Trump threatens Canada, Panama, Greenland

Donald Trump has refused to rule out using the United States military to seize control of the Panama Canal and Greenland.

Donald Trump has refused to rule out using the United States military to seize control of the Panama Canal and Greenland.

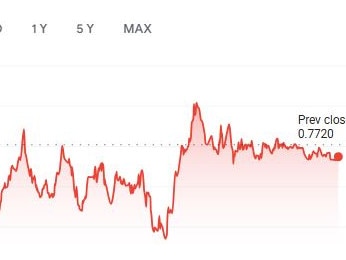

Experts have warned that the Australian dollar could continue to plummet even further after falling sharply to a near-five-year low.

Greenland’s PM has raised eyebrows with a new push for the island’s future, as President-elect Donald Trump seeks a US takeover.

From ramen noodles to online gambling, Australia’s $225bn Future Fund has some pretty wild investments on its books. Here are our top 10 wildest bets.

The ASX 200 finished the week strongly off the back of surging commodity stocks and an unexpected business partnership

Donald Trump has been warned by a former Aussie Prime Minister that any plans to impose tariffs on Australia could be illegal.

Experts have offered their outlooks for the economy in 2025, and while there’s some good news, there will be continued pain to come for many.

Denmark has made a shift in Greenland after Donald Trump said he wished to obtain the island to strengthen the United States.

A new outlook has forecast the Australian economy is on a “narrow path to a soft landing” and is tipped to improve next year – but there’s a major catch.

The ASX has surged back and broken a days-long losing streak – after better than expected inflationary data out of the US sent markets higher around the world.

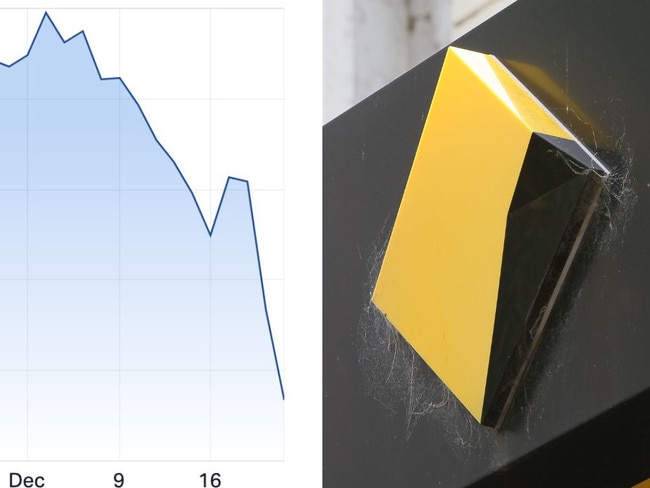

Australia’s major banks have emerged the losers in more drama today, with Commonwealth Bank leading the charge with an almighty tumble.

The ASX has tumbled to a new low after markets continued to sell off, with investors factoring in a less-than-favourable decision in the US.

The incoming US president has said making a country with the world’s 10th biggest economy the next state is a “great idea”.

The ASX 200 traded slightly down ahead of a major decision by the US Federal Reserve, just after the market hit a four-day high.

The incoming president hails massive investment by a Japanese holding company, which is set to create thousands of jobs.

The Reserve Bank has made a major call on the potential impact of Donald Trump’s second presidency on the Australian economy.

A sharp sell-off in banking and tech stocks pushed the Australian sharemarket into the red on Tuesday, even as the heavyweight mining sector soared.

Experts have unveiled a groundbreaking new innovation in China and it could be absolutely devastating for Australia.

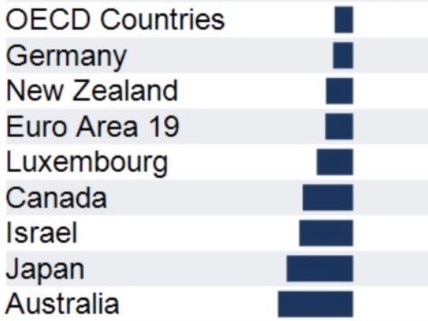

Australians are getting poorer and a leading economist has produced a simple chart that shows why.

It’s been a wild 2024 at the Aussie box office, but cinema operators say a new dawn is rising for the beleaguered movie business.

Australia’s sharemarket cracked a fresh record high on Tuesday, on the back of renewed economic confidence.

Australia’s sharemarket has started the last month of the year with a strong day of trading, as new retail data was surprisingly good.

The world’s richest man and SpaceX CEO has issued a grim forecast for America’s economy.

The Australian sharemarket cracked a fresh record high on Thursday on the back of a surge in the big banks and healthcare stocks.

An iconic actor has made a brutal call on a government that is facing a massive rebellion just months after a landslide victory.

Donald Trump has revealed huge tariffs for three nations and it has had an immediate effect on Australia.

Australia’s grim economic outlook has been revealed, with the federal budget tipped to have its sharpest retraction since covid.

Australia could be on the verge of becoming a “loser” if a trade war was to break out between America and China following the election of Donald Trump.

There are warnings Australia could be hit with hefty tariffs after a move from Anthony Albanese which has raised ire in Donald Trump’s team.

A nation battling 193 per cent inflation and where over half the population has fallen into poverty has been hailed as a blueprint for the West to follow.

An epic showdown between China and the USA is looming – and it poses a huge threat to Australia and the entire global economy.

The ASX 200 rose slightly during Friday’s trading, as the market had a benign broad based rally as Donald Trump announced more key appointments.

New Zealand’s parliament was brought to a halt on Thursday as Maori MPs staged a haka protest on the floor over a controversial “equal rights” bill.

The Australian sharemarket traded strongly on Friday off the back of further rate cuts from the US central bank.

One group of workers faces widespread sexual harassment across multiple industries in Australia, a horror survey suggests.

The price of gold is falling just weeks after reaching a record high, as investors factor in a stronger US dollar.

The ASX has dipped for the second consecutive day, giving back part of last-week’s post gains following the US presidential election.

Jim Chalmers will issue a grave warning about Australia’s economic vulnerability as the world braces for trade tensions in the wake of the US election.

An expert in international relations has offered some blunt advice to Australian policymakers on how to avoid potentially damaging Trump tariffs.

Donald Trump’s election win will cause economic shockwaves across the globe – and Australia won’t be able to dodge the fallout.

The cost of living is set to rise under the Trump administration if the newly elected President passes his tariffs plan on in full.

Aussie farmers are up in arms about supermarket behemoths Coles and Woolies, but an ACCC hearing has heard they have nowhere else to go.

The US Federal Reserve approved its second consecutive interest rate cut on Thursday night, though experts have some disappointing news for Aussies.

A second Donald Trump presidency has pushed US share market and bitcoin to new highs, but it has had a surprising impact on the Australian dollar and exports.

The central bank says if incoming US President Donald Trump were to impose his promised tariff on China, there could be big consequences for Australia.

One of Australia’s biggest banks has warned of a “challenging” time for customers as it releases its full-year results.

Aussie shares rallied on Wednesday as the US vote count rolled in showing former President Donald Trump on a clear pathway to victory.

The price of crypto has gone to new heights as Donald Trump enjoyed a strong start in his path to electoral victory.

The Australian sharemarket slipped on Tuesday ahead of Wednesday’s seismic US Presidential election.

Recent polls have hit the stock market in the US as traders rethink their predictions of a Donald Trump victory.

The UK has been hammered with the biggest tax hikes in the nation’s modern history in a brutal new budget.

One of the world’s leading experts has claimed we are lurching towards a devastating conflict that will make your blood run cold.

A highly anticipated first flight from Texas to a major Aussie city touches down on Monday morning and eager planespotters can watch all the action live.

Australia’s over-reliance on this trading partner will see our living standards fall within the next ten years, experts have warned.

The 56-member Commonwealth said on Saturday that “the time has come” for talks on “reparatory justice” for the trans-Atlantic slave trade.

Australia’s only ASX-listed music company holds plenty of ambition, taking on every element of the lucrative industry in a bid to reach 1 billion fans.

Australia’s budget surplus is one of the best in the world, but it’s not all good news for the economy.

The ASX 200 has rallied strongly following strong falls on Friday, after a spate of good economic news

Australia’s biggest mining company has agreed to a massive settlement with the Brazilian government over an environmental catastrophe.

The ASX 200 has fallen from a record high, as investors are disappointed with the economic growth of Australia’s largest trading partner.

A leading business group says one thing needs to happen to solve Australia’s housing hell and you only have to look at one of our nearest neighbours for inspiration.

China’s economy is in free fall, with “no obvious solution” on the horizon – and there will be devastating consequences for Australia.

Former Prime Minister Scott Morrison has landed a surprise new role in Australia’s budding space industry.

Gen Z is sometimes written off as a “live-for-the-day” generation, but a surprising new trend shows they’re a lot more savvy.

There is a nervous wait to see how Israel responds to Iran’s attack. But there are fears an underhand Tehran strategy that could cost the world dearly.

China has resorted to some desperate moves in an attempt to save its tanking economy, which threatens to take down Australia with it.

Aussie shares crept higher on Wednesday on the back of a Wall St rebound, despite a sharp sell off in heavyweight mining and energy stocks.

The Australian sharemarket fell on Tuesday following muted stimulus measures from China and a sharp pullback on Wall St.

China has a major $1 trillion problem as its ultra-wealthy flee the country and the fed-up middle class left behind decide to simply ‘opt out’ of the economy.

One of Australia’s biggest banks has issued a warning about business confidence after the latest figures were revealed.

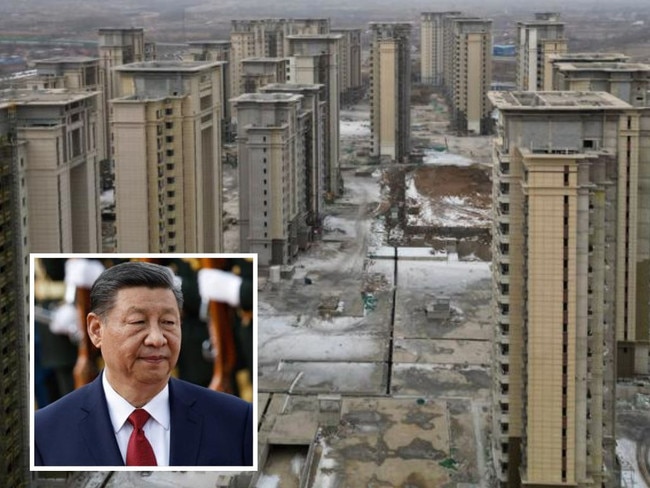

China’s eerie “ghost cities” provide cold, hard proof that Xi Jinping has failed as an “economic tsunami” threatens to unleash chaos.

The Australian sharemarket fell on Friday as the big miners wobbled and uncertainty courses through Wall Street.

The sharemarket inched higher on Thursday as investors braced for Israel’s response to Iranian missile and terror attacks and the release of crucial US jobs data.

A leading financial authority has backed the RBA’s approach to interest rates, but warned further increases would be warranted in the fight against inflation.

Aussie beef destined for US hamburgers has been left stranded in US waters as tens of thousands of American port workers strike.

An industry-first agreement will look to protect one Australian fund’s workers in the age of ChatGPT with a new “gold standard”.

The Australian sharemarket slipped on Wednesday as investors braced for a broader war in the Middle East.

The Australian sharemarket retreated from record highs on Tuesday on a sharp sell-off in the mining sector.

China is in financial turmoil as its lucrative property market implodes – and the consequences for Australia will be inescapable.

The Australian sharemarket notched a fresh record high on Monday on the back of a mammoth rally in iron ore prices.

Original URL: https://www.news.com.au/finance/economy/world-economy/page/4