Leading forecaster Warren Hogan predicts RBA will hike cash rate to 5.1 per cent this year

A top forecaster issued a dire interest rate warning, predicting that the RBA will be forced to hike three times before the end of the year.

A top forecaster issued a dire interest rate warning, predicting that the Reserve Bank will be forced to hike three times before the end of the year.

Judo Bank chief economic adviser Warren Hogan — who was the most accurate forecaster in 2023, correctly predicting the RBA would raise the cash rate five times to 4.35 per cent — told The Australian Financial Review on Friday that he now saw rates reaching 5.1 per cent in 2024.

His prediction comes on the back of higher-than-expected inflation data released on Wednesday, which caused most economists to push back their timeline for a predicted rate cut by the RBA to late 2024 or early 2025.

Mr Hogan, however, has ditched his prediction for a hold until early 2025 then a rate cut, and now believes the RBA will instead raise the cash rate by 0.25 percentage points at its August, September and November meetings.

“Everything points to the fact that 4.35 per cent isn’t the right level for the cash rate,” the veteran economist told The Australian Financial Review.

“The RBA’s strategy this cycle doesn’t seem to be working. They were hoping we could do less than the rest of the world because we were more exposed to the nominal channel of monetary policy through variable rate mortgages … We just need to now get up to the (cash rate) level that other countries are, at 5 per cent.”

Central banks in the US, UK, Canada and New Zealand have raised their cash rates at or above 5 per cent.

AMP chief economist and head of investment strategy Shane Oliver said he was “not going to rule it out” but his base case remains no change until later this year followed by a rate cut in November, December or February.

“You’ve got to give Warren credit, he got last year right,” Dr Oliver told news.com.au.

“The whole interest rates story for the last two years has surprised on the upside, the inflation numbers were disappointing this week, so you can’t rule out the RBA resuming rate hikes and taking them up above 5 per cent. It’s not my base case, I don’t think that will happen, but given the way inflation’s come in on the high side you can’t rule it out.”

The big four banks are still predicting the RBA will hold before cutting later this year — CommBank puts the first cut in September, while Westpac, NAB and ANZ predict a cut in November.

Dr Oliver said he did not think Australia would follow other countries towards 5.5 per cent because of the “immense” hardship it would create for variable rate mortgage holders.

“The complication for Australia is of course homeowners have already seen much bigger rises in their interest rates than their counterparts in other countries, because of the reliance on variable rates,” he said.

“Sitting in America, an average person on a mortgage has seen their rates go up half a per cent, for many people on fixed rates it’s zero.

“The cash rate here hasn’t gone up as much as other countries but the mortgage rates ordinary Australians are paying have gone up by more than other countries. If we were to take the cash rate above 5 per cent it’s going to create immense pressure on households … I think it would cause immense damage.”

He added, “But as I say I can’t rule it out. The RBA has only one tool to control inflation, there’s a risk they’ll resume rate hikes.”

Three 0.25 per cent rate hikes this year would add $226 to monthly repayments for an owner-occupier with a typical $500,000 loan, according to RateCity.

That would mean the borrower was paying $1436 per month more on their mortgage than they were when the RBA started its rate hikes in April 2022.

“Changing cash rate forecasts from Australia’s best and brightest economic minds should make borrowers realise that no-one — not even the RBA — can be sure of the board’s next move,” RateCity research director Sally Tindall said.

“The RBA has made it clear it is data-dependent and not willing to rule anything in or out.”

But Ms Tindall argued the latest inflation data was “unlikely to send the board into a tailspin just yet”.

“The RBA going to take more convincing before it moves from its current wait-and-see approach,” she said.

“If we see another rate hike, instead of a rate cut, then the average borrower with a $500,000 debt and 25 years remaining at the start of the hikes will have to stump up an extra $75 a month on their mortgage. This might seem manageable in isolation, but added to the 13 rate hikes already delivered, and it will be enough to send many borrowers further into mortgage stress, particularly those who haven’t renegotiated their mortgage recently.”

The consumer price index (CPI) rose 1 per cent in the first three months of 2024, the Australian Bureau of Statistics (ABS) reported on Wednesday, up from 0.6 per cent in the December quarter, and well above the 0.8 per cent increase forecast by economists.

The quarterly result brought annual headline inflation to 3.6 per cent.

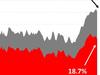

Following the release, markets priced just a 19 per cent chance the RBA would deliver a rate cut at its final meeting this year, scheduled for December. On Tuesday, interest rate futures inferred an 80 per cent chance of a cut.

Dr Oliver noted that there had been a recent pattern in inflation data where “you get this quarterly surprise and the next one’s on the low side”.

“We saw that in the September quarter, numbers were on the high side then we get 0.6 per cent in the December quarter,” he said.

“It’s quite conceivable that yes we did see an upside surprise for the March quarter figures but the June quarter figures will surprise on the downside.”

Education and health costs in the March quarter were “big factors” in the higher number, whereas June quarter figures “tend not to see as big rises in those categories”.

“I think it’s partly seasonal, but maybe it also just reflects the ebb and flow of numbers for some reason, it’s a bit hard to explain.”

Speaking in Brisbane this week, Treasurer Jim Chalmers largely passed over the re-acceleration in quarterly inflation and instead focusing on the annual headline result, which remained below Treasury and RBA forecasts.

“That’s an important bit of perspective, I think people can get carried away, frankly, with the sorts of numbers that we’ve seen today,” Dr Chalmers told reporters.

“We know inflation is persistent, we know that it is lingering, but we are making welcome and encouraging progress.”

— with NCA NewsWire