Horrifying news for Aussie house prices

Ominous signs have emerged in the auction markets of Sydney and Melbourne thanks to one decision by the Reserve Bank.

ANALYSIS

The most recent 0.25 per cent hike in the official cash rate (OCR) by the Reserve Bank of Australia (RBA) has had an immediate dampening effect on house prices, especially in Melbourne and Sydney.

PropTrack’s latest dwelling value results showed that national dwelling value growth slowed significantly in November following the latest RBA rate hike, with values rising only 0.2 per cent over the month. This was the slowest rate of growth since December 2022.

The slowing in price growth nationally was driven by Sydney and Melbourne, which recorded sharp contractions in growth to only 0.3 per cent and 0 per cent respectively in November.

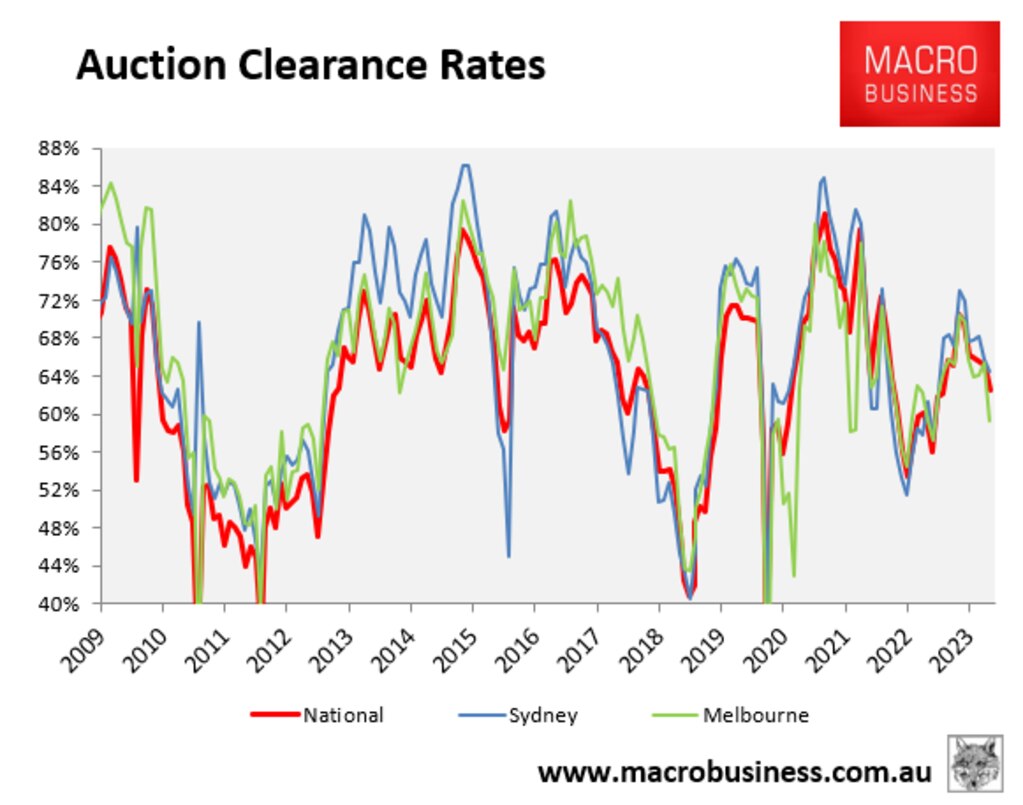

Auction clearance rates have also fallen heavily, signalling a sharp loss in housing momentum.

At the combined capital city level, the monthly average clearance rate fell from a peak of 71 per cent in May to only 63 per cent in November.

The two major auction markets of Sydney and Melbourne drove the decline nationally. Sydney’s auction clearance rate fell from a peak of 73 per cent in May to 64 per cent in November, whereas Melbourne’s clearance rate fell from a peak of 70 per cent in May to 59 per cent in November.

PropTrack has forecast a modest rise in national dwelling values in 2024 of between 1 per cent and 4 per cent, citing “a combination of continued strong demand and limited new housing construction”.

Other commentators are less optimistic.

CoreLogic’s research director Tim Lawless believes “that fragility in buyers’ demand has been exposed by the latest rate hike” and warned that Sydney and Melbourne could move “into a mild double-dip downturn in December and coming into early January”, with it “looking increasingly clear that the housing market is moving through a new inflection point”, and overall prices “generally weakening”.

SQM Research managing director Louis Christopher predicted falling home prices for five capital cities next year, alongside the strong possibility of a negative result nationally, in his latest Boom & Bust Report.

“The interest rate rises of 2022, 2023 and possibly 2024 will finally start to bite homeowners and would-be homebuyers alike,” he said.

“Distressed selling activity is expected to jump, especially in NSW where we are already starting to see a new trend upwards in that data set.”

AMP chief economist Shane Oliver commented that “Sydney and Melbourne house prices are decelerating faster than expected” and warned that “the supply shortfall-driven rebound in home prices this year is rapidly coming to an end as high rates get the upper hand again”.

Finally, Stephen Koukoulas was one of the only economists to predict a strong price rebound in the face of ongoing interest rate hikes.

However, Koukoulas commented that last month’s rate hike from the RBA “could be the straw that breaks the camel’s back” and predicted “between three per cent and five per cent drop in Sydney and Melbourne house prices”.

It appears that the record immigration volumes pouring into Australia are finally being overwhelmed by the RBA’s aggressive monetary tightening and declining affordability, with Melbourne and Sydney leading the slowdown.

Housing construction downturn the bigger worry

The Minutes accompanying the RBA’s October monetary policy meeting raised concern that the “stronger than expected recovery” in Australian house prices “might provide some support to household consumption in the period ahead” and “could also be a signal that the current policy stance was not as restrictive as had been assumed”.

Therefore, the RBA would take comfort in the marked deceleration in Australia’s house price growth following its latest rate hike.

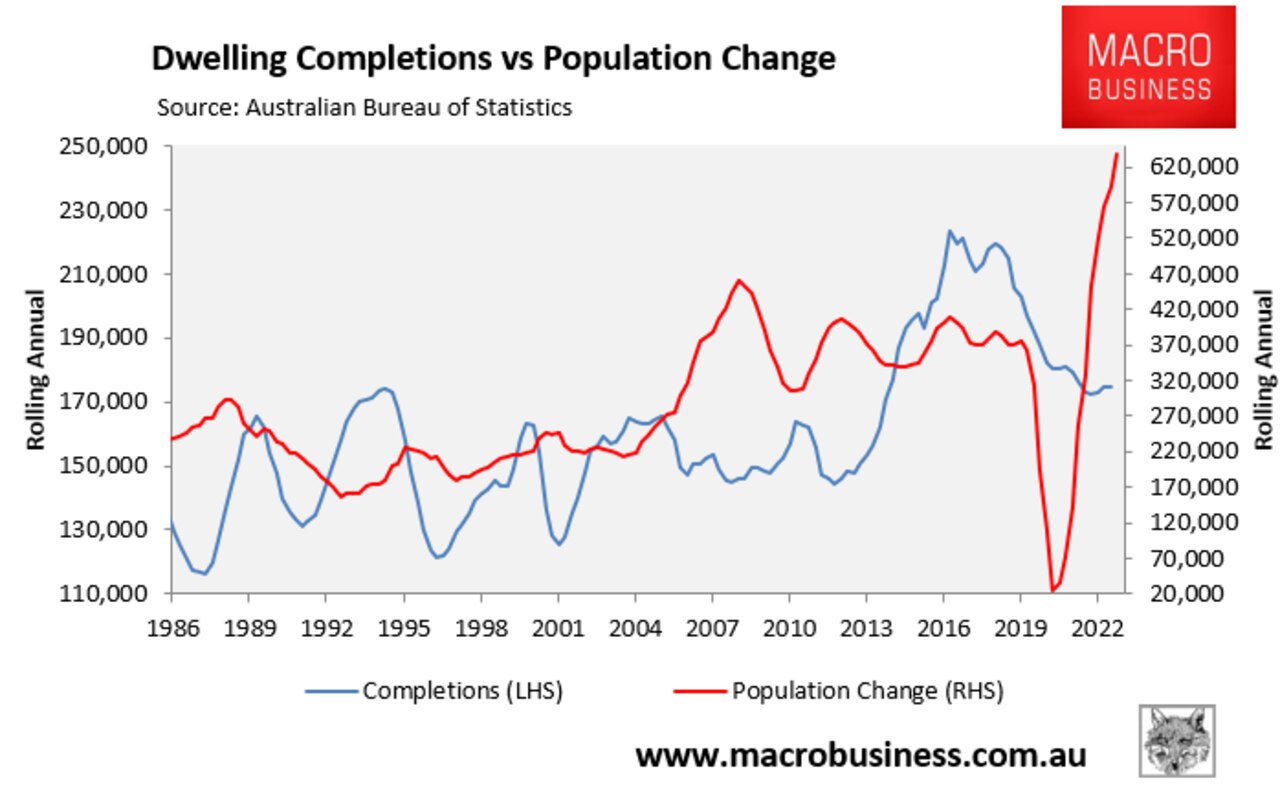

What the RBA would not take comfort in is the collapse in the nation’s dwelling construction, which risks fuelling further rental inflation in the face of record population growth.

Data released since the RBA’s Melbourne Cup Day rate hike point to fewer homes being built in the years ahead and worsening housing shortages.

The latest dwelling approvals data from the Australian Bureau of Statistics (ABS) shows that only 164,200 homes were approved for construction in the year to October, which was the lowest reading in a decade and is about 76,000 fewer than the Albanese government’s target of building 240,000 new homes a year:

Lending for the purchase and construction of a new home also remained at historical lows in October, according to the ABS.

The ABS this month also released estimates of net dwelling additions, which account for demolitions.

In the year to September 2023, Australia is estimated by the ABS to have added only 168,000 dwellings to Australia’s housing stock:

In fact, since the start of the series in September 2011, the best year for the increase in dwelling stock was the 12 months to September 2016 when the number of dwellings increased by 215,500.

Even so, this record year of housing supply in 2016 was nowhere near the Albanese government’s target of 1.2 million homes over five years, which requires 240,000 homes to be built each year.

HIA Chief Economist, Tim Reardon, claims the RBA’s aggressive interest rate hikes have killed off demand for new homes as well as new home construction.

“In the face of an acute shortage of housing stock, the rise in the cash rate has seen the volume of work entering the pipeline contracting for more than two years”, Reardon said via media release following the latest batch of data.

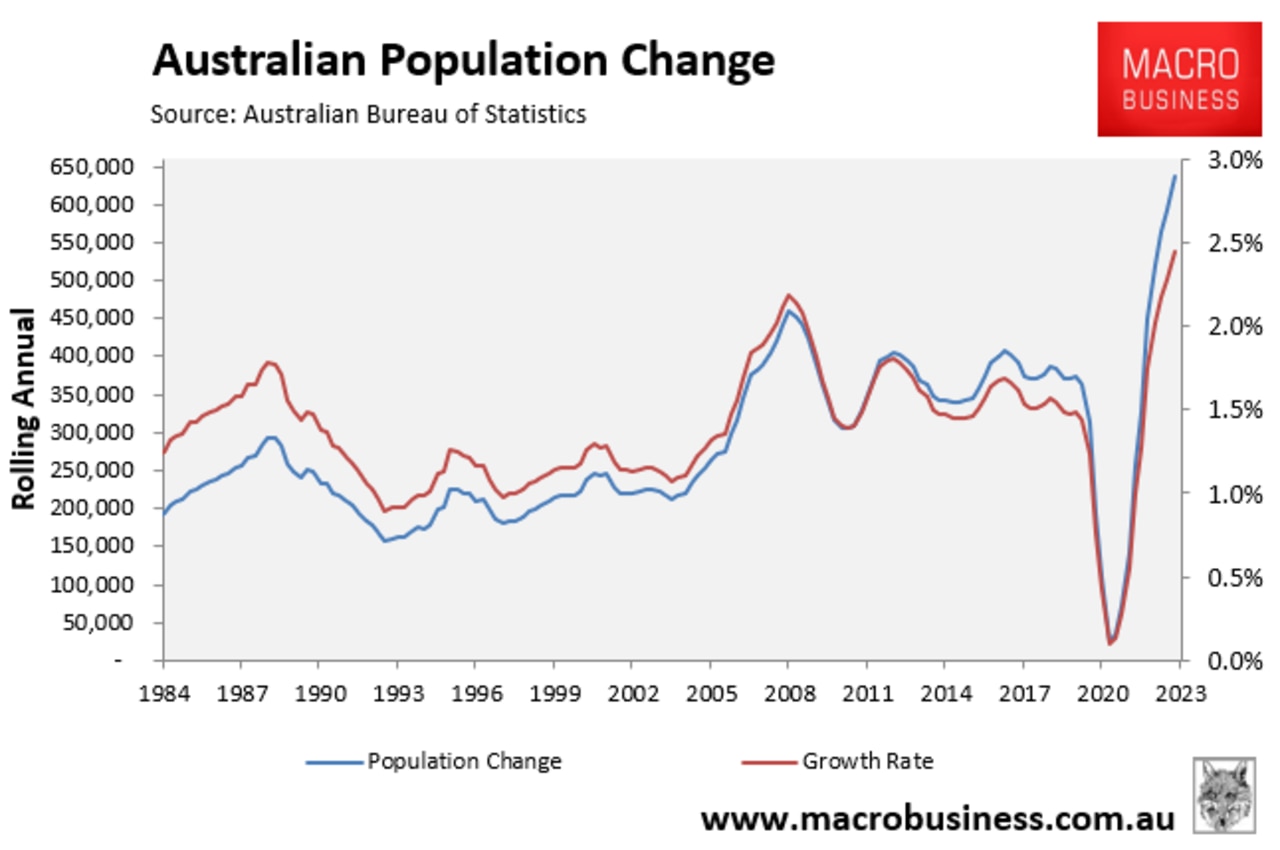

The housing supply situation has been made worse by Australia’s record-breaking population growth, courtesy of the highest net overseas migration in Australia’s history.

The September quarter national accounts, released on Wednesday by the ABS, infer that Australia’s population grew by a record 638,000 in the year to September, driven by estimated net overseas migration of around 500,000 people.

Therefore, actual dwelling completion rates are falling while Australia’s population is surging, which explains why the nation is experiencing record-low rental vacancy rates, soaring rental inflation, an increase in Australians living in group housing, and rising rates of homelessness.

The housing situation will only get worse next year as ongoing strong population-driven demand meets falling rates of supply.

It also presents a headache for the RBA given rents are the second largest component of the Consumer Price Index, meaning strong rental growth is contributing directly to Australia’s inflationary pressures.

With Australia’s housing construction capacity hamstrung by high interest rates, elevated materials costs, labour shortages, and widespread insolvencies, the only viable solution to Australia’s housing supply crisis is for the Albanese government to slash immigration.

More Coverage

Otherwise, Australia’s rental crisis will worsen and inflationary pressures will remain as demand via population growth continues to outstrip supply.

Australia will never build enough homes so long as its population continues to grow at a rapid pace via high levels of immigration.

Leith van Onselen is co-founder of MacroBusiness.com.au and Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.