Aussie bank boss’ shock rates prediction

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

Economists have dampened hopes that new inflation figures could lead to a sooner-than-expected rate cut, unless “something out of left field” happens.

Treasurer Jim Chalmers has called for support from the Coalition to create a separate Reserve Bank board that will solely be responsible for cash rate decisions.

Treasurer Jim Chalmers says the Albanese government and the Reserve Bank are aligned in the fight against inflation.

In a fresh blow to Aussie homeowners, the Reserve Bank Governor has declared rate cuts are still too far away to think about.

The Reserve Bank’s new deputy governor has roasted overconfident rate forecasts labelling them ‘false prophets’, and is not sorry about the takedown.

A man at the top of the Reserve Bank of Australia has warned Aussies against “false prophets” who claim to know what will happen in the future.

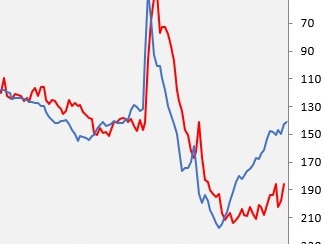

The Reserve Bank of Australia’s ongoing commitment to raise rates if it deems it necessary in the future continues to influence Aussie investors.

She knows it’s news Australia doesn’t want to hear, but the RBA “will not hesitate” to hike rates if inflation continues, governor Michele Bullock says.

The federal government is not splashing too much cash, the Prime Minister says, in light of a worrying Reserve Bank claim.

A top Aussie real estate agency has warned the RBA’s latest interest rate decision could impact Melbourne home sales — but some suburbs need not fear. And the local pub could be the reason.

Mortgage holders have been given a reprieve after the Reserve Bank kept interest rates on hold at 4.35 per cent, but should not expect a cut anytime soon.

The Reserve Bank of Australia has revealed if homeowners will take another hit when it comes to their mortgage repayments.

The man in the hot seat at Australia’s biggest bank has bypassed the Reserve Bank’s next few meetings to November when he expects a shock interest rate move.

Mortgage payers have been warned against complacency, despite expected welcome news around Tuesday’s all important cash rate announcement.

Mortgage payers have been warned against complacency, despite expected welcome news around Tuesday’s all important cash rate announcement.

Inflation has hit 3.8 per cent for the June quarter, but some economists say that figure has given the Reserve Bank room to keep rates on hold.

The June quarter inflation data will be released on Wednesday morning, giving pundits a clearer idea of whether the RBA will seek to hike rates next week.

Anthony Albanese says a respected forecaster’s latest report pointing to a ‘fork in the road’ moment for the economy has endorsed his government’s policies.

Analysts have largely agreed on how Thursday’s job data release will affect the Reserve Bank’s cash rate decision in two weeks time.

A growing list of experts now fear the Reserve Bank will hike rates next month, which could have big consequences for millions of Aussies.

Real estate investors have taken a backwards step on the sector Tuesday, as the Reserve Bank minutes show the cash rate could be hiked again.

The Reserve Bank has released the minutes from its June board meeting where it considered another rate hike. The discussion shows some storm clouds for homeowners.

The worst fears of household borrowers could soon be realised as the Reserve Bank grapples with stubbornly persistent price pressures.

A higher-than-expected inflation rate of 4 per cent for May has raised expectations the Reserve Bank will have to raise rates at its next meeting.

Treasurer Jim Chalmers says higher inflation data released on Wednesday was still lower than what the government had inherited from the Coalition.

While the central bank didn’t change rates at its latest meeting, it did flag an issue it fears could have a huge impact on Australians.

Hawkish remarks from the Reserve Bank haven’t rattled investors, with Wednesday recording a quiet day of trading following Tuesday’s strong advance.

Snapping a two-day losing streak, the sharemarket rallied on Tuesday, propelled by financial and utilities stocks.

Recent spending in state and federal budgets could impact demand, putting more pressure on inflation, the Reserve Bank has warned.

There’s no mortgage relief on the horizon and now borrowers have been hit with an even worse doomsday prediction.

The “complex and opaque” charges have added to calls for greater transparency by the Reserve Bank.

Shares got off to a poor start on Monday, with weak Chinese economic data adding further uncertainty to already cautious investors.

One major Aussie bank has made a major call on when the next rate cut will kick in – and it’s not all good news.

Freshly minted RBA deputy governor Andrew Hausen has said Australia’s central bank won’t be swayed by rate cuts in Europe and Canada.

Homeowners are steeling themselves for potential interest rate hikes following an uneasy statement from the head of the Reserve Bank.

RBA governor Michele Bullock said the bank was watching one key figure in deciding if interest rates would increase again.

The central bank has issued a note of caution following the release of firmer-than-expected inflation figures.

Economists are sounding the alarm for those already under mortgage stress after new figures showed inflation in Australia is showing no signs of easing.

Australian shares slumped on Wednesday after hotter-than-expected CPI numbers renewed inflation fears and narrowed the likelihood of rate cuts this year.

Amid concerns that simmering price pressures will delay much needed interest rate cuts, price pressures intensified in April to 3.6 per cent.

Admitting the risks around an inflation rebound had increased, the RBA board was unwilling to rule out an additional rate hike.

The rise of Australians with their own home office has contributed to Australia’s rental property shortage, a senior RBA official has warned.

Amid concerns that the Albanese government’s third budget will be inflationary, Treasurer Jim Chalmers will pour billions more into the economy.

Jim Chalmers’ Treasury department has delivered a glimmer of hope for inflation crunched households ahead of the federal budget on Tuesday.

While the Treasurer admits the inflation fight “isn’t finished yet”, there’s hope coming – and it could have major implications for homeowners, too.

As debate swirls around how to abate the country’s housing crisis, the Greens say there’s one group the finger should not be pointed at.

A rally in interest rate sensitive stocks on Wednesday pushed the sharemarket into the green for a fifth consecutive session.

A top economist has slammed the RBA’s rates decision, breaking down a key detail that could have a devastating spillover.

Aussies are owing almost $18bn in credit card debt, with experts warning it could get worse in the wake of the Reserve Bank’s latest interest rate decision.

Warning that the RBA would not hesitate to pull the trigger on further rate hikes if needed, Governor Michele Bullock revealed rate hikes had been considered.

The Aussie sharemarket has remained strong in the wake of a less than ‘hawkish’ interest rates decision by the Reserve Bank of Australia.

After a six week reprieve, Australians will learn today whether interest rates will rise again.

Releasing its fresh quarterly forecasts, the central bank painted a gloomy picture on the path for inflation, with one essential cost for many playing a key role.

Ahead of the central bank’s impending interest rate decisions, investors on the Australian share market were in an upbeat mood.

Despite concerns raised by some economists, federal Treasurer Jim Chalmers is set to reject calls for further austerity in the upcoming May budget.

Slashing the structural deficit, easing inflationary pressures, and bolstering productivity must be priorities, the Paris-based organisation has argued.

Aussie stocks edged higher on Tuesday after a slump in retail sales pushed back fears of impending rate hikes.

Stubborn inflation, strong jobs growth, and a rebounding economy could force the Reserve Bank to deliver further rate hikes, economists have warned.

After stronger than expected economic data, traders have built up bets that the Reserve Bank could hike interest rates again.

A top forecaster issued a dire interest rate warning, predicting that the RBA will be forced to hike three times before the end of the year.

Shares erased their early gains on Wednesday after firmer-than-expected inflation data took traders by surprise.

With prices rebounding over the March quarter, investors and economists pushed out their timeline for rate cuts by the Reserve Bank.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

All eyes will be on fresh inflation data to be released on Wednesday which will be critical to the Reserve Bank’s deliberations on rate cuts.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

With Australians ripped off every time they use their credit card, the RBA is considering a crackdown.

More Australians found themselves out of work last month, but the result was stronger than expected and could delay the RBA’s rate cut path.

Borrowers holding out for rate cuts could be waiting longer still for relief, with analysts expecting the RBA to wait for the Fed to move first.

Experts are urging Australians to get on top of their credit cards as the eye-watering post-Christmas debt grew again in February.

Even as household budgets come under pressure, tens of thousands of Aussies took on additional debt in February, new data shows.

Australia’s 2.6 million small and medium businesses could be key to unlocking the next wave of productivity growth.

A pivot from the Reserve Bank could mean hopeful homeowners could have their borrowing power surge by thousands.

For the first time since it started its aggressive run of rate hikes, the RBA did not consider the option, minutes from its latest meeting have revealed.

Shares clawed back losses from Tuesday’s session to come within less than 35 points of the benchmark’s all time high.

The softer-than-expected reading is a further sign the Reserve Bank could move to ease interest rates later this year.

Optimism of an interest rate cut as early as May appears to have been premature, with new government data lowering the prospect of early relief for mortgage holders.

There were hopes of a series of rates cuts coming soon, but hopes have been dashed by shock new figures today.

There were hopes of a series of rates cuts coming soon, but hopes have been dashed by shock new figures today.

The RBA governor gave few clues on when households could expect rate relief – but there is one glimmer of hope for mortgage holders.

Original URL: https://www.news.com.au/topics/reserve-bank/page/6