‘Higher for longer’: Experts bet the house on a Melbourne Cup rate rise

On Tuesday, the nation will stop for the Melbourne Cup. But the Reserve Bank’s decision just before the race starts will be a huge blow.

Interest rates are set to rise on Melbourne Cup Day and the consensus of experts now leans towards rates staying “higher for longer”.

In a blow to mortgage holders, one of the nation’s biggest banks has issued a grim prediction.

“We expect the RBA to increase the cash rate by 25 basis points next week,’’ the ANZ warned.

The bank’s forecast suggests interest rates are not likely to come down after the expected rate rise until September 2024 or later.

“We don’t expect any easing until Q4 2024. The risks for the outlook are towards sticky inflation rather than a concerning drop in activity,’’ it said.

Lifting rates by 25 basis points would take the cash rate to 4.35 per cent on Tuesday after the RBA kept rates on hold at the last four meetings.

Each 25 basis point increase in variable rates lifts monthly mortgage payments by about $15 for each $100,000 borrowed.

For a $600,000 mortgage another rate rise would increase rates by $90 a month.

Since the RBA began raising rates last May, the increases have increased payments by a whopping $1134 for those on a typical $500,000.

That’s $13,000 a year in extra payments.

The ANZ bank’s senior economist Blair Chapman warned on Friday that annual personal credit growth also recorded its strongest result in over a decade.

This was likely due to cost-of-living pressure on households that do not have access to housing equity.

“We expect the RBA to increase rates on Tuesday and to note in the Statement on Monetary Policy that it may need to tighten again,’’ he said.

\

“We expect a hawkish tone throughout the statement. We expect the Outlook chapter to emphasise upside risks to the outlook and the possibility of elevated inflation persisting.

“The RBA is also likely to highlight downside risks, such as the possibility of slower growth in China.

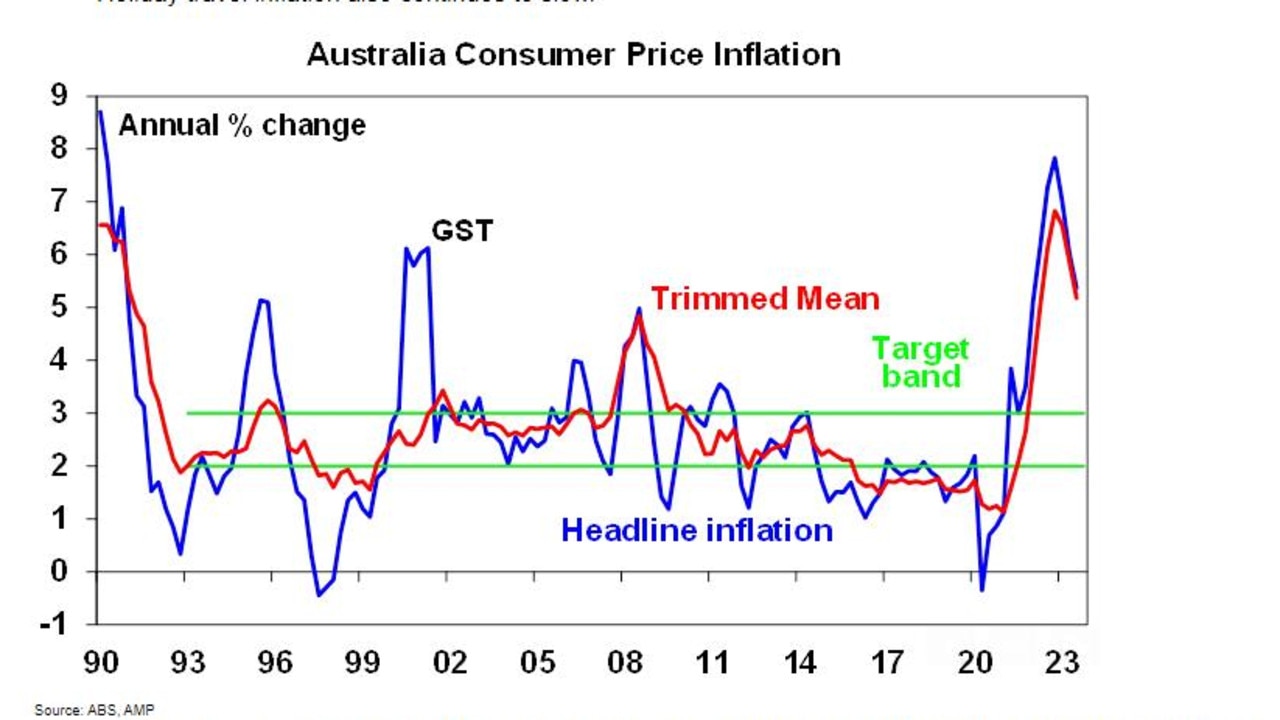

ANZ warned it expected the RBA to increase its near-term forecasts for headline and core inflation.

The vast majority of financial experts are now betting on a Melbourne Cup Day interest rate rise next week.

Separately, the latest macroeconomic outlook from State Street Global Advisors suggests the uncertainty from elevated inflation and the central bank’s efforts to stem this now seems destined to continue.

“The markets are now embracing the ‘higher for longer’ narrative and pushing out expectations for rate cuts,’’ it said.

“The primary theme in all the commentaries for the pause was quite hawkish, indicating caution against letting inflation get out of hand and warning that interest rates could stay elevated for a longer period of time.

“The surge in oil prices over the last quarter, and now, potentially, the breakout of war in the Middle East, has maintained the significance of the said concerns.”

On the flipside, it found the outlook was not as gloomy compared to peers, with Australia having lower recession risks than many other developed economies.

“The RBA has tended to approach rate hikes with greater restraint than other global central banks, only raising rates by a cumulative 400 bps versus 525 bps by the Fed said.

“Instead, the RBA has opted for several hawkish pauses instead. The pause in October serves an example of this stance. A hike is still an option for November.

“Our expectations are that over the next few months the tighter monetary conditions will show a material effect on economic growth. However without any decline in inflation, policy reversal is unlikely.”