Which Aussie tax payers and businesses will receive higher returns in 2021?

The tax brackets have changed which means most Aussies will get a tax boost this year – but a certain group is due a very healthy sum.

In 2021, a heap of changes to the tax rates and rules came into effect, with the benefits flowing to more than 10 million Australians. Every dollar of tax saved means more of your income leftover for saving, investing, or maybe just your next holiday.

But what do the tax changes mean for you?

One of the biggest changes that affects almost all Aussie taxpayers is changes to the marginal tax rate thresholds or ‘tax brackets’.

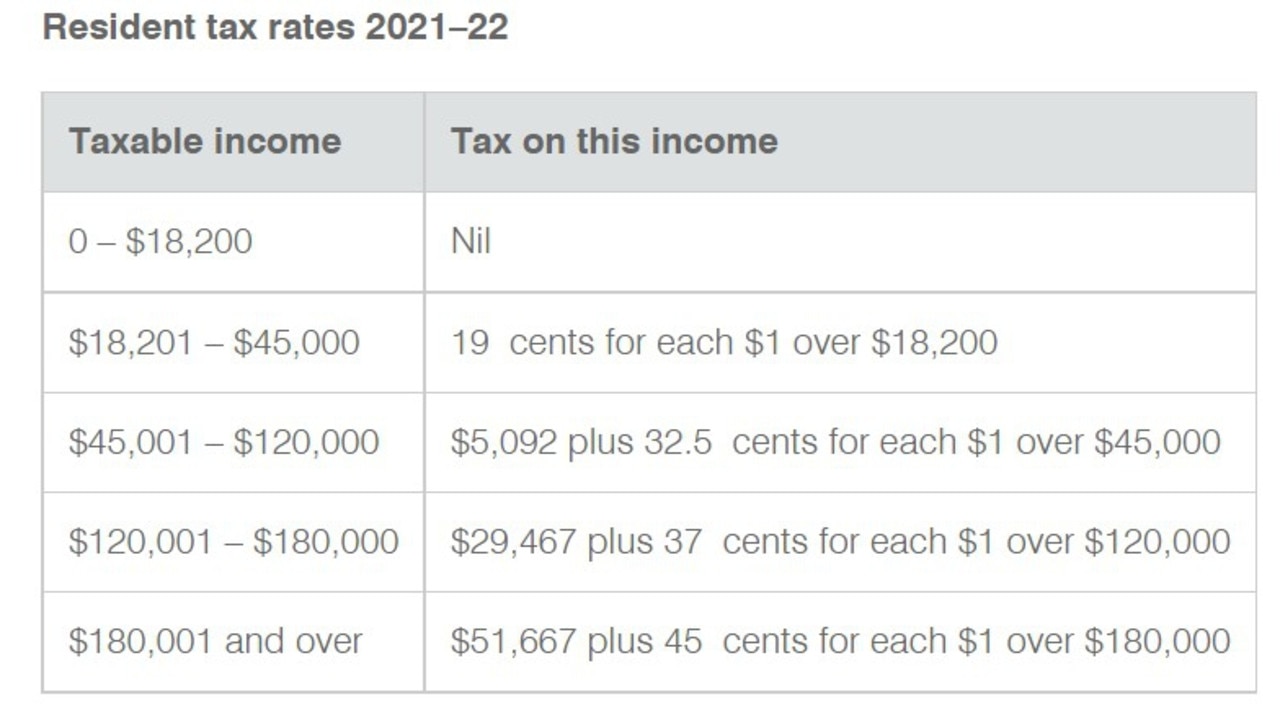

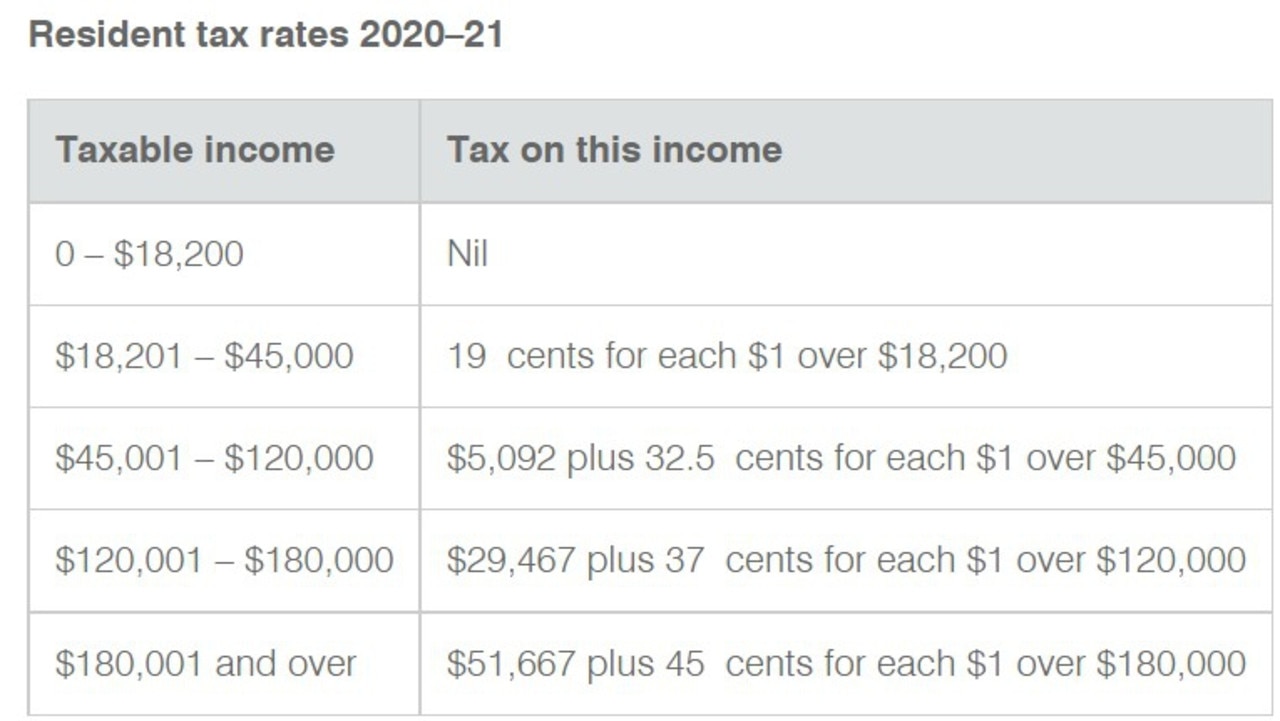

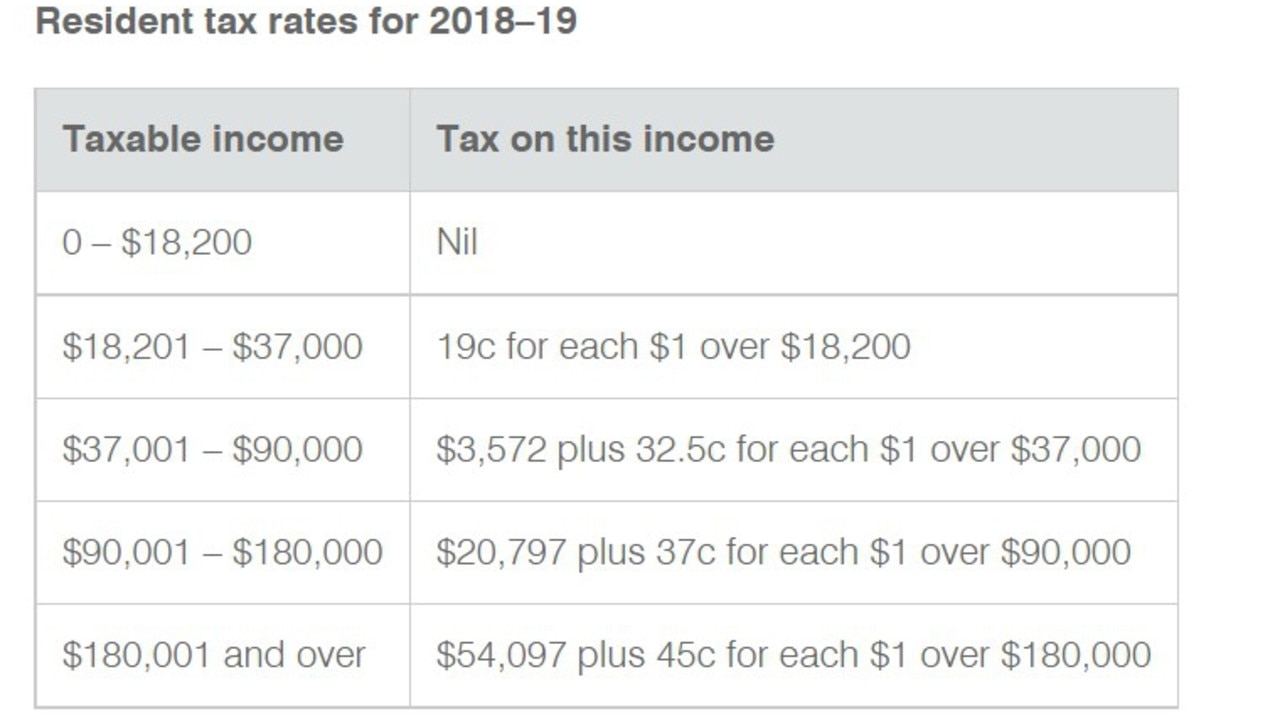

In Australia, we work under a ‘marginal tax rate’ system, where as your income increases, the rate of tax you pay on your income that falls into each bracket is taxed at an increasing rate.

The tax brackets start at 0 per cent on income earned up to $18,200 each year, up to 45 per cent on income earned above $180,000.

It can be a little confusing, but you should be aware that even for someone earning income above $180,000, they still pay a 0 per cent tax rate on the first $18,200 they earn.

In the 2021 May budget, the government made changes to the tax rates that they applied immediately and retrospectively for the 2020/21 tax year onwards, meaning the new tax changes also apply to the 2020-21 financial year.

The key changes to the marginal tax rates and brackets are twofold. Firstly, the 19 per cent income threshold lifted from $37,000 to $45,000, and the 37 per cent tax rate threshold raised from $90,000 to $120,000. These two changes impact every taxpayer with income above $45,000, with some saving thousands of dollars each year.

Get Cashed Up

Created by financial advisor Ben Nash, Cashed Up is a free six-week course to help Aussies get their finances in check. Those who sign up to the budget bootcamp get weekly, step-by-step challenges to improve their financial fitness. By the end of the six weeks, participants will have set a budget, created a savings plan, learned how to invest, and sorted their superannuation. The interactive course can be started at any time and aims to empower participants to make more informed financial decisions.

A benefit to 10 million Aussies

The second big tax change is the extension of the ‘low and middle-income tax offset’ that will benefit more than 10 million Australian taxpayers earning annual incomes of up to $126,000.

This benefit is an ‘offset’, meaning that it will reduce your tax bill by the amount of the benefit, meaning that people earning below the $126,000 threshold will notice a bump in their tax refund.

Big win for businesses

Businesses were also winners in the recent tax changes through three different measures, all put in place to encourage growth and support the recovery of the economy from the Covid-19 pandemic.

The first change is a cut in the small business corporate tax rate from 27.5 per cent in 2019-2020 to 26 per cent in 2020-2021, and ultimately to 25 per cent in the current tax year (2021-22).

Note that the definition of ‘small’ business in this case is pretty generous, with all companies with an annual turnover of less than $50 million qualifying for the reduced tax rates.

Another big win for businesses is the ‘loss carry-back’ rules that allow you to get a refund if a company made a loss in the 2020-2021 financial year but has paid tax on profits in previous years.

This measure will help companies that have been disrupted and suffered losses through the pandemic and help them kick start the current tax year. If you’re in this position, think about doing your tax as soon as possible so you can get your refund sooner.

Small businesses looking to make larger purchases will also benefit through the extension of the ‘instant asset write-off’ provisions that allow companies to fully deduct the full cost of purchases of up to $150,000 in the year of the purchase.

Who benefits most from the changes?

For individual (non-business) taxpayers, the maximum benefit from the low and middle-income tax offset will be those earning between $48,000 and $90,000 who will receive $1080 in annual tax savings.

Lower income earners also benefit, if your annual income is below $37,000, your tax bill will reduce by $255. For those with incomes above $90,000, this benefit slowly reduces for each extra dollar earned above $90,000 to nil once you reach an annual income of $126,000.

The big winners from the changes to the marginal tax rate brackets are those earning over $120,000, who will all have their annual tax bill slashed by $2612.

Businesses should also be pretty happy with the changes, with every business benefiting from the reduction in the company tax rates, and some silver lining for those that have posted losses through Covid-disrupted 2021 through the loss carry back rules.

What does this mean for you?

The immediate benefit from these changes is through your lower tax bill, meaning you’ll hold onto more of your income each year.

The flip side of this is that tax deductions are now worth a little less than they were last year given our lower tax rates. That being said, deductions are great but it’s generally not a sensible idea to spend money just to get part of it back, so the overall impact should be positive.

More tax back means more money you can use for saving and investing, so these changes are a good reminder to make sure you’re on top of your tax planning. Because we have a tendency to quickly adjust our spending to match changes to income, so now is the perfect time to capitalise on the changes and put the money to work for you.

The wrap

The tax rules can be complex and confusing, but given Australia is one of the highest taxed countries in the world it’s valuable for you to get your tax strategy right. And while most of the changes covered here are positive, the fact the rules are constantly changing doesn’t do you any favours in keeping on top of your tax strategy.

More Coverage

Take the time to understand what’s changing and what it means for you, this way you’ll be well placed to make the right tax moves for you.

Ben Nash is a finance expert commentator, podcaster, financial adviser and founder of Pivot Wealth, author of the Amazon best-selling book Get Unstuck: Your Guide To Creating A Life Not Limited By Money.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.