Final big bank announces hike

Aussie homeowners are in for pain as the final major bank hikes interest rates yet again.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

Aussie homeowners are in for pain as the final major bank hikes interest rates yet again.

Three of the four big banks have now changed their interest rates for mortgage holders and some saving accounts.

The major bank has posted a staggering profit on the back of surging interest rates – and has predicted what’s next for the economy.

Banks have started to raise mortgage rates again following the Reserve Bank’s decision to increase the official rate to its highest level in 11 years.

Australians have been dealt a chilling financial hit as interest rates have been hiked once again and now the major banks are responding.

RBA governor Philip Lowe has defended yesterday’s interest rate hike, after it sent shockwaves through the country.

Victorian Premier Dan Andrews has hit out at renewed rate rises that he says are “smashing” Victorian families.

Leading finance expert Mark Bouris has slammed the RBA’s latest interest rate hike, amid calls for the decision to be overturned.

Homeowners have been on a knife edge and now the Reserve Bank has made its latest shock decision on interest rate hikes.

Homeowners will face a double-barrel assault from rising cost-of-living pressures and high interest rates, as the RBA delivered another hike.

Australia’s big banks are predicted to reveal they have raked in their biggest earnings in the last 30 years.

Aussies are anxiously waiting to see whether the RBA will keep rates on hold for the second month in a row, with experts branding it a “close call”.

Few Aussies expect the Reserve Bank will lower interest rates this year as a new poll has revealed many are avoiding new loans unless necessary.

After months of rate rises, one bank has made the choice to decrease a portion of its home loans.

The most aggressive round of interest rate hikes in decades in Australia and a rental crisis are creating a surprise outcome in the property market.

Fresh data has cast doubt over whether the Reserve Bank can continue to keep interest rates on hold for another month.

There were fears that Australia’s property prices could take a huge hit this year, but some surprising predictions have now been made.

The RBA board is in for another tough call on the cash rate in its May meeting, with upcoming inflation data to weigh heavily on the decision.

Australia’s central bank is set for a major overhaul after a wide-ranging review outlined key areas where the bank needed to change.

The Reserve Bank of Australia board will be stripped of its power to set interest rates in a huge shake-up of the central bank.

Australia’s central bank is set for a major shake-up after a wide-ranging review but not everyone is on board with the recommendations.

The system that determines Australia’s interest rates is set for the biggest shake up it’s had in decades after a series of forecast bungles.

Australian homeowners have been dealt a fresh blow as the Reserve Bank released the minutes from its board meeting earlier this month.

One of the nation’s best-known firms has spectacularly unleashed on the RBA, blaming it for pushing the Aussie economy to the brink.

Interest rates may have stabilised but that doesn’t mean mortgages will. And it all goes to prove why Australia is the worst place to have a mortgage.

Australians with mortgages have just been lumped with more bad news as they are trying to enjoy the first month in nearly a year where the RBA paused rates.

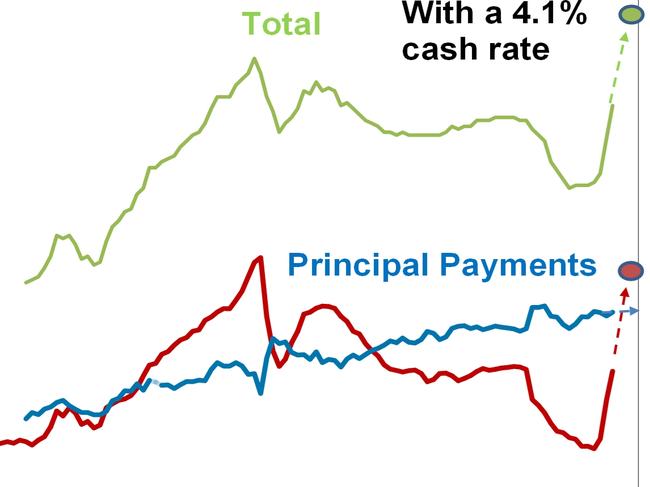

Australia’s mortgage holders are facing a perfect storm of grim conditions, leaving us among the most at risk on the entire planet.

Frustrated homeowners have been saying the same thing for months – and now, the RBA has finally owned up to a major error.

When talking mortgages, this is the most common argument trotted out by Boomers. But it doesn’t prove anything.

Nearly 900,000 Aussies could be in for bill shock when their cheap pandemic fixed-rate home loan expires by the end of the year.

Original URL: https://www.news.com.au/topics/reserve-bank/page/12