‘Force you’: ATO’s warning on business debts

After three years of “lenient payment terms”, the ATO is back to collecting an estimated $50 billion of outstanding tax debts.

After three years of “lenient payment terms”, the Australian Taxation Office (ATO) is back to collecting an estimated $50 billion of outstanding tax debts, causing business collapses to spike.

Revive Financial head of business restructuring Jarvis Archer told news.com.au: “The ATO’s message is clear, make the decision to deal with your ATO debt, otherwise we’ll force you to make it.”

“We’ve seen [the ATO’s] progressively serious campaigns of warning letters, director penalty notices, credit reporting, wind ups and now garnishee notices cleaning out bank accounts, something I haven’t seen since 2018.”

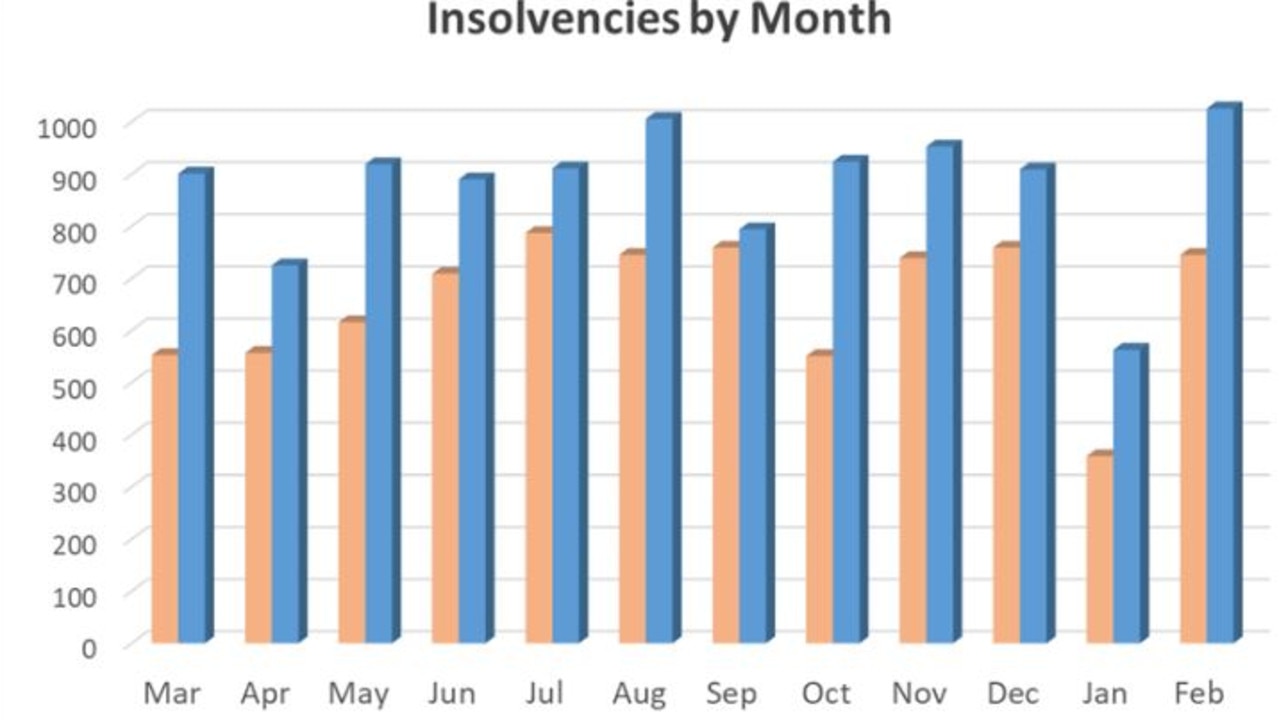

Mr Archer said the rate of company insolvencies in the past four months is sitting 36 per cent above pre-Covid levels, a number that is on par with insolvencies seen after the global financial crisis (GFC).

In 2012, following the GFC, the number of companies entering insolvency peaked at 10,757, a figure Mr Archer said looks likely to be beaten this financial year.

Michael Carrafa, executive director of insolvency firm SV Partners told news.com.au that the ATO was in “full debt collection mode” with its collection tools “being widely used at the moment” and that trade creditors also seemed less willing to accept cents in the dollar for debts.

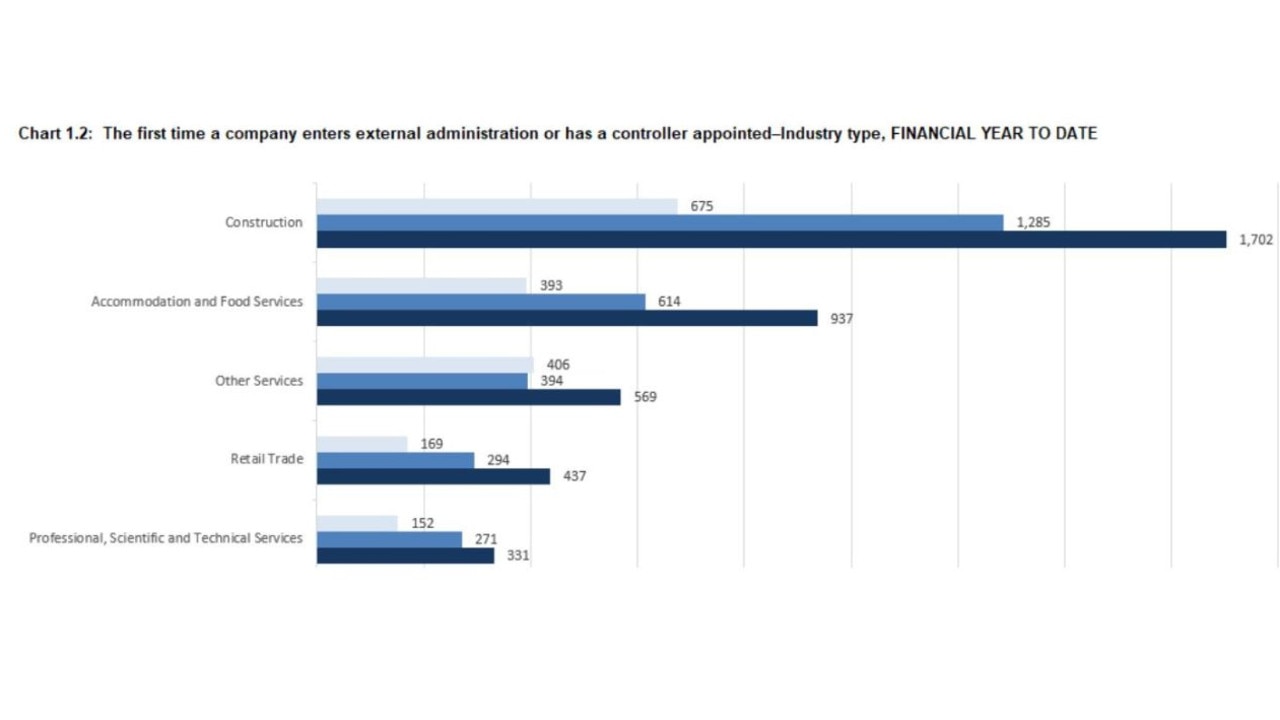

Both men agree the problems are worst in the construction sector, while Mr Archer said hospitality and retail are also being hit hard.

Mr Archer said that this financial year, construction insolvencies have increased by 32 per cent, while hospitality insolvencies are up 53 per cent and retail insolvencies are up 49 per cent.

“This makes sense as these two sectors are most exposed to consumer spending,” he added.

Just a few weeks ago, news.com.au reported on the collapse of a popular Oporto, after the ATO issued the director with a penalty notice demanding $500,000 in back taxes be paid.

The spike in insolvencies follows several warnings from the ATO towards the end of last year.

In December the ATO warned that it would report debt information to credit reporting bureaus if a business has “one or more tax debts and at least $100,000 is overdue by more than 90 days” and is “not engaging with us to manage your tax debt”.

More recently, the ATO announced that it would report 100,000 to 150,000 businesses to a debt collection agency before June 30 this year.

Statutory debts, such as tax and superannuation debts were previously not made public but since 2020 the ATO has had powers to make the non-payment of tax public by recording a default on a company’s credit file.

Mr Archer said that this can seriously affect a business if its suppliers cancel credit or orders, and may cause businesses to lose tenders for work or have financiers freeze facilities, causing disruption and reputational damage.

Mr Archer backed the ATO’s “clean-up year” as vital to creating a level playing field among businesses, but added that the aggressive tax push fuelled concerns about “debt contagion”, which is when businesses that can’t pay their debts result in the failure of other businesses they owe money to.

He said that the ATO’s debt book doubled from $25 billion to $50 billion through Covid and “just like anyone in business, they have a duty to manage their debts responsibly”.

But Mr Archer added: “While I appreciate the ATO’s role, there’s a big gap between where they are and where many business owners are.”

“Company directors are still dealing with the impact of Covid on their businesses, poor economic conditions impacting particular industries, staffing difficulties and serious personal matters, like health issues and divorces,” he said.

“This has caught many directors out who have found themselves personally liable for hundreds of thousands, and even millions, of dollars of their company’s tax debts.”

Mr Archer said Covid debt hangovers coupled with declining consumer spending, against an environment of higher costs and interest rates was squeezing small business owners and leaving them “with nowhere to go”.

“They can’t cut costs any further, and they can’t increase sales to pay higher expenses or their debts which accrued to the ATO during Covid.”

“Many business owners are just hanging on in the hope of better times, but the ATO’s progressive clean-up is cutting short their journey leading to the difficult decision: continue or close.”

For businesses in trouble, Mr Carrafa said: “The clear message that needs to be out there to directors is get the advice early on, people are just leaving it far to late”.

He added that the increase in businesses going to the wall would “probably continue for another 12 to 24 months”, while Mr Archer said: “We’re only in the early stages of the clean-up, meaning insolvencies will peak in the coming year or two”.