‘Triple whammy’: Sign Australia is on the brink

ABS figures from September appear to show good news for the Aussie economy but dig a little deeper and something else is exposed.

ANALYSIS

The Australian Bureau of Statistics (ABS) last week released its labour force survey for September, which revealed that Australia’s unemployment rate fell by 0.1 per cent to only 3.6 per cent.

The monthly ABS labour market survey is always capable of throwing up an unusual set of numbers. And this month’s release was no exception.

The small increase in employment of 6700 in September was less than the consensus market forecast of 20,000, which would usually be characterised as a poor result.

However, the 0.2 per cent fall in the participation rate meant that the unemployment rate fell slightly, which suggests a strong result.

The ABS’ trend series smooths the monthly volatility and shows a labour market that is slowly easing.

While the unemployment rate has risen by only 0.2 per cent since October 2022, the underemployment rate has increased by around 0.5 per cent over the same period:

Thus, the official ABS labour market survey suggests that Australia’s jobs market has softened over the past year, but remains tight overall.

Australia’s unemployment rate poised to jump

The growth in Australia’s labour force is growing at its fastest pace since the late 1970s thanks to the federal government’s record immigration program, which saw around 500,000 net overseas migrants land in Australia in 2022-23:

The ABS reported that Australia’s population aged 15-plus grew by 601,000 (2.8 per cent) in the year to September 2023, which was roughly twice the pace of the pre-pandemic period:

Australia’s labour market, therefore, needs to generate around 37,000 jobs a month currently to keep the unemployment rate flat on an unchanged participation rate.

Alternative labour market measures suggest that Australia’s official ABS unemployment rate will rise.

The Roy Morgan unemployment estimate is obtained by surveying an Australia-wide cross-section of people aged 14-plus.

A person is classified by Roy Morgan as unemployed if they are looking for work, no matter when.

Roy Morgan’s alternative unemployment survey registered a 1.5 per cent increase in unemployment over the year to September, to 10.2 per cent.

The 50,000 jobs created have not kept pace with the estimated 412,000 increase in Australia’s labour force, according to Roy Morgan:

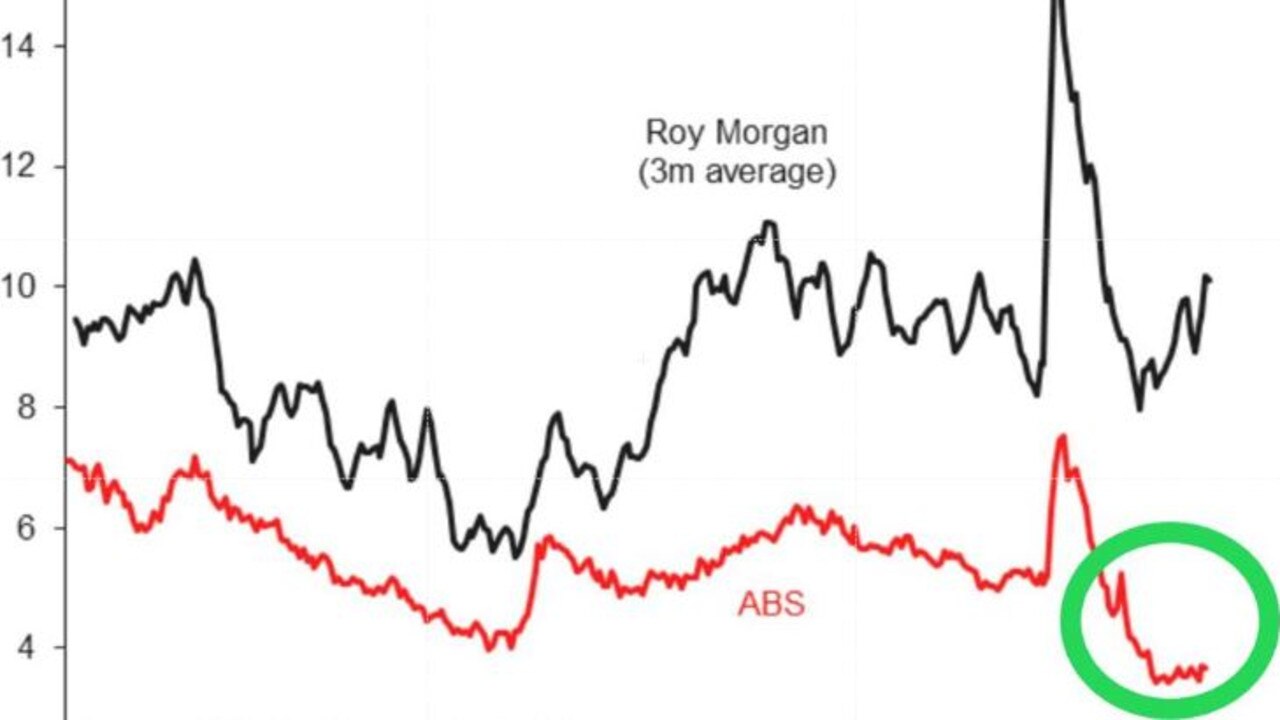

While there are methodological differences in the way that the ABS and Roy Morgan measure unemployment, the two series have historically tracked each other.

Therefore, the jump in Roy Morgan unemployment is pointing to higher ABS unemployment in the period ahead:

The same can be said for SEEK’s applications per job ad measure, which has increased well above pre-pandemic levels, reflecting lower job demand combined with rapid labour supply growth.

Historically, SEEK’s measure has been a strong leading indicator for the ABS unemployment rate, and points to significantly higher unemployment in the period ahead:

Finally, AMP’s leading job indicator “points to jobs growth slowing to around 12,000 a month”, which is well below the circa 37,000 employment growth needed to keep the unemployment rate from rising (assuming a steady participation rate):

How much will unemployment rise?

The Reserve Bank of Australia (RBA) projects that Australia’s official unemployment rate will rise to 4.5 per cent by the end of 2024, from 3.6 per cent currently.

This forecast looks optimistic in light of the above data and the unprecedented growth in Australia’s labour force owing to the Albanese Government’s record immigration program.

Independent economist, Tarric Brooker, estimates that if Australia’s labour force continues to grow at around its current pace and jobs growth simply reverts to its five-year pre-pandemic average of 22,000 per month, then Australia’s official unemployment rate would rise to 5.2 per cent by the end of 2024:

The bottom line is that Australia is adding more workers via net overseas migration than the economy can absorb with new jobs.

This means that the nation’s official unemployment rate will inevitably rise and could easily breach 5 per cent in a year’s time.

The increase in unemployment will also place downward pressure on Australian wages, meaning incomes will continue to lag inflation.

It is especially bad news for Australian tenants, who are facing rapid rental inflation.

Rising unemployment, lower wage growth, and rising rents present a triple whammy for the one-third of Australians that rent.

And all three are being made worse by the Albanese Government’s record immigration program.

Leith van Onselen is co-founder of MacroBusiness.com.au and Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.