ATO blasts ‘un-Australian’ deductions at tax time

The tax office has lashed some for wrongly claiming deductions — and it says the move is hurting Australians who need it most.

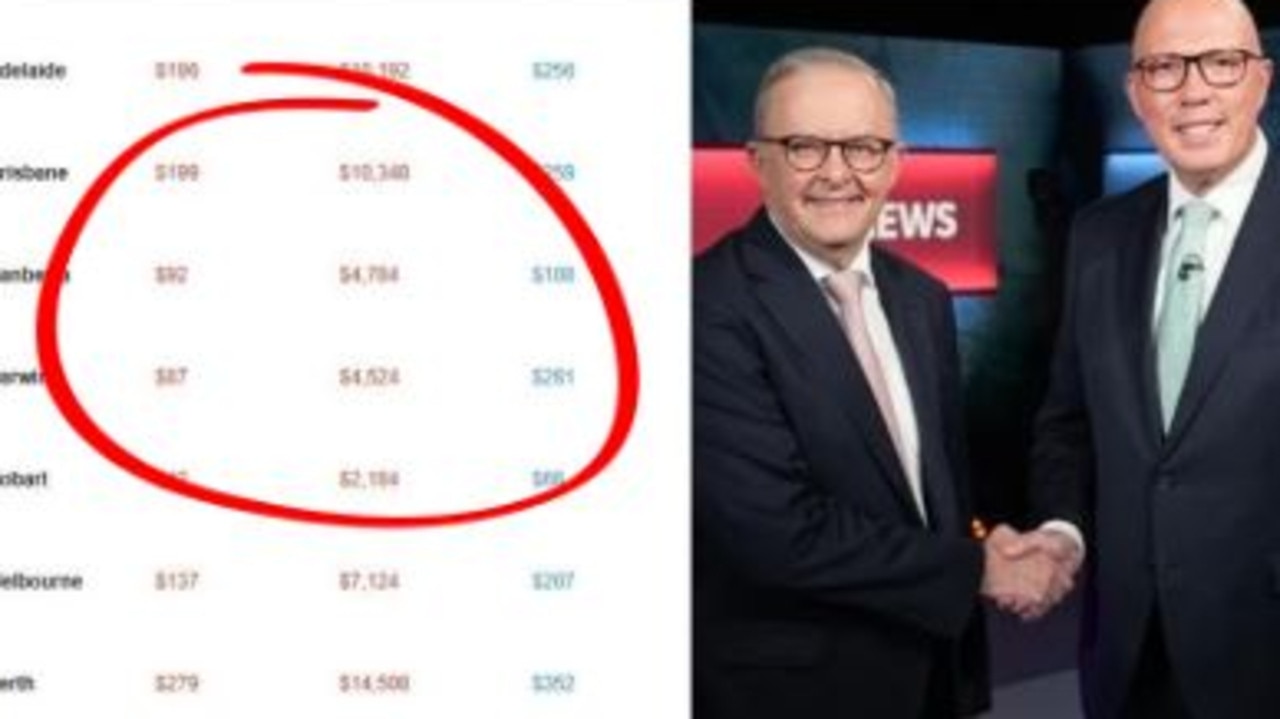

The Australian Taxation Office has lashed landlords for wrongly claiming deductions on their tax return and, as a byproduct, robbing the community of vital funds.

ATO assistant commissioner Tim Loh said a review of income tax returns shows a whopping nine in 10 rental property owners are getting their return wrong.

“Landlords and their registered tax agents need to take extra care when lodging this year,” he said.

“We often see rental income being left out, or mistakes being made with property related deductions – like overclaiming expenses or claiming for improvements to private properties.”

Mr Loh blasted the practice as “un-Australian”.

“When you are overclaiming expenses or claiming for improvements to private properties, you are taking money from the Australian community,” he said.

“Money that could have been otherwise used to further increase funding for things like women’s sports, schools and hospitals.”

He also warned the ATO had sophisticated data matching capabilities to track down thieves.

“This new data provides us with crucial intelligence to paint a picture of what’s true and accurate in tax returns, and we continue to expand our data-catching capabilities to ensure income and deductions are correctly reported,” he said.

Rental income

The ATO said when preparing a tax return, all rental income should be declared, including income from short-term rental arrangements, renting part of a home, and other rental-related income like insurance payouts and rental bond money retained.

“Income and deductions must be in line with a rental property owner’s ownership interest, which should generally mirror the legal documents,” Mr Loh said.

Interest expenses

The ATO is particularly focused on interest expenses and ensuring rental property owners understand how to correctly apportion loan interest expenses where part of the loan was used for private purposes.

“Around 80 per cent of taxpayers with rental income claimed a deduction for interest on their loan, and this is where we’re seeing the biggest mistakes,” Mr Loh said.

“You can only claim interest on a loan used to purchase a rental property to earn rental income.

“If you’ve used any part of your original or refinanced investment property loan to cover private expenses, like buying a new car or renovating the home you live in, you can only claim an interest deduction for the portion relating to producing your rental income.”

Repairs

Mr Loh warns that initial repairs on a property to rectify damage, defects or deterioration that existed at the time of purchase cannot be claimed as an immediate deduction but may be claimed over a number of years as capital works deductions.

“You can claim an immediate deduction for general repairs like replacing a broken light globe or window,” he said.

“But if you rip out an old bathroom and put in a new and improved one, this is a capital improvement and is deductible over time as capital works.”

Short term rentals

According to the ATO, short rentals — including holidays homes — continue to trip people up. It is an area the ATO will be paying “close attention” to this year.

“If you’ve charged a mate’s rate, you can only claim for expenses up to the amount of income you’ve received,” Mr Loh said.

“If you’ve made genuine mistakes, we encourage you or your registered tax agent to fix any errors or omissions in your tax return as soon as you can. If you are deliberately overclaiming, it is un-Australian and penalties will apply.”