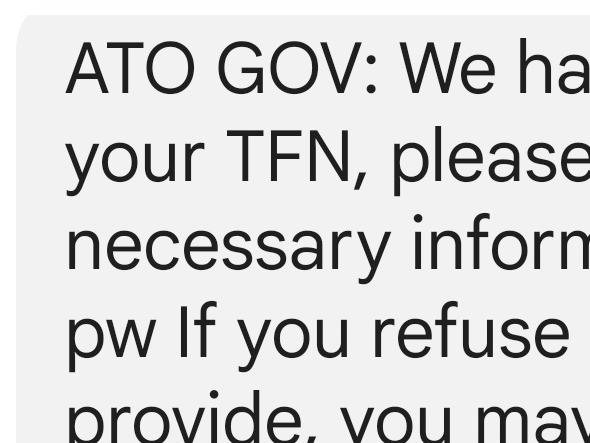

As an important tax deadline nears, cyber criminals are making the most of it to steal money from Australians. This scam went live on Sunday.

Extreme housing affordability pressures are “only going to continue” if unaddressed in Tuesday’s budget, with first-home buyers and those facing homelessness on the agenda.

Employees were ripped off more than $82,000 but despite complaints they haven’t seen a cent. Now the company has gone into liquidation.

Figures show the Morrison Government is collecting more tax than previous governments, but the Treasurer argues there’s a reason for it.

Thousands of backpackers could be eligible for an unexpected cash bonus after the High Court ruled on an ‘unfair’ tax.

The head of the Australian Taxation Office will be hauled over the coals in relation to businesses who received JobKeeper payments.

The tax brackets have changed which means most Aussies will get a tax boost this year – but a certain group is due a very healthy sum.

The ATO has fired off a warning to Australians hiding money from the authorities saying they will feel ‘serious consequences’.

Avoiding this shortcut and putting in the extra work could make a huge difference to what you get back. Find out how to do it.

Some Australian families will enjoy a silver lining from the pain of being in lockdown, with many in line for a tax windfall.

Aussies are being warned that any creative attempts to claim more money will be caught out and people risk facing penalties.

A millionaire mining tech exec who allegedly defrauded the ATO of more than $38.5m has a 40,000 page case against him, a court has heard.

It’s tax time and many of us will be hoping for a handy tax return windfall. But there can also be a nasty surprise for some.

The list of exposure sites continues to balloon with an Australian Taxation Office site in Moonee Ponds and a Melton West supermarket the latest venues to be deemed high risk.

More than 1.8 million Aussies have been put on notice that their tax returns will be scrutinised for incorrect claims.

The ATO has warned 300,000 Aussies that tax time “isn’t a game of Monopoly” where you can roll the dice and avoid reporting income.

An elderly man has been charged after he allegedly defrauded the government of tens of millions of dollars in his income tax returns.

Original URL: https://www.news.com.au/topics/tax-time/page/5