Rate hike to push 1.6 million Australians into mortgage danger

A new report has revealed a frightening trend that may emerge if the Reserve Bank decide to hike rates again at next week’s board meeting.

Further interest rate rises at the hands of the RBA could push 1.6 million Australian households into mortgage stress.

The first RBA meeting for the year scheduled for Tuesday will determine the fate of many Australians who may fall into the financial danger zone.

Despite inflation appearing to have softened, after 18 months of rate rises, fears of more hikes persist for Australians.

New research from Roy Morgan shows 1.527 million mortgage holders were at risk of mortgage stress in the three months to December 2023.

This period included an interest-rate increase on Melbourne Cup Day, with the RBA raising interest rates by 0.25 per cent to 4.35 per cent.

MORE: 33-year-old worth $10m shares top tip to retire rich

Mortgage holders are considered at risk if they are spending roughly a third or more of their income on loan repayments.

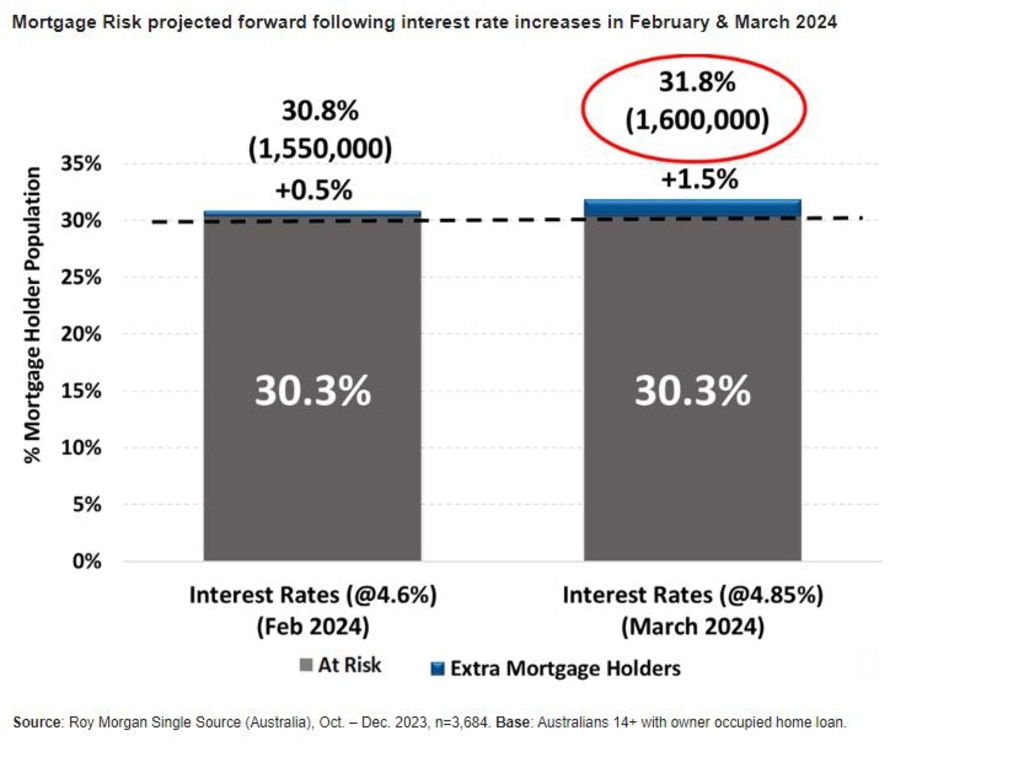

If the RBA raises rates by 0.25 per cent in February, 1.55 million mortgage holders will be considered at risk, according to Roy Morgan. That is an increase of 23,000 households from December 2023.

Another 0.25 per cent hike in March, could increase that “at risk” figure to 1.6 million households, while almost one in five mortgage holders would be at “extreme risk”.

CEO of Roy Morgan Michele Levine said ongoing inflation pressures meant another rate hike was not out of the question.

“Although inflation pressures appear to be easing, there is the possibility a higher-than-expected inflation reading for December would reignite fears that inflation is set to persist during 2024,” Ms Levine said.

“For these reasons we may have further interest rate increases in February and March 2024,” she said.

MORE: ‘Stunning’ home comes with unlimited blueberry supply

Sydney rental market takes another turn

Ms Levine said on top of interest rates, household incomes and employment rates largely effect mortgage stress.

“The employment market in Australia has been exceptionally strong over the last year and this has underpinned rising household incomes which have played a part in reducing overall mortgage stress in December,” she said.

“However, rising interest rates over the last 18 months since May 2022 have caused a large increase in the number of mortgage holders considered ‘at risk’,” she said.

Ms Levine said if further rate hikes transpired, mortgage stress levels could reach what has only previously been seen during the Global Financial Crisis.

“If there is a reacceleration in inflation over the months ahead, that results in further interest rate increases in 2024, levels of mortgage stress are set to increase further to new record highs.”

MORE: Roosters bad boy seeks $4m redemption

New suburbs first homebuyers are targeting

Underground home with turf roof has hidden surprise

Originally published as Rate hike to push 1.6 million Australians into mortgage danger