Secret RBA documents reveal even high-income, middle-class Aussies are in financial crisis

Details of briefings inside the Reserve Bank that you were never meant to see have been released – and they show growing concern about a rapidly worsening crisis.

Secret briefings inside the Reserve Bank reveal a startling surge in the number of middle-class Australians on six-figure salaries seeking a financial crisis support.

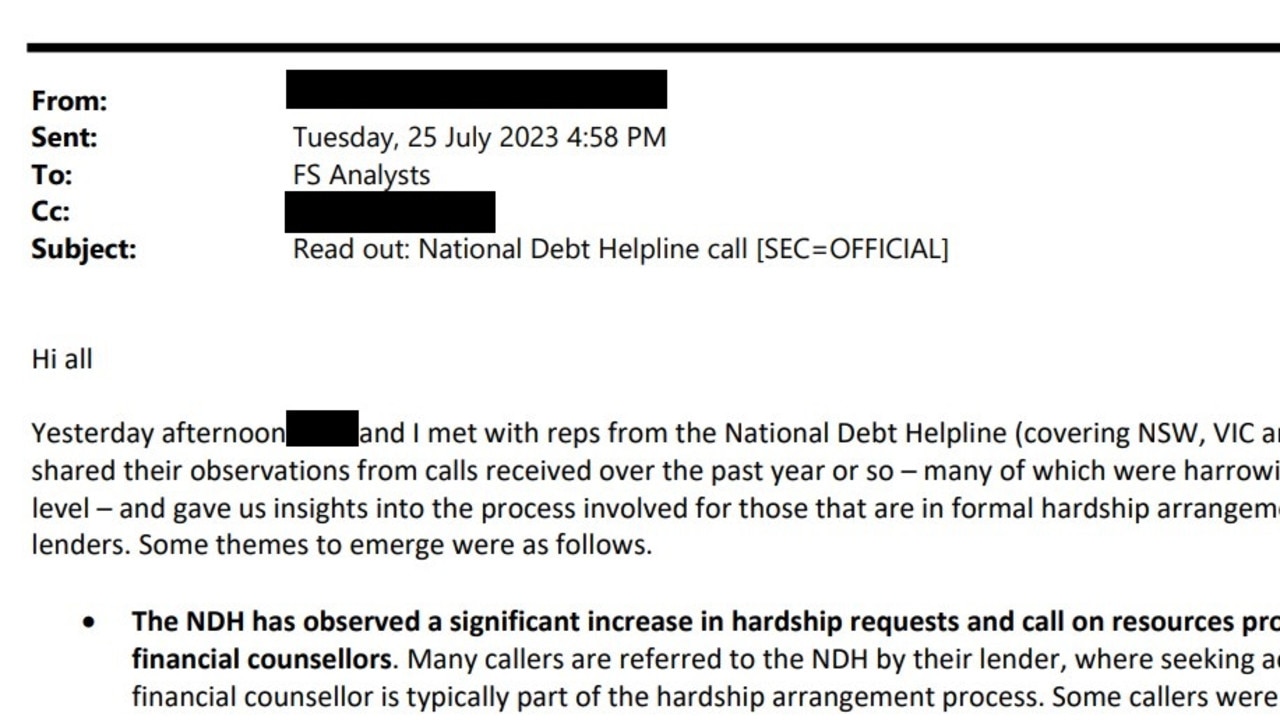

In July, members of the RBA’s Financial Stability division met with representatives from the National Debt Helpline – a resource offering those in need access to free financial counselling.

Engaging with the service is often a requirement of banks when borrowers are unable to meet some or all their home loan repayments, but anyone in distress can seek help.

Notes from the briefing, sent as a confidential internal memo to analysts at the central bank, have been released under Freedom of Information and viewed by news.com.au.

They reveal the NDH has seen a “significant increase in hardship requests” over recent months – especially from Aussies running into strife for the very first time.

“The NDH is experiencing an increasing volume of calls from people who have not experienced financial hardship or drawn on social services previously,” the memo reads.

“Many callers were gainfully employed. Examples were given of mortgagees on six figure salaries residing in prosperous suburbs of Sydney.”

Struggling to make ends meet

The new cohort of “solid middle to upper income callers” is among a “significant number of callers” now relying on credit cards, loans from family and friends or by now, pay later schemes to get by.

Some are avoiding obligations to the Australian Taxation Office or deferring their utilities and council rates bills, the memo also noted.

“Additionally, underinsurance was becoming an increasing problem – borrowers did not have enough spare income to pay insurance premiums for their homes, cars or personal belongings – and some borrowers were asking about how they could qualify to tap into their superannuation balances.”

Data from the Australian Bureau of Statistics for the June quarter showed the value of household deposit accounts plunged by $6 billion – the first fall recorded in 16 years.

Separate ABS data shows the cost of food jumped 7.5 per cent year-on-year in June, with a 15.2 per cent increase in dairy products and a 11.6 per cent increase in bread products.

Utility bills were 12 per cent to 14 per cent higher than a year prior, while insurance costs leapt 14 per cent.

Polling conducted by Resolve for Nine Newspapers found half of Aussies would struggle to meet a major unexpected expense at the moment.

Representatives from the NDH shared examples of “harrowing” cases of distress but said surging demand means it’s several weeks until someone gets an appointment with a counsellor – “If at all”.

“Demand is expected to increase over the coming period, particularly since seeing a financial counsellor is required by lenders for those in hardship arrangements and the full effects of higher interest rates and cost of living pressures were still filtering through,” the memo reads.

“It was noted that even a modest increase in unemployment would impose a call on counselling services that could not be met with current resourcing budgets.”

‘It’s tearing us apart’

A report into the cost-of-living crisis, released by the New South Wales Council of Social Services, noted that for many people, there are simply “few, if any budgetary cuts left to make”.

“This year we’ve seen more people taking ‘last resort’ measures to cover costs – skipping meals and going without prescribed medication and health care, both up by around 33 per cent compared to 2022,” the group’s chief executive Joanna Quilty said.

“There has also been an increase in those relying on buy now, pay later to cover the essentials, especially single parents and people living in regional NSW.”

The NCOSS research showed a “sharp rise” in the number of households with no savings set aside for emergencies.

Ms Quilty said comments from those who participated in focus groups were “revealing”.

“Statements like ‘there’s a lot of fighting about money’, ‘we have no time with our children’, ‘it’s diminished my pleasure in living’, ‘it’s impossible to enjoy family life’, and ‘it’s nearly torn my husband and I apart’ convey some of the anguish and distress that is being felt, particularly for those raising kids,” she said.

“People also spoke of their shame – at not being able to afford a haircut or decent clothes, having to borrow money from family or lining up at food pantries for the first time.

“Much of this distress occurs behind closed doors, affecting individual mental health, family functioning, quality of life and community wellbeing.

“But there are flow-on social and economic costs in terms of children’s development, educational engagement, workforce productivity, and population health, resulting in increased demand on social services, mental health, hospital and other support systems.”

Worrying trend among mortgage holders

A record four per cent increase in interest rates since mid-2022 has many Aussies worried about being forced to sell their homes, the memo reveals.

Instances of NDH callers reporting housing costs accounting for between 50 and 70 per cent of their disposable income were “not uncommon”.

But a new element of this crisis compared to others in the past is the severe rental crunch also unfolding. Nationally, rent prices have climbed by about 12 per cent in the past year.

As a result, there is growing concern that those forced to sell their homes due to financial stress may wind up homeless.

“In many cases, callers were noting that the cost of renting was at least as high as servicing a mortgage,” the memo reads.

Recent research by Roy Morgan revealed a record 1.5 million homeowners are at risk of mortgage stress, a scenario when the cost of home loan repayments is between a quarter and half of income.

“This represents a substantial increase of 642,000 [household] on a year ago just after the RBA began a record-breaking series of interest rate increases,” Roy Morgan chief executive Michelle Levine said.

Some 52 per cent of households say they worse off financially than they were a year ago, while 33 per cent expect to be worse off in the coming year.

Just eight per cent of respondents expect “good times” for the Australian economy over the coming 12 months.