New China tech that will ruin Australia

Experts have unveiled a groundbreaking new innovation in China and it could be absolutely devastating for Australia.

China has made a major technological breakthrough that will have Australia sweating as we head into the new year.

One of Beijing’s most respected engineers is the brains behind the groundbreaking process known as flash ironmaking which could see the nation become far less reliant on importing Australian iron ore.

Iron ore is one of the key ingredients in steelmaking and much of Australia’s economic success over the past four decades can be put down to China’s insatiable appetite for it.

As China tries to overtake the US as the world’s biggest economic powerhouse, it has become by far the biggest producer of steel.

Its steel production capacity is already more than the combined output of every nation on the planet — meaning it is untouchable in key industries such as high-speed rail, shipbuilding and car manufacturing.

To fuel this dominance it has been importing billions of tonnes of Australian iron ore — mostly out of WA’s resource-rich Pilbara region — and paying a handsome price for it.

This is a big deal for our economy as China is the largest importer of Australian iron by a hefty margin. Australia shipped 736 million tonnes – more than 80 per cent of iron ore exports – to China in 2022.

In 2023, iron ore exports alone pumped $136 billion into the economy. Every year, it generates billions of dollars in tax to fund key Australian services.

The exports are one of the only reasons that Australia has managed to escape the pain of several global economic downturns over the past several decades — including the crippling financial crisis of 2008.

However, China’s dependence on Aussie exports is under threat because of a revolutionary ironmaking method that is faster, cheaper, and more environmentally friendly.

Chinese researchers at the prestigious Chinese Academy of Engineering unveiled the new technique — that dramatically reduces processing time from hours to mere seconds — in a new research paper this week.

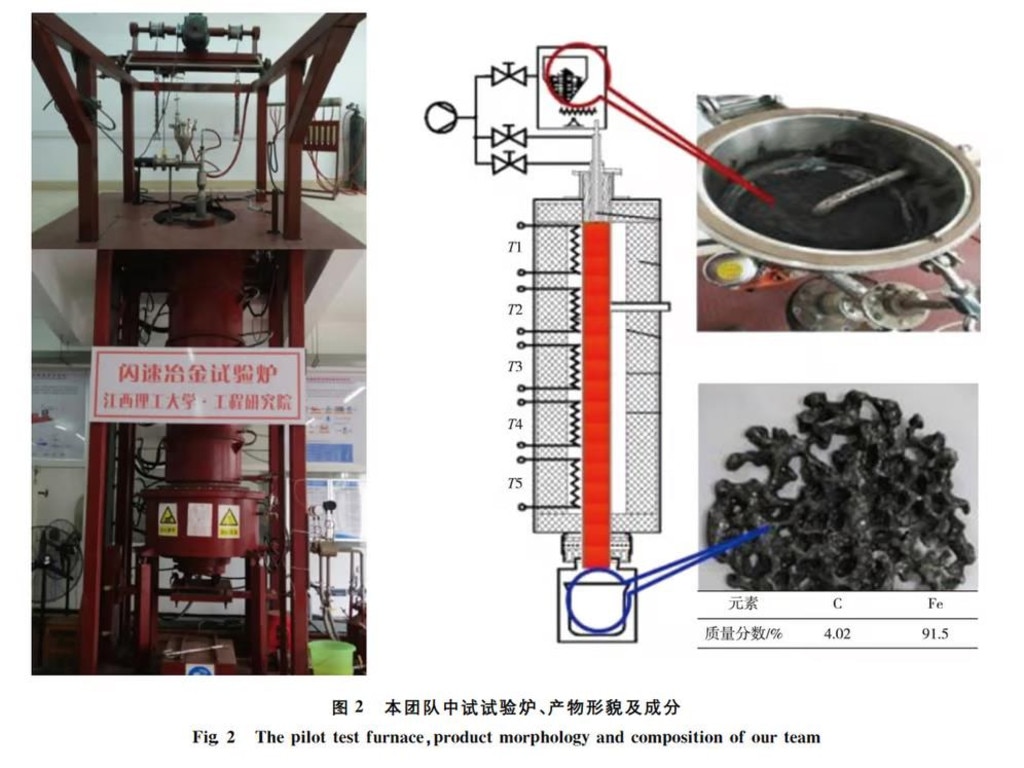

By injecting finely ground iron ore into an ultra-hot furnace using a stick known as a “vortex lance”, a rapid “explosive chemical reaction” occurs, producing high-purity liquid iron droplets that can be used directly in steelmaking.

This results in a 3,600-fold productivity boost compared to traditional methods and it is particularly effective with low- or medium-yield iron ores.

The method “can complete the ironmaking process in just three to six seconds, compared to the five to six hours required by traditional blast furnaces”, wrote the project team led by Professor Zhang Wenhai in a paper published in the peer-reviewed journal Nonferrous Metals.

This is concerning for Australia on several fronts.

If flash ironmaking takes off in a big way, it means China doesn’t have to be reliant on high-yield ore imports to make steel.

One of Australia’s selling points is that it has abundant high grade iron ore that China currently needs because lesser quality ore would damage its mills and create poor quality steel.

However, with this new method China would not have to pay big bucks for the high quality ore it is buying from Australia, Brazil and Africa. Instead it could use poorer grade ore that is abundant in China, according to the researchers.

On top of that, the new technology improves energy efficiency by over 30 per cent and eliminates coal use, significantly reducing carbon emissions — which is a major long-term goal of Beijing’s.

In some ways China has been paving the way in reducing reliance on fossil fuels as it leads the world in building green tech, such as solar panels and wind turbines, but its reliance on coal power and the dirty process of making steel have held it back.

This all means there’s a triple incentive for China to shun Aussie iron ore — it can save money on imports, have a quicker and more efficient method of steelmaking and hit its ambitious climate goals by cleaning up one of its dirtiest industries.

The breakthrough, developed under the leadership of Professor Zhang, comes after decades of research and refinement.

It’s not the first time Professor Zhang has made waves in China. He revolutionised copper production with a similar flash smelting technique he applied to the metal in the 1970s.

As a result China’s consumption of copper today accounts for nearly 60 per cent of global production and Professor Zhang is hailed as a gamechanging innovator. He was handed the first prize in the National Science and Technology Progress Award in 2000 and elected to the Chinese Academy of Engineering in 2003.

However, there is still some work to do to get his new steelmaking innovation off the ground.

The next step involves scaling up his method using a newly designed “vortex lance” capable of injecting massive amounts of ore per hour, potentially producing millions of tonnes annually.

According to his research paper, his team has developed a lance with exceptional uniform distribution performance, capable of injecting 450 tonnes of iron ore particles per hour.

A reactor equipped with three of these lances can produce 7.11 million tonnes of iron annually. According to the paper, the lance “has already entered commercial production”.

“The completed laboratory and pilot tests have proven the feasibility of the process,” Professor Zhang wrote. According to government statistics, the success rate for new technologies that have undergone pilot tests exceeds 80 per cent in China.

A rough year for miners

It has already been a rough year for Australian miners. The nation’s biggest miner BHP has seen its share price drop 16.82 per cent since the start of the year. China has at times seemed as though it would bolster its steel industry with stimulus only for it to leave mills in the lurch.

In August, top steelmaking firm Baowu admitted there would be no significant stimulus package from its Chinese Communist Party owners.

Its chairman Hu Vangming warned that the “winter” of steel demand from China’s struggling construction industry would be “longer, colder and more difficult than we expected”.

Hopes surge for new year

However, there are some positive signs going into the new year — as the share price of miners like BHP and Rio Tinto surged on the ASX on Tuesday.

The optimism is likely being fueled by positive signs coming out of China.

Chinese President Xi Jinping and other top leaders said on Monday they would adopt a more “relaxed” approach to monetary policy as they hashed out plans to boost the economy next year.

The world’s second-largest economy is battling sluggish domestic consumption, a persistent crisis in the property sector and soaring government debt — all of which threaten Beijing’s official growth target for this year.

Leaders are also eyeing the second term of Donald Trump in the White House, with the president-elect indicating he will reignite his hardball trade policies, fuelling fears of another standoff between the superpowers.

On Monday, the Politburo, the country’s top decision-making body, “held a meeting to analyse and study the economic work of 2025”, state news agency Xinhua said.

“We must vigorously boost consumption, improve investment efficiency, and comprehensively expand domestic demand,” Xinhua quoted officials as having said.

“Next year we should … implement a more active fiscal policy and an appropriately relaxed monetary policy,” they added.

Analysts at SG Markets said the shift represented the first of its kind since 2011.

“The readout from the Politburo meeting … is striking all the right notes, with a few notably more dovish phrases and some unusually plainly straightforward pledges,” they wrote in a note.

Another analyst said the shift “shows the government recognises the urgency of economic challenges China faces”.

And the announcement of efforts to significantly boost consumption in the coming year represents “another positive signal”, wrote Zhang Zhiwei, President and Chief Economist of Pinpoint Asset Management, in a note.

Struggling to rebound

Beijing has unveiled a string of measures since September aimed at bolstering growth, including cutting interest rates, cancelling restrictions on homebuying and easing the debt burden on local governments.

And in October, the central bank said it had cut two key interest rates to historic lows.

But economists have warned that more direct fiscal stimulus aimed at shoring up domestic consumption is needed to restore full health in China’s economy as fears of a renewed trade war with the United States mount.

Underscoring the continued sluggish consumption facing China, official data on Monday showed consumer price growth slowed last month.

The consumer price index, a key measure of inflation, came in at 0.2 per cent, down from 0.3 per cent in October, the National Bureau of Statistics said.

More Coverage

That was below the 0.4 per cent forecast in a Bloomberg survey of economists. With meetings this week intended to set out broad approaches rather than specific policies, Ting Lu, Chief China Economist at Nomura, wrote in a note that “we expect little from the conference, despite some hyped market expectations”.

“Due to the property meltdown, the fiscal crisis, and worsening tensions with the US, China’s economy is not in a normal downcycle, so it may take much more than the recent ‘bazooka’ stimulus package to truly reboot the economy,” wrote Mr Ting.

— with AFP