Expect Feb rate hike, economists warn

While household borrowers were spared at the central bank’s final meeting of the year, further rate pain could be right around the corner, economists warned.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

While household borrowers were spared at the central bank’s final meeting of the year, further rate pain could be right around the corner, economists warned.

Ahead of the RBA’s final board meeting for 2023, the Australian share market reached a 10-week high on Monday as fears of further rate tightening continue to fade.

Cash-strapped homeowners have been warned to not “let their hair down” yet, despite inflation falling faster than expected.

The Australian Retailers Association has pleaded with the RBA not to use strong Black Friday retail sales as a reason to raise interest rates next week.

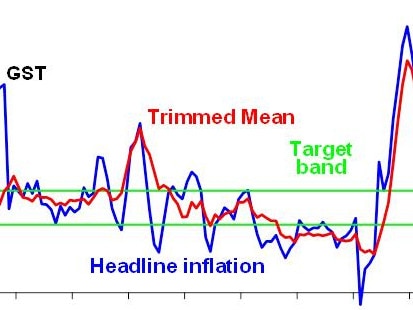

In welcome news for borrowers, price pressures eased in October ahead of the Reserve Bank’s final rates call for 2023.

The RBA governor has copped a lashing after insisting at an overseas jaunt that Aussies were “doing fine” despite 13 interest rate hikes.

New RBA governor Michele Bullock has made a frank admission, conceding borrowers are displeased with the central bank after its punishing rate hikes.

A top official at the UK central bank is set to make the move to Australia and join the Reserve Bank as it battles to tame persistent price pressures.

Cash is no longer king, a new survey has found, with less than one in 10 consumer payments made with notes and coins.

Inflation is increasingly being driven by domestic factors, not those from overseas, RBA governor Michele Bullock says.

Despite a fresh warning the RBA is still prepared to hike interest rates, markets were buoyed from a rally by iron ore miners.

As the Reserve Bank mulls a 14th rate hike, freshly minted governor Michele Bullock has warned current levels of wages growth are unsustainable.

The risk of more rate hikes in the months ahead would have increased had the RBA opted against increasing rates on November 7, fresh meeting minutes have revealed.

Owner-builder John Haley took his cottage to auction the day after the Reserve Bank of Australia hiked interest rates. Here’s what happened.

The big and little things that you are buying might impact your borrowing capacity, beyond the Reserve Bank of Australia. Here’s how to stay ahead of the game.

With annual wages growth hitting its highest levels in almost 15 years, economists are split on the RBA’s next move on interest rates.

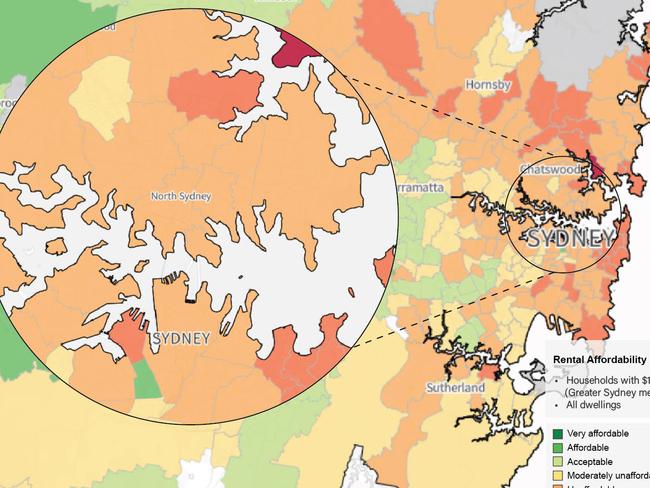

Things have gone from bad to worse for renters as new figures reveal affordability in the majority of Australia has hit its lowest level since before the Covid-19 pandemic.

Households and businesses shouldn’t expect the path to curtail persistent price pressures to be quick or direct, the Reserve Bank has warned.

A top economist has lashed the Reserve Bank for Tuesday’s unnecessary rate rise, which could push Australia into a recession.

The Reserve Bank’s latest quarterly statement has painted a grim picture for Aussies hoping for relief from soaring inflation rates.

Australia’s biggest bank is the last of the Big Four to slug Aussie homeowners with another lift in interest rates. Here’s how much you’ll pay.

One group of Aussies are “undermining” efforts to ease inflation and some of the nation’s most vulnerable are paying the price.

Millions of Australians are now spending more than they earn thanks to the RBA’s rapid run of rate hikes, and some areas are especially struggling.

Almost all of the big four banks has announced it would lift interest rates once again in response to the RBA’s Melbourne Cup hike, increasing pressure on homeowners.

A reprieve after the rate hike could be off the cards as Australia’s central bank battles to tame persistent inflation.

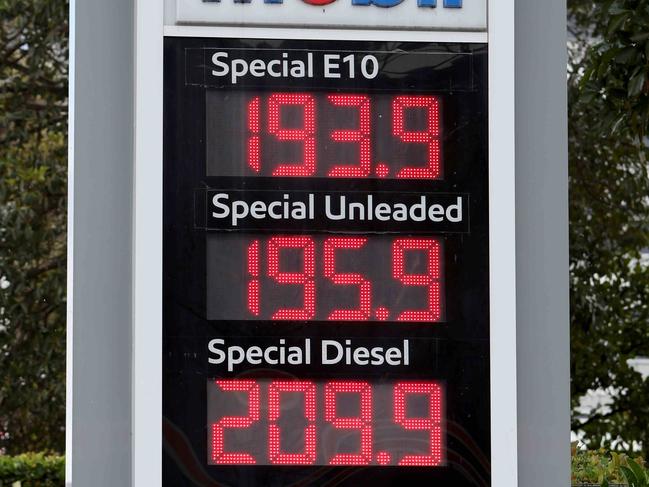

The Reserve Bank has slugged homeowners with another rate rise and a recent surge in petrol prices is partly to blame.

Aussie home buyers are needing nearly double the average full time salary to be able to afford a home, devastating new research reveals.

Despite the RBA hiking interest rates for the first time in five months, the ASX clawed back some of its earlier losses to finish slightly lower on Tuesday.

Freshly minted RBA governor Michele Bullock has dealt borrowers fresh rate pain as the central bank grapples to tame persistent inflationary pressures.

The Reserve Bank of Australia (RBA) has increased the official cash rate again, and the pain could be worse than ever.

“Still too high”: RBA calls out inflation as it increases the official interest rate by 0.25%, delivering fresh cost of living pain for Aussies.

Nearly half of household borrowers are facing financial stress ahead of the Reserve Bank’s November rates call, new analysis has revealed.

The big banks are betting on another rate rise, but a highly regarded economist has broken ranks and urged the RBA to hold fire.

Ahead of the Reserve Bank’s highly anticipated Melbourne Cup Day meeting, the ASX finished in the green.

On Tuesday, the nation will stop for the Melbourne Cup. But the Reserve Bank’s decision just before the race starts will be a huge blow.

Two Aussie banks have hiked interest rates days before the Reserve Bank of Australia is forecast to set another increase.

Interest rate rises and the wider Aussie economy are potentially being screwed by one big RBA decision that is costing us all.

A major economic health check recommends the Reserve Bank makes a major move on interest rates when the board meets next week.

Artificial intelligence, climate change, cyber attacks and a rapid-fire run on the banks, are among the emerging threats facing Australia’s banks.

With monthly retail spending rising the most since January, pressure is mounting on the Reserve Bank to hike rates when its board meets next week.

RBA’s Governor Michele Bullock keeps repeating the same two words as her predecessor – and it indicates grim time ahead for everyday Aussies.

Australia’s biggest banks are warning the Reserve Bank will have no choice but to deliver a 0.25pc rate rise November 7. SEE HOW MUCH MORE IT WILL COST YOU & WHAT’S ON OFFER

Amid shortening odds for a Melbourne Cup Day rate hike, the Reserve Bank governor says the central bank is determined to tame persistent inflation.

In another cost of living blow, the availability of rental properties is “at critical levels” and the RBA said the situation is unlikely to improve in the short term.

The RBA is widely tipped to continue its most aggressive round of rate hikes in decades after inflation figures confirmed soaring prices remained stubborn.

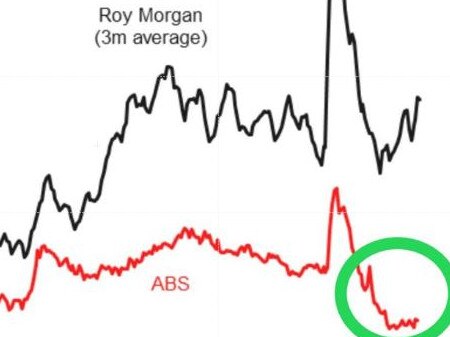

ABS figures from September appear to show good news for the Aussie economy but dig a little deeper and something else is exposed.

Despite a surprise 1.2 per cent reacceleration of inflation in the September quarter, the Aussie share market closed flat.

In her first prepared address as RBA governor, Michele Bullock has revealed the extreme pressure faced by some Aussie homeowners, but warns it won’t stop the board raising rates if necessary.

The latest report from the Reserve Bank of Australia shows how much money the men and women who determine your mortgage bill make each year.

The latest unemployment figures paint a picture of what the Reserve Bank might do with interest rates next week.

The RBA has issued a stark warning to Aussies as the ongoing conflict between Israel and Hamas adds to inflation pressures.

Incoming data over the next three weeks will heavily influence the Reserve Bank’s decision on whether to hike rates on Melbourne Cup day.

The Aussie sharemarket shrugged off fears that interest rates could climb higher before the year’s end to finish in the green.

Despite ultimately keeping rates on hold, new RBA governor Michele Bullock considered another hike to the cash rate in early October.

An alarming number of Australians are feeling the pinch after 12 interest rate hikes and high inflation, a new RBA report has revealed.

The Reserve Bank has revealed a grim statistic showing the pain Aussie households are facing in paying their mortgages, after a punishing 12 rate hikes.

Aussie homeowners are in line for two more massive interest rate shocks in 2023 and the impact could be far reaching.

Australia’s cost of living crisis is hurting millions – and as calls to raise the cash rate gets louder, the futures market has made a shocking call.

An alarming new report from the Reserve Bank of Australia shows the next six months are going to be very tough for many of us.

Borrowers have been offered some brief reprieve with the RBA’s latest decision, but it’s come with a warning.

Millions of homeowners are expected to be spared another punishing rate hike, but the RBA is set to issue a warning that further increases are yet to come.

Amid warnings from economists, the Reserve Bank will weigh up whether a further rate hike is needed to tame inflationary pressures when it meets on Tuesday.

Even if there is good news in the short term for homeowners on interest rates, worse may be coming, experts warn.

Details of briefings inside the Reserve Bank that you were never meant to see have been released – and they show growing concern about a rapidly worsening crisis.

It’s the last thing Aussie mortgage payers need as another interest rate rise looms amid a volatile global economy.

Households could be served with another rate hike before the end of the year as surging petrol prices push inflation higher.

There’s bad news ahead for interest rates in the US but there’s a sign Australia may just escape the rates onslaught.

Employers and unions are at odds over a new jobs target after the government announced major changes to how Aussies work.

A historic change is on its way to Australian banknotes as a final farewell to sacked RBA governor Philip Lowe.

‘Do what is necessary’: Aussies may not be in the clear when it comes to interest rate increases as a key expense threatens to derail inflation.

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

The cash rate seems to have stopped rising – for now – but there’s a worrying sign that things could be about to get a lot worse.

The combined value of Australia’s housing stock has soared, with the average house price in one state rising by a whopping $3200 every week.

Philip Lowe will depart the Reserve Bank this week after a controversial tenure. But what does he plan to do next?

An “alarming trend” in Australian mortgages could signal a new era of difficulty for a certain section of Aussie mortgage holders.

The RBA holding rates steady for a third consecutive month failed to lift the Australian share market on Tuesday.

Outgoing RBA governor Philip Lowe has cautioned that China’s deteriorating economic outlook is one of three “significant uncertainties” facing the local economy.

Outgoing RBA boss Philip Lowe has spared Aussies further financial pain as he heads for the door in less than a fortnight.

Fresh data on household spending and anaemic household spending all but confirm rates reprieve when the Reserve Bank meets on Tuesday.

The Australian share market has stepped up after fresh inflation figures undershot economists’ expectations.

Original URL: https://www.news.com.au/topics/reserve-bank/page/10