Westpac predicts house prices will rise by 5 per cent in 2024

There were fears that Australia’s property prices could take a huge hit this year, but some surprising predictions have now been made.

Despite warnings of more rate hikes and weakening economic conditions, Westpac has predicted that the house price slump will not be as bad as feared.

Instead the major bank has said we should expect house prices to rise once again due to a surge in migration, increased construction costs hampering new supply and the low number of properties for sale.

In February alone, the flow of new capital city listings were 17 per cent lower than a year ago and 11.9 per cent below the previous five-year average.

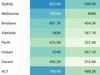

Westpac has declared “convincing signs of stabilisation” in the property market and even predicted Sydney house prices will jump by 1 per cent this year compared to a previous forecast that they would plummet by 8 per cent.

House prices are expected to fall 1 per cent in both Melbourne and Brisbane this year, while prices in Perth and nationwide are set to stabilise, according to the bank.

Westpac had previously forecast last year that Melbourne house prices would fall 10 per cent, Brisbane would suffer a 6 per cent decline and Perth prices would drop 4 per cent.

The 10 consecutive interest rate increases from the Reserve Bank of Australia (RBA) have roughly doubled mortgage rates and restricted borrowing capacity by around 30 per cent.

This represents the sharpest decline in borrowing capacity on record and would usually be associated with a significant fall in home values.

Yet, Westpac chief economist Bill Evans said while house prices are expected to remain flat this year, he believes they could jump higher in 2024.

“Australia’s housing correction is largely over, several factors combining to produce a stabilisation,” Mr Evans and senior economist Matthew Hassan said in a market update.

“Prices now expected to lift 5 per cent in 2024, revised up from 2 per cent.”

Overall, Westpac has predicted house prices will soar by 5 per cent in both Sydney and Melbourne, prices will jump by 6 per cent in Brisbane and rise by 8 per cent in Perth in 2024.

“This shift has come despite further official rate rises in February and March,” the economists wrote.

“Housing recoveries in the past have only tended to flow through to prices once the RBA is actively cutting rates or is very clearly poised to do so. Price gains also tend to follow a sustained lift in turnover, not vice-versa.”

But now Westpac has forecast house prices will drop nationally by 10 per cent – a stark difference from the 16 per cent previously predicted.

“The ‘mini-rally’ in prices may still be quite fragile. But the momentum shift from negative to stable (possibly positive) is still important as it plays into expectations,” the bank’s economists added.

It found prices across the country remained flat in February, before recording a 0.8 per cent gain in March and are tracking for a similar gain for April based on figures to date.

“Further rate cuts and an improving economic backdrop will see momentum carry into 2025 although affordability is likely to constrain upside prospects,” they said.

While all major capital city markets have now seen prices stabilise or post small rises over the last three months, Sydney’s luxury market was leading the way, although the economists warned headwinds could hamper these gains.

“Another major slide seems unlikely although gains will be hard to sustain given interest rates and wider economic headwinds,” the economists warned.

“Markets are still likely to remain on edge near term as interest rates remain high and the full impact of the RBA’s rapid tightening cycle flows through.

“A May rate hike is likely to ‘check’ the improvement in housing-related sentiment near term. Some lift in ‘on-market’ supply is also likely to test the depth of demand.”

The risk that the Reserve Bank can’t tame inflation means rate rises could still hit in the later half of the year, Mr Evans warned, and could continue in 2024 if ongoing high inflation constrains the central bank from backing down on hikes.

“Both developments would clearly undermine housing market improvements and could potentially lead to a reversal,” he said.

Many economists have backed another rate hike next month which would take the cash rate to 3.85 per cent.

But others have also predicted that the housing slump won’t be as severe.

HSBC changed its forecast from a fall of 6-8 per cent for the Australian housing market in 2023, to a drop of just 1-3 per cent.

HSBC Australia and NZ chief economist Paul Bloxham had previously predicted a staggering drop of 15 per cent for house prices, but said migration had driven huge demand.

“Population growth has been even stronger than we had factored in and the leading indicators of new construction have been weaker than expected,” he said last week.

“However, we do not expect a big bounce in prices, given the fixed-rate mortgage resets and expected economic slowdown.”