RBA to ‘increase interest rates three times’

A top forecaster issued a dire interest rate warning, predicting that the RBA will be forced to hike three times before the end of the year.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

A top forecaster issued a dire interest rate warning, predicting that the RBA will be forced to hike three times before the end of the year.

Shares erased their early gains on Wednesday after firmer-than-expected inflation data took traders by surprise.

With prices rebounding over the March quarter, investors and economists pushed out their timeline for rate cuts by the Reserve Bank.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

All eyes will be on fresh inflation data to be released on Wednesday which will be critical to the Reserve Bank’s deliberations on rate cuts.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

With Australians ripped off every time they use their credit card, the RBA is considering a crackdown.

More Australians found themselves out of work last month, but the result was stronger than expected and could delay the RBA’s rate cut path.

Borrowers holding out for rate cuts could be waiting longer still for relief, with analysts expecting the RBA to wait for the Fed to move first.

Experts are urging Australians to get on top of their credit cards as the eye-watering post-Christmas debt grew again in February.

Even as household budgets come under pressure, tens of thousands of Aussies took on additional debt in February, new data shows.

Australia’s 2.6 million small and medium businesses could be key to unlocking the next wave of productivity growth.

A pivot from the Reserve Bank could mean hopeful homeowners could have their borrowing power surge by thousands.

For the first time since it started its aggressive run of rate hikes, the RBA did not consider the option, minutes from its latest meeting have revealed.

Shares clawed back losses from Tuesday’s session to come within less than 35 points of the benchmark’s all time high.

The softer-than-expected reading is a further sign the Reserve Bank could move to ease interest rates later this year.

Optimism of an interest rate cut as early as May appears to have been premature, with new government data lowering the prospect of early relief for mortgage holders.

There were hopes of a series of rates cuts coming soon, but hopes have been dashed by shock new figures today.

There were hopes of a series of rates cuts coming soon, but hopes have been dashed by shock new figures today.

The RBA governor gave few clues on when households could expect rate relief – but there is one glimmer of hope for mortgage holders.

The RBA governor gave few clues on when households could expect rate relief after keeping rates on hold for a third straight meeting.

Australia’s surging mining giants pushed the ASX higher on the day the Reserve Bank left the cash rate unchanged.

The Reserve Bank of Australia has left interest rates on hold for a third consecutive meeting, but when it comes to the outlook, it’s “not ruling anything in or out”.

With household borrowers desperately holding out for an easing in interest rates, traders on Monday trimmed their rate cut bets.

Ahead of the Reserve Bank’s second meeting for the year, the share market edged higher on Monday even as property stocks lost ground.

Months after vacating the top seat at the Reserve Bank, former governor Philip Lowe has confirmed his next move.

After new figures this week confirmed a deepening of Australia’s per-capita recession, analysts have lashed RBA governor Bullock’s latest rate hike.

Interest rates cuts are vital for Aussie mortgage holders but there is a chance that the forecast date for the cash rate cut could change.

The ASX surged to a near record high on Thursday after soft inflation and retail data suggested an end to the RBA’s rate hiking cycle.

Households, eagerly awaiting rate cuts, received some good news when the inflation rate was unchanged in January.

A former RBA governor and a former treasurer have teamed up to slam the government over plans to remove a major design of the RBA in their shake-up.

More rate hikes are still on the cards after the Reserve Bank revealed it considered whether to raise interest rates when it met earlier this month.

Australia’s biggest bank has raised mortgage holders’ hopes by predicting interest cuts will start rolling earlier than expected, with at least three reductions before Christmas.

The Reserve Bank may not cut rates until next year, the CEO of Commonwealth Bank has warned in a break with his own economists.

Michele Bullock has defended a contentious move to lift interest rates as she made a stark warning of what’s to come.

The Reserve Bank’s head of economic analysis says inflation is expected to hit target range by 2025.

The Reserve Bank governor says interest rates may need to go even higher if one thing doesn’t improve – as she offers a glimmer of hope for early reprieve.

The CEO of Australia’s biggest home builder has called on the Reserve Bank to give Aussie buyers and home owners some clarity over the future of interest rates.

The RBA has kept interest rates on hold, but won’t rule out further increases to the cash rate.

The average loan size in the state has dropped significantly while Queensland, South Australia and Western Australia have soared, according to concerning new ABS data.

The banking sector is growing increasingly confident of a coming rate cut, but the products they’ve released ahead of the next RBA move should be considered with caution, experts say.

The share market hit a new high on Wednesday as better than expected inflation figures raised hopes of an end to interest rate hikes.

A new report has revealed a frightening trend that may emerge if the Reserve Bank decide to hike rates again at next week’s board meeting.

Inflation eased in the December quarter to its lowest level in two years, all but guaranteeing the Reserve Bank board keeps rates on hold.

New inflation data released today has given the surest sign yet of whether the RBA will lift interest rates again when it meets next Tuesday.

The IMF has warned the Albanese government must slash spending and the Reserve Bank should hike rates even further.

The tax cuts, which are set to come into effect from July 1, could have major implications for the timing of rate cuts, economists have warned.

In a positive sign for borrowers, inflation continued its broad slowdown in November, easing pressure on a rate hike in February.

Borrowers hoping for rate relief in coming months may have to wait longer still after traders revise their bets on when the RBA will cut.

Australians have been warned to brace for a rough year, with a range of forecasts painting a picture of uncertainty, instability and a “bumpy” road ahead.

Australia’s central bank has warned it may be forced to deliver borrowers a 14th rate hike in the new year, with economists split on the RBA’s next move.

Buy now pay later transactions are set to become more expensive after the Reserve Bank of Australia flagged a major change to the payment option.

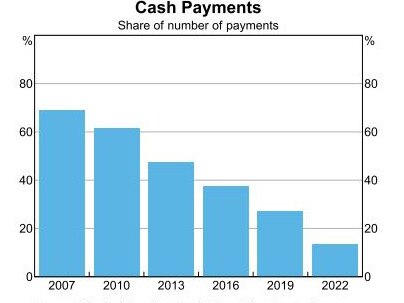

With cash use in freefall and distribution services becoming increasingly unviable, RBA governor Michele Bullock is racing to fix the problem.

Ominous signs have emerged in the auction markets of Sydney and Melbourne thanks to one decision by the Reserve Bank.

The Reserve Bank has issued a stark warning about the number of Australians at risk of financial despair in the months ahead.

Significant reforms to the central bank won’t come into effect until next year after a ‘surprising’ move by the Coalition.

As new data showed the economy “hit the wall” in the September quarter, traders ramped up their bets the RBA would start cutting rates, sending the share market higher.

The RBA has made its final decision for the year, delivering a surprise move after last month’s rise which saw homeowners across the country lumped with mortgage pain.

As household borrowers breathed a sigh of relief as the RBA held off on another rate hike, the Aussie share market had its worst daily result in more than a month.

While household borrowers were spared at the central bank’s final meeting of the year, further rate pain could be right around the corner, economists warned.

Ahead of the RBA’s final board meeting for 2023, the Australian share market reached a 10-week high on Monday as fears of further rate tightening continue to fade.

Cash-strapped homeowners have been warned to not “let their hair down” yet, despite inflation falling faster than expected.

The Australian Retailers Association has pleaded with the RBA not to use strong Black Friday retail sales as a reason to raise interest rates next week.

In welcome news for borrowers, price pressures eased in October ahead of the Reserve Bank’s final rates call for 2023.

The RBA governor has copped a lashing after insisting at an overseas jaunt that Aussies were “doing fine” despite 13 interest rate hikes.

New RBA governor Michele Bullock has made a frank admission, conceding borrowers are displeased with the central bank after its punishing rate hikes.

A top official at the UK central bank is set to make the move to Australia and join the Reserve Bank as it battles to tame persistent price pressures.

Cash is no longer king, a new survey has found, with less than one in 10 consumer payments made with notes and coins.

Inflation is increasingly being driven by domestic factors, not those from overseas, RBA governor Michele Bullock says.

Despite a fresh warning the RBA is still prepared to hike interest rates, markets were buoyed from a rally by iron ore miners.

As the Reserve Bank mulls a 14th rate hike, freshly minted governor Michele Bullock has warned current levels of wages growth are unsustainable.

The risk of more rate hikes in the months ahead would have increased had the RBA opted against increasing rates on November 7, fresh meeting minutes have revealed.

Owner-builder John Haley took his cottage to auction the day after the Reserve Bank of Australia hiked interest rates. Here’s what happened.

The big and little things that you are buying might impact your borrowing capacity, beyond the Reserve Bank of Australia. Here’s how to stay ahead of the game.

With annual wages growth hitting its highest levels in almost 15 years, economists are split on the RBA’s next move on interest rates.

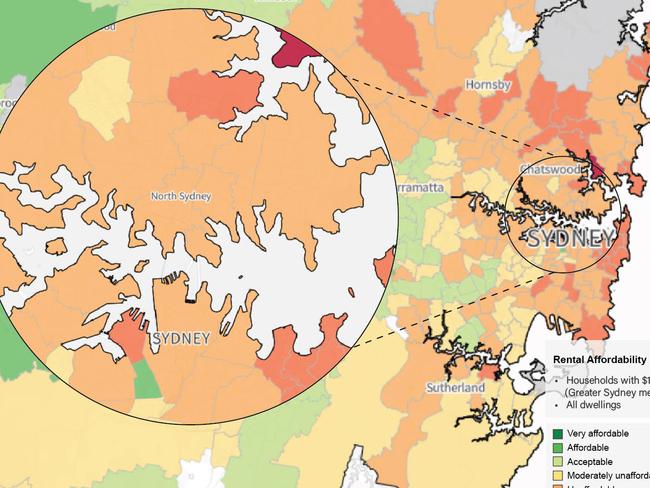

Things have gone from bad to worse for renters as new figures reveal affordability in the majority of Australia has hit its lowest level since before the Covid-19 pandemic.

Households and businesses shouldn’t expect the path to curtail persistent price pressures to be quick or direct, the Reserve Bank has warned.

A top economist has lashed the Reserve Bank for Tuesday’s unnecessary rate rise, which could push Australia into a recession.

The Reserve Bank’s latest quarterly statement has painted a grim picture for Aussies hoping for relief from soaring inflation rates.

Australia’s biggest bank is the last of the Big Four to slug Aussie homeowners with another lift in interest rates. Here’s how much you’ll pay.

Original URL: https://www.news.com.au/topics/reserve-bank/page/8