RBA forecasts rent inflation will continue to rise over the next six months

In another cost of living blow, the availability of rental properties is “at critical levels” and the RBA said the situation is unlikely to improve in the short term.

In a fresh cost of living blow for renters, the Reserve Bank of Australia (RBA) has suggested that rental inflation won’t peak for another six months.

New RBA governor, Michele Bullock, made the comments in response to a question on when rents would peak at a Senate Estimates hearing this morning.

“I’m guessing in the next six months or so, I think, but I’m not 100 per cent sure exactly what quarter,” Ms Bullock said.

Ms Bullock told the committee that the RBA expects rental price inflation will top out at around 10 per cent and then ease.

Rental inflation was 7.6 per cent for the year to September 2023.

Eleanor Creagh, senior economist at PropTrack told news.com.au this was the largest annual rise since 2009.

Ms Creagh added: “Advertised rent price growth remains strong and will continue to feed through to paid rents measure by the CPI [Consumer Price Index] for the next few quarters.”

Rental prices have increased sharply in the past year, largely due to increased demand from a post-Covid immigration boom and a lack of property supply.

Ms Creagh said that PropTrack believed Australians were “unlikely to see real meaningful reprieve over the next few months, though the pace at which conditions have deteriorated may slow”.

“The only sustainable solution to the rental crisis is an increase in the supply of available rentals.”

“However, this takes time, and there isn’t a meaningful release valve on the horizon to increase the supply of available rentals anytime soon,” she said.

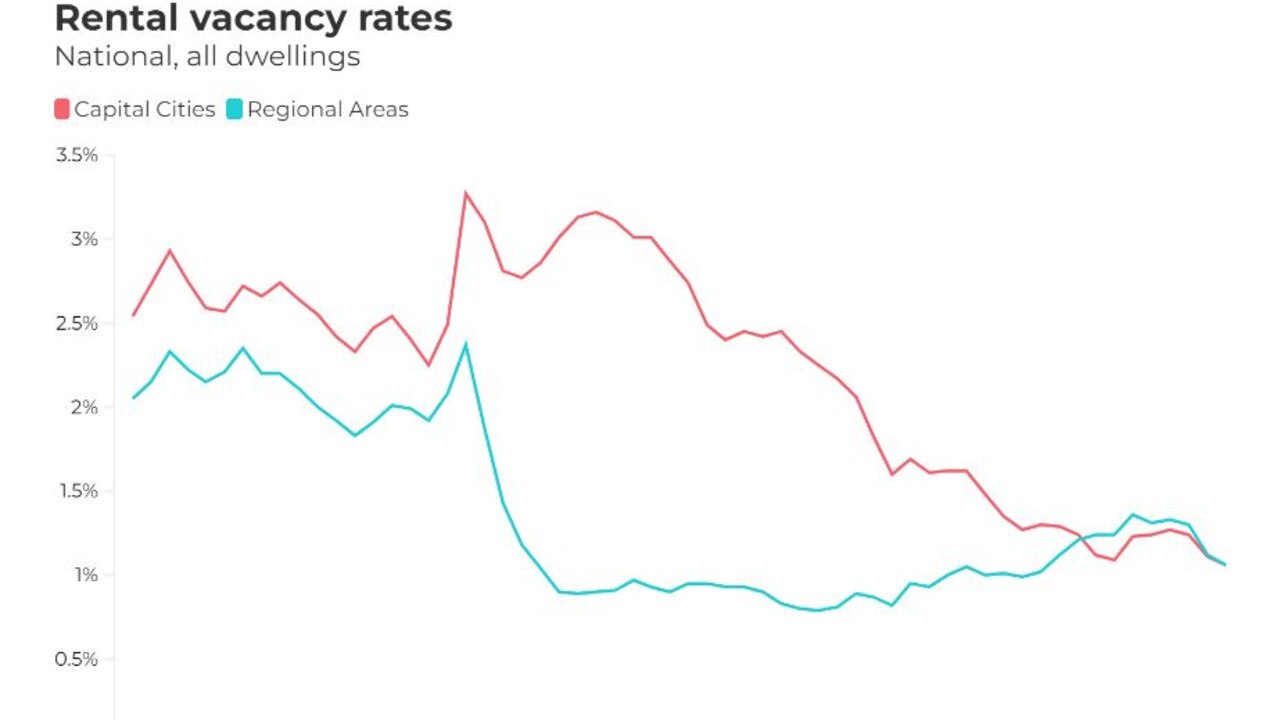

Data from PropTrack shows that in September demand for rental properties reached an all-time high while the number of available properties hit an all-time low at a national vacancy rate of just 1.06 per cent.

With the proportion of rental properties sitting vacant now 55 per cent below March 2020 levels, renters are having to compete for a smaller pool of properties, driving prices up.

More Coverage

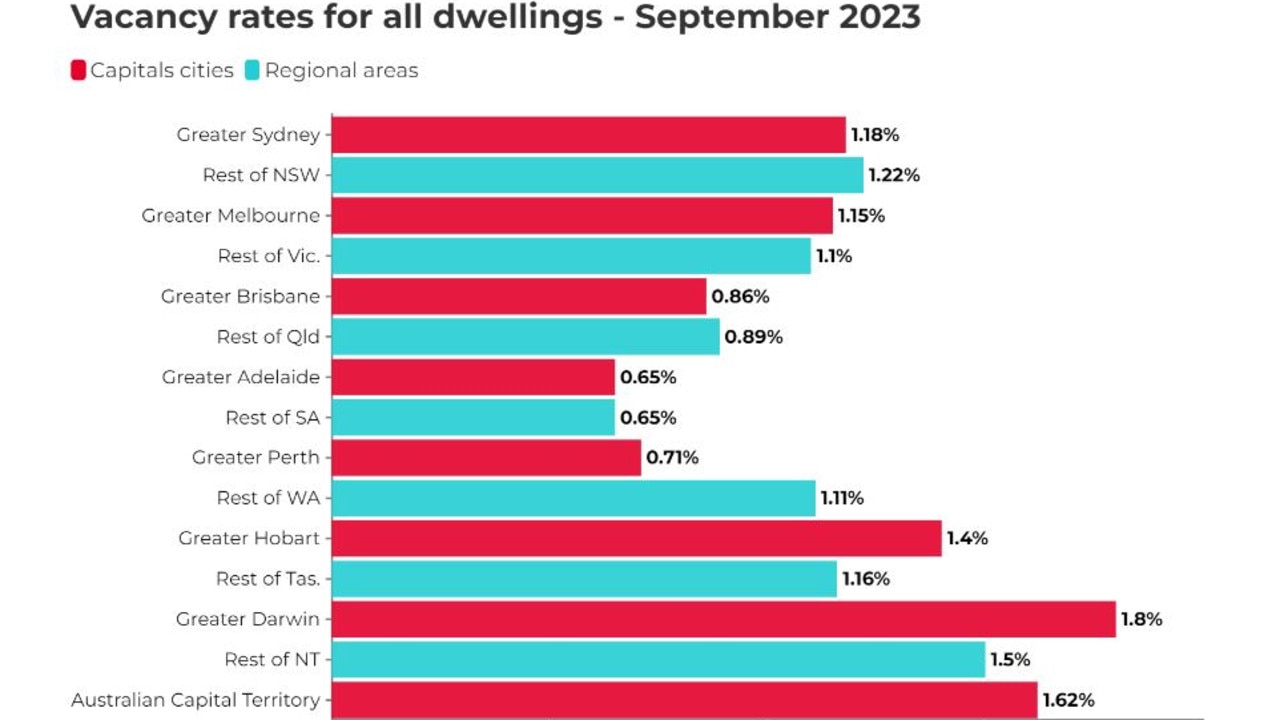

PropTrack found that of the capital cities, Adelaide and Perth have the lowest vacancy rates in the country, at 0.65 per cent and 0.71 per cent, respectively.

It described the lack of availability in those cities as “at critical levels” and PropTrack economist Anne Flaherty said: “More markets are expected to fall below one per cent over the coming year as demand continues to grow”.

“Declining vacancy rates are increasing competition for rentals and placing growing pressure on rents. As a result, rents are predicted to continue rising at above trend levels over the coming months, particularly in the capitals.”